|

| A Marathon rig drills within the operator’s Woodford holdings, where it is focusing on SCOOP development and STACK delineation. Photo courtesy of Marathon Oil. |

|

When so-called “big boy drilling” meets commodity prices that are babyish in comparison, logic would hold that said play would be on the outside, looking in, as operators cherry-pick prospects that offer high returns at low costs. However, at the tail end of 2014, high activity levels implied that the liquids-rich segment of Oklahoma’s multi-zone Woodford shale was poised to defy logic.

Some four months removed from the initial buzz surrounding Continental Resources’ unveiling of its Springer shale discovery in the heart of the South Central Oklahoma Oil Province, otherwise known as SCOOP, year-end zeal for the deep and largely wet Cana Woodford play of the western Anadarko basin remained relatively intact. By way of illustration, even during a week in December that saw 29 rigs dropped from the active U.S. onshore fleet, activity in both the Woodford and its geographic cousin, the Texoma Granite Wash, remained steady. Moreover, independents continued to be drawn to the appropriately named STACK play, which abuts SCOOP to the north and features the Woodford stacked with the younger and thicker Mississippian Meramec formation.

On the flip side, however (Fig. 1), attractive prospects notwithstanding, 2015 activity doubtlessly will feature more valleys than peaks, as wellhead prices fall far below what analysts see as the profitable threshold for Woodford wells. A Bloomberg New Energy Finance (BNEF) evaluation released on Nov. 21 pegs the SCOOP region with minimum wellhead break-even prices of $79.28/bbl, while investment research firm ITG said some Cana Woodford wells would need up to $100/bbl to yield a reasonable profit. Regardless, Continental claims the SCOOP play still delivers higher returns than its pacesetting Bakken shale acreage and will continue to drill, mainly to hold leases. “I’d probably be more inclined to drop rigs in the Bakken, because I’m getting really good results, and I’ve got two to three years of drilling to do in the SCOOP, ” Warren Henry, Continental V.P. of research and policy, told BNEF. Continental’s assertions aside, the repercussions of operators’ announced cutbacks late last year are now being felt in the form of a precipitous decline in new drilling permits.

|

| Fig. 1. Newfield Exploration is conducting an ongoing delineation program on the STACK play that it introduced two years ago. Photo courtesy of Newfield Exploration. |

|

Lower commodity prices are especially acute for the newer unconventional plays in Oklahoma, which must compete with straight-hole drillers for dollars and have raised spacing issues, which the state legislature is expected to tackle this year. Operators also must deal with continuing fallout from a perceived link between unconventional operations and a reported rash of earthquakes across the state.

In the meantime, Oklahoma state coffers already are facing the headwinds of lower prices, with the end of November bringing a rare year-on-year decline in energy tax revenue. “We are beginning to see the signs of softening prices, but we’ve not yet seen the impact of these extremely low prices of below $70. That will take a few months to get in,” Oklahoma State Treasurer Ken Miller told Reuters on Dec. 5.

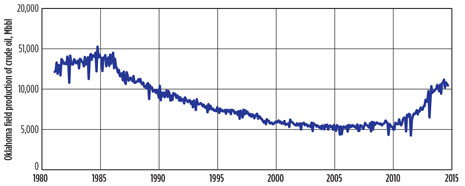

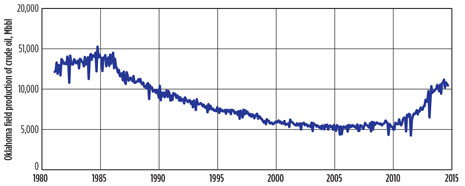

Meanwhile, the latest data available from the U.S. Department of Energy’s (DOE) Energy Information Administration (EIA) show Oklahoma producing 94,792 bbl of oil in the first three quarters of 2014, compared to 114, 620 bbl at year-end 2013, Fig. 2. The most recent EIA data also have gas production, once the staple for Oklahoma, standing at 195,150 MMcfd as of September, compared to 179,952 MMcfd for the same period of 2013. Given Oklahoma’s notorious reporting delays, more up-to-date production numbers are unavailable, nor does the state’s chief regulator, the Oklahoma Corporation Commission (OCC), break out production between conventional and unconventional plays.

