Global drilling begins slow recovery, while production, reserves stay even

Statistically speaking, 2016 was a low point for the ages. The U.S. drilled its fewest number of wells since 1933, the heart of the Great Depression. In Canada, last year’s well count appears to be the lowest since 1972, using figures from the Canadian Association of Petroleum Producers. Also, using World Oil archives, the grand total of worldwide drilling is the lowest since at least 1999, which was the back end of the Asian Financial Crisis.

In contrast to the slow recoveries that have plagued North America and most other regions, the Middle East and Russia remain the healthiest E&P areas. In the specific cases of Saudi Arabia and Russia, drilling remains at historically high levels, as do oil production rates. Some of this may be due to the presence of strong NOCs that are working on timetables independent of commodity prices, and some of it may be strictly a function of maximizing revenue. In any case, all of this activity is woven into an equation that includes the OPEC/non-OPEC production agreements. Whether these quotas will continue remains to be seen.

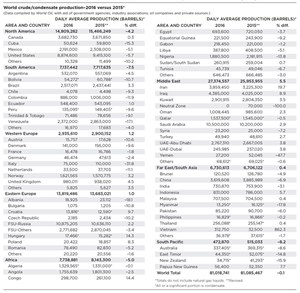

Normally, global oil production will grow at a rate of 1.0% to 1.5% annually, but this was not the case last year. Global output actually fell slightly, averaging 81.019 MMbopd, for a 0.1% loss. Again, some of this flat performance can be traced to the OPEC/non-OPEC production agreements. And yet, WTI crude prices for most of 2016 have not improved measurably, beyond a $43/bbl-to-$51/bbl range. This phenomenon can be traced to lagging global economic performance, and thus, there is no pickup in activity to stimulate more oil demand.

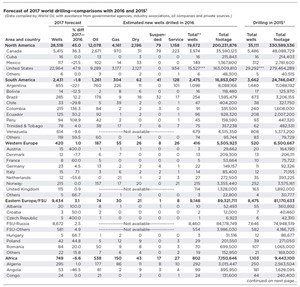

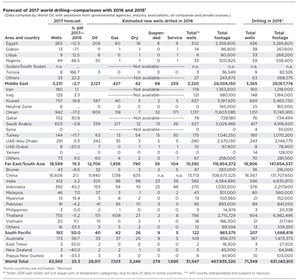

Based on these factors, and others, we forecast that global drilling will increase 23.3% during 2017, to 63,565 wells. Some key activity findings include:

- The U.S. will drill 36.1% of wells globally, up from the very low 30.1% of last year, but still less than the 41.1% rate during 2015.

- If the U.S. and Canada are left out of the equation, drilling in the rest of the world will be up 9.8% during 2017, compared to the 29.7% drop that occurred last year.

- We forecast that the world’s top four drilling countries will be, in order, the U.S. (22,964 wells), China (16,606 wells); Russia (8,672 wells) and Canada (5,415 wells). Together, these four nations will drill 53,657 wells, or 84.4% of all drilling, worldwide. This compares to an 80.8% share in 2015, and an 82.7% share in 2014.

- Russia continued as the world’s top oil producer last year at 10.875 MMbpd, followed by Saudi Arabia at 10.500 MMbpd. The U.S. again finished third at 8.875 MMbpd.

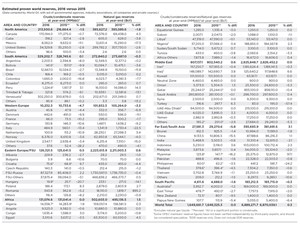

- Global oil and gas reserves remained almost dead-even at the end of 2016, compared to year-earlier levels.

The following regional assessments give perspective and explanation to the statistical findings.

NORTH AMERICA

After a year in the wilderness, North American drilling activity is finally on the upswing. For 2017, we expect a 45.0% gain, to 28,518 wells. By the same token, regional oil production reflected the drilling slump’s effects, with output falling 4.2%. Oil reserves slipped 1.5%, and gas reserves declined 1.9%.

Canada. Amid political uncertainty and stagnant unemployment, Canadian operators are fighting to regain E&P stability and drive pipeline projects forward. However, on the positive side, land sales, which indicate the industry’s interest in future development, have recovered substantially from 2016’s dismal totals.

Last year, Canadian oil production edged 0.3% higher, as output averaged 3.683 MMbopd. Oil reserves declined 0.7%, while gas reserves gained back 4.5%. Drilling during 2016 fell 27.6%, but we now expect a 36% rebound for 2017. For more details on Canada, please see World Oil, August 2017, p. 54.

