Offshore in Depth

Hope for improved Russian-U.S. relations has evaporated, following a U.S. congressional vote and retaliation taken by the Russian government. Following these actions, the ruble exchange rate returned to the RUB 60/$1.00 level. So far, this has not disturbed Russia’s economic recovery, but the Russian market is not reacting to recovering WTI prices, which recently moved above $50/bbl before going back to a $46-$49 range. After more than six months of Donald Trump’s U.S. presidency, it is clear that existing sanctions will remain for longer than expected, while chances for new sanctions are increasing. The window for re-establishing Russian-U.S. dialogue is narrowing fast. Even the number of confrontation points seems to be expanding, with Venezuela now included among a growing number, ranging from Syria to Ukraine.

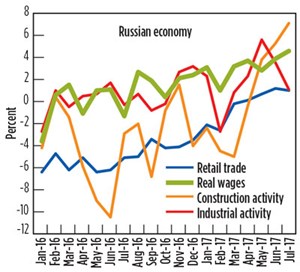

The Russian economy improves. Russia’s economy has shown strong improvement during first-half 2017. Retail trade grew 1.2%, year-to-year (y/y), in June, slightly better than the consensus (1.1%) forecast, and activity continued growing in July (1.3%). Real wages improved steadily, linked to the very rapid fall of inflation to 4.0%-4.5%/year. An increase in industrial production was duplicated by construction growth, which may signal the end of that sector’s slump. Unemployment dropped to 5.1% at the end of the first half.

The strong, 2.4% investment growth, y/y, during first-quarter 2017 was set to continue during the second quarter. The three largest areas of investment activity are extraction (31%), manufacturing (18%) and transportation (17%). The latter generated impressive 21.7% growth during first-quarter 2017; the extraction segment recorded a more modest 1.5% increase, while manufacturing investment plunged 6.7%. Three regions have generated all the investment growth: Moscow city, Crimea and the Far East.

The increase in Far Eastern investment relates mainly to pipeline construction to China. The “Power of Siberia” project is to be finalized by 2019. Nearly half of this major project (1,300 km of the 3,000-km network) had been built by June 2017. The Moscow city renovation, however, has just started and may take nearly 15 years to reach completion.

The stronger-than-expected economic growth, unfortunately, coincides with a weaker-than-expected current account in second-quarter 2017. Import growth reached 27% y/y in first-half 2017, pointing to a sustainable pick-up in imports through 2017. This was to be expected, as consumption and investment increase.

Creating an anti-U.S. alliance? In this context, Russian diplomatic activity is notable, and could be attributed to the improved economic performance. But it also may stem from deteriorating relations with Washington. Building on the Middle Eastern crisis and progress made by Syrian governmental forces, backed by Russian air support in recent weeks, Moscow signalled significant support to the Venezuelan government. Russia’s largest oil producer, Rosneft, said recently that it had made around $6 billion in pre-payments to Venezuelan state oil company PDVSA.

The payments could solve the debt crisis faced by Venezuela. Rosneft expects the repayment to be made in crude oil and oil product deliveries. It is quite important, as it implies that a greater share of Venezuelan production is to be diverted to Russia and not to U.S. refineries.

This support is not surprising. First, with U.S.-Venezuelan relations going from bad to worse, it was to be expected that Moscow would increase its commitment to Caracas, if only to embarrass U.S. officials and create a “bargaining chip.” Even more significant is that this support from Rosneft shows the strong ties that Russia, and notably CEO Igor Sechin, have created in Latin America.

Russia, and Rosneft specifically, find their interests served by this policy. PDVSA has reduced crude sales to its U.S. refining unit, Citgo Petroleum, while increasing supplies to Rosneft, following a plan signed in May to catch up on overdue deliveries. Actually, Rosneft holds a 49.9% stake in Citgo. The stake was offered as collateral, when PDVSA obtained another loan of $1.5 billion from the Russian company last year.

Venezuelan Oil Minister Nelson Martinez said last June that Rosneft would receive some 70,000 bopd as payment for the $1.5-billion loan extended during 2016. Having invested a lot of money in PDVSA, Rosneft is now pledging to continue working in the country’s energy sector, despite the worsening political and economic crisis. Earlier this month, Mr. Sechin said the company was going to increase cooperation with Venezuela in the face of new U.S. sanctions. He has given a good reason why: “The country’s reserves of hydrocarbons are the world’s largest. From this perspective, any energy corporation must seek to work there.”

Yes, Venezuela’s reserves are allegedly greater than those of Saudi Arabia, but it is not the only reason. Support given to Venezuela is obviously political, perhaps a form of “tit for tat” for U.S. support of Ukraine. But, more probably, it is the strengthening of an anti-U.S. front, including China, Iran and now going farther, new Russian allies like Indonesia and the Philippines. ![]()

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)