Canadian operators anticipate slow, steady improvement

At this point a year ago, the outlook was bleak; all signs pointed to a dismal year ahead. It was one of those rare times when the prognosticators were right; it wasn’t until the late stages of 2016 that the signs of the hoped-for turnaround began to manifest for the Canadian oil and gas industry.

Crude oil prices began a slow climb back to respectable levels last year, although they were still lower, on average, than they were in 2015. Natural gas prices also are showing signs of recovery, and both are expected to rise in 2017. And as the world economy recovers, global oil demand is also rising, which augurs well for Canada’s energy industry. So far, stock prices to date are trending up in 2017, which also suggests that optimism is increasing.

The Canadian dollar, although stronger than it was a year ago, still remains weak, compared to the American greenback, trading in the 76-cent range in early 2017. The low Canadian dollar benefits the export-driven oil and gas industry, which still ships substantial volumes of oil and gas south to U.S. customers.

MARKET FACTORS

Still, there are many factors aligned against a speedy recovery. Despite the recent approvals of Kinder Morgan’s Trans Mountain pipeline expansion project, and U.S. President Donald Trump’s nod to TransCanada’s Keystone XL proposal, which have sparked some much-needed optimism, there are at least as many forces aligned against any quick return to pre-recession activity.

Politics have never loomed larger for Canadian producers than they do now, with federal and provincial carbon taxes, and climate change policies, moving forward at breakneck speed, and Trump’s protectionist agenda feeding the market bears. However, Canadian Prime Minister Justin Trudeau has stated that the Trans Mountain approval may not have gone through if Alberta’s New Democrats were not so aggressively pursuing their climate change policies. Trudeau has proved to be something of an enigma from industry’s standpoint, advocating a carbon tax and musing about a phase-out of oil sands, while signaling support for pipeline projects, both within Canadian borders and down into the U.S.

Although it is clear that producers are not yet ready to resume the frenetic pace seen prior to 2014, increased commodity prices—and healthier balance sheets—should prompt investment in activity that will result in quick boosts to production, rather than bigger projects that require more up-front investment. This isn’t likely to change until the actual long-term impacts of climate change policies, and their implementation, are known.

Political/regulatory influences. A year ago, Canadian politics were in focus for the country’s producers, but that focus has shifted south following the election of Donald Trump as U.S. President. In the early days of his presidency, the Canadian industry is trying to read the portents contained in a myriad of Executive Orders, tweets, and conflicting news. For example, Trump has invited TransCanada to resubmit its application for the Keystone XL pipeline. Yet, the conditions he set, before he will issue the presidential permit, included a mandate that TransCanada purchase all its steel for Keystone from American suppliers. And most of what the company needs it already owns, of which only about 50% was (or will be) purchased in the U.S.

Meanwhile, a lawsuit that the company launched in 2016 against the U.S. federal government—following Obama’s rejection of the project—was put on hold by a Texas judge in January, who gave the company three months to gain the presidential permit. It remains to be seen how this now-six-year saga will end, but it seems unlikely that a clear resolution will occur any time soon.

President Trump also has targeted the North American Free Trade Agreement (NAFTA) for renegotiation, which could affect the Canadian economy in unknown ways; no one really knows which pieces of the long-standing agreement could be in Trump’s crosshairs. Ironically, TransCanada’s lawsuit was based largely on the assertion that Obama’s veto of Keystone violated NAFTA.

Within Canada, TransCanada’s proposed C$15.7-billion Energy East pipeline has run into issues. This occurred after the troubled National Energy Board (NEB), Canada’s federal energy regulator, had to restart its process following conflict-of-interest allegations, and a new review panel was struck. The 1.1-MMbopd pipeline also faces the same type of opposition that has cropped up across North America in recent years. Boosted by “victories” over the Keystone and Northern Gateway projects, pipeline opposition continues to grow, even though facts clearly show that the safest way to transport oil and natural gas is by pipeline.