Mexico. Nearly half of Mexico’s oil production comes from two offshore fields in the northeastern Bay of Campeche—Ku-Maloob-Zaap (KMZ) and Cantarell. Cantarell was once one of the world’s largest oil fields, but its output has been declining significantly for 10-plus years. KMZ adjoins Cantarell and has emerged as Mexico’s most prolific oil field. Crude oil production nearly tripled between 2004 and 2013, when it reached 864,000 bpd. Onshore fields account for roughly 25% of Mexico’s total oil production. Most of this output is light or extra-light crude from the southern part of the country. Overall, Mexican oil production declined 5.1% during 2016, to 2.191 MMbpd.

It has now been more than two years since Mexico’s first bidding round was held on July 15, 2015, from which just two of 14 offshore blocks were awarded, both to a consortium composed of Sierra Oil & Gas, Talos Energy and Premier Oil. And earlier this summer, just under two years later, those companies announced that “estimates for the Zama-1 well (drilled on Block 7) are in excess of 1 billion barrels.” An industry analyst for Wood Mackenzie has called Zama-1 “one of the 20 largest shallow-water fields discovered globally in the past 20 years.” Buoyed by these results, the Mexican government will continue to hold lease sales at regular intervals.

Mexican drilling will be down 21.5% this year, while production was off 5.1% last year, and oil and gas reserves declined 11.1% and 17.3%, respectively.

U.S. After experiencing its worst year for drilling since 1933, the U.S. upstream market is making a significant recovery, although drilling in 2017 will still be less than 2015’s level. Activity continues to be driven by the lynchpin of the U.S. market, the Permian basin. During 2016, U.S. drilling totaled just 15,527 wells, down 47% from 2015’s level. This year, a 47.9% increase is on tap, which should generate a 22,964-well total.

Meanwhile, reflecting last year’s depressed drilling, U.S. oil production fell 5.7%, to 8.875 MMbpd. Oil reserves are estimated to have declined 2.6%, to 34.3 Bbbl. Gas reserves also slipped 2.6%, to an estimated 299.8 Tcf. For more on the U.S., see World Oil, August 2017, p. 47.

SOUTH AMERICA

Drilling throughout the region should bottom out this year, as some countries begin to improve. South American operators drilled 32% fewer wells last year, and they will lower that total another 1.8% this year. Regional oil production slipped 7.5%. Oil reserves remained nearly steady, while gas reserves were down 0.3%.

Brazil. Data from regulatory agency ANP show that development of deepwater and pre-salt resources has driven dramatic increases in Brazil’s production. Pre-salt output made up 40.7% of overall production in 2016, for an average 1.02 MMbopd, an increase of 45% in one year. Recent reforms in Brazil’s offshore sector are being driven by cashflow issues at state firm Petrobras, the reduced world oil price, and changes to the Brazilian administration.

Last year, Brazilian oil production jumped 3.3% higher. Proven oil reserves fell another 2.7%, while gas reserves also dropped 11.9%. Drilling plummeted 62%. However, a 12.2% gain, to 285 wells, is forecast this year.

Venezuela. The country possesses great resources and potential, but the upstream sector is slowly failing. That failure stems from lack of sufficient drilling, field maintenance and capital investment, as well as interference from President and would-be dictator Nicolás Maduro.

Accordingly, Venezuelan oil production averaged 2.372 MMbpd, down 17.1% from 2015’s level. There were reports during the summer that output had fallen below 2.0 MMbpd. Drilling was down 16% last year, at 679 wells, and a further 9.6% drop to 614 wells is forecast. Despite these indicators, Venezuela insists that its oil reserves have edged higher, to 302.25 Bbbl. Officials also claim a less-than-1% gain in gas reserves, to 202.7 Tcf.

Argentina. Shale may have an increasingly important role within Argentina’s upstream sector in coming years. Crude oil production has declined, overall, during the past two decades, due to conventional assets maturing and a lack of sufficient investment in exploration and development. This year, to date, shale oil production from unconventional fields has increased as a result of higher drilling efficiency. The Vaca Muerta formation (Fig. 1) makes up about 60% of the country’s 27 Bbbl of technically recoverable shale oil reserves.

Drilling by Argentina’s operators fell 24% last year, and another 22.1% drop is forecast for 2017. Oil production slid 4.5%, to 532,070 bpd. Oil reserves declined 8%, while gas reserves held almost even.

