Rig counts rose in early 2014, but falling prices bring uncertainty

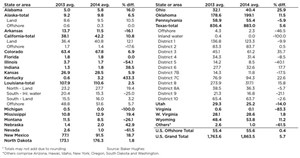

While the ongoing oil-price decline is bound to affect the U.S. rotary rig count in the coming year, 2014 saw a significant increase over the previous year—especially in the regions where one might expect that to happen. The average rig count for 2014 was above 1,860 rigs running, a 6% increase year-over-year, or about 100 rigs higher. The Permian basin of West Texas and New Mexico experienced the greatest increase in activity, with the rig count rising 16% to 17% on average, or about a 60-rig improvement. Activity in the Eagle Ford shale region of south-central Texas shot up about 35%, or an average of 16 additional rigs running for the year.

The other most-active oil and gas states—California, Colorado, Kansas, Louisiana, North Dakota, Utah, West Virginia and Wyoming—all posted significant drilling increases.

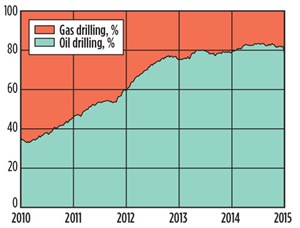

The shift in targets that began with the rise in oil prices continued in 2014. The percentage of drillers going for liquids surpassed the 80% level for the first time in modern history. Although gas prices largely stabilized in 2014, the temptation to find the more valuable oil kept, and held, the industry’s (almost) undivided attention. While the drop in world crude prices may well affect the overall trend in 2015, gas is unlikely to regain the crowning position that it held in 2009, when the oil/gas percentage split was the reverse of 2014’s ratio.

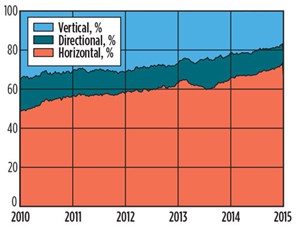

The push toward more horizontal and directional drilling shows no signs of abating. In 2014, over 73% of wells were drilled horizontally, while another 10% were directional. Vertical drilling accounted for just 17% of the total. The rule has been longer laterals, along with the ability to precisely target the desired formation. These factors have led to an almost unprecedented increase in drilling efficiency. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- The last barrel (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)