Stable growth carries the day

There is a sense that the worldwide upstream industry is finally getting back to a more familiar, normal level of activity. By all measures—oil prices, capex, rig counts, well counts, footage drilled and more—global E&P activity generally is on the mend.

And yet, unlike other industry recessions, this period is not being followed by a massive upswing in activity worldwide. Instead, there is a more cautious, measured rebound underway, and that is probably a good thing. What this industry needs now, more than anything, is solid, stable growth that will last. Again, by all measures, companies appear to be following just such a plan, as the recovery continues.

The last few years also have fundamentally altered the way in which the industry operates, with cost-cutting/watching, ever-greater efficiencies and digitalization being carried forward permanently. Add to that the noticeable reluctance of operators and service companies, alike, to hire back too many people, too fast, no matter how good things may look. Meanwhile, the industry also finds itself wrapped into the ongoing trade and tariff disputes and sanctions, because its principal products—oil, gas, refined products and petrochemicals—are key items in those affairs, as are some of the commodities that operators use in their operations, such as steel.

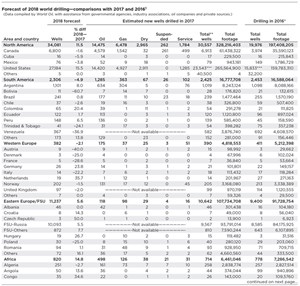

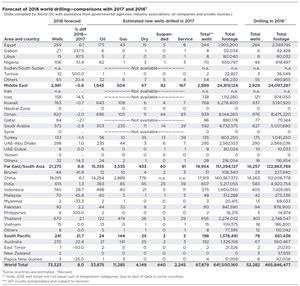

Given these factors and others, our updated forecast calls for global drilling to increase 8.0% during 2018, to 73,323 wells. Some key activity findings include:

- The U.S. will drill 37.0% of wells globally, up from 2017’s figure of 34.7%.

- If the U.S. and Canada are left out of the equation, drilling in the rest of the world will be up 5.1% during 2017.

- We forecast that the world’s top four drilling countries will be, in order, the U.S. (27,184 wells), China (19,015 wells), Russia (10,093 wells) and Canada (6,800 wells). Together, these four nations will drill 63,092 wells, 86.0% of all drilling, worldwide. This compares to an 85.4% share in 2017, and an 81.6% share in 2016.

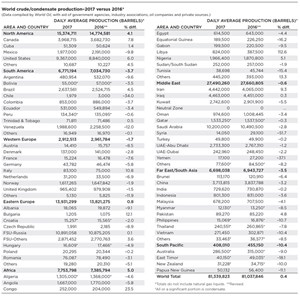

- With OPEC/non-OPEC agreed reductions in place, worldwide oil production barely increased during 2017, rising 0.4% to 81.340 MMbpd.

- Russia remained the world’s top oil producer last year at 10.891 MMbpd, followed by Saudi Arabia at 10.200 MMbpd. The U.S. stayed in third place at 9.367 MMbpd.

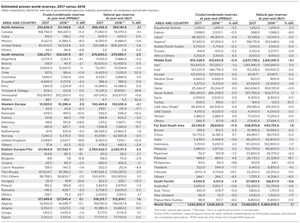

- Global oil and gas reserves showed minor movement, with oil reserves losing 0.4%, while gas reserves added 1.1%, to top out at over 7,000 Tcf.

NORTH AMERICA

According to U.S. Energy Information Administration (EIA) short-term forecasts, North American production will account for most of the expected growth in global oil supply during 2018 and 2019, among non-OPEC producers. Yet, with minimal estimated production growth in Canada, and declining output in Mexico set for 2018, the U.S. is forecast to account for nearly 90% of incremental North American liquids supply growth. The most significant output gains are occurring in the Permian basin. We forecast that 34,081 wells will be drilled in North America during 2018, an 11.5% increase from 30,557 wells drilled in 2017. It is also a significant 36% increase from 2016’s level, when 19,976 wells were drilled in the region. North American oil production averaged 15.4 MMbpd during 2017, a 4.1% increase over the year before. Oil reserves were nearly flat, while gas reserves were up about 2%.

