Norway pushes the oil recovery envelope

It’s been a tough period of adjustment for the Norwegian E&P sector, since oil prices began to tumble nearly a year ago. Operators, associations and governmental officials were already worried about the high cost structure of Norway’s upstream projects, well before the oil price crisis.

Accordingly, company executives and officials already had launched a cooperative effort, to see what could be done to lower the costs of equipment and services, find ways to save time, and increase operating efficiencies across the board. Included in the latter item, efficiencies, is an effort by Statoil to wring more profit out of existing assets by improving the overall oil recovery rate.

Already, Statoil has achieved a 50% recovery rate in some fields, and the effort across additional fields continues to gain steam. What follows, in this third and final article of a series on Norway’s E&P sector, is an examination of goals, activity trends and technical efforts related to boosting the oil recovery rate to beyond 50%.

GOALS AND POLICIES

Statoil is the leader of the effort to raise oil recovery rates. Although the Norwegian government has stated that it would like to see greater recovery of the country’s offshore reserves, officials have not stated a specific goal. “The overall goal of the government is to maximize the profit from the Norwegian Continental Shelf (NCS), to the benefit of the Norwegian people,” said Minister of Petroleum and Energy Tord Lien, in comments to World Oil. He further explained, “The government has not set a fixed target for the recovery rate. For the companies, however, increased recovery rate is obviously an important tool to maximize their profits. I simply point to a fact—that increased recovery will increase revenues.”

The director general of the Norwegian Petroleum Directorate, Bente Nyland (Fig. 1), further amplified and clarified the government’s attitude on the subject. “Norwegian authorities do not have an official goal for recovery rate,” said Nyland. “However, we have a goal for oil reserves growth of 7.5 Bbbl of oil in the period from 2014 to 2023.”

“The government estimated in 2014 that each 1% increase in recovery factor corresponds to $48 billion of added value for the Norwegian economy,” noted Tore Irgens Kuhnle, Business Development leader for SURF, at DNV GL Oil & Gas. “In comparison, in Abu Dhabi, a 75-year, onshore concession to foreign oil majors ended in January 2014. The Emirate was looking for commitments from potential partners to maximize extraction of oil over the next 40 years. It is understood that the government was pressing for oil recovery commitments of 60% or more, compared with a typical, global, average recovery factor of 35%.”

“At Aker Solutions, it is our understanding that the previous and sitting governments have been focused on increasing the value creation or oil recovery rate on the NCS,” said Hervé Valla, chief technology officer at Aker Solutions. “This is done by directing funding through the Norwegian Research Council to support the development and qualification of technology that might enable increased recovery rates. Norwegian authorities have initiated or supported several studies to achieve increased recovery. A variety of committees, with participants from operators, service industry and academia, have been established, and challenged to cooperate in advising on measures to be taken, to increase the value creation on the NCS.”

Rounding out the picture are some observations from Torjer Halle, chairman, Schlumberger Norway. “The Norwegian government has a strategy plan for improved oil recovery (OG21),” said Halle. “As part of this strategy plan, the government initiated a National Center of Excellence for Improved Oil Recovery (NIOR) in 2014. A large number of universities and research institutions are engaged in this initiative, including Schlumberger. An ambition level for an average recovery rate around 70% has been mentioned for NIOR, but it is early days yet.”

OPERATIONAL TRENDS

Leading the charge on improving Norway’s oil recovery rate, Statoil already has reached a 50% recovery factor (for some fields), as mentioned earlier, and is working toward 60% as its stated goal. “Statoil has approved measures that give the company and partners reason to expect an oil recovery rate above 50% on the NCS, and, for several existing oil fields and future fields, an even higher figure,” said Press Spokesperson Morten Eek. “A recovery rate of 50% represents an increase of 7.5 Bbbl, based on the 30% estimate of the plan for development and operation (PDO), corresponding to more than two Statfjord fields. The global average is currently about 35%, according to the Norwegian Ministry of Petroleum and Energy (2014 figure).”

“Statoil is working to achieve its goals,” confirmed NPD’s Nyland. “In their portfolio, they have fields with very different premises, when it comes to reaching their goals.” At ConocoPhillips Norway, Stig Kvendseth, Manager, Communication and Government Affairs, offered, “As a co-venture company to Statoil in licenses, we support good and profitable IOR projects.”