|

| Fig. 2. Oklahoma oil production trend line. Source: U.S. Energy Information Administration (EIA). |

|

Elsewhere, tight oil and condensate production looks set to drop this year in the geological hodgepodge that is the Granite Wash, which traverses northern Oklahoma and extends into the Texas Panhandle, which is the focal point of the most recent activity. The latest data available from the Texas Railroad Commission (TRC), that state’s chief regulator, show oil production from the non-shale Granite Wash averaging 17,190 bpd for the first three quarters of 2014, compared to a daily average of 22,144 bbl for all of 2013. Condensate production declined sharply to 19,892 bpd between January and September, from the 2013 average of 35,090 bpd. Texas Granite Wash gas production, likewise, has declined from the 1,088 MMcfd delivered in 2013 to an average of 847 MMcfd over the first nine months of last year.

SPRINGER: LATEST WOODFORD HIT

Described as considerably more complex than the Devonian black shales found elsewhere in North America, the Woodford shale covers nearly all of Oklahoma, where it has sourced some of the state’s most prolific oil and gas fields. The reservoir rock offers a diverse production mix from the predominately gassy Arkoma basin in eastern Oklahoma to the oil- and condensate-prone Anadarko basin to the west. The 1,000-sq-mi core of the liquids-rich Cana Woodford in the southernmost portion of the Anadarko continues as the epicenter of nearly all Oklahoma activity. There, the over-pressured Woodford reservoir features shales ranging from 100 to 300 ft thick and well depths of more than 16,000 ft.

According to Baker Hughes, during a week that saw nearly 30 rigs laid down, the Cana Woodford rig count remained unchanged at 43 units, actively making hole as of Dec. 12, up 11 rigs year-over-year. To the east, five rigs were on location in the Arkoma Woodford, the same number working in December 2013, while the gas-condensate Ardmore Woodford to the southeast was down week-over-week by one unit, leaving six rigs drilling on Dec. 12, a seven-rig drop from the like period of 2013. While fourth-quarter data were not available at press time, Baker Hughes documented 232 and 63 new wells being drilled in the Ardmore and Arkoma Woodford, respectively, in the third quarter. Surprisingly, the gas-rich Arkoma Woodford saw 37 new wells drilled over third-quarter 2014, up 24 from the third quarter of 2013, while the Ardmore Woodford dropped from 70 to 18 wells between the same quarters.

Those numbers, however, paled in comparison to the oily Cana Woodford, where Baker Hughes data showed 83 new wells drilled in the third quarter, as opposed to 69 wells constructed in the same quarter a year earlier. A total of 302 Cana Woodford wells was drilled in 2013, a tally that despite the intrinsic flexibility of independents, could be in serious jeopardy going forward, judging from the number of new drilling permits issued. Consider that in the wake of the price drop last year, the OCC between Nov. 1 and Dec. 15 issued 260 drilling permits for the five counties (Carter, Stephens, Garvin, Grady and McClain), comprising the core of SCOOP, which remains the center of Cana Woodford activity. During the more favorable pricing environment of Nov. 1 to Dec. 15, 2013, a total of 616 drilling authorizations was issued for those five counties.

The oil price free-fall also threatens to toss, at best, a moist blanket over prospects for the new Springer Shale play, which Continental unwrapped in late September and Wood Mackenzie soon afterwards predicted could produce between 40,000 and 60,000 bpd within five years. The home-grown independent had kept the Springer close to the vest, using the same stealth that it employed in amassing a commanding 471,000-net-acre leasehold in the SCOOP, which it introduced in November 2012. The Bakken shale pioneer said in December that its SCOOP leasehold now has a resource potential of 3.6 Bbbl.