WESTERN EUROPE

There is some hope that Western Europe is turning the corner for E&P activity. Regional drilling fell 20.0% during 2016, but a 1.0% gain is expected this year. However, oil reserves slumped 4.7%, and gas reserves were off 3.3%. For a third consecutive year, regional oil production improved, gaining 1.2%, to 2.936 MMbpd.

Norway. In late August 2017, the Norwegian Petroleum Directorate (NPD) released its 2017 Resource Report, and it presented a very bright picture. “We have been producing oil and gas in Norway for nearly 50 years, and we are still not halfway done,” said Ingrid Sølvberg, director of development and operations at NPD. “Vast volumes of oil and gas have been discovered on the Norwegian shelf that are still waiting to be produced… This will yield profitable production for many decades in the future.”

At the turn of the year, there were 77 discoveries on the Norwegian shelf being considered for development. In addition, nearly 850 million Sm3 o.e. (5.35 Bboe) can be produced through improved recovery measures. Norwegian drilling was down 15% during 2016, and NPD predicts that it will remain level this year. Oil production gained 3.2%, to 1.622 MMbpd.

UK. The country’s Oil and Gas Authority (OGA) has estimated that an additional 900 MMbbl of oil could be extracted from the UKCS by increasing the recovery factor of “a prioritized selection of large oil fields.” The current OGA forecast recovery factor for the UKCS is around 43%, which means that over half of the oil discovered is left within the reservoir. OGA says that small improvements to these rates could make a major difference to overall reserves.

Seven additional blocks have been put on offer for the 30th Offshore Licensing Round. The blocks were not initially on offer, pending clarification of boundary lines between the Landward and Seaward licensing regimes. The round will close for applications on Nov. 21, 2017.

British oil production posted a second consecutive output gain, rising 4.5% to 980,011 bpd. There should be further improvement, given the start-up of output at BP’s Quad 204 project, back in May. Oil reserves declined 3.4%, and gas reserves took a 15% hit. Like so many countries, UK drilling plummeted 30% during 2016. A slight pickup is forecast for 2017.

EASTERN EUROPE/FSU

In the region overall, drilling last year was up 7.9%, due principally to a gain in Russian activity. This year, regional drilling will be up another 3.1%. Meanwhile, crude and condensate production rose another 1.0%, to 13.819 MMbpd. Oil and gas reserves were up 0.5% and 0.6%, respectively.

Russia. For an 11th consecutive year, Russia led the world in combined crude and condensate output, averaging 10.875 MMbpd (up 2.2%). Russian gas production also grew 0.7%, to 22.6 Tcf. Oil reserves were up 2.2%, while gas reserves were off slightly, at 1,730.6 Tcf. Russian drilling, led by Rosneft, continued to ignore low commodity prices, gaining 10.6% during 2016. This year, a further 2.5% gain in wells drilled is forecast.

Enhanced by recent discoveries, a number of field development projects are underway, operated by a group of firms that includes Lukoil, Gazprom Neft, Rosneft, Gazprom and Total, among others. For example, progress was made in western Siberia last year, when Lukoil started commercial oil production at Pyakyakhinskoye field. The company reported that 72 oil wells and 31 gas wells had been drilled at the field, which is situated in the Yamal-Nenets Autonomous District.

Last January, Gazprom Neft struck oil in the Sorochinsky District of Orenburg Oblast. Novosamarskoye field is reportedly the first discovery in the area, which is believed to hold a series of smaller deposits. Rosneft made a discovery in western Siberia early this year, as well. In March, the company announced the discovery of Anastasyinskoye field in the Republic of Bashkortostan. The field was discovered after drilling two exploration wells in the West Kungak license area.

Other FSU countries. Drilling in former Soviet countries outside of Russia last year was down about 5%. This year, a 4.9% increase is forecast. Combined oil production from the 14 republics averaged 2.771 MMbpd, down 3.4%. Oil reserves declined 3.1%, while gas reserves were up 0.5%.

Within this group, Kazakhstan’s production slid 3.5%, to 1.595 MMbopd. Azerbaijan averaged 833,535 bopd, down 1.8%. Within the third-largest producer, Turkmenistan, overall liquids output averaged about 238,780 bpd, down 5.1% from 2015’s level.

AFRICA

As expected, African drilling fell 27% last year, with every major country posting a decline except Algeria. This year, another decline is expected, although less severe than in 2016. For a third straight year, African output failed to meet expectations, falling 5%, to 7.739 MMbpd. Regional oil reserves were virtually unchanged at 131.1 Bbbl. Gas reserves rose 1.5%.

