Engineering effective and efficient completions

The notoriously narrow economic margins emblematic of unconventional plays have increased the pressure to maximize reservoir drainage at the lowest possible cost. Placed squarely in the crosshairs of this fiscal condition are horizontal well paths, completed with multi-stage hydraulic fracturing stimulations, which, while opening the door for enhanced recoveries, represent one of the single-largest components of total well costs.

On the other hand, as operators intently scrutinize the risk-reward ratio of every project, step-change advancements in the design, execution and monitoring of hydraulic fracturing programs have brought significant opportunities to reduce the former and maximize the latter. Indeed, the development of data-driven and play-specific modeling technologies, to optimize the design and placement of hydraulic fracturing programs, has been combined with on-site analytical tools and expertise that provide real-time treatment adjustments. Thus, the costs of more effective stimulation programs often are more than offset by enhanced recoveries from these impermeable reservoirs with corresponding higher returns on investment (ROI).

FRAC STRATEGIES

Typically, it was assumed universally that, along with geology and reservoir characteristics, hydraulic fracturing and completion designs all had a hand in a well’s production and estimated ultimate recovery (EUR). However, to what degree one swayed over the other was difficult, if not impossible, to determine, due to well complexity and reservoir uncertainty. For example, impressive production rates may be attributed to the fracture and completion design when, in fact, the higher flowrates are controlled by high-quality reservoir characteristics. Conversely, a fracture or completion design may be blamed for a poorly producing well when, in reality, the root cause could be laid on inferior reservoir quality.

Attempts to better understand the reservoir conditions that drive production commonly relied on hydraulic fracture modeling in tandem with reservoir simulation tools to model fluid flow, both inside the reservoir and within the created fracture. However, building such a model to evaluate completion effectiveness required difficult-to-obtain, well-specific reservoir and geomechanical characteristics—including permeabilities; porosity; saturations; pressures; identification of geologic discontinuities, such as natural fractures; stresses, as well as fluid and rock properties; among many others. In practice, much of these data generally are not available for reservoir modeling, so evaluating the efficiency of a completion, and subsequent forecasting of well production, rely on numerous assumptions with built-in biases.

However, designing a strategy based on assumptions realistically does not lend itself to optimizing hydraulic fracturing and completions in the widely heterogeneous nature of unconventional plays. As a case in point, concurrent with the accelerated use of microseismic monitoring as a barometer for hydraulic fracturing efficiency, many operators are focused on maximizing reservoir contact via large-volume, high-rate stimulation treatments, with less consideration extended to incorporating conductivity into the fracture designs to sustain flowrates and, in turn, long-term profitability. While pumping tremendous volumes of frac sand has demonstrated benefits in brittle dry gas shale plays, with low-to-intermediate stresses, the rock properties and stresses intrinsic to other impermeable shale formations render large-volume frac sand treatments largely inefficient, with respect to optimizing production, costs and environmental impact.

Thus, the ever-tightening economics of shale plays have accentuated the inherent value of identifying and understanding the effect of well-specific key performance drivers in the design of fracture stimulation and completion programs.

DATA-DRIVEN MODELING

Historically, a discrete, single-well approach that builds numerical reservoir models based on assumptions from available data was typically used to forecast production for a given completion and stimulation design. Unfortunately, this discrete approach requires realistic and specific estimates of key performance drivers. For heterogeneous shale plays, utilizing multi fractured horizontal wellbores, and obtaining reliable estimates of key geological and reservoir characteristics, is expensive and problematic. Thus, this standard modeling methodology can be ineffective in yielding a true production forecast and assessment of completion efficiency, and thereby poses a tremendous economic drawback in planning future designs in the specific area.

A groundbreaking data-driven analysis process (WELLWORX) accelerates the development of optimal and cost-effective fracture and completion design for a particular reservoir. This type of multi-well modeling approach provides operators with a site-specific index of the key completion success indicators that enable accelerated optimization of completion and fracture design. In addition, operators can optimize field development strategy accordingly, to efficiently exploit the full potential of the reservoir and maximize ROI. This process utilizes data-driven artificial neural network (ANN) modeling techniques to identify critical geology, and reservoir-related fracturing and completion parameters that drive production in a targeted area. The predictive ANN model is derived from a dedicated workflow that begins with gathering data—from geological, drilling, completion, production and other sources—and continues through the data refinement, processing and modeling stages to the eventual development of a model directed at optimizing well completions, prospect evaluation and the identification of underperforming wells for a field or formation.

This type of modeling approach establishes cause-and-effect relationships of various completion and fracture-related inputs, using much lessor well counts compared to statistical regression models, delivering simulations of reservoir, fracture, completion and production performance sooner for individual wells in a field development. While helping accelerate the design of the most optimal fracture program, the WELLWORX modeling process, likewise, proves useful in evaluating prospects, while identifying reservoir quality and re-frac opportunities.