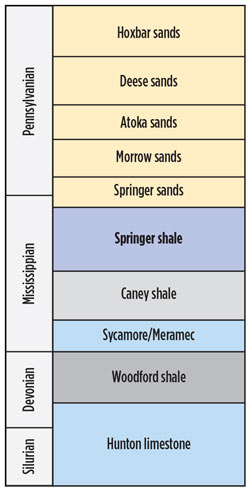

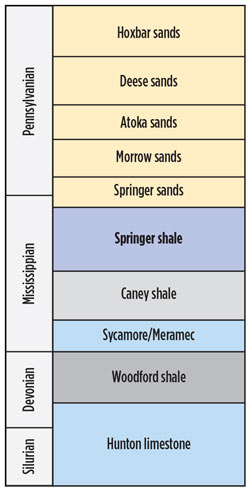

Overlaying the Woodford in the SCOOP fairway, at a depth of roughly 12,500 ft, the organic-rich Mississippian Springer is described as an over-pressured mixture of shale and sandstone with high permeability and porosity, Fig. 3. The formation is said to pose a number of technical issues, not the least of which is the risk of wellbore collapse. “A lot of things can bite you here, as we’re operating at some pretty good depths. This is big-boy drilling, as we call it,” Chairman and CEO Harold Hamm told analysts in November. “We’ve not had much difficulty ourselves with Springer. It was maybe one or two instances, but our people are getting the job done.”

|

| Fig. 3. Basic lithology showing deposition of Springer shale in relation to the Woodford. Source: Newfield Exploration. |

|

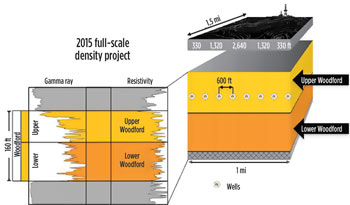

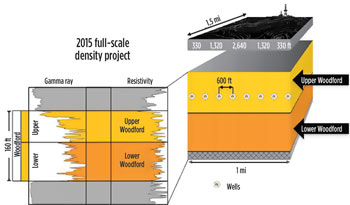

At year’s end, the Oklahoma City independent had 10 rigs targeting the Springer fairway, including those dedicated to drilling two density pilots, Fig. 4. Thus far, Springer has notched 15 producing wells, delivering average, 30-day, initial production (IP) rates of 830 bopd. During 2015, Continental says it will transition from 4,500-ft to 7,500-ft laterals at a cost of $12.2 million/well, which it believes will add 600-900 ft of unexploited reservoir. “Because the Springer is above the Woodford, as you drill to the Woodford, you’re always getting a free look at it, basically,” said President and COO Jack Stark. “We know where it’s at. We can map it out. So, I think you can continue to expect good things coming out of the Springer.”

|

| Fig. 4. The Good Martin eight-well density pilot is one of two Continental is conducting in the Springer fairway. Two additional density projects are planned this year in the condensate core. Source: Continental Resources. |

|

Continental maintains that it will run an average of eight rigs in the Springer play throughout 2015 and, as of December, still planned to operate a cumulative 18 rigs throughout its SCOOP play, with 94 net wells on the board for this year. In third-quarter 2014, Continental increased year-over-year SCOOP production 81% to 36,346 boed, which it planned to increase to 200,000 boed at year-end 2014.

In a related development, Continental formed its first-ever joint venture with an international operator on Oct. 27, when it sold South Korea’s SK E&S Co. Ltd. a 49.9% interest in its Northwest Cana Woodford gas assets for $360 million. The agreement covers 44,000 acres and 37 producing wells, mainly in Blaine and Dewey counties, where the now-partners plan to run four rigs this year to develop the gas-rich acreage.