Nigeria continues to have major difficulties with attacks on production facilities, and oil field theft is rampant. Analysts at Wood Mackenzie estimate that as much as 30% of the oil transported via pipelines through the Niger River delta is stolen. In response, as reported by Bloomberg, IOCs and their Nigerian partners are using surveillance helicopters equipped with infrared cameras on a daily basis. They’re also experimenting with drones, and cages on wellheads rigged with alarms

Despite the many problems, some progress is being made. For instance, Total’s Egina oil field development remains on track to achieve first production in 2018. The 550-MMbbl project in 5,740 ft of water will eventually produce 200,000 bopd to an FPSO. Once online, Egina could nearly double Total’s Nigerian output.

Looking at overall activity, drilling last year plummeted 44%, but the forecast calls for a 48% rebound. Given the problems in various field areas, Nigerian oil production dropped 13.8%, to 1.881 MMbpd. Oil and gas reserves were both up marginally.

Angola’s output declined 2.5%, to average 1.756 MMbpd. Oil reserves remained essentially flat, as did gas reserves. Drilling tumbled declined 45%, totaling just 99 wells. A further reduction, to 53 wells, is forecast this year.

In late August 2017, Angolan Petroleum Minister Jose Maria Botelho de Vasconcelos said that his nation’s economy requires oil prices to rebound to $60/bbl this year. The minister said that IOCs continue to invest in Angola, and tenders for onshore blocks that were suspended earlier this year would be relaunched after a new government is appointed this month. A tender for oil blocks in the Namibe basin off southern Angola also may be opened next year to offset declines at older fields, he said. Angola has worked with producers to cut production costs to an average $10-12/bbl from about $15-20/bbl three years ago.

Algerian drilling rose 17% last year, and a smaller 1.0% increase is forecast for 2017. Crude and condensate output slipped slightly, averaging 1.330 MMbpd. Oil reserves were up about 2%, while gas reserves inched 0.3% higher.

In March 2017, state company Sonatrach said that it plans to boost crude oil output 14% in the four years to 2021, and devote funding to exploration projects. The firm expects to invest $9 billion from 2017 to 2021 in its search for new deposits of oil and gas. Sonatrach, itself, will drill an average 100 wells each year, and plans to invest more than $50 billion during the period.

MIDDLE EAST

The Middle East may have peaked out in several categories last year, as NOCs put the brakes on activity, in line with reduced OPEC quotas. As expected, drilling was off slightly last year, losing 1.3%. This year, a further 2.7% decline is forecast. Regional oil production grew again, increasing 5.5% to 27.375 MMbpd. Middle Eastern oil reserves were up slightly, at 807.1 Bbbl, while gas reserves remained virtually even at 2,825.8 Tcf.

Saudi Arabia. The Kingdom’s production rose 2.9%, to 10.5 MMbopd. Oil and gas reserves held nearly steady at 260.8 Bbbl and 298.7 Tcf, respectively. Drilling is estimated to have totaled 627 wells in 2016, a 1.6% gain. A small decline to 603 wells is expected this year.

In 2016, Saudi Aramco discovered two new oil fields, Jubah, 300 km north of Dammam, and Sahaban, 280 km south of Dammam, along with one new gas field, Hadidah, 470 km south of Dammam. At year-end, the firm’s total number of fields was regrouped to 130.

In 2016, Saudi Aramco made significant progress on two major projects. One of these is the second 250,000-bopd expansion project at Shaybah, in the Rub’ al-Khali, or Empty Quarter, which went onstream in 2016, raising its overall production capacity to 1.0 MMbopd of Arabian Extra Light crude oil—double the facility’s original capacity. In addition, the firm continued drilling wells to increase production capacity at Khurais field, 150 km southeast of Riyadh, by 300,000 bpd, from 1.2 million bpd to 1.5 million bpd, by mid-2018.

Kuwait. Drilling in the emirate declined 5% last year. This year, a nearly 19% increase is expected. Oil production was up 3.5%, at 2.901 MMbpd. Oil and gas reserves remained flat at 101.5 Bbbl and 63.2 Tcf, respectively.

Kuwait continues to pursue its goal of remaining one of the world’s top oil producers, with a target of 4.0 MMbpd of crude and condensate production by 2020. Most of this capacity expansion is likely to come from work done by Kuwait Oil Company (KOC), with total KOC capacity slated to reach 3.65 MMbpd by 2020. The remaining 350,000 bopd are expected to come from work done by Kuwait Gulf Oil Company in the Divided Neutral Zone.

