What's New in Exploration

It is true that most offshore exploration today leads to at least hundreds of millions of dollars in capex to produce a discovery, and it can easily chase up to billions. It is true that most offshore discoveries, anywhere new, will take five to eight years, from first discovery, to get significant amounts to market. It is true that super-large, undiscovered reserves are believed to no longer exist onshore [an exception may be Apache’s Alpine High ≥ about the same capex]. It is also true that none of us know the price of oil, five to eight years out.

It may be true [says ION Geophysical] that Panama is the next big thing for exploration offshore. Ohhhh, I hope seismic airguns don’t scare off my best sail fishing ever—not! However, remaining reserves to the north, just in the GOM from known fields [circa 2015] are estimated by the U.S. Bureau of Ocean Energy Management (BOEM) to be 3.48 Bbbl of oil and 7.3 Tcf of gas. These reserves are recoverable from 569 active fields. Reserves in this report are defined as “proved plus probable (2P)” estimates.

As of Dec. 31, 2015, BOEM estimates that the Original Reserves are 23.06 Bbbl of oil and 193.8 Tcf of gas from 1,312 fields. Original Reserves are the total of the Cumulative Production and the current Reserves. This number includes six fields that moved from Resources to Reserves during 2015. It also includes 743 fields that have produced and expired. Cumulative Production from all fields accounts for 19.58 Bbbl of oil and 186.5 Tcf of gas.

Note that all the reserves quoted are engineering estimates from exiting fields! Resources are assumed to be huge, but unknown. BOEM’s Lease Sale 249 (Aug. 16, 2017) did well, so now we have Lease Sale 250 [2018] on about 77 million acres in the Gulf. There’s still a lot of upside, and in the North Sea, and offshore Newfoundland, and... If you count basins such as offshore Brazil, and offshore West Africa, then you see there is large, conventional offshore potential remaining. Add in sub-salt or Arctic, and there you go.

I remember an argument that I had in the 1990s with a U.S. exploration V.P. about being told to stop looking at prospects that held less than 50 MMbbl of oil. The subject of the debate was an onshore Cotton Valley Reef play (Freestone, Limestone, Leon and Robertson counties) out of our Tyler, Texas, office. I bet today, that if he were still in the job, 20 MMbbl of oil would earn him a bonus. I also remember, in that same meeting, being asked what my seismic budget was for the Far East. I added to the printed number in our budget book another $5 million. After all, it seemed that Tyler wasn’t going to need it. Only the chief accountant, and my immediate boss, caught what I did. I was promoted.

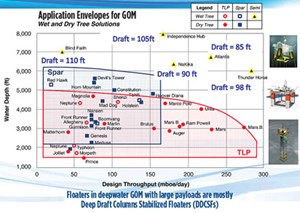

No matter how you build it—spar, TLP or semi (see chart on this page)—high-volume offshore production needs Archimedes’ principle and a lot of money. Is it worth it? It certainly has been. Yet, there is little “build it and they will come” thinking going on. I do see a glint on the horizon from a couple of majors. BOEM still believes that 48.5 Bbbl of oil and 142 Tcf of gas remain undiscovered in the GOM (as of Jan. 1, 2014; OCS Report, BOEM, 2017–005), with the vast majority coming in water depths greater than 800 m (more than 2,600 ft).

Onshore oil production costs today are about $35/bbl to over $80/bbl. Few are below $20. I reviewed an onshore prospect with an exploration cost at less than $2, and a production cost estimated at $14, with no takers, because it is conventional, and has small reserves. I remember a break-even of about $15 in the North Sea in the 1980s. The denominator really, really matters!

Stripper wells make a living at less than 10 bopd, with $5-to-$25/bbl in costs. Their operators dream of reserves and production of the offshore type. I know a small producer that makes a profit at draining an old, large oil field gaining about 2 to 3 bbl of oil per 1,000 bbl of water. A good, conventional, U.S. onshore new find would be 10 MMbbl of oil. Remember, the Hubbert bell curve states that the big stuff was found early, before your time, and only the backside of the curve is available. Of course, those who followed that bell did not know about subsalt, the “new” Arctic

or shale.

Any time that we believe we have all the answers and have spent too much… you could still be underspent [e.g. Thunder Horse, $5 billion and 700 employees]. Yet, for 1 Bbbl of oil and 250,000 bopd, what would you do? ![]()