FIELD VALIDATION

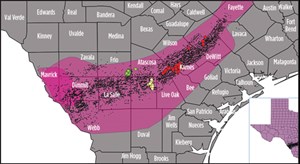

Producing oil, gas condensate and dry gas, the Eagle Ford shale of South Texas clearly illustrates the distinctive challenges in designing fracture stimulation programs in plays, which—along with localized variations in thickness, thermal maturity and pore pressure—also feature diverse reservoir fluid types, Fig. 1. To optimize well-specific completion and fracture treatment designs, aimed at maximizing production and well economics, a data-driven ANN model was built from an integrated, multi-operator data set.

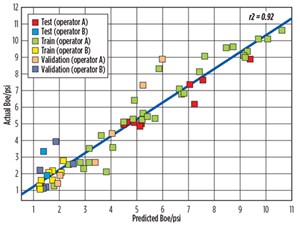

Specifically, the ANN model—which was trained and tested on a comprehensive database of multiple operators—identified Eagle Ford-specific cause-and-effect relationships of various completion and fracture-related inputs, as well as readily obtainable geologic and reservoir-related parameters, Fig. 2. The model outputs, comprising normalized oil and gas production to account for pressure management differences, on the whole delivered predicted and observed best 30-day well productivity values (R2) greater than 0.9 for boe/psi, 0.8 for bbl/psi and 0.85 for Mcf/psi.

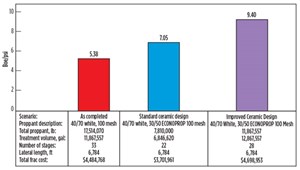

The ANN model determined that deeper wells, with their comparatively better reservoir characteristics and higher thermal maturity, tend to produce more hydrocarbons, as do those completed with fracture stimulation programs, coupled with additional frac stages to enhance reservoir contact and high-conductivity fracture designs, Fig. 3. In addition, while bolstering the compelling correlation between pounds of proppant pumped and 90-day oil production, the model supported the dual-hypothesis that large-volume sand treatments generally increase costs and inefficiencies, and that the contribution of 100-mesh sand size proppant to oil production is negligible.

Elsewhere, comprehensive ANN modeling of completed wells in Pennsylvania's Marcellus shale showed an across-the-board under-stimulation that could have been rectified by increasing fracture stages (decreasing fracture spacing) and overall stimulation volumes. The model, which showed geology and reservoir quality as the dominant controllers of Marcellus gas production, predicted that, with the more effective completion and frac designs, the wells would have delivered considerably higher production during their first six months onstream. More importantly, using typical type curve parameters, the higher IP30 rates estimated by the ANN model would increase forecasted EUR to more than 10 Bcf/well for proven undeveloped locations.

ON-SITE ANALYTICS

Complementing WELLWORX data-driven modeling for optimizing hydraulic fracturing designs, STRATAGEN Fracture Supervision & Advisory Services combines new-generation diagnostic tools and the on-site analytical expertise of fracturing specialists that have intimate knowledge of the geological regimes and geomechanics of a specific play. Specifically, analyzing data captured by the FRACPRO fracture design and analysis software allows the wellsite advisors to make real-time adjustments that maximize treatment efficiencies, minimize screen-outs and reduce costs.

The FRACPRO software effectively models any type of hydraulic fracture stimulation job, including limited-entry treatments, multiple perforated intervals and horizontal well fracturing with stress interference. Moreover, the technology furthers understanding about proppant placement, conductivity and fracture dimensions. The software also has the capability to simulate single and multiple-treatment horizontal wells with reservoir properties imported directly from log files. Special displays engineered in the software allows for clear visualization of the fracture’s placement along the lateral.

To optimize the treatment strategy, the software-generated data can be used in conjunction with routine step-down tests to determine near-wellbore friction values prior to the main treatment of every frac. Step-down tests are especially beneficial in natural fracture environments that can precipitate high leak-off and tortuosity.

The conducting of routine step-down analysis is credited with saving one Eagle Ford operator a cumulative $8.7 million over the course of a single year. Specifically, during the year, an aggregate 1,377 frac stages were pumped, with the screen-out rate dropping from the industry average of 2% to 0.36%, reducing the associated costs by some $3.3 million. Further, the on-site analytics reduced the use of costly stimulation acid from 5,000 gal to 2,000 gal per stage, saving $4 million throughout the year. Real-time treatment adjustments also saved the operator nearly $1.4 million by reducing gel consumption by 280,000 lb.

Elsewhere in the Eagle Ford, an evaluation of an operator's planned completion, using an extensive well database and fracture model data for the targeted field segments of the lateral section, identified a high risk of contracting a water-bearing zone. Recommendations from a predictive model, which combined the historical drilling, completion and production data set with real-time FRACPRO output, suggested the operator's planned completion would intersect a water-bearing zone and reduce four-month aggregate production to as low as 7,000 bbl. By selectively fracturing the lateral, the operator avoided the water-bearing portions, resulting in a cumulative four-month oil production of 22,000 bbl. This result compared favorably to offsets and indicated no detrimental effects from the water-saturated zone. The operator increased production some three-fold, resulting in incremental value of $1.13 million from a well that otherwise would have been uneconomical. ![]()

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)