Teamwork—The great facilitator

WIRED FOR EFFICIENCY

“The mud pump called and said it’s not feeling well.”

Onboard the Noble Globetrotter I drilling vessel and at distant onshore facilities, the pump’s status is noted in real time, along with the health and performance of other major drilling, well control, power generation, and dynamic positioning equipment, Fig. 1. The holistic data form a digital twin that replicates the rig’s physical assets and, along with advanced analytics, detects off-standard behavior so that operators can respond before there is a problem, Fig. 2.

Described as the world’s first Digital Rig, the vessel is wired with technology developed by a partnership between GE and Noble Corporation, aimed at data-driven operational efficiency via data analytics. Their Digital Rig, powered by GE’s Predix platform, collects data through individual sensors and control systems, and transmits it in near-real time to GE’s Industrial Performance & Reliability Center for predictive analytics. Noble receives real-time data and the collective analysis to improve rig efficiencies, and shares relevant insights with manufacturers to improve equipment performance.

The implementation already has captured anomalies and produced alerts to inform potential failures up to two months before they would occur. Ultimately, the Digital Rig may deliver as much as a 20% reduction in operational expenditures across the targeted equipment through reduction of unplanned downtime, improved revenue, and lower maintenance costs.

This unlocking of synergies, from drilling operations to equipment expertise and software analytics skills, is the driver of a holistic transformation of the offshore industry, predicts Andy McKeran, general manager of GE’s Marine Solutions. At the initial deployment of the system, he said, “We are excited to be able to move an important step closer to achieving our vision of a more autonomous future for marine operations.”

Much of the efficiency gain is expected to come from predictive maintenance. The digital twin has a learning curve that will progressively enhance the ability to predict machine behavior. As more data are acquired and analyzed, it will promote maintenance insights, improve effectiveness and reveal new opportunities.

Maintenance effectiveness is expected to improve the understanding of equipment health before, and after, maintenance is conducted, explains Krishna Uppuluri, GE’s Marine Solutions V.P. of digital marine products. Risk reduction is also anticipated through twin-generated prediction of the potential for premature or regular failures before they manifest.

Two Noble rigs are outfitted with the system, and two more were planned by the end of the second quarter. The deployments are just the beginning.

“The potential of digitalization will go beyond a single vessel, opening the door to transforming our entire fleet,” according to Bernie Wolford, Noble’s senior V.P. of operations. “The data backbone paves the way towards autonomous drilling, and digital technology is facilitating a new era of drilling and asset performance improvements that are unprecedented.”

While it is too early in the process of learning and applying knowledge to cite specific insights, Wolford noted in early June that significant productivity gains had already been made, using a variety of data sources, including a digitized daily reporting system.

PUT A LID ON IT

The challenge of capping a subsea blowout is well documented. Industry capabilities for dealing with that scenario improved considerably with the March launch of the Offset Installation Equipment (OIE) system. An industry first, the OIE is designed for conditions that prevent direct vertical access to a wellhead. Its delivery completes a unique subsea well capping system six years in the making.

Focused on enhancing industry response to subsea well-control incidents, the system is the product of a collaborative effort between Oil Spill Response Limited (OSRL), an industry owned cooperative; the Subsea Well Response Project (SWRP), a non-profit joint initiative; and the oil and gas engineering firm, Saipem.

Development of the offset technology was the final phase of the SWRP. The project was established in 2011 on the recommendation of the International Association of Oil & Gas Producers (IOGP) to achieve four core objectives: design a capping toolbox to shut in the well; design a toolkit for subsea injection of dispersant; collaborate with OSRL on deployment to the wider industry; and conduct global containment system feasibility studies.

SWRP Project Lead Eli Bøhnsdalen commented that, “OIE has the potential to make a huge difference in capping a well or stopping a critical blowout, in areas where direct vertical access to the blowing well is unsafe, and this has never been attempted before.”

The launch in Trieste, Italy, where the equipment is based, makes the system available to existing OSRL members and current OIE members, including BP, Chevron, ConocoPhillips, ExxonMobil, Petrobras, Shell, Equinor and Total. Saipem, which has been responsible for the design, fabrication and testing, is responsible for the OIE’s ongoing storage and maintenance. Each member organization will undergo personnel training on system capabilities and operation during an incident.

OIE equipment can be deployed up to 500 m from an incident site and has a working depth of 75 to 600 m, Fig. 3. The equipment is fully compatible with OSRL’s capping equipment, creating an end-to-end capping and containment solution.

The main component is a carrier composed of four ballast tanks, a winch system to control the carrier position and lift payloads, a Cardan joint for capping stack positioning, and an ROV interface for controlling carrier functions from the topside control room. The 236-ton (air weight) system is 13.7 m tall and 12.7 m × 10.4 m wide, Fig 4.

