Global E&P mid-year spending outlook: Collapse underway

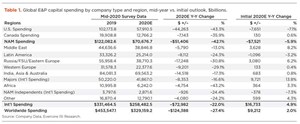

Overproduction by Saudi Arabia and Russia in March and April, and the accompanying oil price crash before the OPEC+ deal was reached, have taken their toll on the 2020 capital spending outlook. Here, at Evercore ISI, we forecast global E&P expenditures will decline 27% in 2020, a 3,000-bps (basis point) turnaround from the 2% increase in spending anticipated in our December survey.

This ends three straight years of modest growth since 2016, with the net cumulative gain at 16% off the 2016 trough but still 39% below the 2014 peak. Earlier expectations for a fourth straight year of modest improvements in 2020 have reversed course. We now forecast global E&P spending to establish new lows that are 16% below the 2016 trough and 55% below the 2017 peak. Global E&P spending is now back to 2005’s level.

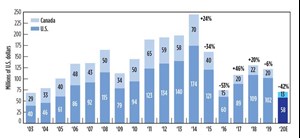

The double black swan of a global pandemic and a market share war is bringing additional casualties to the energy industry. International spending shifted from an anticipated third consecutive year of positive growth to a 22% contraction, with all regions in decline, Table 1. Meanwhile the pace of decline in North America (NAM) has accelerated to 42% from an anticipated 6%, Table 1. The U.S. accounts for 80% of NAM activity, as Canada is contracting for the sixth time in 10 years.

OVERVIEW

In fact, 2020 is on track to be the second-worst year for NAM in our survey’s 35+ year history. Second only to the 53.5% collapse in NAM spending experienced during 2016, 2020 is likely to be even worse than the 39% and 34% declines posted in 1986 and 2015, respectively. Spending is contracting for the fourth time in six years, and three of these years rank in the top four of 12 down years registered in our survey’s history.

The devastation brought forth to the U.S. and Canadian industry cannot be overstated, as three years of painfully slow single-digit growth from 2017-2019 have been eliminated. NAM E&P capex has now fallen 5% below the 2016 trough and is 71% below the 2014 peak, reverting back to 2003/2004 levels before the U.S. shale gas revolution began. Overall, NAM capex has contracted during 12 of the last 36 years by an average 24%.

Double-digit declines in all international regions. Within the international markets, we initially expected E&P capex to increase 5% for 2020, but now we expect it to decline 22%, with all international regions contracting by double digits. This is only the second time in modern history that all regions are in decline (2020 and 2015), and the only time that all regions are contracting by double digits. Africa’s capex held up better than most in 2015, due to ongoing development projects, but the opposite is occurring now. Large developments have wound down, and discretionary work is easily deferred.

We expect Africa to lead international capex declines at 43%, followed by Russia/FSU/Eastern Europe and Western Europe tied for second place with near-30% contractions in spending. Capex is also falling significantly in Latin America, down 24%, while spending in Asia and the Middle East is experiencing relatively modest capex cuts in the mid-teens. By operator types, independents are cutting swiftly, down near 25%, while majors are 17% less.

Like NAM, 2020 is on track to be the second-worst year for international E&P spending in our survey’s 35+-year history and second only to the 25% decline in 2016. International capex has contracted in 10 of the last 36 years by an average 2%, with four contractions in the past six years ranking among the worse downturns. International E&P capex has fallen 13% below the 2017 trough and is 48% below the 2014 peak, reverting back to 2006/2007 levels.

Offshore rig count crashed through our bear estimates. The near-30% swing in international capex spending plans is evident offshore, where both the floating and shallow-water rig counts have fallen from their March peaks. Offshore spending tends to be stickier, given the complexity of these projects relative to land-based activity, and we had expected activity to hold up better. However, with COVID-19 travel restrictions further raising offshore costs, operators were quick to terminate contracts, defer rig tenders and relinquish exploration programs.

Progress on recently approved development projects slowed, as rigs were put on standby and operators sought capex cuts and pricing concessions across service and product lines. As a result, both the floater and jackup rig counts fell quickly over the past few months, and rig contractors have re-accelerated attrition.

NORTH AMERICA: UNITED STATES

The first half of 2020 was quite the roller coaster for NAM activity and capex spending. During the first two months of 2020, OFS companies experienced improving utilization levels, as E&P customer budgets reset, and rigs and completion crews were re-activated. The U.S. land rig count was relatively resilient in the first quarter, declining 4.2% sequentially. This compared to declines during the three previous quarters of -11%, -7.5%, and -5.5%, respectively.