U.S. As this issue went to press, it appeared that U.S. sanctions were already impacting oil buyers, as companies skipped October orders from Iran. Yet, American producers, particularly in the Permian, may not be in a position to fill the potential supply gap. A report from IHS Markit said that the three supermajors active in the Permian—ExxonMobil, Shell and Chevron—will need to invest nearly $30 billion collectively in the play through 2020 to achieve growth targets. Unfortunately, these investments will jump-start cost inflation and gradually force consolidation in the basin, said the report. As costs escalate, the increased execution risk may be too great for smaller companies to overcome, possibly forcing them into mergers or sales.

This theme was exemplified by Concho Resources’ $9.5-billion acquisition of RSP Permian. RSP had been one of the smallest pure-play Permian independents before making itself a much bigger, much more appetizing, target for a big company. And then there is BP’s $10.5-billion purchase of BHP Petroleum’s acreage in the Permian, as well as the Eagle Ford shale in South Texas and Louisiana’s Haynesville shale. Meanwhile, the Bureau of Ocean Energy Management reported that 14,220 tracts were offered for sale during region-wide Gulf of Mexico Lease Sale 251. The sale generated $178.1 million in high bids for 144 tracts covering 801,288 acres. Twenty-nine companies participated in the sale, submitting $202.7 million in bids, making this the best lease sale in quite some time. For more information on the U.S. market, please turn to the main U.S. forecast article on page 41.

Canada. Investors have been pushing Canadian operators and service companies to merge, so they can cut costs and combine resources. However, that effort isn’t going so well. The value of deals involving Canadian companies fell 29%, to $45.5 billion during the first seven months of 2018, according to data compiled by Bloomberg. The shortfall in what analysts expected is driven by consistently higher oil prices, which have emboldened management teams to put off deals and pursue their own paths. This trend, say analysts, is hampering consolidation that is necessary to allow Canadian firms to compete with lower-cost shale drillers in the U.S. Further complicating and dampening the market is rising U.S. output, which has cut the demand for crude and refined products from Canada, which has forced the country to find new, non-U.S. customers. We forecast that Canadian operators will drill 6,800 wells during 2018, a slight decrease from 6,913 in 2017, but a 71% increase from 3,974 wells in 2016. Canadian oil production rose an impressive 7.8% last year to 3.97 MMbpd, while oil reserves slipped 0.4% lower, and gas reserves dipped 4.1%. For more details on the Canadian market, please turn to page 49.

Mexico. Paramount among positive news in Mexico’s E&P sector is the major oil discovery struck in July 2017 by Talos Energy at its Zama-1 well, 37 mi from Puerto Dos Bocas, near Tabasco. The well has a gross oil-bearing interval of 1,100 ft, with 558 to 656 ft of net oil pay. This find has encouraged other operators to strive for similar results, helping to prop up the country’s upstream efforts. Yet these positive aspects are clouded by President-elect Andrés Manuel López Obrador, who says that when he takes office on Dec. 1, he will hold off auctioning any new oil blocks for at least two years. He also plans to modify laws to support the dominant role of state oil company Pemex.

López Obrador said that his incoming administration will not try to make changes to Mexico’s Constitution, which was amended in 2013 to allow for private investment in oil and gas. Rather, his regime will use its majority in Congress to fine-tune the hydrocarbons law. Among the expected changes, Pemex would be able to choose partners to develop reserves without needing approval from federal oil regulators, allow the government to grant new oil blocks to Pemex directly. Meanwhile, Pemex’s crude oil output has declined every year since 2004, prompting López Obrador to pledge to turn the situation around by funneling an additional $3.9 billion for E&P to Pemex.

