Low oil prices put the brakes on the global E&P train

After spending several years on a plateau, the upstream industry has plunged into a downturn and looks set to endure the second recession in a 15-year global E&P spending upcycle.

Last year, global spending amounted to $729 billion, but this year the Evercore ISI survey group expects that figure to drop below $700 billion. International spending, outside North America, should contract about 15%.

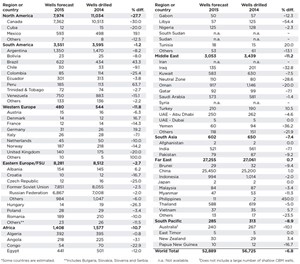

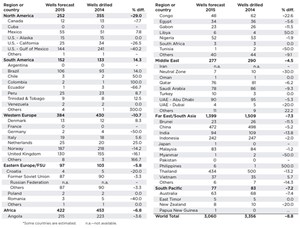

Accordingly, World Oil’s survey of operators and international petroleum agencies reveals that drilling is expected to slow down significantly this year. Excluding the U.S., worldwide drilling is set to contract 6.8%. North America and Western Europe will take the hardest hits. The Far East, however, will buck the trend by increasing drilling marginally.

NORTH AMERICA

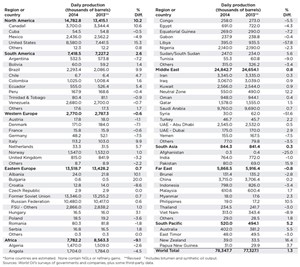

Thanks to a 15% boost in U.S. output, North American oil production rose 10.2%, to 14.8 MMbpd. Regional drilling, excluding the U.S., improved last year, to more than 11,000 wells. This year, however, low commodity prices will depress drilling 27.7%, to just under 8,000 wells.

E&P activity in Western Canada is being subjected to the same market forces as the U.S. Overall, Canadian drilling is set to drop 30% this year to 7,362 wells. Investment in Canada’s oil sands extraction industry is dropping, and shale operators in the Horn River and Montney are cutting back on drilling. The one bright spot is offshore the East Coast of Canada, where Statoil expects to drill appraisal wells in deepwater Bay du Nord. For more information on Canada, please see the article on page 79.

In response to declining production, Mexico is ending Pemex’s monopoly and holding licensing rounds to encourage foreign investment. The actual lease sale has been postponed, but should still be competitive despite the decline in oil prices. On its own initiative, Pemex is expected to drill 593 wells during 2015, an increase of 19.1% from 2014. For more information on Mexico, please see the article on page 87.

SOUTH AMERICA

With the preponderance of national oil companies, well construction in South America is expected to slow down only 1.2%, to 3,551 wells during 2015. The bright spot in the region is Colombia, which is producing about 1 MMbopd. Regional oil production rose 2.6%, to 7.42 MMbpd.

Despite news of corruption scandals at Petrobras, oil production from Brazil’s pre-salt Santos and Campos basins reached 700,000 bpd in December. Combined onshore and offshore activity will result in an increase of 43.3% to 622 wells, according to data from ANP, the state regulator. Actually, offshore activity is expected to increase slightly, with onshore drilling rising to 516 wells.

Venezuela is suffering from a lack of proper investment to maintain existing fields, and its attitude toward some Western countries, and their operators, is cutting the nation off from potential sources of additional capital. Nevertheless, state firm PDVSA continues to muddle along. Last year, Venezuelan drilling was down about 6%, at 883 wells. For 2015, a 15.1% loss to 750 wells is forecast. Venezuelan oil production fell about 1%, to 2.68 MMbpd.

WESTERN EUROPE

Drilling activity in the region is expected to reflect weakness in the Western European economy, with an 11.8% decrease to just 480 wells. Overall, activity in the North Sea is expected to decrease 12.4%, to 365 wells. Oil production took another tumble, averaging 2.77 MMbpd, a 0.6% decline.

Last July, the UK committed to fully implementing the recommendations of the Wood Review. Andy Samuel, former managing director of BG Group’s E&P in Europe, was later named as CEO of the Oil and Gas Authority—the soon-to-be regulator created in response to the review. British output fell another 3.2% last year, to average 815,000 bopd.

Last November, the UK unveiled the results of the nation’s 28th offshore licensing round. Awards for an initial tranche of 134 licenses—covering 252 blocks—were announced on Nov. 6. Last year, the UK also launched its 14th onshore licensing round. The license offers are expected to be made public during the first half of 2015.

