Fates hinge on election, cracking the code

Some 350 mi and a gaping civic and developmental fissure separate the unconventional cores of the Denver-Julesberg (DJ) and Uinta basins. In contentious Colorado, the DJ Niobrara’s seat at the head of the table is jeopardized by a potentially decimating electoral showdown in November, while northeast Utah’s multi-horizon Uinta basin is yet to get a foot in the door.

“All of our acreage is in Wyoming. That’s really kind of important at this point,” William Thomas, CEO of Niobrara first-mover EOG Resources Inc. told Barclays CEO Energy-Power Conference on Sept. 5, in an obvious reference to next month’s ballot initiative that would quintuple setbacks and effectively put nearly all of Colorado’s prospective privately-held acreage off-limits to new wells

The triple-deck Niobrara, often stacked with the underlying and similarly productive Codell shale, is the source rock for the copious Wattenberg and Silo fields of Colorado and Wyoming, respectively. Most activity is concentrated in, and around, the gas- and condensate-rich Wattenberg of Weld County, Colo., which also is home to the long-festering conflict between operators, neighborhoods and anti-drilling activists, along the populous Front Range corridor.

Between lobbying, DJ-Niobrara operators managed to average 26 active rigs in September, down one rig year-over-year, according to Baker Hughes. Across the border, only five rigs were at work throughout Utah, all but two operated by EP Energy Corp. and Newfield Exploration Co., which—along with Crescent Point Energy Corp. and, more recently, Middle Fork Energy Partners LLC—hold dominant positions within the Uinta’s quasi-core Altamont-Bluebell field, the basin’s largest. As with 66.5% of Utah’s aerial reach, the Uinta is controlled largely by the U.S. Bureau of Land Management (BLM).

Despite the charged environment and midstream issues, the U.S. Energy Information Administration (EIA) estimates that October oil and gas production in the Niobrara region will increase to 620,000 bpd and 5,177 MMcfd, respectively, up year-over-year from 506,000 bpd and 4,719 MMcfd, Fig. 1. Meanwhile, operators point to the August start-up of DCP Midstream’s Mewbourn 3 gas processing plant, and similar facilities in the works, as helping mitigate severe midstream constraints.

Outside the EIA’s radar of major shale plays, the five principal Uinta counties (Carbon, Duchesne, Emery, Grand and Uintah), as of August, had produced a cumulative 12,735,663 bbl of oil and 119,651,490 MMcf of gas this year, according to the Utah Department of Natural Resources (DNR). A breakdown of DNR data shows the quintet delivering an aggregate 28,762,264 bbl of oil and 302,339,076 MMcf of gas for all of 2017.

DUELING INITIATIVES

Spurred by incessant urban opposition, Colorado’s electorate next month will decide whether to increase setbacks from any “occupied structure or vulnerable area” from the current 500 ft to 2,500 ft. Passage of Initiative 97 would prohibit new wells from being drilled on 85% of the state’s non-federal land, the regulatory Colorado Oil and Gas Conservation Commission (COGCC) concluded in a July 2 study.

“This is a ban. It’s to drive you out of the state,” Chip Rimer, senior V.P. of Noble Energy Inc. told the Colorado Oil and Gas Association (COGA) 2018 Energy Summit, as quoted by the Wall Street Journal on Aug. 30.

The same election includes an offsetting initiative, which would enable private property owners to seek compensation if a law restricts oil and gas operations or otherwise reduces their land’s “fair market value.” The so-called Initiative 108 is championed by both the industry and the Colorado Farm Bureau.

As a statutory amendment, even if approved by voters, Initiative 97 could still be overturned or revised by the state legislature. Initiative 108, meanwhile, is a constitutional amendment and would automatically become law with a favorable vote.

Rimer’s dire warning notwithstanding, Noble plans to increase DJ expenditures in its play-high 335,000-net-acre position, at the expense of curtailing completions in the takeaway-challenged Delaware basin. In a twist of fate, gas processing constraints had forced Noble earlier to reduce DJ activity from once “historical levels.”

“Given the temporary deferral of completions in the Permian, we are planning to reallocate some 2018 and 2019 capital to the DJ basin. This will provide additional DJ volumes in 2019, partially offsetting more moderate Permian growth,” Gary Willingham, executive V.P. of operations, told analysts on Aug. 3.

With two operated rigs, Noble drilled 23 wells with average lateral lengths of 10,000 ft in the second quarter, concentrated within the Wells Ranch, East Pony and newly initiated Mustang integrated development plan (IDP) area.

Anadarko Petroleum Corp. laid down two rigs and one completion crew in the second quarter, across its 350,000-net-acre Wattenberg leasehold, but insists next month’s vote had no bearing on the decision to trim DJ activity levels. “If anything, you might take just the opposite of that. If we were concerned about it, we would push the capital forward and not wait,” says President and CEO Robert Walker.

Anadarko is now operating four rigs (Fig. 2) and two completion crews, down from six active rigs and three completion crews in the first quarter. The company drilled and turned-in-line 63 wells in the second quarter, compared to 89 wells drilled in the first three months of 2018.