We forecast that Mexico will drill 76 wells during 2018, a 3.8% decrease from 2017’s level, and a 47.7% plunge from 149 wells in 2016. As alluded to earlier, Mexican oil production fell again during 2017, losing 9.8%, to 1.977 MMbpd. Mexican oil and gas reserves both fell, losing 8.0% and 5.6%, respectively.

SOUTH AMERICA

The continent continues to experience a lackluster upstream sector, even though oil prices have improved considerably and remain consistently higher. Last year, the region drilled 2,425 wells, a slight decline from 2016’s level. This year, we expect South American drilling to slip another 4.9%, to 2,306 wells. Regional oil production declined 3.7% in 2017, to 6.771 MMbpd. Oil and gas reserves actually posted small increases, gaining 0.1% and 2.3%, respectively.

Argentina is working to counteract deterioration of its E&P sector, all the while battling high inflation and declining production rates. However, the country’s largely undeveloped Vaca Muerta shale—which reportedly holds upwards of 16 Bbbl of oil and 308 Tcf of recoverable gas—is still attracting big investors like YPF, Total, BP and Wintershall. Last year, a hefty $1.15-billion joint investment was reported. Accordingly, drilling and production in the country is set to pick up. World Oil forecasts an 8.0% boost in drilling this year to 1,101 wells. This should help to stem the slide in oil production, which fell 9.6% in 2017 to 480,954 bpd. Oil and gas reserves declined 4.1% and 3.2%, respectively.

Brazil’s highly prospective pre-salt layer still draws international operators, eager to explore the deep waters of the Campos and Santos basins. With several recent start-ups, including Libra and Bùzios fields, Brazil’s oil output is ramping up. Production gained 4.5% last year, to 2.638 MMbopd. Drilling is also set to rise slightly to 241 wells, from last year’s 239.

Venezuela. Drilling and production in Venezuela continue to descend into uncharted lows, as the country faces severe economic instability at the hands of the regime of socialist President Nicholas Maduro. Production fell to a low of 1.5 MMbopd this year and, unfortunately, there are no signs of improvement. By the same token, drilling in Venezuela is expected to continue its descent. World Oil forecasts a 36.9% decline in drilling this year, to just 367 wells, down from 582 wells in 2017. Oil reserves supposedly rose 0.2% higher, while gas reserves were down 0.6%.

Guyana is quickly becoming Latin America’s new crown jewel for exploration. Just prior to its ninth discovery offshore Guyana, on the Stabroek Block, ExxonMobil increased estimated recoverable resources for the block to more than 4 Bboe. Since then, the company’s Hammerhead-1 uncovered additional resources in the Guyana basin. The country’s recent discoveries—including Liza, Liza Deep, Payara, Snoek, Turbot, Ranger, Pacora and Longtail—have put Guyana on the map as a near-future oil producer.

WESTERN EUROPE

Western Europe has experienced declining production for several years. However, the Norwegian Petroleum Directorate reports that the region—specifically the Norwegian Continental Shelf (NCS)—still holds an estimated 141 Tcfe of undiscovered resources. To capitalize on those resources and maintain current production (2.912 MMbopd in 2017), a number of new, very large discoveries are necessary. However, Western European drilling will likely see another slight decrease, from an estimated 390 wells in 2017 to about 382 wells in 2018. Regional oil reserves gained 2.9% in 2017, while gas reserves lost 2.1%.

Norway. The Norwegian Petroleum Directorate released its 2018 Resource Report in June, affirming that large resources remain on the NCS. However, an increase in exploration and discoveries is necessary to maintain the country’s production level, currently at 1.617 MMbopd. New exploration acreage, offered during recent licensing rounds, is peaking operator interest, generating improved seismic data and well results.

After a substantial decline in exploration wells during 2016–2017, drilling should rebound in the near future. For now, the country remains steady, with 202 wells anticipated this year—down slightly from 205 last year. Installation of the Aasta Hansteen facility in April should transform Norway’s gas market. The field, with recoverable reserves estimated at 1.8 Tcf, should start production by year-end. It is not only the largest spar FPSO in the world, but it is also the first spar on the NCS. Oil reserves were up in 2017, while gas reserves declined.