Then March came, and the decline in oil prices and COVID-19 logistical challenges drove completion activity to a halt, while the U.S. land rig count pulled back sharply. We are forecasting capex in the U.S. to decline 43%, to $58 billion in 2020, Fig. 1. This is lower than 2016 U.S. capex spending of $60 billion. We estimate the 2020 U.S. land rig count will decrease 58%, year-over-year, and average 389 units for the year. The second-quarter U.S. land rig count has declined 51%, but recently the declines have started to shallow out. The U.S. land rig count exited 2019 at 782 rigs, and the industry has since dropped 528 rigs to reach 254 in the latest week.

OFS companies have poor visibility for the second half of the year. We continue to believe that the recovery will be “W”-shaped. This means that after activity levels bottom out in the second quarter, there will then be a small recovery in the third quarter before budgets are exhausted and activity levels decline again into year-end. There remain too many assets, companies, management teams and debt. This downturn will accelerate the restructuring and consolidation cycle that is required.

Bottoming-out process. Oilfield service companies have dusted off their downturn playbooks, which say that they should aggressively cut costs (both variable and structural costs); cut their own capex spending levels; lay off and furlough labor; cut salaries and compensation; and close underutilized facilities. We wonder whether these steps will be enough, given that this is truly an unprecedented downturn event (which it appears to be).

However, there are some positive signs emerging. Record global inventories are likely approaching a peak, and stronger demand and reductions in supply have flattened the curve for inventory levels. Weekly rig count declines are starting to shallow out from where they started at the beginning of the downturn. The path forward will still be challenging, but a little stability off the bottom will help.

Updated U.S. land rig forecast. We are updating our U.S. land rig count forecast to reflect our revised U.S. capex spending survey and second-quarter rig count declines, and to roll out our 2022 forecast. We now expect the U.S. land rig count to decline 58% in 2020, compared to our previous forecast of -56%. This was driven by the rig count declines in the second quarter that were steeper than we previously expected. We are also lowering our 2021 rig count expectations, now expecting it to decline 38%, compared to our previous 29% drop.

Future of U.S. land. The shorter cycles of unconventional development, combined with a lower “new normal” for activity levels, will lead to assets being scrapped, companies closing their doors, and leverage being reduced (for many, likely through bankruptcy). It might take until 2023 for the rig count to get back over 400 again, which is a far cry from the prior peaks. The industry was built for a 2,000-rig market, rather than a new peak that might be 500-600 rigs.

NORTH AMERICA: CANADA

Canada is in complete disarray. As we noted earlier, Canada is going through its sixth contraction in 10 years. The land rig count is at its lowest in modern history, bottoming in recent weeks at only 12 units. This compares to the previous trough of 34 units in May 2016 (week 18), as Canada’s rig count typically bottoms in weeks 18-19 and begins to rise sharply over the following weeks. However, the rig count continued to drop by 13 units this year through week 26 vs. rising by 40 over the same period in 2016 and averaging +72 over the prior four years (2016–2019).

We expect Canadian capital spending to decline 35.9%, to $12.766 billion. This stands in stark contrast to our original outlook for 2020, which called for a slight, 0.6% gain in spending, to $130 million.

MIDDLE EAST

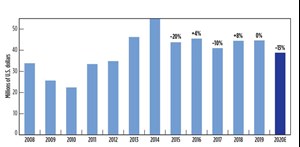

We expect spending by select Middle Eastern companies to fall 12.5% on a year-over-year basis for 2020, down from anticipated growth of 8% in our December report, Fig. 2. The sharp decline in oil prices in March commanded an immediate response, and Saudi Arabia implemented plans to cut production to 7.5 MMbopd, or 40% from April levels, while the UAE and Kuwait joined in with cuts of 180,000 bopd.

We believe companies in the region are implementing 10%-to-20% reductions across their upstream activities, with the overall E&P capex down 12.5%, as several of the largest players remain committed offshore. For example, Saudi Aramco is moving ahead on a new shipyard to manufacture jackups and land rigs. We expect regional E&P capex to end the year 5% below 2017 levels and 29% below the 2014 peak, back toward the 2012/2013 level.

