Energy issues

I attended the Deloitte Oil & Gas Conference, here in Houston, in the waning days of September, hoping to hear some good news for a change. And, there was some, in the long term. But the short term is still iffy, according to David Knapp, chief energy economist and senior editor for the Energy Intelligence Group’s Global Oil Market Analysis, who sees global capex cuts through 2018 of $800 billion to $1 trillion in the upstream sector. And that is a precursor of dubious demand going forward, based on energy use per capita trending downward, according to Rob Gardner, manager, Economics and Energy Division, Corporate Strategy Planning Department of Exxon Mobil.

While the morning’s early presentations did not bring a smile to everyone’s face, things started uphill with a presentation by Scott Sheffield, chairman and CEO of Pioneer Natural Resources. Sheffield has taken Pioneer to an enviable place in an upstream industry plagued by low prices. The firm’s focus is on the Permian basin. With the existing infrastructure and, in places, up to 4,000 ft of shale, break-even prices, said Sheffield, are in the $28-$29/bbl range in a play where producers can operate for $2/boe, for about a 10% return. At today’s low-to-mid-$40s prices, operators can realize a 40%-to-50% return. There is a downside. Given these figures, the price of acreage in the Permian basin has skyrocketed, reaching $58,000/acre in a small area. That is because very little acreage, and only acreage in the Delaware basin, is available.

And there is, according to Sheffield, the looming prospect that methane emissions regulations could curtail some 1 MMbopd of Permian basin production, because of the $80,000-plus price tag per well for methane emission mitigation technology. At that price, the numerous 2–3-bopd wells in the Permian basin aren’t economic. Be that as it may, Sheffield presented a scenario of hope and accomplishment in the Permian basin, and the SCOOP and STACK plays in Oklahoma, a scenario that will drive Pioneer to add six rigs to its Permian basin fleet next year, raising the company’s total rig count to 17 in the play. Why not? According to Sheffield, the Permian basin could soar from 2 MMbopd to 10 MMbopd over the next decade or two.

Some of that region’s vast potential lies in a newly announced discovery in the far west Permian basin. Known as Alpine High, the discovery by Texas-based Apache Corporation is said to contain the equivalent of at least 3 Bbbl of oil. The area of the discovery was overlooked for years, because it was thought to have little, if any, potential. But Apache took a chance and was rewarded with a giant that is still not completely understood. “This is a giant onion that is going to take us years to unveil and peel back” John Christmann IV, Apache’s CEO, told the Wall Street Journal.

Producers like Pioneer and Apache have made the Permian basin, and Texas, a prosperous and healthy place. A recent report by the Institute for 21st Century Energy, U.S. Chamber of Commerce (http://www.energyxxi.org/sites/default/themes/bricktheme/pdfs/er-fullreport-16.pdf), details the impact of oil and gas development in Texas, home to the Permian basin and a number of other important plays, such as the Eagle Ford and the Haynesville. The report, the second in the Energy Institute’s Energy Accountability Series, finds that the Texas economy would be highly stressed, if the area’s vast oil and natural gas resources had not been developed.

This report, titled “What if America’s Energy Renaissance Had Not Actually Happened?,” examines figures over a seven-year period (from 2009 through 2015), to determine the effect of oil and gas development on the state of Texas and the nation. The report concludes that the state of Texas would have lost 675,500 jobs, $122.8 billion in annual GDP, and $59.4 billion of labor income, had the oil and gas industry not existed. That is compounded by an additional $576 billion of state GDP, and 2.9 million jobs that would have been put in jeopardy.

At the national level, 4.3 million jobs and $548 billion in annual GDP would have been lost, while electricity prices would have been 31% higher, and motor fuels would have cost 43% more.

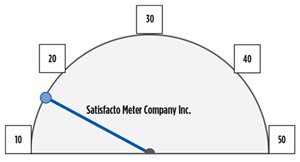

It’s a little tough to know what to believe in this two-dimensional world, where the sky continues to fall at the same time that pockets of sunshine and happiness spring up. To shed some light on this issue, I have developed the “Satisfacto Meter.” Incorporating oil and gas prices, costs, activity levels, rig counts, discoveries, dry holes, and the number of oil and gas professionals drinking heavily at my local bar, the Satisfacto Meter is meant to indicate the satisfaction level of those in the upstream industry at any given time.

The reading to the left was taken in the third week of September. Let’s hope it moves higher. ![]()

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)