One example of Statoil’s progress is Gullfaks oil field in the Norwegian sector of the North Sea, Fig. 2. “When the PDO was approved for Gullfaks field in 1981, it was based on a recovery rate of 44%,” explained Eek. “Since production started in December 1986, the field has now produced more than 2.56 Bbbl of oil and exported more than 70 Bcm of natural gas. Currently, the recovery rate is 59%, and with five IOR initiatives and lifetime-extending programs in operation and to be deployed, we now aim for a 62% recovery rate on Gullfaks field, with production expected beyond 2036. This gives us high hopes to push towards 70% for some fields to be developed, i.e. Johan Sverdrup, with start-up in 2019 and an expected lifetime of 50+ years.

The ultimate goal of 70% recovery has been duly noted by other industry entities. “Yes, I think this is realistic,” said Nyland. “We think 70% is a good ambition, and this represents a potential that we, in the NPD, expect the licensees to plan for, when they make their development plans for the field.”

“Petoro has worked in the license, to build a business case for enhanced recovery on Johan Sverdrup,” said Geir Gjervan, communication director for the state firm that manages the Norwegian government’s holdings in producing fields. “We have initiated studies for this business case, and are arguing for early decisions to be made on capabilities for enhanced recovery.”

“From all appearances, they are well on their way to reaching their target and more,” said Miles Buckhurst, global concept director, HPI, at Jotun AS. His firm, known for its specialty paints and coatings for offshore structures, is naturally concerned about potential corrosion and deterioration of field assets that are producing beyond their originally intended lifetimes.

“The short answer is yes, 70% is realistic over the life of Sverdrup,” said DNV GL’s Kuhnle. “The reservoir of Johan Sverdrup is of a very high quality and with high permeability. Another field with a high-quality reservoir is Stafjord, which in 2013 had a recovery rate of 66%. Sverdrup has a reservoir with varying thickness and a different oil quality than Statfjord, but this proves that it is possible.”

Meanwhile, one of the more sage comments came from Eirik Renli, CEO at reservoir stimulation firm Fishbones AS, who noted, “It is difficult to predict the future, however one must set ambitious goals to focus on continuous improvement. It should be noted that the recovery rate was 30% when Statoil was formed.”

A cautionary note was sounded by Schlumberger’s Halle. “The National Center of Excellence for Improved Oil Recovery (NIOR) will, in collaboration with the supporting oil companies and service companies, organize pilot tests,” said Halle. “But until then, we will not know how well we are doing. However, the ongoing research projects are showing great promise.”

Efforts by other companies. Other operators and their partners are also working to improve their oil recovery rates. Accordingly, the figure that most often pops up is that operators other than Statoil are now averaging 47% recovery of oil reserves at their fields. “That is correct,” confirmed NPD’s Nyland. “The average on the oil fields of the NCS is 47%.”

“Yes, 47% may be close to the average on the Norwegian Continental Shelf,” acknowledged Halle. “However, the most significant difference in recovery rates is between the fields having topside/platform completions and the fields having subsea completions. The latter have a 12% lower average than the fields with top–side/platform completions.”

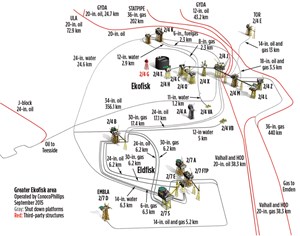

The primary example outside of Statoil may be provided by ConocoPhillips. That firm’s best case is the IOR work related to Ekofisk field, Fig. 3. “In the early 1970s, when the field came onstream, the recovery rate was estimated to be 16-17% in this chalk reservoir field,” noted Kvendseth. “A water injection project came onstream in 1987 as the first-ever in a chalk reservoir. This has improved recovery, together with new drilling techniques; more wells; permanent reservoir monitoring with fiber-optic seismic cables; a new operational model utilizing integrated operation support centers onshore; new platforms and infrastructure; and other best practice methods. We now estimate a recovery rate at 52% for this field.

In addition, we are improving recovery at Eldfisk field, nearby Ekofisk,” added Kvendseth. “The Eldfisk water injection project was started in 2000, and in early 2014, Eldfisk II, with a new integrated platform, went onstream. More production wells and water injectors, combined with an efficient new modern platform and pipelines, will improve the recovery rate and extend the field’s lifetime.”

TECHNICAL EFFORTS

To achieve these improved recovery rates, Norwegian operators have been implementing a wide variety of new technologies, as well as other, proven methods. “Drilling of more and different wells has given the largest contribution to improved oil recovery, in addition to water and gas injection,” said Nyland. “At most fields on the NCS, this is the production strategy from day one. In addition, various other methods are used on several fields.”