According to Wood Mackenzie, UKCS E&A activity continued to fall in 2014. The number of exploration wells decreased 18%, to 23. Lower oil prices are sure to bring further budget cuts, particularly for exploration. Accordingly, UK drilling is forecast to slide another 20%, to 140 wells.

In Norway, a record number of applications were submitted by 47 companies for the Awards in Pre-defined Areas, 2014 (APA 2014) round. Thus, in January 2015, Norwegian officials offered ownership interests in 54 new production licenses. Forty-three companies were awarded ownership interests in one or more licenses; 23 of these will be offered operatorships. On Jan. 20, Norway announced its 23rd licensing round, comprising 57 blocks, or parts of blocks. These are distributed with 34 blocks in the southeastern Barents Sea, other parts of the Barents Sea (20), and the Norwegian Sea (3). The government aims to award the licenses during first-half 2016.

Norwegian activity was high in 2014, as four new fields went onstream. Production averaged, 1.55 MMbopd, up 1%. According to the Norwegian Petroleum Directorate, 56 exploration wells were spudded, resulting in 22 new discoveries—two more than in 2013. However, Wood Mackenzie called 2014 a “lackluster year for exploration,” with only four discoveries classified as commercial or likely to be developed. Norwegian drilling, overall, should fall 14.2%, to 187 wells, which is still a relatively high figure.

EASTERN EUROPE/FSU

Activity throughout Eastern Europe is expected to drop 2.7%, to 8,281 wells. Drilling in the region is dominated by Russia, which accounts for 83% of all new wells. Thanks to a surge in Russian output, regional production increased 0.7%, to 13.5 MMbopd.

Last year was a tumultuous period for relations between the U.S., the EU and Russia. In response to the Ukrainian crisis, Russia was hit with sanctions, which—in the face of high brownfield depletion—will likely carry forward and hinder the nation’s ability to exploit its shale resources and Arctic deposits. Nevertheless, as Russian companies stepped up drilling last year, the country’s oil production, in December 2014, rose to a post-Soviet record of 10.667 MMbpd, indicating that the country has yet to feel the effects of sanctions. Drilling this year is expected to ease off slightly, losing 2.0% to 6,867 wells.

Last September, Rosneft and Exxon struck oil in the Kara Sea with the Universitetskaya-1 wildcat. Then, in January 2015, Exxon Mobil began production at the Sakhalin-1 project’s Arkutun-Dagi field, the last of three fields to be developed. Peak production from the field should reach 90,000 bopd. The field will bring total production at Sakhalin-1 to more than 200,000 bopd.

Other countries. In November, Arnaud Breuillac, Total’s president of E&P, said that Kazakhstan’s Kashagan oil project in the Caspian Sea will definitely resume output by 2017. Production may even resume in 2016, said Breuillac.

In January 2015, the Croatian government granted 10 licenses for exploration in the Adriatic Sea.

AFRICA

The investments for sustaining production levels and increasing reserves have been inadequate at best, even in countries with relative economic and social stability. The bright spots lie offshore, in the western regions and in deep water. Falling oil prices have made outside investors even more reluctant to commit to projects. Accordingly, African drilling is predicted to decline 10.7%, to 1,408 wells. Oil production slipped 9.1%, averaging 7.78 MMbpd during 2014.

Nigeria. Africa’s largest economy (surpassing South Africa in 2013), has experienced a decline in crude production since second-half 2013, falling an estimated 80,000 bpd by the end of 2014. To add further pain to a grim situation, Nigerian officials reported that rampant theft from oil pipelines, along with sabotage by insurgents, was costing the country 300,000 bopd. Stepped-up patrols and air surveillance have had only a modest impact on the loss. Nigeria’s abundant natural gas reserves lack gathering infrastructure, meaning that up to $3 billion in potential gas revenues are being flared. The country produces about 4 Bcfgd.

Offshore, Shell’s Bonga North West project began producing oil last August. Oil from Bonga North West is transported by a new subsea pipeline to the Bonga FPSO export facility. Ultimately, the project should add 40,000 bopd to Nigeria’s offshore production. Nevertheless, unless there is a dramatic reversal in crude oil prices or unprecedented investment, many observers expect that crude production may continue to decline at annual rates of 15% to 20%. Production averaged 2.14 MMbopd last year. Drilling will remain stagnant at 125 wells.