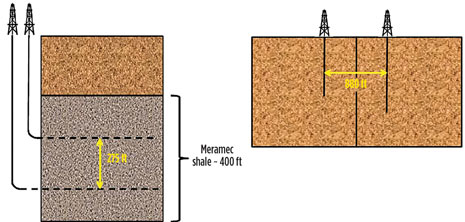

To the immediate north of the SCOOP fairway, two-thirds of the more than 165,000-net acres that Newfield Exploration controls in the Woodford-Meramec STACK play it introduced two years ago has been effectively production-delineated, says The Woodlands, Texas independent. Here, the Woodford thins to less than 200 ft, while the Meramec can reach thickness up to 475 ft, according to Newfield.

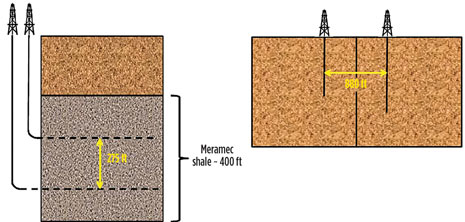

The latest four wells in the ongoing delineation program delivered on average 30-day IP of 764 boed with 85% oil. One of the delineation wells was drilled and completed for a “best-in-class” $9.8 million, while two of the wells were drilled as part of Newfield’s first Meramec stacked vertical spacing tests, Fig. 5. The wells performed above the type curve, with the initial 30 days of production averaging 808 boed with no interference recorded.

|

| Fig. 5. Newfield’s first STACK vertical spacing tests featured 275-ft vertical spacing in the Meramec (left) and 880-ft spacing across the lease line. Source: Newfield Exploration. |

|

Including STACK, Newfield holds roughly 400,000 net acres across the liquids-rich SCOOP, STACK and emerging Springer plays, and holds a first-mover position in the Arkoma Woodford gas play, where it holds 150,000 net acres and has drilled some 400 horizontal wells. Most of the company’s activity, however, has centered on the three oily properties, where Newfield earmarked $750 million last year and operated eight rigs. Newfield said its liquids growth had increased 80% over 2013 levels and planned to exit 2014 with production of 50,000 boed. Plans for 2015 drilling activity have not been made available.

Also, among the more active local players, Marathon Oil maintains plans for a reasonably aggressive drilling program. Two more rigs are slated to be on location within its 142,000-net-acre position in the oily Woodford, where the company is focused on SCOOP development and STACK delineation. The total leasehold takes in the 12,000 net acres that Marathon acquired in October, to enlarge its SCOOP position, including prospective Springer acreage.

In its latest update, Marathon said third-quarter 2014 production was up 27%, year-over-year, to 19,000 boed, with six new wells put online during the quarter. Of those, the four SCOOP wells put in production were completed with mile-long laterals and 30-day IP rates averaging 2,800 boed with 55% liquids.

President and CEO Lee Tillman said that, along with further SCOOP and STACK development, Marathon will explore new horizons, including the Springer, Caney and Granite Wash. Marathon holds 70,000 net acres in the Granite Wash, Tonkawa, Cleveland and Marmaton plays.

Meanwhile, after closing last summer on a purchase and sale scheme, Denver’s Cimarex Energy and local stalwart Devon Energy each added 50,000 net acres to their individual Cana Woodford and East Cana leaseholds. They individually plan relatively robust drilling and development programs in 2015.

For its part, Cimarex, which now controls some 128,000 net Woodford acres, said it still plans to have seven rigs drilling and is gearing up the development of its core Cana Woodford holdings. “We have committed to do this additional development row in Cana, and we’re bringing some rigs in to prosecute that, and that’s steady as she goes,” President and CEO Tom Jorden told analysts late last year. “We think that project really can stand tall in this commodity-priced environment.”

In June, Cimarex finalized its $497-million acquisition from QEP Energy, and, immediately afterwards, sold Devon 50,000 net acres, representing a 50% stake in the asset, for $248.7 million.

