Prices reduce U.S. oil drilling, but gas activity remains steady

The downward slide in crude oil prices is expected to have a proportional impact on oil-directed drilling in the United States. On the other hand, the Henry Hub gas price has remained under $4/Mcf since 2010, so gas-directed drilling is expected to remain steady during 2015.

With Saudi Arabia abandoning its traditional role of a swing producer to lift up prices, international oil companies and U.S. shale operators have taken on that role by announcing budget reductions and activity slowdowns. The full impact of the budget cuts, as much as 40% in some cases, will be realized in first-half 2015.

North American shale operators, who can turn their operations around on a dime, have been quick to reduce capital expenditures and cut rig counts. Down the supply chain, service companies have announced layoffs by the thousands in their North American operations.

Given these fundamental economic realities, and the analysis of our proprietary surveys of operators, and U.S. state and international petroleum agencies, World Oil forecasts the following:

- U.S. drilling will drop 19.8% to 38,033 wells.

- U.S. footage will go down 20.9% to 315.6 MMft.

- U.S. Gulf of Mexico E&P activity, particularly focused on long-term deepwater activity, will continue at a lower level. If oil prices remain depressed for an extended period, fewer new projects will be sanctioned. Rig rates will slide, due to overbuilding of deepwater drillships, and there will be a negative impact on lease bidding.

BUDGETARY CUTS

Over the past several years, World Oil has featured an extensive upstream spending survey from Barclays Capital. Last year, the chief analyst in charge of that survey, James West, in whom we have great confidence, moved to another investment house called Evercore. So, this year, we feature his same spending survey, but under the Evercore name. West and his team have analyzed actual spending for 2014 and planned expenditures for 2015. During the current round, they received responses from about 300 companies worldwide. While their survey covers a significant chunk of the global upstream industry, it is, by no means, the total market.

As regards the U.S., Evercore suggests that 2015 will mark the second recession in a 15-year, global E&P spending upcycle. In fact, 2014 spending finished much stronger than expected, with the U.S. total hitting $174 billion, equal to a 19% increase. So, when Evercore originally put their 2015 forecast together before prices took their complete free-fall, they initially thought U.S. spending would be down about 8% this year. So, after the big price drop in December, they revised their outlook and are now calling for a 30% decline in spending, to about $122 billion for the survey group. For more details, please see the capital expenditures article.

OPERATOR SURVEYS

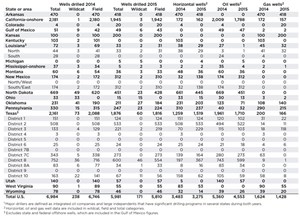

World Oil surveyed 12 major U.S. drillers (integrated companies and independents with large drilling programs) and 80 independent operators (a cross-section of small and medium-sized firms) working in various states. Together, these two groups represent 8,254 wells, or 17.4% of all U.S. drilling in 2014, and 6,997 wells, or 18.4% of all activity forecast for 2015. Their data yielded some interesting trends.

Among the major drillers, 6,984 wells were drilled nationwide in 2014, of which just 238, or 3.4%, were exploratory, Table 1. This year, these companies will decrease their drilling 14.4%, to 5,981 wells, including 171 for exploration. Last year, 3,483 (49.9%) of the total wells were horizontal completions. This year, that share will grow to 54.8%. In addition, 76.7% of all wells last year were oil-directed. This year, 76.1% of this group’s wells will be oil-directed. Average footage drilled per well in this group was 9,271 ft last year, and this figure is actually expected to slip lower during 2015, to 9,149 ft/well.

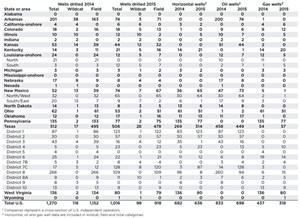

In the independent group, 1,270 wells were drilled during 2014, of which 118 (9.3%) were exploratory, Table 2. This year, independents will drill 1,016 wells, a 20.0% reduction in activity. Of this amount, 98 wells (9.7%) will be drilled for exploration. Nearly 54% of all wells drilled last year were horizontal, and that share will rise to 62.6% in 2015. The share of wells that targeted oil during 2014 was 65.6%, far less than that of the majors group. This year, the share of drilling that targets oil among smaller independents will be 68.7%. Average footage drilled per well by independents in 2014 was 9,909 ft, and this figure is set to climb to 10,572 ft/well in 2015.