The carrier is submerged from a vessel using a depressor weight and free-flooding of the four ballast tanks. Once submerged, a drag chain provides passive height control (relative to the seabed), which allows the carrier to be moved laterally by vessels into the vicinity of the incident well.

Positive buoyancy is maintained using the ballast tanks clad with buoyancy modules, which provides sufficient uplift to carry a variety of response equipment payloads. Positional control of the carrier in the vicinity of the well is achieved using mooring winches. Once over the well, the Cardan joint provides the capability to align and lower the capping stack (or other equipment) onto a BOP or wellhead. The carrier is controlled via a well owner-sourced ROV, which provides an interface for hydraulics, power and communications. Support equipment includes control and workshop containers, assembly and transport equipment, and air supply equipment from topside to subsea.

TESTING THE WATERS

Should a deepwater blowout occur in the U.S. Gulf of Mexico (GOM), a containerized package of water sampling and monitoring equipment is standing by in Katy, Texas. Field data and scientific support from deployment of the mobile system will be used to speed and optimize subsea dispersant injection, which is critical to reducing potential shoreline impact and providing for a safer work environment near the incident, Fig. 5.

The technology is the latest addition to the capabilities of HWCG LLC, a consortium of deepwater operators and non-operators, born out of the Macondo event and dedicated to deepwater incident response. It was developed and is supported by CSA Ocean Sciences Inc. (CSA), a marine environmental consulting firm. CSA maintains the equipment for HWCG members and will provide mobilization, deployment, and scientific support services, should the equipment be needed for a response. CSA specializes in multi-disciplinary marine projects focused on the potential environmental impact of various activities.

The system consists of three components: an operations container, laboratory container, and launch and recovery system. The package will provide an extensive examination of the subsea water column down to the sea floor, to a depth of approximately 10,000 ft. Within hours of an event, the equipment can be mobilized to a GOM seaport and outfitted on a supply boat.

Deployment of the package enables in situ measurements of fluorescence, turbidity, particle size, and dissolved gases in the water column. These data are used to characterize water column conditions and identify the potential presence of subsea oil, which is crucial to planning the response and mitigating the effects from deepwater oil spills in a subsea environment.

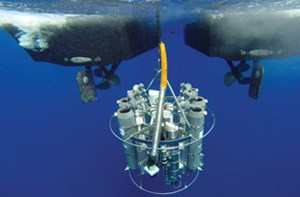

Instruments are deployed on a rosette array, using a custom electromechanical cable that provides power and two-way communication, Fig. 6. Measurements are acquired with Sea-Bird Electronics (SBE) and WET Labs oceanographic instruments, including an ECO-CDOM fluorometer and ECO-FLNTU combined fluorometer and turbidity sensor; laser in situ scattering and transmissometer (LISST-Deep) manufactured by Sequoia Scientific; an SBE43 dissolved oxygen sensor; and CONTROS methane and carbon dioxide sensors.

In standby mode, the system is stored securely with continual power and air conditioning at the Seanic Ocean Systems Inc. facility in Katy. When mobilized, the system will be trucked to the selected port and placed on a suitable vessel.

HWCG LLC is a major industry consortium advancing optimal deepwater containment solutions for its members operating in the U.S. GOM. (While HWCG is the consortium’s full name and no longer an acronym, it originally stood for Helix Well Containment Group.) HWCG members represent about two-thirds of all U.S. deepwater operators who have drilled approximately one-third of all deepwater wells since the Macondo event and currently produce nearly a third of the U.S. GOM deepwater oil and gas. All the members contribute to a mutual aid program that pools assets, personnel and technical resources. In addition to owned assets, HWCG has agreements with several prime vendors for additional services, equipment, expertise and personnel.

Its stated goal is to protect people, property and the environment through a robust, modular response plan, and the capabilities to quickly and comprehensively respond to a deepwater blowout. The consortium said this comprehensive approach resulted in the U.S. Bureau of Safety and Environmental Enforcement (BSEE) granting a member the first permit to resume deepwater GOM drilling in 2011.

Technology innovation is guided by a modular design philosophy leading to equipment upgrades and new capital projects. The consortium’s response system builds on equipment proven in the Macondo event, including the Helix Fast Response System comprised of the Q4000 intervention vessel and Helix Producer 1 (HP1) from Helix Energy Solutions Group. HWCG continues to expand and simplify its response capability, and is building a production test system suitable for deployment on a single vessel—a solution that will have the ability to eliminate the HP1 from the response, which will improve safety while reducing complexity.

HWCG intervention equipment is capable of capping and containing a well with the mechanical and structural integrity to be shut in at depths to 10,000 ft. The new water sampling and monitoring system is the latest addition to an equipment ensemble that includes two dual-ram capping stacks (135/8-in., 10,000 psi, and 18¾-in., 15,000 psi); a capture and process capacity of 130,000 bfpd and 220 MMcfgd; and dispersant injection and monitoring equipment. Operations are conducted from a dedicated joint command center at the PetroSkills Conference Center in Katy.

