Gas price woes fail to dampen production, drilling

A fledging Appalachian basin operator hopes its more established brethren will follow its lead and abstain from chasing growth amid a bleak gas price environment that shows no sign of strengthening anytime soon.

“If we can get some help from the others in the basin that are a little more responsible like we are with our activity level, then hopefully we can see some better prices for 2020,” says Michael Hodges, executive VP and CFO of Montage Resources Corp., the outgrowth of the all-stock merger of Eclipse Resources Corp and Blue Ridge Mountain Resources, Inc. that closed on Feb. 28.

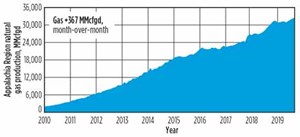

There appear to be few converts, as the low-cost Marcellus and the underlying Utica/Point Pleasant combo continue to break production records. Centered in the Pennsylvania sweet spot and spreading across neighboring West Virginia and Ohio, the nation’s largest dry and wet gas play is expected to produce a record 32,605 MMcfd in September (Fig. 1), up from 29,351 MMcfd in September, 2018, according to US Energy Information Administration (EIA) estimates.

This, despite gas prices the EIA predicts will only average around $2.60/Mcf in 2019, even as much of the US was baking in a near-historic heat wave this summer. Operators, however, say they have long quit banking solely on weather swings for price relief, but rather choose to focus on the growing prospects of year-round demand from a budding in-basin power and petrochemical complex and an expanding takeaway infrastructure.

In the meantime, Montage has set a relatively flat year-end production target of 535 to 555 MMcfed, after averaging production of 535.5 MMcfed in its first full quarter as a standalone company. During the second quarter, the new company drilled 12 gross (10.2 net) wells, comprising seven Ohio Marcellus and five Utica dry gas wells, and completed 15 gross (13 net) gas and condensate wells.

Given the low-price environment seen for the second half of 2019, Montage will run a single rig for the reminder of the year. The new company holds a largely undeveloped 218,000-net-acre Marcellus-Utica leasehold that sweeps across southeast Ohio, West Virginia and north-central Pennsylvania.

Deep-rooted Cabot Oil & Gas Corp is one of the few following the example set by its upstart peer, albeit delayed. Following a full year 2019 production growth target of 16-18%, the company will dial back in 2020 with a relatively modest 5% increase in year-over-year production. “Going forward, we see absolutely no rationale for continuing to chase double-digit production growth when supply growth could outpace expected demand growth at this time,” says CEO Dan Dinges.

Cabot will drill and complete around 90 net wells this year and place roughly 85 new drills on production within a tightly concentrated 179,000-net-acre position in high-yielding Susquehanna County, PA.

“With three rigs and two frac crews, we’re kind of throttled back about as far as we can,” Dinges said on July 31.

Owing to the incremental spending attributed to the four previously unscheduled wells and a change in the operating plan for an eight-well pad under construction, Cabot says 2019 capital expenditures will increase moderately to a range of $800 to $820 million. Much of the higher spend will go toward extending the average lateral lengths on the new pad from 8,950 ft to 12,450 ft, resulting in an additional 140 completed stages for the year.

DRILLING DOWN SLIGHTLY

The low prices have not turned a handful of key players against sinking new wells. According to Baker Hughes, a GE company, the Marcellus-Utica has only dropped slightly over the past year with a combined 69 rigs working on average during August, compared to 75 active rigs in August 2018. Of those, only 14 rigs were at work in the notoriously higher cost Utica.

Many of those rigs also are drilling what has been a cascade of falling lateral reach records. CNX Resources Corp. is the latest to extend the horizontal bar with the recent drilling of a Pennsylvania record Marcellus well with a 19,609-ft lateral reach. One of 30 wells the prolific operator drilled in the second quarter, the ultra-long horizontal well was constructed on a six-well pad with average lateral sections of 15,744 ft.