Cimarex says it will continue its planned Cana Woodford development program, even though its well costs have increased to between $7.9 million and $8.4 million, which it attributes to the upsized fracs now incorporated in its well designs. While comparatively costlier, the upsized frac program has shown appreciable increases in average 30-day IP from peak rates of 6.7 MMcfed to the high of 9.9 MMcfed delivered by the latest two wells. “In addition to applying the larger frac to development wells, we are also testing the concept on acreage outside the core development area,” said Vice President of Exploration John Lambuth. “We are pleased with the results we’ve had thus far.”

In the third quarter, the independent said Cana Woodford liquids and gas production was up 31% sequentially to 406 MMcfed. Last year, Cimarex also drilled six Meramec wells in the now-delineated 70,000 net acres that it holds in the core of the still-emerging play.

With its 50,000-acre acquisition, Devon increased its Cana Woodford position to roughly 280,000 net acres, most of which, it says, lies in the condensate window. In its operational update at the end of the third quarter, the Oklahoma City-based independent cited the “highly competitive economics at Cana” as justification for a planned acceleration of drilling activity to include more than 10 rigs in the first quarter of 2015.

At the time, Devon said Anadarko basin production reached a record, averaging 98,000 boed, which was 17% higher than third-quarter 2013 production. The 30-day IP of the seven most recent Cana-Woodford wells put on production averaged 1,440 boed, which Devon said doubled its type curve. Devon said the higher production rates were attributed to newly enhanced completion designs that include 70% more proppant, a doubling of the number of frac stages and tighter perf clusters.

GRANITE WASH SELL-OFF

To the north, activity in the geologically eclectic tight-sands play, which reaches some 160 mi long and 30 mi wide across the Texas Panhandle and western Oklahoma, has remained steady over the past year. Baker Hughes data showed the rig count of Dec. 12 unchanged from the week prior at 57 active rigs, 36 of which were drilling in the Texas sector, most of them operated by legacy player Apache Corp.

Somewhat surprisingly, 31 more wells were drilled in the third quarter of 2014 (264) than in the prior quarter (133), according to Baker Hughes, which documented 150 Granite Wash wells constructed in third-quarter 2013. Going forward, Texas regulator TRRC showed 232 drilling permits being issued for that state’s portion of the Granite Wash, compared to 310 authorizations for all of 2013, and far below the seven-year high of 783 permits issued in 2008.

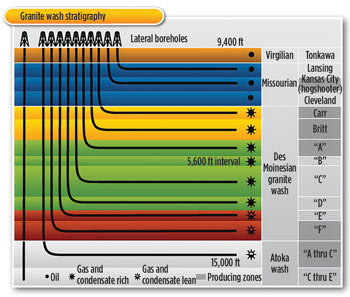

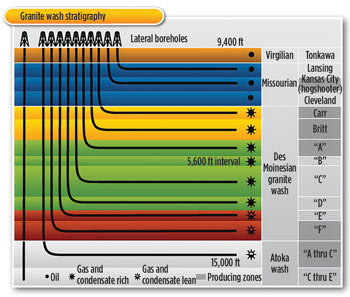

Though not a shale, the Granite Wash is described as an unusual tight-gas sandstone, comprising multiple intervals of eroded remnants of various lithologies. While much of the play yields significant oil and gas conventionally, significant reserves of gas and liquids are in unconventional deposits with poor reservoir quality, requiring shale-like horizontal drilling and multi-stage fracing, Fig. 6.

|

| Fig. 6. Developed both vertically and horizontally, the Granite Wash comprises multiple target intervals. Source: Linn Energy. |

|

Of late, the biggest news has centered on the wholesale liquidation of acreage among some of the play’s most veteran operators, with Apache topping the list. The independent expected to close in fourth-quarter 2014 on the sale of some 115,000 net acres spread out between its Granite Wash Stiles Ranch field (Fig. 7) in the Texas Panhandle and its Mocane-Laverne and Verden fields in western Oklahoma. Net production from these properties averaged 26,000 boed in third-quarter 2014.

|

| Fig. 7. An Apache rig at work on its legacy Stiles Ranch field in the Granite Wash play. Photo courtesy of Apache Corp. |

|

The acreage to be sold is in the heart of Apache’s 1.8-million-acre Central Region, which the independent describes as its first core operating area. On Nov. 20, however, Apache said it would cut $1.4 billion from its North American onshore expenditures and sell non-core assets to focus on its most promising shale plays.

