Reducing gas flaring delivers economic and environmental benefits

The iconic oilfield gas flare is coming under fire. The common and long-used practice of burning off, or flaring, associated natural gas from oil wells is being scrutinized with a new set of standards, driven by the industry’s push to maximize field economics while embracing practices that promote environmental stewardship.

Gas flaring is applied in cases where, for a variety of reasons, there is no midstream pipeline located at or near the wellhead, or the pipeline can’t take additional gas. Once deemed unusable because it could not be easily transported to a fractionating facility, associated gas that is typically flared at the well-site is now considered a commodity that is worth capturing, processing and transporting to market. As producers strive to make use of as much energy as possible, and to reduce their carbon footprint to comply with ever-stringent state and federal regulations, innovation is bringing solutions to the forefront.

One technology, developed in collaboration with major North American operators, is turning the traditionally stranded natural gas byproduct at well-sites in North Dakota, into a valuable resource that is being transported and used off-location, and in the oilfield itself. At the same time, the process removes hundreds of thousands of tons of greenhouse gas emissions, including CO2, from the atmosphere annually.

The gas flaring issue is not isolated to North America. In fact, the amount of flared gas at oil well sites globally has increased over the past five years, a trend attributed to ramped-up oil production in the Middle East, Africa, South America and the U.S. In a December 2016 report issued by the Global Gas Flaring Reduction Partnership (GGFR), a World Bank-led consortium of oil companies, governments and international agencies dedicated to reducing gas flaring, states that an estimated 147 billion cubic meters (Bcm) of associated gas was flared in 2015, an increase of 2 Bcm over 2014.1

The report, entitled New Data Reveals Uptick in Global Gas Flaring, estimates that if the flared gas were processed for power generation, it could provide approximately 750 billion kWh of electricity. The study also reveals there are more than 16,000 gas flares at oil well sites globally, resulting in about 350 million tons of CO2 being released into the atmosphere annually. Russia is the world’s largest gas-flaring country, burning about 21 Bcm annually, followed by Iraq (16 Bcm), Iran (12 Bcm), the U.S. (12 Bcm) and Venezuela (9 Bcm).

ECONOMICS, ENVIRONMENT, REGULATION

In the U.S., economics, emissions reduction and increasingly strict state/federal clean air guidelines and mandates are giving oilfield operators an incentive to reduce flaring of associated natural gas that has increased with the spike in unconventional oil production. Flared gas contains components that can reduce air quality and cause health issues if improperly combusted. Unrestricted flaring of associated natural gas in the oilfield also can trigger compliance with Title V of the U.S. Clean Air Act, which requires major producers of air pollutants to obtain operating permits that must be certified annually, adding significant operational cost. State environmental regulations, which vary considerably, also have raised the bar for the industry to meet air quality standards in quantifiable ways.

The oil-rich Bakken/Three Forks play, in North Dakota, holds an estimated 7.4 Bbbl of recoverable crude oil and 6.7 Tcf of associated gas, according to a U.S. Geological Survey report. The play, located in the Williston Basin, covers the western part of North Dakota, eastern Montana, and southern Saskatchewan, Canada. The unconventional shale oil boom that began in the early 2000s, catapulted the play into one of the most prolific oil basins globally.

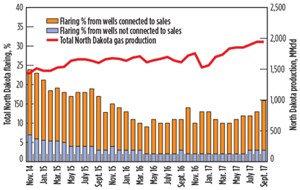

With more than 14,000 wells, the Bakken is now producing more than 1.1 MMbopd, and nearly 2 billion cubic feet (Bcf) of associated wellhead gas per day, Fig. 1. Unfortunately, the midstream capacity for capturing and transporting wellhead gas to market is either not available or lacks the capacity to handle the volume of produced gas in North Dakota. Generally, the region is characterized by extreme environmental conditions, including undulating geography and difficult weather conditions. This combination of factors is the primary reason the state has the highest volume of flared associated gas in the U.S.