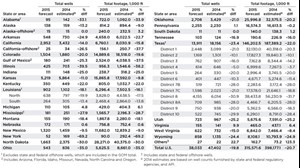

U.S. FORECAST

So, given the spending outlook, commodity prices and survey results, it is not a surprise that World Oil is calling for a significant decrease in the U.S. forecast. Up until now, U.S. activity has remained in a narrow band between 44,000 and 48,000 wells per year, going back to 2011. Last year, activity was up about 2%, as operators drilled about 47,400 wells. This year, World Oil forecasts that drilling will drop nearly 20%, to just over 38,000 wells, Table 3. And there is always the possibility that this decline could be a little larger. We also expect footage drilled to fall at a slightly faster rate, dropping nearly 21%, to about 315.6 million ft of hole. This is due, of course, to the fact that a greater share of drilling will be lost in shale plays, where many wells have long laterals.

GULF OF MEXICO

While top-tier projects in the Gulf of Mexico continue to move forward, the U.S. Bureau of Safety and Energy Enforcement (BSEE) has informed World Oil that it expects the number of wells drilled in the Gulf of Mexico to drop from 241 in 2014 to about 144 in 2015. The agency reports a proportionate decrease in total new footage from 4,038,461 ft to 2,019,230 ft. We think that BSEE’s number for 2013 is a bit low, and we also believe that activity will not be quite as slim in 2015, as the agency predicts. Therefore, we forecast a total of 180 GOM wells during 2015, a 25.3% decline.

Some of the major projects that achieved first oil in 2014 include Chevron’s Jack/St. Malo (94,000 bopd and 21 MMcfgd) (Fig. 1), Anadarko’s Luicius (80,000 bopd and 450 MMcfgd), Shell’s Cardamom (50,000 boed) and Hess Corp.’s Tubular Bells (50,000 boed). As one of the partners, Chevron has sanctioned the Hess-operated Stampede project (80,000 bopd) at a total cost of $6 billion and first oil in 2018. The new project pipeline should continue with several announced discoveries: Guadalupe and Anchor (Chevron); Leon (Repsol); Norphlet (Shell); and Katmai and Danzler (Noble Energy). The final investment decisions on some of these potential projects may be delayed, in anticipation of an improvement in oil prices. In late January, BP relinquished its operatorship of the Gila and Tiber discoveries, and the Gibson exploration prospect, to Chevron.

The mood of offshore operators to invest in exploration leasing will be tested on March 18, 2015, when the Bureau of Ocean Energy Management (BOEM) holds its 40-MM-acre Central Gulf of Mexico Lease Sale 235, which will include approximately 7,611 blocks, featuring several tracts near the Mexican border.

U.S. SHALE PLAYS

Liquids-rich shale plays are expected to bear the brunt of low crude oil prices because of high break-even costs. Many of the leading U.S. independents are making adjustments by either divesting non-core assets, or reducing budgets and rig counts. A representative sample includes Chesapeake Energy, which sold 414,000 acres from its southern Marcellus and eastern Utica shale assets to Southwestern Energy for $4.798 billion, to increase its liquidity position to $9 billion. Continental Resources decreased its rig count from 50 to 31 rigs. These rigs will be allocated to SCOOP Woodford/Springer (16 rigs), North Dakota Bakken (11), and Northwest Cana (4) activity. While Pioneer Natural Resources has hedged its production until the end of 2015, it may sell its EFS Midstream operations for about $3 billion.

On a state-by-state basis, Texas will experience an overall 23.4% decrease in new well activity to 13,911 wells. Particularly hard-hit will be District 8, which includes the Permian basin (-30.9% to 4,155 wells), as well as Eagle Ford District 1 (-21% to 2,448 wells), District 7C (also -21% to 1,598 wells) and District 2 (-10.1% to 1,169 wells). Texas led the nation in oil production at the rate of 3.403 MMbpd in November 2014. That figure potentially could dip below 2.5 MMbpd in the latter part of 2015. In the Barnett shale, operators may be showing signs of drilling lower-cost, traditional gas wells in other districts, but they are not willing to increase their drilling of higher-cost shale gas wells in Districts 5, 7B and 9, which contain the Barnett. So, there will be another year of reduced drilling, with a 23% decline forecast in these districts, combined.

