Oil and Gas in the Capitals

It is that time again. A new administration in Washington, a new federal budget and its priorities being proposed, and tax reform being debated, have all joined to bring the subject of energy subsidies, yet again, to the forefront. As usual, the refrain is being heard that fossil fuels—especially “big oil”—are heavily and unfairly subsidized at the expense of underfunded renewables.

These subsidies are also drawing attention, as federal and state policymakers struggle to deal with energy incentives that are straining competitive electricity markets. For example:

- Energy Secretary Rick Perry has ordered a study to assess how energy subsidies and policies are affecting baseload power generation, which may lead to reform of wind production tax credits.

- In Washington, FERC recently sponsored a technical conference on the issue.

Senator Chuck Grassley (R–Iowa) has stated that it irritates him when people criticize “subsidies for one type of energy while disregarding market-distorting benefits provided to other sources.” Indeed. So, how does the energy scorecard stack up?

A stacked deck. As usual, conventional wisdom is wrong. There is a huge imbalance in federal incentives for the oil and gas industry, compared to renewables. However, the imbalance is strongly in favor of renewables and it is increasing rapidly. In a recently published study, we found that over the past several years, the imbalance of subsidies in favor of renewables over other energy technologies has become overwhelming (http://misi-net.com/publications/EnergyIncentives-0517.pdf). This clearly contradicts the contention that federal incentives favor oil and gas at the expense of renewables.

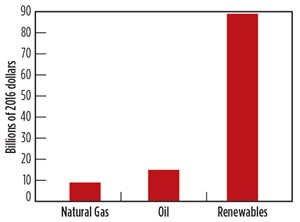

As shown in Fig. 1, during the years 2011-2016, renewable energy (solar, wind, biomass, geothermal and hydro) has received $89 billion in federal incentives, which is:

- Nearly four times as much federal incentives as for oil and natural gas, combined.

- Nearly six times as much federal incentives as for oil.

- Nearly ten times as much federal incentives as for natural gas.

In fact, over this period, renewables received more than three times as much federal incentives as oil, natural gas, coal and nuclear, combined. So much for the contention that renewables are being “starved.”

Of course, renewable energy advocates only prefer to classify hydro and geothermal as renewable sources, when it suits their purpose—such as to show how much renewable energy is being used in the U.S. Hydro provides over 90% of this renewable energy. However, somehow, federal support for hydro and geothermal is not supposed to be included in federal subsidies for “renewable energy.”

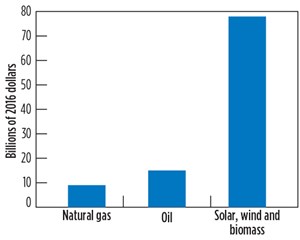

Accordingly, Fig. 2 excludes federal support for hydro and geothermal, and shows only subsidies for solar, wind and biomass. These figures show that during the 2011-2016 period, these renewable technologies received $78 billion, which is:

- More than three times as much federal incentives as for oil and natural gas, combined.

- More than five times as much federal incentives as for oil.

- Nearly nine times as much federal incentives as for natural gas.

Over the years 2011 through 2016, these three renewable energy technologies received three times as much federal incentives as oil, natural gas, coal, and nuclear, combined. Thus, even excluding hydro and geothermal, renewables are being subsidized about three times as heavily as all fossil fuels and nuclear energy, combined.

Notably, energy technologies provide very different contributions to the U.S. energy mix. Oil and gas provide over 61% of U.S. energy needs, whereas wind and solar provide less than 3%. Thus, per unit of energy, renewables are massively over-subsidized, compared to oil and gas.

The bottom line. So, what does all of this mean? Does it imply that the oil and gas industry receives too much federal support? Too little? Does it imply that renewable industries receive too much federal support? Or do they receive too little?

The information provided here implies none of this. The “optimal” level of federal support is an issue well outside the scope of this column. Nevertheless, the information presented here is important to remember, when we hear that renewable energy is being “starved” of federal funding compared to the oil and gas industry. ![]()

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)