Rigs, completions rise, as differentials sink

Bolstered by the eagerly-awaited start-up of the Dakota Access Pipeline (DAPL), the takeaway bottleneck that trapped Bakken-Three Forks producers behind an economic eight-ball is evaporating and taking pricing differentials with it.

With an initial design capacity of 470,000 bpd, DAPL took on first oil in May after a very public setback, and in the process helped sink differentials that not so long ago hovered at $28/bbl, relative to the West Texas Intermediate (WTI) benchmark, according to the U.S. Energy Information Administration (EIA).

“First-quarter oil differentials were well below the low end of guidance, benefiting from the addition of new pipeline infrastructure in the Williston basin,” said Whiting Petroleum Corp. CEO James J. Volker on April 27. “Some of our areas in the Bakken now are in the low $5s, and the outlook is actually for that to even improve a little bit more.

This is quite likely, as a less-than-peak production increase (thus far) and additional pipeline capacity mean less reliance on higher-cost rail. The non-regulatory North Dakota Pipeline Authority estimates the now-expanded pipeline network, rail and local refining triumvirate can collectively accommodate more than 2.8 million bpd of crude this year.

While the liquids-rich Bakken and underlying Three Forks shale are deposited throughout the conventionally mature Williston basin, which extends into Canada, the sweet spots remain firmly lodged in North Dakota. There, lower differentials have contributed to an improving economic climate that has returned the Bakken-Three Forks to a higher tier in select operators’ asset portfolios. This is reflected in an active rig count that has nearly doubled, and the emergence of a potentially fertile landing spot for frac spreads.

A year removed from a wholesale pull-back, an average 44 rigs were active in the Williston basin in May, compared to 23 in the like month of 2016, according to Baker Hughes.

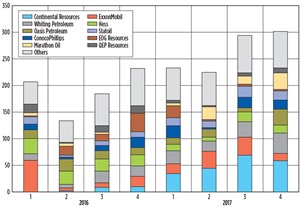

However, for the remainder of 2017, Norway’s Rystad Energy suggests that frac crews may take precedence over drilling crews, as completions are expected to accelerate in the back half of the year, with “high intensity” being the operative descriptor, Fig.1. Operators have cautioned, however, that personnel, or lack thereof given the payroll rout of the past two years, has become a potential wild card in that scenario.

“The services market in the Williston is starting to tighten. There is sufficient equipment to cover demand for services, but the manpower required to run the equipment requires a little lead time to put in place,” says Taylor L. Reid, president and COO of Oasis Petroleum Inc., which intends to continually operate two frac crews from its wholly-owned Oasis Well Services (OWS) throughout the year, augmented intermittently with a third-party spread.

MORE, BIGGER COMPLETIONS

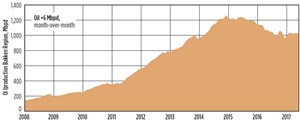

Rebounding from weather-related curtailments in December and January, Bakken oil producers are expected to deliver an estimated 1.032 million bpd in June, up 6,000 bpd over May deliveries, according to the EIA, Fig. 2.

In the most recent data available, the EIA also documented an 821-well drilled-but-uncompleted (DUC) inventory as of April. Wellhead break-even prices (BEP) for Bakken wells completed in 2017 will average around $40/bbl, according to a Rystad analysis, which singled out first mover Continental Resources as having the lowest BEP among its peers, averaging $28/bbl across its premier 815,000 net-acre asset.

The Bakken pioneer intends to run four rigs throughout 2017 and employ nine frac spreads by mid-year, as it whittles down a DUC inventory that comprised nearly 200 wells at quarter’s end, including the 30 new drills constructed in the early going of 2017. As of May, Continental was running eight stimulation crews and closed out the first quarter with 50 gross (17 net) new wells put onstream, with cumulative net production of 108,992 boed. Four of those wells delivered record 30-day production rates, averaging nearly 1,712 boed, which the company attributes largely to its multi-faceted completions strategy that encompasses tighter stage spacing; increased proppant/ft; increased diverter technology; more aggressive flowback; and high-capacity lift technology.

Continental cites that optimized completion strategy as responsible for nearly doubling Bakken return rates to an average 75%, assuming a $7-million completed well cost and $55/bbl WTI price.

Whiting Petroleum, likewise, is stepping up completions, with 123 gross wells scheduled to hit the sales lines this year, 68 of which are scheduled for completion in the second half, split nearly evenly between the Bakken and Three Forks. Whiting says 16% of its typical 40-stage completions this year will entail proppant loadings of between 10 million and 15 million lb/well.

Whiting is operating five rigs within its 732,819-gross-acre (443,310-net) position, where first-quarter production averaged 109,125 boed.

For EOG Resources, drilling took a backseat, as 27 wells drilled earlier were completed in the first quarter. Average treated lateral lengths were 8,500 ft, and 30-day production rates averaged 715 boed/well. The first-quarter completions included 24 wells drilled prior to 2016, while three of the newly completed wells were in the company’s non-core Bakken Lite asset in northwestern North Dakota. Two Bakken Lite wells were completed in the Bakken, and the remaining well targeted the Three Forks, all using the operator’s typical high-density frac strategy.

EOG controls 230,000 net acres across North Dakota and Montana, of which 120,000 acres underlay the North Dakota core.