Saudi Aramco is weighing bids for new long-term offshore maintenance contracts involving its huge Marjan oil field, which could be valued at $1.5 billion to $2 billion annually. However, the Kingdom deferred plans to FID the $5-billion Zuluf field until at least fourth-quarter 2021. Meanwhile, ADNOC has plans to expand Al Dabbiya and Umm Al Dalkh oil fields, with new EPC tenders issued despite delaying the $20-billion Hail & Ghasha sour gas project.

In contrast, Qatar Petroleum is moving forward with its LNG expansion strategy and has signed $19 billion of contracts with three South Korean shipyards to build 100 LNG carriers through 2027. Despite the global LNG glut, the company plans to expand its North Field’s LNG production capacity from 77 MTPA currently to 126 MTPA by 2027. Meanwhile, BP is in early-stage discussions to sell a 10% stake of its total 60% interest in the Khazzan natural gas field in Oman for an estimated $1 billion.

LATIN AMERICA

We expect spending by select Latin American companies to decrease 24% from 2019 levels, accelerating from a modest 3% contraction in our December survey. Operators increased spending for a second consecutive year in 2019, helping capex recover 22% off the 2017 trough. Unfortunately, the decline we envision for 2020 will more than offset gains from the prior two years. Latin American E&P capex is now on par with 2007 levels.

Despite poor results from the sixth pre-salt round, where only one area was successfully auctioned off, Brazil’s Petrobras plans to divest stakes in some non-core exploration acreage in the Espirito Santos basin. The NOC plans to shoot new 3D seismic in mature Campos basin fields, where the company plans to deploy two new FPSOs to revitalize aging fields. While majors are postponing exploration, due to lower oil prices, they continue to view Brazil as a key upstream destination.

In contrast, majors such as Chevron continue to wind down operations in Venezuela, where production has fallen 20% thus far, this year, due to lower oil prices and intensifying U.S. sanctions. Rosneft also terminated its operations in Venezuela. Argentina’s government is planning to launch new subsidies to stimulate upstream investments, while ExxonMobil continues to advance work in the Guyana-Suriname basin.

RUSSIA/FSU/EASTERN EUROPE

We expect spending by select Russian and FSU companies to fall 31% from 2019 levels, which is a sharp reversal from 6% growth in our December survey. This marks the third annual decline for the region, with the net cumulative fall at 38% from 2017 levels. E&P spending in Russia and the FSU region is now poised to fall to levels not seen since 2007/2008.

Russia, along with Saudi Arabia, Kuwait and UAE, agreed to a record 10%, 9.7-MMbopd production cut in global supply for May and June, which has now been extended through July. Russian oil production fell to 8.59 MMbopd in May, near the country’s target, and Russian oil producers’ compliance with the OPEC+ quota is clearly reflected in their revised 2020 capex plans. Capex is also lower, due to foreign currency exchange losses, with the Russian ruble weakening against the U.S. dollar. Meanwhile, gas producers have seen a decline in demand, due to the global shutdown but continue to forge ahead with new development projects.

Russia’s largest oil producer, Rosneft, expects OPEC+ production cuts to extend into 2022. The giant is ditching plans to rehabilitate Samotlor oil field in West Siberia, where Rusgazalliance has started phase 1 of a three-year development of Semakovskoye field. The Russian independent will drill 19 wells to bring 7.5 Bcm of natural gas online in the region’s first horizontal development program.

Lukoil also continues to make progress on its third greenfield development in the Caspian Sea, with first oil scheduled for 2022. With two other developments in the area, the company has plans to drill four additional exploration wells. Meanwhile, Gazprom has all but halted gas exports through the Yamal pipeline to Europe, as Russian shipments across Ukraine into Europe ran at about half-capacity in May.

Romanian independent Black Sea Oil & Gas (BSOG) is 30% complete in its $400M Midia gas project, with first gas slated for 2021. Meanwhile, Gazprom has all but halted gas exports through the Yamal pipeline to Europe, as Russian shipments across Ukraine into Europe ran at about half of capacity in May. ExxonMobil is trying to exit the giant Neptun Deep JV with OMV Petrom in Romania.

