Port Fourchon laying foundation for a deeper future

The stubborn down cycle in offshore drilling activity has failed to dissuade the management of southern Louisiana’s Port Fourchon from sticking to its long-range game plan.

Bearing witness to that stay-the-course strategy, consecutive agreements in late 2016 take the port one step closer to eventually adding floater repair to what already ranks as the premier service-and-supply hub for the deepwater Gulf of Mexico oil and gas industry.

The Greater Lafourche Port Commission (GLPC) board agreed on Sept. 29 to a right-of-first-refusal on more than 900 acres immediately south of the port, where the proposed Fourchon Island development will be the first purpose-built deepwater rig repair and refurbishment facility on the U.S. Gulf Coast. That agreement came on the heels of the signing of a Memorandum of Understanding (MOU) between the port commission and the U.S Army Corps of Engineers to investigate the feasibility of creating up to 50-ft drafts into Port Fourchon to accommodate deep-draft rigs and support vessels.

“Louisiana currently does not have a port that can handle deepwater rig repair and maintenance,” said Port Fourchon Executive Director Chett Chiasson. “We wouldn’t necessarily be competing with ports in Texas and Alabama, but they can’t handle it all. Our objective is to attract business that may be leaving the Gulf and going overseas for cheaper rates. If a rig is here, we want to see that it stays in the Gulf of Mexico and does not leave to get refurbished.”

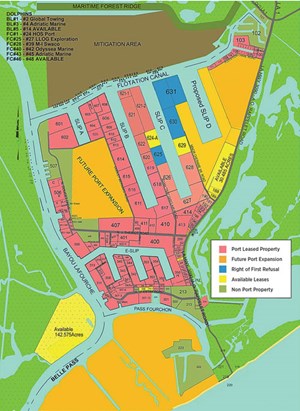

The deepwater rig repair center is part and parcel of a comprehensive master plan aimed at developing new-generation port facilities. These efforts go hand-in-hand with the ongoing development of the 16-year-old Northern Expansion campaign, which will add considerably to the more than 66,000 linear ft of waterfront and just over 1,100 leased acres that the port now controls, Fig. 1. Critical to the long-term vision staked out for this once-inaccessible swamp in Lafourche Parish is deeper drafts, to not only support the development of a rig repair center, but also to enable supersized vessels to navigate the port.

“It would allow us to service the specialized deeper-draft vessels currently serving the deep water that can’t come into the port right now. We have some ships coming in that have to be light-loaded, so the deeper drafts would allow them to offload directly,” Chiasson said.

COMPLEX PROCESS

Mobilizing the first dredging machine to begin the physical work of deepening the channels must await the conclusions of an exhaustive feasibility study, a process that will take at least 18 more months.

Chiasson said the port is first examining the feasibility of increasing the depth of the channel running from Belle Pass into Bayou Lafourche and up to the Northern Expansion area (Fig. 2), which is authorized for a 24-ft draft, but with 3-ft advanced maintenance, essentially increases the draft to 27 ft. “We want authorization to go to perhaps 27 ft to 30 ft, from Belle Pass into Flotation Canal and the new Northern Expansion slips,” he said.

The second, and far more complex, objective is spelled out in the MOU, signed last August under the auspices of Section 203 of the U.S. Water Resources Development Act of 2000. That agreement clears the way for examining the environmental and economic feasibility of deepening, in 5-ft increments, the nearly 5-mi main channel that links Port Fourchon to the Gulf of Mexico to between 35 ft and 50 ft. “Basically, we would go from the Gulf up to Belle Pass, where it intersects with Bayou Lafourche, and Old Pass Fourchon. That’s where we would have our deep-draft port facility (Fourchon Island),” Chiasson said.

The feasibility study is concentrated on the northern environs of Port Fourchon, where the newer bulkheads can safely accommodate deeper drafts. “We will not be going into the E-Slip area of Port Fourchon right now, because the older bulkheads are not designed to handle large drafts. The newer bulkheads were designed with sufficient factor of safety to enable us to get to 30 ft with minimal retrofits,” he said.