With the combined completion of nine 2-mi lateral wells on its Grizzly, Caribou and Behr pads during the first quarter, WPX Energy is on track with planned guidance that calls for connecting up to 47 wells to production this year. Spread out to three wells/pad, the wells averaged aggregate 30-day production of just under 1,988 boed.

The Tulsa, Okla., operator plans to maintain a two-rig fleet this year across its 85,000-net-acre position concentrated within the Fort Berthold Indian Reservation of western North Dakota. WPX drilled 11 wells in the first quarter, eight of which specifically targeted the underlying Three Forks formation.

UPWARD TRAJECTORY

Hess Corp. has orchestrated an aggressive 2017 drilling and completion program, adding a fourth rig in April, with plans to have six rigs operating by year-end on the 569,000 net acres it controls in North Dakota. In the first quarter, however, Hess drilled 11 wells, with eight hooked up to sales. This was down significantly from the year-ago quarter, when 19 and 31 wells were drilled and completed, respectively. Nevertheless, backed by an estimated capex of $675 million, the company says it remains on pace to drill 80 Bakken wells this year, with 75 scheduled to go online.

Like many of its contemporaries, Hess is upsizing its standard completions, going from 35 to 50 frac stages, while testing tighter spacing and higher proppant loadings. “We’re doing a lot of experimentation with higher stage counts. We’ve got a number of 60-stage completions in the ground now,” says COO Greg Hill.

Houston’s Marathon Oil Corp. also has returned to growth mode in the Bakken, where it plans to average six rigs this year (Fig. 3) and bring 70 to 75 gross wells to production. Activity will focus primarily on the West and East Myrmidon assets in McKenzie County, which Marathon says generate 90% and 50% returns, respectively, at flat $55/bbl WTI prices. Marathon controls roughly 175,000 net acres, which includes both the Myrmidon and Dunn County Hector asset.

Marathon plans to expand the enhanced completions program introduced last year on its 60,000-net-acre Myrmidon asset, with designs calling for 45 to 50 frac stages and 6 million to 15 million lb of proppant/well, targeting both the Middle Bakken and the three benches of the Three Forks. Four wells on the newly completed Maggie North pad in East Myrmidon delivered first-quarter production averaging 1,878 boed.

“I think with the Bakken, particularly in the geologically advantaged areas like Myrmidon, where we’ve seen such a strong response to the higher-intensity completion designs, it has quite frankly elevated on an economic basis, eye-to-eye with the best in our portfolio,” says President and CEO Lee Tillman.

Pure play operator Oasis Petroleum plans to go from two to four rigs by mid-year, and is already looking at adding a fifth rig in 2018. After closing on a $785-million acquisition of 55,000 net acres in December, Oasis now controls a concentrated leasehold of 518,000 net acres across North Dakota and eastern Montana.

Oasis completed 13 gross (9.7 net) operated wells in the first quarter, which ended with a DUC build of 82 gross wells. The company plans to complete 76 gross (51.7 net) operated wells in 2017, heavily weighted toward the second half of the year.

While the average frac size is projected at around 10 million lb/well, President and COO Taylor Reid said eight of the wells to be completed will be split evenly, with 20 million and 30 million lb of sand, with ongoing tests of proppant loadings from 1,000 to 3,000 lb/lateral ft.

Conversely, Abraxas Petroleum’s Watson, for one, is not convinced super-sized proppant loadings necessarily translate to increased drainage. He pointed to six wells on the company’s North Fork Stenehjem super pad that were completed in 41 frac stages, utilizing 870 lb/ft of proppant and multiple polylactide (PLA) diverters. Those wells went on to deliver 30-day average production rates from the Middle Bakken and Three Forks of 1,226 and 1,069 boed respectively, with four additional wells now being completed in similar fashion.

“Until such time as we see actual results be positively impacted by higher proppant load completions, we feel like where we are right now is kind of the optimum level.” he said.

OTHER ACTIVITY

ConocoPhillips was running four rigs in early May across the 620,000 net acres that it owns, where Bakken wells delivered first-quarter production of 59,000 bopd. No guidance has been released on more specific 2017 drilling and production plans.

QEP Resources is operating one rig within a 116,200-net-acre leasehold, where activity is centered largely on its South Antelope and Ft. Berthold assets in northwestern North Dakota, targeting both the Middle Bakken and Three Forks horizons. Nine South Antelope wells were completed in the first quarter, at a total cost of $5.6 million/well; six Fort Berthold wells also were completed and hooked up to sales at a total cost of $6.2 million/well.

Newfield Exploration Co., which is running a single rig on its 85,000-net-acre leasehold, completed two Middle Bakken wells and one Three Forks well in the first quarter, with an average 30-day production rate of 2,445 boed. The three wells in Newfield’s Lost Bridge Federal concession in Dunn County, N.D., were completed with an average proppant loading of 10 million lb.

XTO Energy Inc., meanwhile, is down to two rigs on its 494,016-net-acre leasehold, where first-quarter oil and gas production came in at 78,000 bpd and 143 MMcfd, respectively. While no specific 2017 guidance has been made available, Darren Woods, CEO of parent ExxonMobil Corp., told analysts on March 1, “In the upstream, more than one-third of the capex will be invested in advancing our large inventory of short-cycle opportunities. They are primarily Permian and Bakken unconventional plays and short-cycle conventional work programs.” ![]()