Oil and gas in the capitals

The Russian ruble’s recent appreciation remains firm. The ruble broke down the RR 60-to-$1 barrier some weeks ago. While it has advantages for Russia, and may help to limit inflation, it also could have negative consequences for Russia’s economy, if it were to strengthen further. This movement reflects the sentiment of foreign investors that the Russian economy is now on a growth path. But this movement also reflects the feeling that there would soon be opportunities for speculation in Russia.

Exchange rate developments. This appreciation is now clear to anyone that looks at the exchange rate versus the euro or the dollar, confirmed over the last year. The ruble has just returned to the nominal exchange rate that it had with the dollar at the end of May 2005, explained, in large part, by recovering oil prices. Expressed against Brent crude, these prices rose from $32/bbl in January 2006 to around $56/bbl today, as a result of various OPEC and non-OPEC agreements. The exchange rate rise was, therefore, logical and not a surprise.

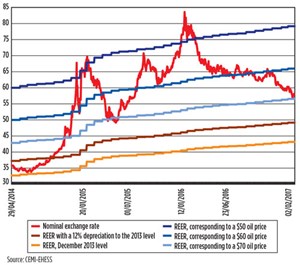

But, when comparing exchange rate forecasts with oil prices, we see that the rate corresponds to a much higher oil price than what is real. Oil and gas extraction can play an important role in Russia’s financial and budgetary balances, and in managing monetary liquidity. A computational model has determined the exchange rate level, if it were determined solely by oil price. Results are displayed in the chart on this page.

The nominal exchange rate is still largely undervalued, compared to the ruble’s real value (inflation-adjusted). Yet, it corresponds to producing a $69 oil price. Brent prices range from $55–57/bbl. So, what explains this 23% difference?

Why is the ruble appreciating? The importance of hydrocarbons has been reduced in Russia’s budget, and for the economy and exchange rate. The predictive model used dates from 2012 to 2015. Thus, it tends to overestimate oil price impact. The economy’s structure has changed since 2012-2013, and the weight of manufacturing has increased, not just for GDP but also for exports.

This overestimation is now at least 10%. This also means an exchange rate appreciation of 10–12%, relative to its “normal” level that relates to oil prices. Thus, there are monetary phenomena that affect the exchange rate:

- First, the Moscow stock exchange has been largely undervalued during 2015 and 2016. Capital inflows related to share purchases are taking place. This phenomenon is likely to continue for at least first-half 2017, as equity markets are under threat of major political changes in Europe. These same markets are largely overvalued in the U.S.

- Second, it’s very clear that the Central Bank of Russia’s (CBR) base interest rate is one of the highest among emerging countries. If the real interest rate is taken into account, it is currently the highest for all emerging countries.

- Third, which links to the first, is the improvement of enterprise profitability in Russia, which encourages investors to put money in them. These investments will increase, not only because of the low share values but also because of the expected rise in dividends. Moreover, any improvement in the ruble tends to accentuate this phenomenon.

In fact, if the CBR governor, Mrs. Elvira Nabiulina, were to express a willingness to keep the exchange rate around RR 60-$1, she may not have any room to maneuver.

The CBR’s dilemma. Economy and the Ministry of Finance are indicating that the depression was less intense in 2016 than initially feared. In 2015, the GDP declined only 2.8% against an initial -3.7% indication. As for the 2016 results, they show GDP stabilizing (with a + 0.2% variation) against an initial -0.6% estimate. The approximately 0.8%-0.9% difference between the first estimates and the final figures is probably due to the impact of the substitution of local products for imports, which appears to have been more important than expected.

This is good news and bad news for Russia. It’s good news, because it shows that the depression was far less severe than what was thought. But, it’s also bad news, because these results will encourage the CBR to maintain its high interest rate policy, while observers expected the Bank to behave more dovishly in 2017.

The problem is that high interest rates are attracting capital to Russia, causing the ruble to appreciate above the “normal” level that could be deduced from oil prices. This appreciation erodes economic competitiveness and could trigger a reversal. This problem is not immediate—the ruble’s real exchange rate is still largely undervalued. But now, we have to look at an exchange rate of RR55 to $1 as the real alert point. ![]()

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)