In spite of state firm Sonangol’s original, ambitious, 2-MMbpd, oil production goal for 2015, Angola’s crude output has not been able to exceed 1.8 MMbpd. Sonangol has now deferred that goal until the end of 2017. Although several new projects are coming to fruition, the combined increase has not been sufficient to offset declines in older fields. Production averaged 1.70 MMbopd, down 4.5% from 2013’s level. Drilling is projected to be off slightly, at 218 wells.

In Block 17 offshore, Total started up its CLOV development (Cravo, Lirio, Orquidea, Vileta) last June with a 160,000-bopd capacity. Total also holds a 30% interest in the Kaombo development, Block 32. The ultra-deepwater project holds reserves estimated at 650 MMbbl. Eni has begun oil production from its West Hub Development in Block 15/06. The field is producing 45,000 bopd, with an ultimate goal of 100,000 bopd. The East Hub development should start up in 2017, and will add another 100,000 bopd. Cobalt’s Cameia project in Block 21 should add another 100,000 bopd during 2017.

Algeria is Africa’s third-largest producer and has experienced production declines similar to Nigeria and Angola. By the end of 2014, Algerian output was averaging 1.12 MMbopd, which is a 16% decline from the 2005-2010 average. Collapsing crude prices have hit the nation particularly hard, because the government depends on petroleum for 97% of its export revenues. In a major effort to reverse the five-year decline, Algeria announced an initiative to invest $100 billion in the energy sector by 2020, with an emphasis on the country’s large shale deposits in the Benue Trough region.

Disappointingly, the most recent licensing round only awarded four out of 31 available blocks. This was the lowest success rate of any of the four rounds undertaken since Algeria’s 2005 Hydrocarbons Law, despite tax incentives created for foreign operators.

An ongoing military conflict in Libya continues to stifle development. The petroleum industry collapsed after the Libyan dictatorship was overthrown three years ago. Production recovered modestly in the next two years, only to disintegrate again in the wake of a civil war, bottoming out last spring to an estimated 215,000 bopd. The conflict continues to revolve around control of Libya’s nine oil export terminals. By last December, Libya’s crude output had reportedly fallen below the country’s own consumption level. The fighting has taken a toll on drilling, as well, with a 54.4% reduction to just 57 wells expected.

While struggling with political unrest, Egypt has gone from being a net energy exporter to a net importer. Highly subsidized fuel has left the government with a deepening debt, and motivated to develop its petroleum resources. In early January 2015, the Egyptian Petroleum Ministry reported that it had signed exploration agreements, for both oil and natural gas, offshore in the Gulf of Suez and in the Western Desert. The ministry signed deals worth about $270 million with Shell, BP, Eni and smaller companies. Also, about $124 million in grants were allocated for drilling 41 wells.

Last fall, Egypt signed exploration deals worth $187 million, covering seven exploration areas. In recent years, foreign companies have been hesitant to explore for petroleum in Egyptian waters, because the amount the government pays barely covers investment costs. Oil production averaged 691,000 bpd, down 4.3%. Drilling is forecast to fall 12%, to 441 wells.

MIDDLE EAST

With OPEC throwing down the gauntlet of not reducing production, well activity in the Middle East will drop off 11.2%, to 3,053 wells. World Oil estimates that there will be 277 offshore wells drilled, down 4.5%. Regional oil production continued its slow movement upward, rising about 1%, to 24.8 MMbpd.

Saudi Arabia has 16% of the world’s proved oil reserves, is the largest exporter of total petroleum liquids in the world, and possesses the world’s largest crude oil production capacity. Saudi Arabia’s long-term goal is to further develop its lighter crude oil potential, and maintain current levels of production by offsetting declines in mature fields with newer fields.

Saudi Aramco said that it will conduct additional drilling at existing fields to help compensate for the natural declines from mature fields. Saudi Arabia is also expanding its natural gas production capabilities throughout the Kingdom. Therefore, we expect Saudi drilling to remain nearly even, at 573 wells.

In the UAE, specifically Abu Dhabi, recent exploration has not resulted in any significant discoveries of crude oil. However, state firm ADNOC has compensated for this lack of discoveries by emphasizing EOR techniques, designed to extend the lifespan of existing oil fields. Over the last 10 years, by improving recovery rates at existing fields, such techniques have helped Abu Dhabi to nearly double its proved oil reserves. Accordingly, production in Abu Dhabi made a slight gain last year, to 2.55 MMbopd. Drilling in Abu Dhabi will be down minimally this year, to 250 wells.