According to research commissioned by DNV GL in 2014, 54% of oil and gas companies, worldwide, are investing in EOR and similar technologies. “EOR uses natural gas injection; CO2 injection; chemical injection, including polymers; thermal recovery (not used on the NCS), or even bacteria to improve the sweep efficiency in the extraction process,” said Kuhnle. “There is no ‘one-size-fits-all’ EOR solution in Norway, or elsewhere. It is not easy nor a quick-fix. You need to gather large amounts of data from the reservoir in a pilot. It takes time to characterize a reservoir, to select the most appropriate EOR method. It can take between five and 10 years before increased production offsets the additional cost of EOR.”

“A further increase in recovery rate on the NCS has to be achieved through technology solutions,” said Aker Solutions’ Valla. “There are, however, special challenges related to offshore EOR. These include: 1) costly retrofits to existing offshore facilities to provide process equipment for EOR; 2) logistics for EOR chemicals; and 3) the environmental aspect of several EOR chemicals.

What follows is a review of these various methods.

Injection methods. Norway has significantly higher recovery rates than other oil producing regions, a result, to a large extent, of the fact that most oil fields in Norway are using water injection or gas injection for pressure support. “Subsea raw seawater injection has been developed for fields with long tiebacks and limited produced water availability,” said Aker Solutions’ Valla. “The Norwegian industry is also in the forefront for subsea water treatment.

“Norway has been spared the heavy oil challenges, due to NCS oil being relatively light,” added Valla. “The dominant way of adding power or lift to the wellstream is by means of gas injection. However, ESPs and multiphase pump systems also have been developed. Polymer injection is included currently as part of the field development plans for large developments in Norway. To minimize the use of the costly polymers, they are often mixed with low-salinity water.”

Water handling. With mature fields and very high water production, efficient means of handling produced water have become important. “Efficient, compact coalesce technology for topside water separation, and installation of subsea water separation and reinjection facilities (Troll subsea and Tordis), has been developed,” said Valla. “Intelligent completion technologies, with valves shutting off high water-producing zones, have emerged, with the increasing use of horizontal and multilateral wells.

Subsea compression. “A relevant example is Åsgard field’s subsea compression project,” said Statoil’s Eek. “It was put onstream in September, as the world’s first of its kind (Fig. 4). During the last phase of the project, it was discovered that we were able to increase the project’s reserve basis by an extra 24 MMboe (this is on top of the originally estimated, 282-MMboe total recovery increase). New technology and enhanced robustness in the installation phase will ensure total recovery from Mikkel and Midgard fields of 306 MMboe, and extend the operational life of the reservoirs until at least 2032.”

“For gas fields, the main IOR method is compression,” noted Valla. “Subsea compression enables the location of a compressor as close to the wellstream as possible, and minimizes the facility cost. At Åsgard, Aker Solutions has supported Statoil on installation, testing and start-up activities. The compression system is designed for large flowrates, built to be reliable, efficient and flexible. This versatile technology is of particular value for developments in deepwater and harsh environment areas.” Aker Solutions is continuing to improve future versions of compression systems, to deliver slimmer and more cost-efficient solutions.

Mapping-while-drilling, paired with seismic. “The National Center of Excellence for Improved Oil Recovery (NIOR), which Schlumberger participates in, has two key objectives for improving recovery rates significantly—to mobilize immobile oil, and to improve the volume sweep of the oil,” said Halle. “The first objective is addressed by tailor-making the design of injection fluids for a given reservoir rock and, thereby, mobilizing immobile oil. The second objective is addressed by placing the wells optimally with geosteering, and then adjusting injection and production rates from these wells by using inflow control devices (ICDs). By monitoring the fluid fronts between the oil and the injected fluids, using 4D seismic, these fronts may be optimized for depletion by adjusting the injection and production rates, using the ICDs. These latter technologies are all essential parts of Schlumberger’s solution for IOR.

“The Schlumberger GeoSphere reservoir mapping-while-drilling service delineates the reservoir geometry, and refines its position more than 30 m around the wellbore, in real time,” continued Halle. “This is an order of magnitude larger than what was previously possible, reaching the scale of reservoirs, and comparable with the resolution of surface-seismic data. Operators are now using a combination of GeoSphere and surface seismic, in complex geologies, to optimize reservoir contact and minimize drilling risks associated with reservoir exits. Both of these play a direct role in the economics of recovery, in terms of dollars per barrel. Post drilling, further processing of seismic information, with locally less uncertainty and higher resolution information, can be done to enhance reservoir understanding and optimize recovery strategies.”

