Shaletech: Canadian Shales

After a year-long time-out, benched rigs are being put back in the game as operators cautiously loosen the purse strings across western Canada’s established shale plays.

“We’re very excited about 2017,” said Crescent Point Energy CEO Scott Saxberg, putting in the rear view mirror what the Canadian Association of Oilwell Drilling Contractors (CAODC) decried “as the worst year on record” for its membership, concentrated mostly in the copious Western Canada sedimentary basin (WCSB)—home to all of the nation’s unconventional production.

While sufficiently fluid to respond to fickle commodity prices, 2017 E&P budgets have largely reversed a two-year spending decline, as exemplified in a 100-rig spike in the active rig count late in the first quarter, and just before the typical spring break-up hiatus. During the week of March 20, CAODC documented 184 rigs drilling ahead, primarily in the provinces of Alberta, British Columbia and Saskatchewan, compared to a March 2016 average of 84 active rigs. To further put the improving prospects into perspective, CAODC says the number of active rigs throughout the WCSB sank to a low of 35 last May, during the height of the seasonal spring break-up, compared to the 80 rigs at work during that same month of the year prior. A high of 279 rigs were at work in January, at the height of the winter drilling season.

“Customer demand has surprised to the upside, and the duration seems to be lasting longer than we expected,” Kevin Neveu, CEO of Precision Drilling Corp., said on Feb. 10, well into the 2016–2017 winter drilling season. “We believe the seasonal spring break-up slowdown will be weather-driven and not budget-constrained, as we saw last year and the year before.”

The Petroleum Services Association of Canada (PSAC) tends to agree. On Jan. 30, the trade association revised its original 2017 new well forecast, and now predicts 5,150 wells to be drilled this year, a 23% increase over its November estimate. The new PSAC forecast now has 2,706 wells being drilled in Alberta, where multiple targets include the gas and liquid windows of the maturing Montney shale, the underlying Duvernay tight oil play, and the Cardium shale/sandstone, the basin’s largest conventional oil reservoir and a comparatively late entry to the unconventional picture. The Cardium also extends into the Montney fairway of British Columbia, which is expected to see 367 new wells this year, up from the 280 predicted in the original PSAC forecast, Fig. 1.

A significant growth spurt is expected for Saskatchewan, where 1,985 new wells are envisioned, as operators take advantage of the low-cost and geologically uncomplicated Viewfield Bakken and the dual-bench Shaunavon light oil resource plays, both of which lie just across the Montana and North Dakota borders. Activity, likewise, is intensifying in the shallow west-central Saskatchewan portion of the Viking formation, generally described as a “variably shaly, fine-to-coarse-grained sandstone.” With year-end production of 17,900 boed, pure play operator Raging River Exploration said its latest Saskatchewan Viking wells, with 3,960-ft laterals, deliver 113% internal rates of return (IRR). The company plans to begin production from 106.1 net wells during the first quarter.

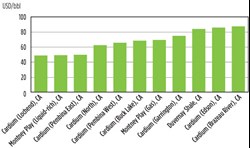

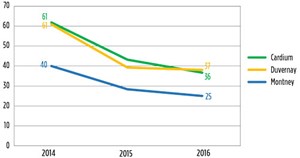

Buoying the near-term prospects for the notoriously high-cost and pipeline-constrained WCSB is the three-year drop in the average oil-weighted break-even prices (BEP) for the principal Montney, Duvernay and Cardium shale plays, from $50/bbl to $30/bbl, says Norwegian consultancy Rystad Energy, Figs. 2 and 3.

“This represents a decrease of over 40%, on average,” says Senior Analyst Sona Mlada, who added that factoring in the effects of facility costs and price discounts to the raw wellhead BEP shows that, relative to the WTI benchmark, the liquids-rich portion of the Montney realizes far more attractive break-even costs, on average, than pure gas acreages.

OIL SANDS TO SHALE

A number of players, of late, have reduced spending significantly, or otherwise abandoned Alberta’s oil sands, as reflected in separate March transactions that saw Shell liquidate most of its holdings for $7.25 billion, and Marathon Oil Co. divest its entire interest in the Athabasca Oil Sands Project (AOSP) for $2.5 billion. Consequently, the spotlight has never been brighter on the shale sector, as Canada hopes to reverse the downward trend in non-oil sands production.