In addition to technology, HWCG also has been conducting annual subsea blowout exercises to integrate response capabilities, process and equipment. The last one, conducted in Houston, May 2017, brought together more than 200 well control experts for the large-scale exercise. Stone Energy, the event host, acted as the “responsible party” in a simulated well blowout scenario. HWCG’s mutual aid team, which includes experts from 16 member companies, vendors and response partners, assisted Stone Energy in regaining well control.

INSPECTIONS TAKE FLIGHT

Hear that buzzing noise? Aerial drones are taking on an increasing role in inspecting offshore structures, including production platforms, drilling rigs and FPSOs. Much of what’s occurring has been visual inspection, but some of the newest technology being tested in the North Sea will conduct ultrasonic testing and 3D laser scanning, as well live-streaming 4G high-resolution video.

In Aberdeen, Air Control Entech (ACE) and the Oil & Gas Technology Centre (OGTC) are developing three unmanned aerial vehicles (UAVs) to provide these inspection capabilities. The OGTC calls the endeavor a step change in the functionality of UAVs for the remote inspection of oil and gas facilities.

The OGTC works with industry and academia to co-invest in new technologies. In the 12 months since its launch in 2017, it has co-invested £37 million in more than 70 technology projects, focused on key themes of asset integrity, well construction, small pools, digital transformation and decommissioning.

Developing advanced UAVs is vital to the Asset Integrity group’s goal of eliminating the impact of asset integrity on operational uptime by 2026, says group manager Rebecca Allison. “The feedback and support of our industry partners has been instrumental, so it’s no surprise that there is already wide-spread interest in trialing the technology.”

The ACE trials are deploying the UAVs on the North Sea facilities of several major operators. Focused on developing UAV technology with improved flight and safety performance, and functionality, the testing will conclude phase one in September 2018. The next phase will focus on use in confined spaces, as well as battery technology.

Kieran Hope, managing director for ACE, says the drones may reduce the cost of inspections 50%. That’s attributed mostly to man-hour savings, and greater reporting speed and efficiency. Instead of weeks with 3- or 4-man crews on ropes and scaffolding, a drone might do the job in days with a pilot and payload operator. For example, a recent under-deck survey that previously had required nearly a month was completed in four days. The man-hour savings also represent a significant reduction in crew risk exposure.

Each of the ACE drones is designed for the instrument package with variations that include payload weight and size, and propeller configuration, Fig. 7. The live-stream configuration uses a 4G network for real-time, high-definition video streaming and data transfer from offshore inspections to onshore teams. For ultrasonic testing, electromagnets lock the UAV onto the structure, which reduces power requirements for longer flight times and multiple readings at a single location. Advanced 3D laser scanning technology will enable measurements within 2 mm to improve the accuracy of re-engineering efforts.

The advances are among the latest in the industry’s growing use of offshore drones. In publishing its guide for drone use, Oil & Gas UK recently observed that an increasing number of oil and gas operators are using UAVs for inspections, as well as aerial photography, surveying and security.

The trade association’s HSE director, Mick Borwell, said, “The technology is particularly attractive for its use in improving safety. For example, sending unmanned aircraft, instead of people, into confined spaces to conduct inspections reduces risk, and is also effective and efficient. We expect their usage to grow.”

VIRTUAL P&A

Every decommissioning presents a unique challenge. Going through it before the work starts pays off in improved safety, efficiency and reduced cost. Aberdeen’s Robert Gordon University (RGU) has introduced a unique simulation capability that enables bespoke planning and preparation of plug and abandonment (P&A) operations, Fig. 8.

That capability is a world first, says RGU. It uses specialized P&A software and a multi-function simulator platform that also supports training in advanced well control, deepwater drilling, extended reach drilling, managed pressure drilling and pressurized mud cap drilling.

Since its introduction in December, approximately 48 people—including P&A service providers, operators and drilling contractors—have trained on the simulator. The students are trained as a team from a specific company. Each course is a custom process of classroom and simulator activities.

The decommissioning capability was developed in collaboration with funding from The Oil & Gas Technology Centre, KCA Deutag, and Drilling Systems, and technical support from Baker Hughes, a GE company.

At Drilling Systems, COO Clive Battisby says the new decommissioning simulator shows how close collaborative partnership and expertise really work to create truly custom, cutting-edge, real-time training simulations and systems.

“In this case using the physical tool data, and CAD drawings taken from the customer’s real-world downhole tools, has been added into the simulation to create a package of decommissioning tools. They allow knowledge and skills to be learned in a safe learning and very realistic environment.” ![]()

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)