The study is expected to be completed in early 2019 and, if all goes well, development of the Fourchon Island rig repair facility could get underway by 2020.

DIVERGENT TRENDS

In the meantime, while GOM production is expected to reach a new high this year, the 80 companies holding more than 140 leases across the port’s 1,200 developed acres continue to cope with a persistent drilling slide. According to Baker Hughes, 18 active rigs were on location as of March 24, down nine from the same period last year. While the near-term outlook remains cloudy, hope that the uptick in commodity prices of late will stabilize is brightening prospects to a degree. In its annual forecast, World Oil projects drilling will increase around 9% to 128 new wells this year, up from the 117 wells constructed during 2016, in what was the low point of the current down cycle. Moreover, a number of players, led by independents, have said they would increase investments in the Gulf this year.

“We’re seeing some promise. It’s not great by any means, but at least we can see things inching up a bit,” says Chiasson. “It looks to me that we are at a plateau now and ever so slightly things are starting to edge back up.”

One exception can be found in the Gulf’s expanded fleet of offshore supply vessels (OSV). Owing to the now-universal commandment to “do more with less,” operators find they can contract fewer vessels to service their offshore assets, Fig. 3. “We’re not seeing any pickup in vessel activity,” Chiasson said. “The vessel providers are still struggling and will probably continue to struggle for awhile.”

The near-term outlook is entirely different on the production side. In February, the U.S. Energy Information Administration (EIA) predicted the Gulf of Mexico will produce, on average, a record 1.79 MMbopd in 2017, reaching a high of 1.9 MMbopd by December. Much of the increased output can be traced to six deepwater fields that the EIA identified as going online between 2016 and 2017. The production outlook brightened further with Shell’s Feb. 28 decision to sanction development of its deepwater Kaikias field in the Mars-Ursa basin. It was the first such project that Shell had authorized in 18 months.

Hess, which is installing its Stampede tension leg platform (TLP) in Green Canyon, with first oil expected in early 2018, says it will divert $375 million to the deepwater Gulf this year, Fig. 4. In January, Danos landed the contract to perform the Stampede mechanical hook-up and commissioning support services, with all material and personnel to be marshaled out of Port Fourchon. For this year, it has been all-hands-on-deck for the Gray, La., provider of personnel and related production and project support services. “We’ll have 25 to 30 people offshore for six months, working through completing the offshore hook-up,” said Mark Danos, V.P. of project services.

Pure play operator W&T Offshore, likewise, said it plans to raise 2017 capital expenditures for its deepwater and shelf assets to an estimated $125 million, providing prices continue to stabilize. “We are as enthusiastic as ever about the opportunities in the Gulf of Mexico,” said Chairman and CEO Tracy W. Krohn in March.

Adding an exclamation point to continuing development and production activities, Chevron, one of the Gulf’s foremost deepwater producers, set a passenger record in 2016 at its wholly owned facility within the port-controlled South Lafourche Leonard Miller Jr. Airport, according to Chiasson. The super-major transported more than 82,000 passengers from its $30-million airport facility, which consolidates its entire Gulf of Mexico aircraft fleet. “Chevron is fully ramped up and uses the facility for all its (Gulf) logistical operations. The airport, as a whole, is busier than ever, with nearly 112,000 passengers served in 2016,” said Chiasson.

BUILD-OUT CONTINUES

While the port has not had a single tenant bail out, the trying market conditions, especially for the drilling support sector, led one prospective tenant to decide it could ill-afford to follow through on an earlier right-of-first-refusal. That leaves 800 linear ft of new bulkhead property on Slip C available for the taking. “It’s been a while since we’ve had property available,” said Chiasson. “But, we have three companies looking at it now, so that’s promising. We’re continuing to slowly build more waterfront, so at this point, we believe it’s fine to have property available.”