UK. Despite closure of the Forties Pipeline System in December, the UK Continental Shelf (UKCS) has managed to maintain a production level—approximately 1.63 MMboed—not seen since 2011. The country’s Oil and Gas Authority projects an increase this year, as new fields are brought onstream. With the added output of several key projects going onstream this year—including Quad 204 (130,000 bpd), Mariner (55,000 bpd, Fig. 1) and Clair Ridge (120,000 bpd)—the UK may soon become a net crude oil exporter for the first time in about 14 years. Drilling in the UK, however, should see a marginal decline into 97 wells in 2018. Oil and gas reserves both fell in 2017.

EASTERN EUROPE/FSU

Driven by increased Russian activity, regional drilling was up 13% last year, and a further 5.6% gain is set for 2018, with most countries anticipating higher tallies. Oil production inched up 0.8%, to 13,931 bpd. Oil and gas reserves were both up marginally.

Russia. With the recent start-up of the Yamal LNG project’s second train, Russia’s output is increasing. Start-up of the third and final train is anticipated for early next year. The $27-billion development (once at full capacity) will process natural gas from the giant onshore South Tambey gas and condensate field, supplying 16.5 million tons of LNG per year to Europe and Asia.

Several new Russian projects are in development. However, many are expected to only offset the decline in output from aging fields, according to EIA. The country’s eastern oil fields, as well as its Arctic reserves, are expected to play a larger role in output growth.

The Caspian Sea holds some of the region’s largest offshore fields, including the Vladimir Filanovsky development and the Korchagin desposits. Presently, Phase 2 is underway at Vladimir Filanovsky, which holds estimated recoverable reserves of 1.06 Tcf of gas. Likewise, Yury Korchagin operations are moving forward. In July, Lukoil drilled the first production well in the eastern portion. Russian drilling should see a 5.5% jump this year, to 10,093 wells. Oil output inched 0.1% higher, to 10.891 MMbpd. Oil and gas reserves were slightly higher.

Other FSU countries. Since the collapse of the Soviet Union in 1991, the Caspian Sea’s legal status has been contested by its surrounding countries. Territorial disputes, as well as a spat over whether the Caspian is a sea or a lake, have prevented exploration of resources that EIA estimates to be at least 20 Bbbl of oil and more than 240 Tcf of gas. The countries—Russia, Azerbaijan, Iran, Kazakhstan and Turkmenistan—were able to form a treaty in August, however, agreeing that the development of seabed reserves will be regulated by separate deals between Caspian nations. Given the new agreement, other FSU drilling will likely pick up nearly 8.0%.

Other FSU oil production was up 3.6%, at 2.871 MMbpd. Kazakhstan’s giant Kashagan field in the northeastern Caspian saw several supply outages earlier this year, causing a 120,000-bopd dip in regional output.

AFRICA

After a significant hit to its E&P sector, Africa may finally see increased drilling this year. With stronger balance sheets and higher oil prices, operators are now in a position to capitalize on the continent’s vast resources. Last year, African drilling fell 27%. This year, however, a 14.8% increase is expected, to 820 wells. Regional output gained 5.0%, while oil and gas reserves were both up slightly.

Angola. New energy legislation and more favorable investment terms are drawing more interest from international operators, including Chevron and Total. Accordingly, Angola hopes to increase its production up to 250,000 bopd by 2020. Output last year averaged 1.667 MMbopd. Drilling in Angola should increase 13.6% this year, to about 50 wells.

Nigeria’s efforts to expand exploration outside the Niger River Delta and boost production face an uphill battle, as militant attacks on infrastructure and oilfield installations persist. The country’s declining oil production is causing an economic crisis, forcing the federal government to dip into excess oil revenue to help fund a war against Boko Haram’s Islamist insurgency.