Regional regulations. To help solve the problem, the North Dakota Industrial Commission (NDIC) in 2014 enacted a policy designed to reduce gas flaring by establishing targets for the capture of associated gas. The targets are designed to reduce the flared volume of gas, the number of oil wells flaring and the duration of flaring from wells. Producers operating in Bakken must submit gas capture plans for all drilling applications and for increased density, temporary spacing and proper spacing cases.

The targets, which recognize the development of infrastructure to gather, process and transport gas volumes instead of flaring, requires time to implement and take effect over several years. The current gas capture requirement is 80%. By Nov. 1, 2018, operators must meet a gas capture goal of 88%, increasing to 91% by November 2020. Flaring volumes are tracked on a monthly basis and operators that don’t meet the benchmarks are subject to production restrictions.

Energy producers in the play have made significant progress to reduce flaring, with the volume of flared gas significantly declining since 2014, even as total natural gas production has grown, according to the U.S. Energy Information Administration.3 However, in September 2017, North Dakota operators flared 2% more natural gas than permitted, or 54 MMcfpd, bringing total flared wellhead associated gas to 323 MMcfpd, according to Lynn Helms, director, North Dakota Department of Mineral Resources Oil and Gas.4 The uptick marked the first time the threshold has not been met since gas capture targets were established.5

No production restrictions were imposed, however subsequent failures to meet the flared associated gas standard could trigger restrictions, particularly as the industry struggles month-by-month to meet next year’s gas capture target rate of 88%, said Mr. Helms in a Nov. 15 press conference.

To meet that goal, the oil and gas industry has needed to expand natural gas processing capacity by 10% to 12% per year. That metric has not been achieved due to the decrease in capital expenditures that has slowed infrastructure development for many midstream operators. To date, the industry has invested about $13 billion in gas gathering and processing, but needs to spend another $11 billion to meet capture targets.

CAPTURING, PROCESSING GAS BEFORE FLARING

Recognizing the need to curb flare volumes even before the North Dakota restrictions were implemented, GTUIT, a Billings, Montana-based designer and manufacturer, collaborated with major operators in the region to develop solutions that capture and process wellhead gas.2

Method. Early on, the company had two key design objectives: 1) development of an integrated flow control system that could adapt to the ever-changing flow; and 2) chemistry of the well and the engineering of reliable, unmanned mobile and modular equipment that could be deployed at the wellsite, Fig. 2. The result is a unique modular system that can be mobilized to the wellsite with flow control capability that provides gas compression and refrigeration to lower the temperature of the gas stream to -35°F, Fig. 3. The process results in the creation of a stream of NGLs and conditioned field gas.

GTUIT has designed, built and currently manages a fleet totaling 22 MMcfgd of wellsite modular and mobile (250 MMcfgd, 500 MMcfgd and 1,000 Mcfgd) units for many leading North Dakota producers.

Since 2012, the company has recovered more than 1 MMbbl of NGLs, 201,650 tons of CO2 and nearly 212,000 tons of volatile organic compounds from Bakken gas flares. In addition to flare reduction and NGL recovery, the units condition wellhead gas to deliver a consistent dry gas that is used to power engines, reducing maintenance costs and extending equipment life, Fig. 4.

Improved economics. In addition to the marketable NGLs, the mobile units produce a conditioned, dry gas composed primarily of ethane and methane that can be processed into LNG or CNG and transported offsite for use as fuel. Once the processed gas leaves the wellsite, it can be used to power drilling rigs, or hydraulic fracturing fleets, to heat water for fracs, to make remote power, and to operate any other equipment that uses natural gas or propane.

The dry gas is also used onsite to power turbines and reciprocating engines for well-site power generation. An emerging trend toward oilfield electrification, with diesel-powered drilling rigs and other equipment being replaced by electrically-powered equipment using natural gas, further expands this opportunity.

The company has been providing feed gas to a field LNG system for more than a year. The LNG unit produces 6,000 to 9,000 gal of LNG per day which is sold to drilling, hydraulic fracturing or frac water heating operations at a discount to diesel prices. The processed gas is also used for feedstock for CNG operations which is sold, discounted to diesel prices, and used as diesel replacement. The feedstock helps producers recover value from potentially flared associated gas, reduces air emissions, helps meet state flare capture regulations and minimizes their carbon footprint.