As part of its more measured build-out, the port hierarchy is soliciting bids for the construction of 939 linear ft of bulkhead on the west side of Slip C. Work also will commence later this year on an additional 871 linear ft of bulkhead, also on Slip C and due north of the now-available 800-ft bulkhead. Elsewhere within the Northern Expansion, the design process is underway for the first level of hydraulic dredging in preparation for building the new Slip D, which is expected to begin later this year.

“As we’ve said in the past, we’re getting ahead of the game to make sure we have properties available when needed, so companies don’t have to look anywhere else,” says Chiasson.

As for tenants, Newpark Drilling Fluids completed a comprehensive facelift of its port base, which doubled mud mixing and storage capacities and includes the industry’s “most progressive” liquid mud plant design features, says Regional Operations Manager Sam Smith.

The expanded facility now has a total of over 75,000-bbl storage capacity for water-based and synthetic-based drilling fluids, as well as two newbuild 1,250-ton barite barges. Along with closed-top tanks and high-rate pneumatic mixing systems, the wholly refurbished base also replaces forklifts with a distinctive monorail salt delivery system. The monorail delivers pure salt at a rate of more than 500 ton/hr continuously into two hoppers, and with the capacity to blend over 15,000 bpd of salt-saturated drilling fluid. ![]()

An “oasis” in the heart of Port Fourchon

As you enter the primary access road into the core of Port Fourchon, among the cranes, tanks, operational structures and other exemples of a well-established industrial infrastructure, you come upon a veritable oasis, complete with colorful native vegetation, recreational waterways, jogging trails and even a pavilion for hosting fishing tournaments and the like.

That is precisely the scene that the movers and shakers of this Lafourche Parish institution hope to create within an existing pond that covers some 90 acres alongside LA Highway 3090. “Our goal is that the first thing you see when you enter Port Fourchon is a beautiful marsh and recreation area,” says Port Fourchon Executive Director Chett Chiasson. “It will bring to life what we’ve always said about industry and environment working together and not being exclusive of one another.”

The project will begin taking shape this summer as 12 ft to 15 ft of material hydraulically dredged in the initial phase of the Slip D development is diverted, from the normal and isolated mitigation area north of the port to the more visible and readily accessible location. “We actually amended our permit to allow mitigation on the pond we have in the port. We’ve spoken with a number of environmental agencies, permitting entities and other groups, who are really embracing the idea of having a mitigation area, where you can grow different types of plants and have an interactive recreational facility for the people who work and stay at the port as well as the vessel crews,” said Chiasson.

The ambitious project entails the creation of tidal creeks, which can be used for kayaking, fishing and other aquatic activities, surrounded by safe jogging and walking trails, and all set among a botanical garden of sorts. Plans also call for the eventual construction of a pavilion with parking accommodations for everyday use and hosting myriad events, such as fishing tournaments or corporate functions. ![]()

Port may join LNG export sector

Once all the regulatory edicts are crossed off, Port Fourchon could be joining the liquefied natural gas (LNG) exporting community. On Jan. 29, port tenant Energy World USA laid out plans to build a mid-scale LNG production and export facility on a nearly 143-acre lease, immediately west of Belle Pass and outside the existing port development.

Along with the 2-million-ton/annum LNG export terminal, to be known as Fourchon LNG, Energy World also plans to build a smaller plant on the site to provide fuel for the next generation of LNG-powered offshore supply vessels expected to join the Gulf of Mexico fleet. At upwards of $900 million, the two plants together represent “the port’s largest single investment,” says Port Fourchon Executive Director Chett Chiasson.

“We’re keeping our fingers crossed that they could be breaking ground on the export plant within two to two-and-a-half years. Conceivably, they could be breaking ground on the small-scale domestic plant within the next year to year-and-a-half,” said Chiasson.

Energy World USA is a subsidiary of the Energy World International Ltd. (EWI) group of companies, which counts LNG production and distribution among its energy-related portfolio. ![]()

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)