Not surprisingly, National Energy Board (NEB) 2016 production data for the primary producing provinces of Alberta, British Columbia and Saskatchewan show another yearly drop in light oil production. According to Canada’s chief regulator, the three provinces collectively produced an average of 556,428 bpd last year, down from the average 617,128 bpd delivered during the previous year. However, the trio averaged gas production of 14.781 Bcfgd in 2016, up slightly from the 2015 average of 10.092 Bcfgd.

Murphy Oil Corp., for one, plans to divert up to a quarter of its $890-million 2017 budget to develop the Alberta Montney and Duvernay interests acquired just over a year ago, and just before the June divestiture of its remaining oil sands interest for $744 million. As of now, Murphy plans to operate a two-rig program for the next two years.

The May 2016 JV with Athabasca Oil Corp. gave Murphy a controlling 70% interest in more than 200,000 gross acres in the Kaybob Duvernay, and a 30% stake in 25,000 gross acres in the Placid Montney play. “We monetized our non-core Canadian heavy oil seal asset, leaving us with a more focused unconventional-only onshore portfolio,” said CEO Roger Jenkins.

In 2016, the Tupper Montney asset produced 200 MMcfgd, while the largely undeveloped Kaybob Duvernay acreage delivered an average of just over 3,000 boed during the fourth quarter. The partners completed the drilling of a five-well Montney pad in the first quarter of this year, while a two-well Duvernay pad also was set to come online during the first quarter.

Meanwhile, in addition to its oil sands sell-off, Shell pocketed $1.037 billion from the Nov. 30 sale of non-core shale assets to Tourmaline Oil Corp. The Calgary independent, in turn, increased its planned 2017 capital budget to $1.35 billion, up from the $825 million spent on drilling and completions last year.

The acreage and infrastructure deal includes 145,000 net acres in west-central Alberta’s Cardium-rich Deep basin and a 61,000-net-acre Montney position in northeastern British Columbia. Tourmaline now holds a commanding 1.9 million acres in the Deep basin, where it plans to drill up to 31 horizontal wells this year. The operator was running 14 rigs at year-end and tentatively plans a 17-rig program in 2017, as well as to drill a cumulative 300 gross wells across its core Deep basin, Montney and Peace River assets.

Tourmaline expects 2017 production to average between 250,000 and 260,000 boed, a 30% year-over-year increase.

Shell still holds approximately 430,000 net acres in the Alberta Duvernay, where its current Fox Creek production stands at roughly 17,000 boed. According to a spokesperson, the major has provided no near-term guidance on activity within its retained leasehold.

On March 29, ConocoPhillips sold its 50% stake in the Foster Creek Christina Lake (FCCL) oil sands partnership and most of its Deep basin assets to Cenovus for $13.3 billion. ConocoPhillips retains its 50% interest in the Surmont oil sands joint venture, as well as the 82,000-net-acre Blueberry Montney position in British Columbia, where it is presently running a single-rig appraisal drilling program. Additionally, the independent added 30,000 net acres to its Montney leasehold late last year.

BOUNCING BACK

Encana Corp. increased its planned North American capex to between $1.6 billion and $1.8 billion, up from its estimated $1.1 billion spent last year. Encana’s Canadian activity is concentrated wholly on its core Duvernay and Montney assets, where plans are to run an aggregate nine-rig fleet this year.

The Calgary independent plans to run seven rigs across its nearly 600,000-net-acre Montney position in northeastern British Columbia and northwestern Alberta, where it is delineating stacked play potential with the underlying Duvernay. Between 70 and 80 Montney wells are expected this year, with total drilling and completion costs of $4.5 million/well, normalized to 9,000-ft laterals.

Transferring the enhanced completion designs used in its South Texas Eagle Ford leasehold, Encana says that by fourth-quarter 2017, it plans to have doubled liquids production from the same period last year, with higher-priced condensate making up 85% of its Montney production mix. “It is our view that Western Canada will continue to require condensate imports for the foreseeable future,” says Reneé Zemljak, executive V.P. of midstream, marketing & fundamentals. “So, condensate in Canada will continue to command a premium to [U.S.] Gulf Coast pricing.”

Encana also plans to run two rigs and drill up to nine wells in the estimated 343,000 net acres that it holds in Alberta’s liquids-rich Duvernay shale, where average, normalized, total well costs are coming in at $8.5 million for 8,900-ft laterals. Encana, which said 2016 Duvernay production jumped 86% from the year prior, pointed to two recent wells completed in the volatile oil window that delivered 60-day initial production (IP) rates of around 1,500 boed, of which nearly 1,000 bpd were comprised of condensate.

Elsewhere, a sampling of fellow Calgary-based independents further reflects the generally bullish outlook.