Nevertheless, Nigerian drilling is on the rise. After just 70 wells were drilled last year, the “Giant of Africa” will see a 51.4% increase to 106 wells in 2018. Despite the ongoing conflicts, some progress is being made, as Total’s Egina project is still on track to achieve first oil by year-end. The ultra-deepwater field, situated more than 80 mi offshore, has a forecast production capacity of 200,000 bopd.

Algeria. As the largest foreign oil producer in Algeria, Anadarko (alongside partner Sonatrach) operates three mega projects in the country’s Sahara Desert region—Ourhoud, HBNS and El Merk. Collectively the partners have discovered 3 Bbbl of oil, to date.

Likewise, Eni and Sonatrach partnered earlier this year, with plans to convert the Berkine basin to a major regional gas hub. Although Algeria is one of Africa’s leading gas producers, it is struggling to relaunch exploration and development. Accordingly, the country’s drilling activity is likely to hold steady at 251 wells this year, down slightly from 258 wells last year. Oil and condensate production averaged 1.305 bpd, down 4.6%.

Egypt. As majors, including Eni and BP, strengthen regional E&P, Egypt continues on a path to becoming a net exporter. Additionally, recent discoveries in the eastern Mediterranean Sea, near the northern coast, should boost output significantly and alter the outlook for regional gas markets. Recent exploration success is attracting drillers; therefore, activity is set to rise 6.1% this year, to an estimated 259 wells.

The West Nile Delta, Nooros, Atoll and Zohr fields were fast-tracked for development by the Egyptian government and have begun production, giving the country’s output a substantial boost. Production last year was 614,500 bopd.

MIDDLE EAST

The Middle East continues to offer lucrative opportunities for the upstream sector, but not without some turmoil. The region is a potential beneficiary of the brewing trade war between the U.S. and China, as the Asian nation strikes back with retaliatory tariffs on U.S. petrochemical products. Alternatively, U.S. sanctions on Iran’s oil exports are looming. In 2017, the region drilled 2,999 wells, a slight increase from 2016’s level. For 2018, we forecast a 0.6% decrease to 2,981 wells. Regional oil production was down slightly, at 27.490 MMbpd. Middle Eastern oil and gas reserves were down slightly.

Saudi Arabia had the world’s second-largest oil production at 10.2 MMbpd during 2017. Saudi Aramco is responsible for keeping spare capacity broadly between 1.5 MMbopd and 2.0 MMbopd. The country’s drilling remains in a range between 550 and 600 wells annually. Two new oil fields and one new gas reservoir were found last year. Efforts to develop secondary reservoirs also continued. In addition, Midyan gas field was readied to go onstream. There was little change in oil and gas reserves.

Kuwait is among the countries that will benefit most from an OPEC-agreed increase in production, because the country has enough spare capacity, said Ole Sloth Hanse, head of commodities research at Saxo Bank A/S. In addition, Khafji oil field in the Divided Neutral Zone between Kuwait and Saudi Arabia is preparing to restart production in 2019, with maximum output expected at 350,000 bopd, according to Reuters. We forecast 763 wells will be drilled in 2018, a slight decrease from 2017’s level, but a major increase from 2016’s 637 wells. Oil production was down 5.5% at 2.743 MMbpd.

UAE–Abu Dhabi. This emirate is another entity that will benefit most from OPEC’s increase in production. ADNOC reported to Bloomberg that it can pump as much as 3.3 MMbopd and will increase output capacity to 3.5 MMbpd by the end of the year, “should this be required to help alleviate any potential supply shortage in the market.” We forecast 298 wells will be drilled in 2018, a slight decrease from the levels of 2017 and 2016. Oil production was down 1.2%, at 2.733 MMbpd.

FAR EAST/SOUTH ASIA

Southeast Asian governments are adapting their upstream policies to capture a share of new investment, according to GlobalData. Driven by Chinese activity, we forecast that 21,275 wells will be drilled in the region, a 6.6% increase from 2017’s figure. Oil production averaged 6.698 MMbpd, down 3.5%. Oil reserves were down 11.4%, due to a major revision in Vietnam.