UAE-Abu Dhabi. Across the emirate, oil production was up 3.8%, while drilling totaled 290 wells, up 19%. Drilling should level out this year, at 291 wells. Oil reserves continued to hold steady at 94.5 Bbbl, and gas reserves were flat at 215.1 Tcf.

Abu Dhabi’s National Petroleum Construction Company, along with French firm Technip, is continuing work on a contract with operator ZADCO to expand oil production at Upper Zakum field to 750,000 bpd by 2018, and to 1.0 MMbpd by 2024. To meet this target, ZADCO is employing an artificial island concept with extended-reach drilling and maximum reservoir contact technology. Production from Lower Zakum field—operated by Abu Dhabi Marine Operating Company—also is set to increase to 425,000 bopd from the current 345,000 bopd.

Israel. Most of Israel’s E&P activity has been offshore gas development projects, witness Noble Energy giving the go-ahead earlier this year for work to begin on developing Leviathan field at a $4-billion cost. And then in June 2017, Energean Israel submitted a field development plan for Karish and Tanin offshore gas fields. So, it’s an exceedingly rare day, when an operator spuds a significant well onshore Israel. But that’s what Dallas-based Zion Oil & Gas did at the beginning of June, Fig. 2. As of the end of August, the wildcat was still drilling and had reached a 2,000-m depth.

FAR EAST/SOUTH ASIA

Once again, a significant reduction in Chinese drilling during 2016 pushed the region down 18%, to 15,592 wells. This year, a 19.3% increase is on tap. Regional oil production was up 0.4%, at 6.731 MMbpd. Oil reserves declined 5.8%, while gas reserves rose 3.1%.

China. For the fourth straight year, Chinese drilling decreased during 2016. Wells drilled were down 17%. For 2017, we expect Chinese drillers to finally break the string and boost drilling 21.1%. The drilling slump and accompanying drop in producible reserves added was too much of a barrier for production engineers to overcome. They saw their multi-year streak of wringing out additional output from existing fields stopped cold, as production fell 6.9%, Fig. 3. China’s oil reserves also dropped 15.5%, while gas reserves fared better, inching up 1.1%.

There is more to China’s production story than just reduced drilling. Given current crude oil prices, PetroChina, Sinopec, and CNOOC have been unable to compete within the low-price global environment. Thus, they have been forced to reduce production from many of their high-cost fields within China. According to a U.S. Department of Commerce report, in 2016, China’s capital investment in oil and gas exploration and production during 2016 fell 31.9%, to RMB 233.1 billion Yuan, or about $32.4 billion.

India. Drilling fell yet again last year, losing 2.4%. For 2017, activity should pick up 5.2%, to 612 wells. India’s oil production slipped 3.1%, to 730,870 bpd. Oil reserves slipped 0.6%, while gas reserves slumped 2.1%. In a budgetary speech earlier this year, Finance Minister Arun Jaitley said that India will merge its existing state-owned oil and gas companies into one global firm, so that it can compete with some of the largest NOCs and IOCs worldwide. In all, 13 companies are being considered for the merger. Also, in March 2017, the government announced that it will extend the leases for oil or gas fields, four years before their initial 20-year terms expire.

Indonesia. Oil production rose 5.7% last year, to average 831,000 bpd. The SKK Migas agency said that drilling fell 53% during 2016. However, that number should rebound 45% this year. Earlier this month, the Ministry of Energy and Mineral Resources (EMR) conducted rollout sessions on a regulatory amendment to the gross split concept for upstream oil and gas. This new concept is expected to have a better economic value for the industry. However, this regulation does not change the basis of the gross split. The initial gross split for petroleum is 57% for the government and 43% for the contractor, whereas the initial gross split for natural gas is 52%, government, and 48% contractor.

SOUTH PACIFIC

Throughout this region, drilling fell 41%. This year, activity will improve 50%. Regional production of crude and condensate fell 8.2%, to about 472,870 bpd. Oil reserves declined 1.6%. Gas reserves were off 0.3%.

Australia. Drilling last year dropped 42% lower, with about 34% of the wells drilled offshore. This year, a 58.7% increase is forecast. Crude and condensate production declined 8.6%, to 337,405 bpd. Oil reserves were down 1.2%, while gas reserves remained level.

Output from new, smaller offshore fields is lasting, on average, less than 10 years and has not been able to offset production declines at larger, mature fields. Supply from new condensate projects associated with natural gas field developments is expected to boost overall output and offset some of the production declines during the next few years, beginning later in 2017.

The Carnarvon and Bonaparte basins off the coast of northwestern Australia remain the busiest areas for overall drilling activity. ![]()

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)