The NEB has been criticized for its convoluted approval process, so it is taking steps to increase transparency and streamline how it reviews applications. In late 2016, federal Energy Minister Jim Carr announced that a five-member review panel had been struck, to consult with Canadians and come up with recommendations to reform the regulator. The panel is to make its recommendations to Minister Carr by March 31, 2017.

As optimism grows, so do capital expenditures, and this is perhaps the clearest signal of what the year ahead is likely to bring. Drilling forecasts are increasingly rosy, with World Oil’s surveys revealing a surprisingly bullish outlook; some respondents are even forecasting drilling to rise above 2015 levels. And land sale numbers, which were down sharply in 2016, already have shown signs of a robust recovery.

SPENDING PLANS

Overall, forecasts and spending plans remain conservative, but most companies build enough flexibility into their capital programs to allow for quick shifts upward or downward, depending on the market conditions of the day. Some analysts are extremely bullish, projecting industry-wide increases of as much as 40%. Of course, much of the increases signal a return to normalcy, as most companies slashed spending plans throughout 2016 while the recession deepened.

Suncor Energy has announced a capital program of C$4.8 billion to C$5.2 billion during 2017, with some 40% of spending focused on its Fort Hills and Hebron projects, both of which are expected to see first oil this year. Suncor is one of the few companies expecting to spend less, as this budget reflects a decrease of approximately C$1 billion from last year.

Canada’s largest producer, Canadian Natural Resources Limited (CNRL), recently announced a slight increase in 2017 spending, to C$3.89 billion, compared to C$3.85 billion in 2016. However, the company notes that it expects cash flows to be between C$6.5 billion and C$6.9 billion, which means it could increase spending by up to C$525 million, if plans change. The company plans to spend about C$1.1 billion on its Horizon Phase 3 expansion, targeted to be onstream during fourth-quarter 2017, adding 80,000 bopd of production.

Husky Energy revealed that it will increase spending more than 30%, to C$2.6 billion to C$2.7 billion, compared to C$2.0 billion last year. The company plans to focus on Western Canadian conventional and thermal projects, adding production of approximately 45,000 bopd.

Seven Generations Energy Ltd. also has announced plans to spend between $C1.5 billion and C$1.6 billion, after reducing its 2016 capital budget to just under C$1.0 billion. The company expects production to range between 180,000 boed and 190,000 boed, from its single active play, the liquids-rich Kakwa River natural gas project in northwest Alberta.

Encana Corporation, has said that it will spend C$1.4 billion to C$1.8 billion in 2017, with a primary focus on its Permian basin assets (acquired in 2014), and British Columbia’s Montney play. Encana has been hit hard by the recession, reducing its staff 55% since 2013.

Crescent Point Energy meanwhile, has announced plans to spend C$1.45 billion, most of which is allocated to the company’s aggressive, 670-well drilling program, focused primarily on its Williston basin play in southwestern Saskatchewan. Crescent Point expects to exit 2017 with a production rate of 183,000 boed.

And Cenovus Energy has said that it will increase spending in 2017 to C$1.2 billion to C$1.4 billion, a 24% increase, with most of the funds allocated to sustaining its oil sands and other base operations. The remainder will focus in increasing oil sands production at Christina Lake and tight oil output in southern Alberta.

M&A ACTIVITY

As is typically the case, difficult times often result in increased merger and acquisitions (M&A) activity, particularly when industry is coming out of a low cycle. Activity in 2016 spiked during June and July, with asset sales driving much of the action. With the industry’s overall health expected to improve throughout 2017, analysts are forecasting an increase in M&A, particularly as companies that lag the recovery become targets.

According to Sayer Energy Advisors, 2016 was an average year for M&A, with C$24 billion worth of deals, of which nearly 60% were asset sales. Last year’s activity represents a 67% increase over the $15 billion of deals in 2015. For 2017, Sayer predicts an increase in larger asset packages, with a shift to share offerings from companies with stronger balance sheets.