Historically, Apache, by far, has been the most dominant player in the play, illustrated in the latest 2014 update, where it reported averaging 31 drilling rigs while drilling 70 gross wells in its Granite Wash and Cleveland acreage. Third-quarter 2014 production averaged 90,760 boed, up 1% quarter-over-quarter, Apache said.

Elsewhere, Templar Energy of Oklahoma City on Sept. 22 closed on its $588-million acquisition of Newpark Exploration’s Granite Wash holdings. The purchase encompasses 42,000 net acres in both the Texas and Oklahoma sectors, with current net production of 65 MMcfd of gas equivalent and proved net reserves of 38 MMboe.

Linn Energy, meanwhile, closed on the $1.9-billion sale of its entire 145,000-net-acre Granite Wash and Cleveland holdings to institutional affiliates of EnerVest and FourPoint Energy. At the time of the sale, Linn, an upstream MLP, said it had been running four rigs on the acreage, which delivered production of 195 MMcfed and holds 2013 proved reserves of 755 Bcfe.

In a related development, Chesapeake Energy said its Mid-Continent operations, which include both the Granite Wash and the Mississippi Lime, produced approximately 96,000 boed at the end of the third quarter. Chesapeake holds 249,000 net acres in the region, with 85,000 acres prospective for the Granite Wash.

Chesapeake operated 18 rigs and connected 63 gross wells in the third quarter, but has not yet announced any plans for this year. That said, under the distribution subordination mechanism of the Chesapeake Granite Wash Trust, Chesapeake is obliged to drill 118 horizontal development wells by June 30, 2016, in the defined area that includes royalty interests in Washita County, Okla., acreage, which the operator conveyed to the trust.

EARTHQUAKE RESPONSE

Along with weakening prices, Oklahoma operators also are facing the potential backlash of growing fears that link drilling and production to a reported increase in earthquakes across the state. Saying the state’s response “to the alarming rise in earthquake activity” is too critical for rhetoric and politics, OCC Vice Chairman Patrice Douglas on Aug. 20 unveiled a multi-faceted “game plan” that the state’s chief regulator plans to enact.

The 11-pronged OCC approach would include adoption of the “traffic light” system that the National Academy of Scientists (NAS) recommends, which uses the latest data to review the proximity of proposed disposal wells to faults and area seismicity, to determine whether they should be permitted or else approved with restrictions.

In addition, any well depth uncertainty must be addressed, using the very latest technology to determine true depth. Further, under the new rules, mechanical integrity tests for disposal wells with capacities of 20,000 bpd or greater must be performed annually. The previous rules called for an MIT once every five years.

The new rules also stipulated that issues in existing wells once considered minor must be addressed immediately, “even if it requires well shut-down.”

On the other hand, some contend that Oklahoma has not necessarily been shaken by an unusual increase in seismicity; it is more a case of advancing monitoring technology that makes them easier to measure. “The Oklahoma seismic activity uptick in the last five years is not unprecedented,” Continental Resources Senior V.P. of Exploration Glen Brown said in a Nov. 27 presentation to the Oklahoma Independent Petroleum Association (OIPA) fall conference. “During the 1950s, another active earthquake period occurred in Oklahoma, but it was poorly measured as compared to today.”

Over the same five-year period, Brown said, higher earthquake activity has been recorded in Virginia, South Carolina and other areas with zero oil and gas activity. “Earthquake locations in Oklahoma are inversely related to horizontal drilling, stimulation and/or saltwater disposal,” he added.

|