Given the heightened awareness of gas flaring on a global level, the company signed a global marketing agreement with Caterpillar Oil and Gas to expand its services, in conjunction with Caterpillar dealers worldwide, to international markets, including the Middle East, South America and Africa. Outside North America, both the environment and economics are drivers for the technology, given higher demand and prices for natural gas and the need for power.

CASE STUDY

For more than two years, the company has provided well-site gas processing/flare capture services to a top-ten Bakken operator, which, like all North Dakota production companies, is required to keep flare capture values at or below NDIC targets. In 2016, the company produced approximately 33,000 boe from typical shale-type wells that experience rapid declines in production over a relatively short period of time.

In this case, the task of capturing flared associated gas is especially difficult because much of the company’s production is located in a region of the Bakken traditionally underserved by midstream services. Because the modular units are trailer-mounted, they can be mobilized to the well-site immediately after hydraulic fracturing flowback. As the gas volumes decline, the number of units and processing capacity is decreased to match the wells’ gas output.

In the fall of 2017, the company mobilized 1,500 Mcfgd of the client’s 6 MMcfgd contracted capacity to one of the operator’s production pads. Associated gas from the Bakken/Three Forks formation is typically 1,500 btu/ft3 with yields of approximately 4-5 gal of NGLs per Mcf of gas. At these typical yields and well flows of 1,500 Mcfgd, the operator is generating between 6,000 and 7500 gal of NGLs daily. The NGL market during this time (not including transportation and marketing fees) was $0.55/gal, yielding the operator $3,300 to $4,125 per day.

The conditioned gas from mobile units is used to provide feedstock for the CNG compression station, and power the approximately 1.5 mW of power generation needed for compression and gas processing, Fig. 5. CNG sales are increasing the company’s revenues helping to defray lease operating expenses and increase overall revenues.

VALUE ADDED BENEFITS

Innovation and technological advancement that have occurred over the past decade are enabling operators to extract more oil from both conventional and unconventional fields and expand into new, often isolated, frontiers that until now have been inaccessible. The flip side of this positive trend is the increased production of associated wellhead gas.

Lack of a pipeline or other midstream infrastructure at well sites worldwide presents a dilemma for an industry pushing to maximize field economics, achieve environmental sustainability and avoid penalties and increased operational cost by complying with regulations.

A modular, mobile technology that can be quickly and easily deployed at the wellsite is providing a viable natural gas capture and processing solution in the oilfields of North Dakota. Expansion of the system beyond North America could play an important role in reducing global flaring, while helping producers develop profitable outlets for NGL and conditioned field gas, significantly reduce CO2 and other gases and achieve regulatory compliance. ![]()

REFERENCES

- World Bank, Global Gas Flaring Reduction Partnership (GGFR), “New data reveals uptick in global gas flaring,” Dec. 12, 2016. http://www.worldbank.org/en/news/press-release/2016/12/12/new-data-reveals-uptick-in-global-gas-flaring

- Hess Corporate Sustainability Report, 2015. http://www.hess.com/docs/default-source/sustainability/hess-2015-csr.pdf?sfvrsn=2

- U.S. Energy Information Administration, “Natural gas flaring has declined sharply since 2014,” June 2016. https://www.eia.gov/todayinenergy/detail.php?id=26632

- North Dakota Industrial Commission, Director’s cut report, June 2017. https://www.dmr.nd.gov/oilgas/directorscut/directorscut-2017-06-13.pdf

- U.S. Energy Information Administration, “North Dakota aims to reduce natural gas flaring,” Oct. 2014. https://www.eia.gov/todayinenergy/detail.php?id=18451

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- Digital transformation: Accelerating productivity, sustainability in oil and gas (November 2023)

- Technological advances increase efficiencies and flexibility (November 2023)

- Volatile organic carbon emissions in oil and gas industry: Impact and mitigation (November 2023)

- Technological innovation delivers transformative product suite to upstream sector (November 2023)

- Executive viewpoint (August 2023)