CNX says it also made a breakthrough during the quarter in efforts to reduce the completed costs of Utica deep dry gas wells, with the six-well Majorsville pad in southwest Pennsylvania averaging $12.1 million/well for median 6,454-ft laterals. The first multi-well Utica pad in the area will also be among the first to employ CNX’s wet Marcellus blending strategy. Mixing damp Marcellus gas with its dry Utica counterpart, according to CNX, can generate up to 30% uplift in net asset value.

“We have several damp gas pads being blended with dry gas and entering dry gas systems and bypassing expensive processing. With the coming turn-in-line of three southwest Pennsylvania Utica pads over the next few quarters, we expect to see a growing impact in the near term,” says Executive V.P. Timothy Dugan. “It only takes one Utica well to blend three to four damp Marcellus wells.”

The company plans to operate a three-rig fleet for the remainder of 2019, before throttling back to two rigs and one frac spread next year. After completing nine wells in the just-completed quarter and putting four wells on production, CNX plans to exit 2019 with a cumulative 39 new drills, 23 completions and 22 wells turned-in-line.

CNX holds just under 1.2 million net acres, largely concentrated across Pennsylvania and northern West Virginia with non-contiguous acreage scattered across Ohio.

With Marcellus breakeven prices averaging $1.50 to $1.75/Mcf, Chesapeake Energy Corp delivered 929 MMcfd (155,000 boed) in the second quarter, up significantly from the 805 MMcfd (134,000 boed) put to sales in the like period of 2018. The company put 14 wells on production with 12 wells slated to be turned-in-line in the third quarter on its Pennsylvania-centric 540,000-net-acre leasehold, where it is running two rigs and one frac crew.

Nonetheless, Chesapeake expects production to remain flat for the remainder of the year, citing, in part, lingering takeaway limitations. “The breakeven in Marcellus is extremely low and very, very competitive, but we obviously still have some takeaway constraints up there with the infrastructure that exists in the northeast,” says Executive V.P. and CFO Nick Dell’Osso.

Elsewhere, despite the lowest quarterly spend ($303 million) since going public in 2013, pure play operator Antero Resources Corp. drilled 23 Marcellus wells in the second quarter with an average lateral length of 12,500 ft. In a play where drilling efficiencies rank among the highest in the unconventional community, Antero says it may have hit a world record during the latest quarter with the drilling of 9,650 lateral ft in a rolling 24-hr period.

Antero, which controls more than 612,000 net Marcellus-Utica acreage in northern West Virginia and eastern Ohio, put 40 Marcellus wells with average 10,227-ft laterals on line during the quarter with 60-day rates averaging 18.8 MMcfd on choke. They joined the six Utica wells put on production in the 126,000-net-acre Ohio portion of the company’s aggregate leasehold. At average lateral lengths of 12,900 ft, the sextuple averaged 60-day on-choke rates of 22.7 MMcfd.

Antero is targeting 115 -125 completions this year, with preliminary guidance calling for 110 -120 completions in 2020. The company will average four rigs and three to four completion crews for the remainder of the year.

With activity heavily weighted to the first half, Southwestern Energy Co will lay down four of its six rigs by the end of the third quarter. The operator drilled 23 wells, completed 26 wells and placed 23 new drills on production in the second quarter, with average lateral lengths of 10,211 ft. Of the 23 wells turned-in-line, 12 exhibited 30-day rates of 11 MMcfed, a 60% increase compared to offsets put on production in the second quarter of 2018, which Southwestern attributed partially to longer laterals. Five wells with laterals exceeding 15,000 ft. were among the second-quarter new drills, bringing to 10 the inventory of ultra-long wells drilled year-to-date.

Southwestern holds a 480,000-net-acre position that spans northeast Pennsylvania and northern West Virginia.