Multilateral stimulation technology. Developed by Fishbones AS, this method can assist with boosting production rates and increasing the recovery percentage, Fig. 5. “The technology helps operators access oil from layers and natural fractures, away from the wellbore, in a controlled process, where risk for stimulating into unwanted zones is diminished,” said Renli. “A Fishbones Dreamliner MST was installed in a subsea well, in Smørbukk South field, during July 2015. There were 144 laterals drilled from the mainbore, to connect the reservoir in a short, 6-hr pumping operation. We also have installed two systems onshore, in Texas, over the past year, both with promising production results.”

Subsea electronics. Harder-to-reach reserves, low recovery rates and the increasing complexity of subsea reservoirs mean that there is a need to deliver a subsea electronics system that maximizes return on ROI for subsea operators. “Vectus 6.0, the latest Subsea Electronics Module (SEM) from Aker Solutions, is the first in a series of product releases that will deliver a holistic solution to subsea oil and gas production,” said Valla. “At its heart is a software and electronics platform, with a distributed architecture that brings a step-change in flexibility, management and monitoring. We also have developed a subsea electric actuator with a unique, compact modular solution that allows us to configure actuators for a wide range of valve control applications. This solution maximizes the flexibility for subsea production system architecture, eliminating the constraints of hydraulic supply, and for field expansions or modifications, allowing further field developments with lower costs and increased hydrocarbon recovery.

Structural maintenance. A frequently overlooked factor that affects operators’ ability to raise the oil recovery rate is tied up in the condition of platforms and other offshore field assets. Corrosion and other deterioration on offshore structures can threaten the ability of these assets to host additional increments of brownfield oil production.

“For the platforms to continue operation, they have to be in legal compliance with regard to structural integrity,” noted Jotun’s Buckhurst. “In addition, hydrocarbon leaks are a serious possible threat, and there have been several incidents in the last few years caused by CUI (Corrosion Under Insulation) and other issues. To extend maintenance intervals and reduce costs during tail-end production, tailored coating solutions for maintenance will be important. There often is limited, bad capacity on platforms, and framework maintenance is very often one of the first disciplines to be prioritized downward, as other maintenance often takes priority.”

“Maintenance is, of course, crucial for extending the lifetime of offshore installations,” said Nyland.

ADDITIONAL RESEARCH

Last year, Statoil opened its widely-hailed IOR research center in Trondheim as an accompaniment to its ongoing work to improve oil and gas recovery rates. “Research is important,” said Nyland, “and we hope that the center will present results that will benefit Norwegian petroleum production. Last year, another IOR research center, the Norwegian national IOR research center, was opened in Stavanger, connected to the University of Stavanger. Initiatives like these are important for long-term petroleum recovery on the shelf.”

Additionally, FORCE is a cooperating forum for improved oil and gas recovery (IOGR) and improved exploration (IE), conducted by oil and gas companies and authorities in Norway. “Within FORCE there are two projects that can be mentioned with respect to improved oil recovery,” said Nyland. “First, an agreement allows for collaboration to perform pilots. Companies can share the expenses and gain knowledge. Also, some of the major challenges for EOR efforts offshore are related to establishing a business case by doing reservoir simulations. Within FORCE, there is a JIP on Predicting EOR potential, from lab to field. All the major NCS operators participate in this project.

LOOKING AHEAD

Although low oil prices are a major factor in operators’ decision-making today, as to whether to pursue higher recovery factors at individual fields, they won’t last forever, a fact that NPD’s Nyland wants project managers to remember. “In times with low oil prices, it is important that the oil companies take a long-term view, instead of making their decisions based on today’s oil prices,” said the director general. “In our databases, we have a lot of IOR projects reported by the companies. Actually, 6% of the estimated total resources (undiscovered resources included) are resources in fields with a potential for development.

“With current low oil prices, we can expect normal activities for increased recovery, such as infill drilling, to drop significantly,” agreed DNV GL’s Kuhnle. “This may lead to a significant number of planned wells not being drilled, despite being a part of the original PDO. The effect of reduced infill drilling activity can be dramatic, as it will highly impact on the production decline. Existing fields may have a yearly production decline in the region of 7-10%, with infill drilling and other measures in place. However, without such activities, the decline can change to the order of 20% per year.”

“Our concern is that decisions need to been made, in order to produce these resources,” continued Nyland. “In addition I would like to stress, over and over again, the importance of including possibilities for IOR, when a field development is planned.” ![]()

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)