China’s drilling increased 25.6% to 17,919 wells in 2017. For 2018, we forecast 19,015 wells, a 6.1% gain. This increase comes from various factors, including China’s fracing technique improvement, and the need to replace coal with gas in an effort to reduce pollution. As the region’s largest producer, China’s output was 3.2% lower, at 3.714 MMbopd. Gas production is set to climb between 6% and 8% annually through 2020, according to researchers at China National Petroleum Corp. In addition, China surpassed the U.S. as the world’s largest crude oil importer in 2017, at 8.4 MMbpd, according to EIA. By 2040, China is forecast to be the second-largest shale gas producer, after the U.S., growing to 22 Bcfd, according to the BP Energy Outlook. Chinese oil reserves were up 3.7%, while gas reserves were down slightly.

Indonesia’s government has made significant policy changes, aimed at attracting new investment. This prompted a 42% gain in drilling, to 575 wells in 2017. Drilling should increase further, to 740 wells in 2018. Eni announced the approval of a development plan for Merakes field, offshore East Kalimantan. Merakes field is estimated to hold about 2 Tcf of natural gas, in 4,920 ft of water, 22 mi southwest of the Jangkrik FPU. The approved plan foresees drilling and completing six subsea wells, and construction and installation of subsea systems and pipelines that will connect to the Jangkrik FPU. Indonesian oil production averaged 801,300 bpd, a 3.6% decline.

India. A recent open acreage licensing policy has inspired a modest increase in recent drilling activity. Wells drilled were up 4% in 2017, to 607. In 2018, we forecast a 1.3% increase to 615 wells. With the addition of 55 blocks into the mix, India hopes to increase its drilling activity. Oil production was nearly flat last year. India’s natural gas production grew in the last financial year. Overall, India produced 1.2 Tcf of natural gas in the last financial year.

Malaysia. In 2016, the country drilled 42 wells and increased to 48 wells in 2017. After a leadership change in the 2018 elections, the pro-subsidy government has re-introduced fuel subsidies, reversing a trend of fuel price reforms, Bloomberg reported. We forecast a 45% increase to 70 wells in 2018. In March, an FID was reached in Pegaga gas field, Block SK 320, offshore Malaysia. Operator Mubadala Petroleum and its partners have proceeded to the construction and installation stage, and plan to invest in excess of $1 billion in the development, with first gas expected by third-quarter 2021. Oil production averaged 676,200 bpd, a 4.1% decline.

SOUTH PACIFIC

In the South Pacific region, the vast bulk of activity is in Australia. We forecast the region to drill 241 wells in 2018, a 21.7% increase. South Pacific oil production averaged 408,010 bpd, a 10.4% reduction. Oil and gas reserves declined slightly.

Australia. We expect the country to drill 235 wells in 2018, comprising 97.5% of all wells drilled for the region. That figure is up from 198 wells in 2017. Offshore exploration wells remained at a record low, plunging from 20 wells in 2016 to five wells in 2017, according to the Australia Petroleum Production & Exploration Association (APPEA).

Oil production fell again, losing 9.0% to 286,500 bpd. In 2016, Australia was the world’s second-largest LNG exporting country with 60 Bcm. Gas production (LNG and domestic use) increased nearly 21% in 2017. By 2020, Australia is predicted to become the world’s largest LNG exporter, overtaking Qatar. As further evidence, the world’s first floating LNG project (Shell Prelude) is under construction, and expected to come online in 2018, according to the U.S. Department of Commerce.

Papua New Guinea. Despite reports of discoveries, Papua New Guinea continues to be a relatively untapped resource. We forecast that the southwestern Pacific island nation will drill three wells in 2018, down one well from 2017 and down 3 wells from 2016. However, recent 3D seismic reprocessing, and a net gas pay discovery look promising. ![]()

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)