In late January, Calgary’s AltaGas Ltd. kicked off the new year with a blockbuster deal, acquiring Washington D.C.-based WGL Holdings Ltd. for C$8.4 billion.

DRILLING

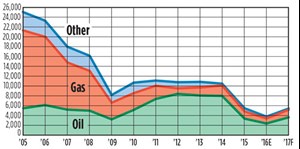

As expected, drilling numbers were extraordinarily low in 2016, continuing the trend established the year before. According to Daily Oil Bulletin records, of the total 4,072 wells drilled last year, about 69%, or 2,812, were estimated to be oil wells, compared to more than 62% of the total in 2015. Overall, drilling fell almost 24%, from the 5,359 drilled in 2015, and well short of the 11,170 drilled in 2014. Exploratory drilling dropped to 254 wells in 2016, down 6.2%, compared to 431 the year before.

In Alberta, drilling decreased 28% in 2016, with 2,005 wells drilled, compared to 2,799 the year before. In Saskatchewan, drilling fell 10%, with 1,632 wells drilled, versus 1,804 in 2015. In British Columbia, operators drilled just 342 wells in 2016, down 37% from 539 wells in 2015. And in Manitoba, drilling fell 61% to 81 wells in 2016, compared to 207 in the previous year.

The Canadian Association of Petroleum Producers (CAPP) said that across Canada, 3,766 wells were drilled last year, with about 2,370, or 63%, targeting oil. Another 27%, or 1,014, were gas wells, with the balance being dry holes and service wells. There were 15 wells drilled offshore East Canada. CAPP said that in Alberta, 2016’s drilling was down 37% at 1,816 wells; Saskatchewan was down 4%, at 1,557 wells; B.C. fell 45%, to just 285 wells; and Manitoba declined a whopping 59%, to a mere 86 wells.

Looking ahead, the Canadian Association of Oilwell Drilling Contractors is predicting a modest recovery, calling for a 31% increase in drilling activity, to 4,665 wells. CAODC forecasts an average rig fleet utilization of just 23%, still far better than 2016’s utilization rate of 17%. Meanwhile, the Petroleum Services Association of Canada is considerably more bullish, calling for 5,150 wells to be drilled, an increase of almost 45%. Uncharacteristically, CAPP is equally bullish, calling for a 44% gain to 5,429 wells, including 2,781 in Alberta, 2,214 in Saskatchewan, 297 in B.C. and 108 in Manitoba.

Canadian oil production, said CAPP, averaged 3.7 MMbpd during 2016, and gas output was roughly 15.4 Bcfd. Active oil wells totaled 80,089, while producing gas wells reached about 209,000.

LAND SALES

As expected, land sales revenue fell again in 2016, with some provinces at historic lows. Overall, the industry spent just C$217.5 million in Western Canada, down 65% from the C$375.8 million collected in 2015. The record high of $5 billion in 2008, offers a stark perspective on how dismal last year truly was.

Alberta once again drew most of the action, with $148.6 million spent, which was still a 50% decrease from $298.7 million in 2015. This is the lowest total recorded in Alberta in more than 20 years. British Columbia set a record low, pulling in only C$15.2 million, eclipsing the previous mark of C$16.7 million in 1982. Last year’s total represented a drop of 15.6% from C$18 million in 2015.

Saskatchewan also saw its revenues fall, but only slightly, to C$53.5 million, dropping just over 5% from C$56.5 million in 2015. Finally, Manitoba took in just over C$262,000 last year, compared to C$2.2 million last year.

Land inventories are one of the most consistent indicators of future drilling activity; the decrease in land sale volumes indicates that although there are some positive signs in Canada, it would be premature to suggest that any sort of “boom” is imminent. ![]()

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- Executive viewpoint: TRRC opinion: Special interest groups are killing jobs to save their own (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- Management issues: New U.S. House Speaker is strong supporter of oil and gas industry (December 2023)