Industry at a glance

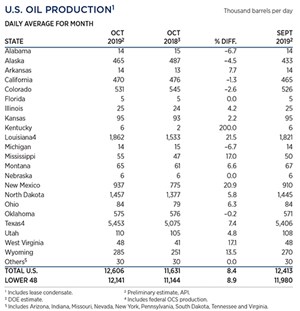

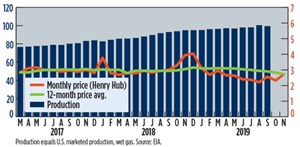

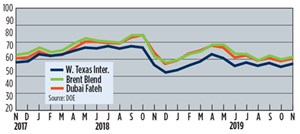

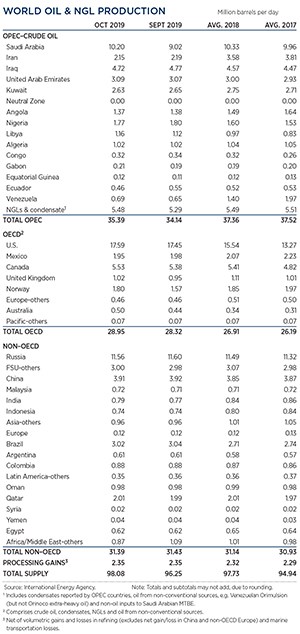

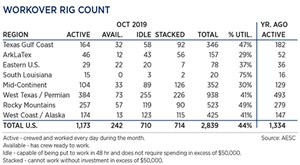

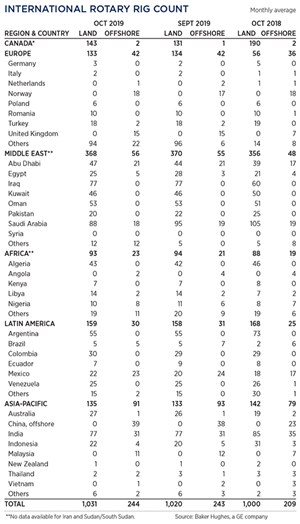

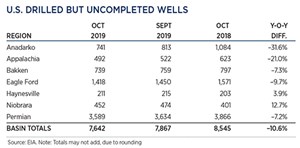

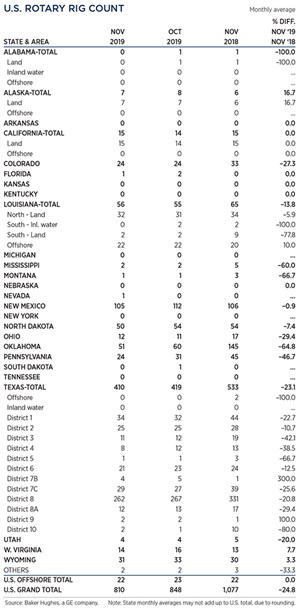

Saudi Arabia indicated that it’s tired of contributing most of OPEC’s production cuts while Iraq, Nigeria and Russia fail to reduce output, as agreed. The kingdom increased production 1.17 MMbopd in October, to 10.30 MMbopd, the highest level this year. Russia once again failed to keep its side of the bargain, pumping 11.23 MMbopd in October, 54,000 bopd more than its OPEC+ cap. Meanwhile, U.S. production surged to another all-time high at 12.61 MMbopd, up 1.35 MMbopd from a year earlier (API). Despite the increases, WTI crude ($56.24) was up 4.2% in November, while Brent ($61.73) logged a gain of 3.4% m-o-m. The U.S. DUC count dropped to 7,642 in October, a y-o-y reduction of 10.6%. Drilling activity in the U.S. averaged 810 units in November, 25% less than the year-ago figure of 1,077. International drilling activity increased 12 rigs m-o-m, to average 1,275 units in October.

- Management issues- Dallas Fed: Activity sees modest growth; outlook improves, but cost increases continue (October 2023)

- Industry at a glance (June 2023)

- Industry at a glance (May 2023)

- Management issues- Dallas Fed: Oil and gas expansion stalls amid surging costs and worsening outlooks (May 2023)

- Executive viewpoint (April 2023)

- Global offshore market is on the upswing (April 2023)