Tamarack Valley Energy Ltd. finalized the $407.5-million acquisition of Spur Resources Ltd. on Jan. 11, giving it 470 net sections in the Alberta Cardium and Viking light oil fairways. The company is running three rigs and plans to drill between 140 and 150 net wells this year, including up to 122–130 Viking and 12–14 horizontal Cardium wells.

Painted Pony Petroleum Ltd. plans to drill and complete 61 net Montney wells in 2017, within its 127,354-net-acre leasehold in the Townsend and Blair-Daiber areas of northeast British Columbia. Compared to last year, the company plans to nearly triple 2017 production to an average of 408 MMcfed. Last year, the company drilled 36 and completed 38 net wells, producing an average 138 MMcfed.

As part of its strategic alliance with AltGas Ltd., Painted Pony approved a 100-MMcfgd expansion of the Townsend shallow-cut gas processing facility, which is expected to be completed in October. In December, Painted Pony delivered more than 170 MMcfgd to the facility and, thus far, is averaging 136 MMcfgd in 2017.

Seven Generations Energy Ltd. plans to run between nine and 10 rigs this year, and drill between 100 and 110 wells on its Alberta Montney leasehold, which it expanded last August with the acquisition of 155 net sections held by Paramount Resources Ltd. acreage. With capital investments increased to between $1.5 billion and $1.6 billion, the company has set 2017 production targets of 180,000 to 190,000 boed.

Torc Oil & Gas Ltd. plans to drill a cumulative 65 gross wells this year, up from 35.7 net wells in 2016. The wells are to be spread out between its West Pembina Cardium holdings in Alberta, and its Torquay (Three Forks) and conventional assets in southeastern Saskatchewan.

Trilogy Energy Corp plans to drill at least 35 net wells this year across the 867,480 gross acres that it holds in northwestern Alberta, where it targets the gas and liquids windows of the Montney and Duvernay shales. Trilogy drilled 23 gross wells last year.

NEW COMPLETION, EOR SYSTEMS

On Nov. 29, Blackbird Energy Inc. followed, what it claims, was a record 76-stage pin-point completion without the aid of coiled tubing, by paying $3 million to buy a 10% stake in the completions provider, Stage Completions Inc., and its nearly year-old Bowhead II collet-activated fracturing system.

Blackbird employed the Bowhead technology in an oversized Upper Montney completion, in a Grand Prairie well that comprised total proppant loading of 3,757 tons, and frac pump rates as high as 63 bbl/min. Blackbird said the project represented the highest tonnage and frac rate ever completed in a 4.5-in. monobore Montney well, without coiled tubing assistance.

Introduced last May, the Bowhead II system runs a dissolvable ball on collet, which subsequently activates sliding sleeves, enabling the maintenance of a constant diameter wellbore that is cementable in place. Along with allowing longer laterals, tighter spacing and higher pump rates and tonnages, Stage says the technology provides pin-point fracturing capability to increase estimated ultimate recoveries (EUR), while improving water management.

In a related development, Blackbird beefed up its Montney leasehold in March with the all-stock acquisition of 13 gross sections contiguous with its existing acreage in the Elmworth/Pipestone corridor of western Alberta. The newly acquired acreage, formerly held by Paramount Resources Ltd., increases Blackbird’s Montney position to 115 gross sections.

Meanwhile, bolstered with a new injection control device (ICD) introduced in late 2016, Crescent Point Energy plans to step up its aggressive waterflood enhanced oil recovery (EOR) campaign this year across its Saskatchewan Viewfield Bakken and Shaunavon resource plays. Compared to its prior technology, Crescent Point claims the recently engineered ICD enables a three-fold increase in water injectivity volumes. At year-end, the 300 injection wells installed in the company’s Bakken and Shaunavon waterflood programs had added 10.5 MMboe of 2P reserves—the fourth consecutive yearly increase.

Crescent Point also plans to increase 2017 spending to $1.45 billion, up from $1.1 billion in 2016, with roughly 25% earmarked for its Saskatchewan tight oil holdings. The Calgary independent drilled 270.3 new tight oil wells last year in the 960,000 net acres that it controls in southwestern Saskatchewan, with 270 net wells also slated for 2017. Of the aggregate 344.5 net wells that it drilled last year in the Williston basin, Crescent Point’s activity in the Saskatchewan segment focused on in-fill development in its Viewfield Bakken acreage, along with step-out drilling in its still-emerging Flat Lake holdings. ![]()

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)