Including federal OCS output, Louisiana produced 1.427 MMbopd in October 2014. World Oil expects the state to experience an overall 18.1% drop in the number of wells drilled to 902. The southern portion of the state, which is devoted primarily to conventional oil drilling, will hold up better during 2015, with a -13.4% reduction.

North Dakota, which produced 1.187 MMbopd in November 2014, will suffer a severe cut, due to reduced activity in the oil-rich Bakken shale play. World Oil expects the number of wells to be drilled in 2015 to drop 30% to 1,663. In late January 2015, leading operator Continental Resources improved its liquidity position for E&P activity by selling off its midstream pipeline and gas processing assets to Kinder Morgan for $3 billion.

Oklahoma, which encompasses both conventional oil, and shale oil and gas production, is expected to suffer a 21% reduction in the number of wells drilled to 2,708. The state produced 342,000 bopd and 6.54 MMcfd in November 2014.

One of the few bright spots in the U.S. is Pennsylvania, which is the core of the giant, gas-rich, Marcellus shale play. World Oil estimates that gas-directed drilling in the state will actually increase 1.1% in Pennsylvania to 2,255 wells. Leading operator Range Resources plans to focus 95% of its 2015 budget on Marcellus activity, Fig. 2.

In California, activity has been remarkably consistent over the last several years. Last year, roughly the same number of wells, just over 34-hundred, was drilled, as was in 2013 and 2012. The vast majority of activity is accounted for by just four operators, and these companies remain focused, for the most part on relatively safe oil plays, dominated by shallow, vertical wells that are inexpensive to drill. Accordingly, California’s drilling will be down less than in many states, with a 14% decline to about 2,950 wells.

Field production from onshore Alaska has declined from 1.974 MMbopd in February 1988 to 500,000 bopd in 2013. The prospect for future production growth was squashed on Jan, 25, 2015, when President Obama called for a restriction on oil and gas exploration in the 12 million acres of the Arctic National Wildlife Refuge (ANWR). While the suggestion is unlikely to be implemented, it does create another point of dispute between Obama and the Republican party majority in the U.S. Congress.

BP operates 16 fields on the North Slope, accounting for two-thirds of Alaska’s production. The other major operator is ConocoPhillips. In July 2014, ConocoPhillips signed a contract to build a new rig to drill on the North Slope from February 2016. On the natural gas side, ConocoPhillips received authorization from the U. S. Department of Energy (DOE) in April 2014 to export LNG over a two-year period from its Kenai terminal, Fig. 3.

World Oil expects drilling offshore Alaska to remain unchanged from 2014’s level at 15 wells. Noteworthy news in the region came from President Obama, who designated the waters of Bristol Bay as off-limits for oil and gas leasing. The North Aleutian Basin Planning Area that includes Bristol Bay consists of approximately 32.5 million acres. A portion of this planning area, which includes Bristol Bay, was leased in the mid-1980s, but never developed, due to litigation. Last month, Shell announced its intention to re-start its Arctic drilling program in the Chukchi Sea.

As a group, the Rocky Mountain states, principally Colorado, Wyoming, New Mexico and Utah, were down about 4%, at more than 5,400 wells. This year, we predict that these states will be down another 19%, roughly in line with the country, as a whole. In the largest driller, Colorado, activity was concentrated again in the Niobrara) shale, with the shift toward oil-directed drilling in full bloom. This year, both state figures and our operator survey group indicate that there will be a swing back toward more gas drilling.

In Wyoming, the story is much the same. Last year’s rush toward oil-directed drilling will begin to reverse this year, and wells, in general, will be drilled for less footage.

In New Mexico, we are beginning to see a resurgence in activity, in the northwestern portion that features the San Juan basin. However, the majority of drilling will remain in the southeastern half of the state, where activity is holding up remarkably well. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)