After spudding 43 wells and turning 48 to production in the second quarter, PDC Energy, Inc., intends to operate three rigs and one completion crew for the remainder of 2018. With around 100,000 largely contiguous net acres prospective for both the Niobrara and Codell, PDC is focusing primarily in Weld County’s prolific Kersey area, where 30% of the estimated 150 to 165 new drills this year will feature lateral reaches of 10,300 ft.

The electoral stakes would seem particularly high for pure-play operators like Extraction Oil & Gas Inc., whose 325,000-net-acre leasehold includes some 170,000 acres in the DJ core. The Denver-based independent, however, declined to comment on the potential impact of the initiative, or its planned activity for the rest of 2018.

In the second quarter, Extraction drilled 29 net (40 gross) wells, targeting the three Niobrara benches and the Codell, with lateral lengths averaging around 7,725 ft. The company also completed 46 net (61 gross) wells during the quarter.

Fellow Wattenberg-centered player SRC Energy Inc. also has not commented on the potential ramifications for its 90,000-net-acre Wattenberg asset. For now, SRC plans to drill 117 gross (100 net) Niobrara and Codell wells in 2018, with 116 gross (103 net) wells earmarked for completions. The company drilled 27 net (31 gross) wells in the second quarter.

RURAL EDGE

Not surprisingly, properties outside the urban front line are prized assets. HighPoint Resources Corp., of Denver, formed through the recent combination of Bill Barrett Corp. and Fifth Creek Energy, is especially keen to tout its status as “the only exclusively rural DJ basin operator.” HighPoint controls 151,100 net acres, spread across the more sparsely populated plains of Colorado’s Northeast Wattenberg and southeast Wyoming, where its cumulative DJ assets include 86,700 net acres in Hereford field, near Laramie.

The company is running two rigs in the Hereford asset and one in the Northeast Wattenberg, and expects to drill between 120 and 125 gross wells this year, most of which will be constructed with average lateral lengths of 9,500 ft. Extended-reach drilling began in April on an aggregate 10-well Niobrara and Codell drilling spacing unit (DSU) in the Hereford asset, with initial flowback expected in the third quarter.

EOG operates well outside of Colorado crosshairs and in the friendlier confines of Wyoming’s Powder River basin. There, the Houston operator controls 400,000 net acres, where this year the Niobrara and underlying Mowry shale plays were designated the company’s latest premium drilling locations.

EOG plans to average two rigs and one completion spread throughout 2019, and complete around 45 wells, compared to 39 in 2017.

Restructured Bonanza Creek Energy, Inc., likewise, describes its 67,000-net-acre position in the rural Wattenberg as posing “little urban development risk.” As of September, Bonanza Creek was running two rigs and two completion crews, with 2018 guidance calling for the drilling of 59 net (77 gross) Niobrara and Codell wells, with 37 net (49 gross) wells to be put online.

POOR PLAYER’S PERMIAN?

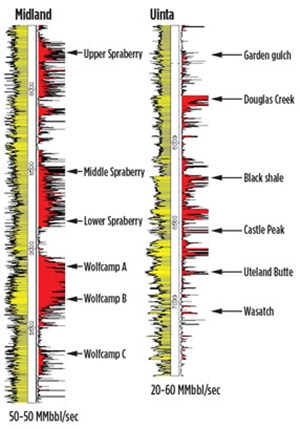

With multiple, prospective zones (Fig. 3) and leases that can be had for chump change by comparison, the Uinta would appear to be a cost-effective alternative to the increasingly pricy Permian basin. However, owing to the growing pains intrinsic to a nascent play, well costs can run “just a little bit north of $10 million,” says the EP Energy chief.

“We think there’s a lot of things that we can do long-term to actually drop that cost structure down, but as it happens in any program like this, when starting out, you usually are kind of in a high-cost period, while you’re testing and trying things,” President and CEO Russell Parker told analysts on Aug. 10.

Holding around 157,000 net acres, EP is running two rigs and has upsized the 2018 in-field pilot program to include four horizontal wells with 10,000-ft lateral reaches. The company drilled two wells in the second quarter, with average lateral lengths of 9,000 ft, while re-completing a company-record 29 wells.

Since 2012, Canada’s Crescent Point has amassed around 300,000 net acres in what it still described as an “emerging and early-stage resource play.” In the second quarter, the Calgary-based independent drilled 15 gross (7.9 net) wells and has set a 2018 production target of 25,000 boed.

Advancing in-basin activity now features the concurrent completion of the stacked Castle Peak, Wasatch and Uteland Butte formations, with laterals up to 10,560 ft long.

After wrapping up a 20-well horizontal drilling JV program in its Central basin asset last year, Newfield will run a single rig in 2018, to hold by production (HBP) the “vast majority” of a more-than-225,000-net-acre leasehold.

Newfield plans to drill an additional 10 to 15 wells in the Central basin this year, and says total drilling and completion costs are now less than $7 million/well. Second-quarter net production of around 21,000 boed was up nearly 30%, year-over-year.

On July 10, Denver’s Middle Fork Energy Partners took the first step in entering the major stakeholder ranks, with a definitive agreement to acquire the estimated 230,000 net acres and associated production held by QEP Resources, Inc. The $155-million deal includes properties in Duchesne and Uintah counties, with quarterly production last reported at 54 MMcfd of gas equivalent. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- What's new in production (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)