WESTERN EUROPE

We expect spending by select European companies to decrease 29% from 2019 levels, down from a modest +1% gain expected in our December survey. This ends three straight years of positive growth since 2016, with the net cumulative gain at almost 26% off the trough and within 22% of the 2014 peak. We now expect the region to establish a new low, with the decline more than offsetting improvements over the prior three years. Spending by a select group of European companies is now 11% lower than the 2016 trough and 45% below the 2014 peak, with E&P capex back to 2006/2007 levels.

The Norwegian government is finalizing a support package for the energy industry. It may include temporary changes in the petroleum tax system on the Norwegian Continental Shelf. Spending should contract about 20% this year, and another 16% in 2021, with both exploration and field development taking a hit as some major developments shift into the completion phase.

Meanwhile, various agencies are stepping up efforts to develop new low-carbon technologies targeting hydrogen, batteries, offshore wind and green shipping. A new study by the University of Aberdeen estimates more than a quarter of the UK North Sea’s reserves, or about 4.2 Bbbl, are “uneconomic” at $45/bbl.

INDIA/ASIA/AUSTRALIA

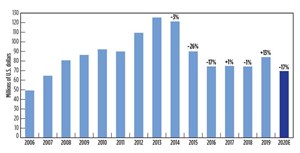

We expect spending by select Indian, Asian and Australian companies to decrease 17% from 2019 levels, besting all but the Middle East’s 13% contraction, Fig. 3. Spending finally accelerated in the region last year, with overall capex increasing 13% after hovering around the $74-$75-billion trough for three consecutive years. We had initially projected modest gains of 1% for 2020. However, a 17% decline will establish a new low that is 44% below the 2013 peak, putting regional capex back on par with levels not seen since 2007/2008.

While 2019 saw increased drilling, with the Baker Hughes* rig count increasing 4% on average, companies are shifting priorities in 2020. Asian companies have partly cut capex for acquisitions, with Santos completing the $1.26-billion acquisition of ConocoPhillips’ Northern Australia and Timor-Leste assets. JadeStone and New Zealand Oil & Gas are on the lookout for new producing assets and development projects, as well as exploration prospects.

In contrast, India’s ONGC continues to focus on domestic production and is moving forward with a $700-million pipeline replacement project and the $1-billion Daman Upside project, which will require a large offshore processing platform. Mubadala is also moving ahead with the $1-billion Pegaga gas project offshore Malaysia, while CNOOC remains active and recently confirmed a 730-MMbbl oil discovery in Bohai Bay. The company launched an offshore licensing round for foreign companies to bid on 15 blocks through the end of September targeting deepwater and HPHT acreages.

AFRICA

We expect spending by select African companies to decline 43% in 2020, with the year-over-year decline the worst of any international region and on par with the collapse in the U.S. We had initially anticipated the same group of companies to increase capex 3% and build on the 9% growth posted in 2019, which capped three consecutive years of favorable growth. Spending had increased 40% off the 2016 trough and recovered within 16% of the 2012 peak. However, a 43% decline in 2020 will establish a new low in our survey that is 21% below the 2016 trough and 52% below the 2012 peak.

Nigeria’s Department of Petroleum Resources launched its long-awaited marginal field licensing round, covering 57 undeveloped discoveries. A list of prequalified bidders is expected to be announced shortly, though a bid deadline has yet to be communicated. The managing director of the Nigerian National Petroleum Corporation (NNPC) recently called for the region to drive down its production cost to $10/Bbl or less to compete with fellow OPEC members; but high costs, geopolitical turmoil and security issues have hampered the region and several Majors are seeking to divest assets.

Chevron has plans to divest eight onshore and shallow-water blocks in Nigeria, while Total seeks to sell its 12.5% stake in Block OML 118 that includes the prolific Bonga, Bonga Southwest and Aparo fields. ExxonMobil is also looking to sell assets in Nigeria and Chad. As a result, we do not anticipate a recovery in E&P spending for Africa in the near term.

DISCLAIMER

Evercore ISI has a client relationship with, or has received compensation for non-investment banking, securities-related services from this subject company, Baker Hughes Company, in the last 12 months. Evercore ISI or an affiliate has received compensation from this subject company, Baker Hughes Company, for investment banking services in the last 12 months.

- Management issues- Dallas Fed: Activity sees modest growth; outlook improves, but cost increases continue (October 2023)

- Executive viewpoint (April 2023)

- Global offshore market is on the upswing (April 2023)

- The last barrel (March 2023)

- Industry at a glance (February 2023)

- The last barrel (February 2023)