Gulfport Energy Corp. is among the few active players producing less this year than it did last year, dropping from a cumulative 189,766 MMcfe over the first half of 2018 to 185,044 MMcfe in the first six months of 2019. Gulfport, which holds roughly 210,000 net acres in the Utica/Point Pleasant core in Ohio, drilled10.2 gross wells in the first half of 2019 with 26 gross wells put one line. The company laid down the one rig it was operating and concluded its yearly drilling program in the third quarter.

Equinor ASA is running a single rig on a 247,000-net-acre leasehold, but reportedly is on the hunt for possible deals in the Appalachian basin to bolster its portfolio of gas-rich acreage. Meanwhile, Bloomberg reported on May 7 that Saudi Aramco has proposed a joint venture or the acquisition of a stake in the Norwegian company’s Appalachian basin holdings. An Equinor spokesman declined comment on the Aramco report or whether the company is pursuing any deals in the basin.

ROLE REVERSAL

Elsewhere, nearly two years after EQT Corp. snapped up fellow pure play operator Rice Energy Inc. in a $6.7-billion acquisition, the acquiree is calling the shots. In upending the traditional post-acquisition hierarchy, two Rice co-founders were appointed to top spots in July and immediately re-installed their former company’s Marcellus development strategy.

Citing the legacy issues of a “poorly planned” development approach, resulting in higher costs and underperforming wells, newly anointed President and CEO Toby Rice said EQT will employ the pre-acquisition combo development scheme on 80% of planned projects. Basically, combo development consists of drilling multiple wells from multiple pads simultaneously, which compared to EQT’s former development design, has to date increased footage drilled/day by 50% with per-foot costs down 40% , while largely sidestepping the wellbore interference problems that Rice said had forced the extended shut-in of around 30 MMcfd of gas.

EQT plans to exit 2019 with cumulative production of 1,480 to 1,520 Bcfe. The new iteration of EQT holds aggregate 660,000 net acres in the Marcellus core of southwestern Pennsylvania and northern West Virginia, and 64,000 net Utica acres in southeastern Ohio. The company will average five to seven rigs (Fig. 3) and three to five frac crews in 2019.

HELP ON THE WAY

Complementing the start-up of local gas-fired power plants over the past few years, Shell’s widely promoted ethane cracker, under construction in Beaver County, PA., highlights what producers hope will emerge into a major petrochemical hub. A bill still weaving its way through the government bureaucracy in mid-August also would extend federal loan guarantees to build an estimated $3.4-billion natural gas liquids (NGL) storage hub in the Appalachian basin.

Meanwhile, the North East Gas Association has documented no less than 12 pipeline projects in various stages of development, including the beleaguered Constitution Pipeline that would carry Marcellus-Utica gas to the Upper Northeast–home to the nation’s highest gas prices. The 124-mi. Cabot and Williams Companies-led network is tied up in the courts after New York denied the necessary water permits, prohibiting the pipeline from crossing the state on its way north.

The Constitution hold-up aside, increased industrial and electric power demand, coupled with a brightening LNG and Mexican export picture, promise to boost gas consumption by 21 Bcfd over the next five years, says Range Resources Corp. “This (increased demand) is happening at a time when natural gas producers are slowing activity and storage is at similar (levels) as last year, when you look at days of supply basis. We think that sets up a very constructive story that’s not been reflected in the forward curve,” says President and CEO Jeffrey Ventura.

For its part, Range increased second quarter production 10% year-over-year with 16 wells put on line. Range plans to close out 2019 with 88 new producers, nearly all in southwest Pennsylvania, where the company controls some 1.5 million net effective acres and is operating two rigs and one to two frac spreads.

During the quarter, Range drilled four extended reach wells with laterals averaging more than 16,500 ft, at drilling cost/lateral ft 22% lower than the year-to-date average cost/lateral ft. WO

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- Driving MPD adoption with performance-enhancing technologies (January 2024)

- What's new in production (October 2023)

- Rig electrification drives down emissions, bolsters efficiency while improving onshore drilling economics (October 2023)

- Wellbore seal control and monitoring enhance deepwater MPD operations (October 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)