SOUTH ASIA

The area was already suffering from a stagnation of exploration and development before low oil prices occurred, and now that situation is exacerbated. Accordingly, drilling will fall 7.4%, to 602 wells. Offshore, activity will be confined to India, where new wells will decline 13.8%, to 94.

In India, the growing demand for oil and gas, fueled by its economy, continues to drive efforts by the government to boost production. Nevertheless, production fell 1.0%, averaging 764,000 bopd. Drilling will lose 7.1% and total 521 wells.

Pakistan has been experiencing heightened interest in E&P opportunities, although lower commodity prices may derail that trend. The politically tumultuous nation is offering its biggest sale in eight years—a 10% stake in Oil & Gas Development Co.—to meet targets as part of a loan program with the International Monetary Fund. The country’s oil production rose 15.9% last year, to 80,000 bpd.

On the exploration front, Pakistan Petroleum Limited, has made another gas and condensate discovery in District Sanghar, Sindh. This is the sixth discovery on the block. OMV has discovered gas and condensate in the Mehar exploration license. Overall, drilling will shrink 9.2%.

FAR EAST

The South China Sea remains a hotly contested region. The Philippines challenged China’s claims to much of the South China Sea at a UN tribunal, seeking to check China’s push for control of disputed waters. In May 2014, CNOOC placed a rig near the disputed Paracel Islands, off the coast of Vietnam. This led to confrontations between Vietnamese and Chinese boats, setting off a wave of violent protests in Vietnam. Throughout the region, production was down 0.8%, at 5.87 MMbopd. Thanks to Chinese activity, this is the only region that will see a drilling increase in 2015, with 27,255 wells expected for a 0.7% gain.

As China is by far the dominant country in the Far East, its demand growth will continue to drive a thirst for hydrocarbon resources, both inside and outside its borders. CNOOC hit several offshore discoveries in 2014. In addition to these discoveries, production from recent CNOOC development projects is also coming online.

Meanwhile, state firms CNPC and Sinopec continue to run massive development drilling programs onshore, in an effort to push Chinese oil production higher. Output has stalled short of 4.0 MMbopd, averaging 3.72 MMbopd last year.

Indonesia gave up on its target of restoring output to 1.0 MMbopd, even as operations begin at the Cepu Block in central Java. Banyu Urip field, on the Cepu Block, is expected to have peak production of 165,000 bopd from 49 wells by April 2015. However, it may not be able to reach peak output, according to SKK Migas, the country’s upstream regulator. Indonesian output averaged 798,000 bopd last year, down 3.4%.

Chevron delayed developing the second phase of the Gendalo-Gehem deepwater gas project, off Indonesia’s Borneo Island, which was due to go online in 2019. Chevron said it needed more time to revise development plans, as it found additional reserves. Indonesian drilling is forecast to slip 2.0%, to 994 wells, including 242 offshore.

In the Philippines, daily crude and condensate production increased to 19,000 bpd, driven by recent exploration success. Two gas wells were drilled in 2014, one offshore and one onshore. According to officials, five to six onshore exploration wells will be drilled in 2015, and six are to be drilled offshore, including two wildcats. Despite China muscling in on the South China Sea, the Philippines will look to uphold its right to exploit waters within its 200-nautical-mi, exclusive economic zone.

SOUTH PACIFIC

The South Pacific area saw continued growth and development, driven by new discoveries onshore and offshore. Regional drilling improved to 313 wells, including 83 offshore. Nevertheless, lower oil prices will cool off activity, with an 8.9% reduction to 285 wells expected. Offshore work will lose 7.2% and total 77 wells. Regional production rose 5.2% last year, to average 520,000 bopd.

Australia dominates the activity, accounting for nearly 85% of drilling. The country will see a 10.1% decrease in new wells for 2015, although offshore work will be less affected, slipping 7.4% to 63 wells. Cost over-runs continue to hamper Australia’s LNG developments, and now the recent slide in crude oil prices is throwing another punch, threatening their economic viability. While the country has plenty of gas, finding new oil deposits remains a problem. Oil production averaged 402,000 bopd last year, a 5.5% increase.

New Zealand opened 405,000 km2 for exploration in eight blocks, three onshore and five offshore, through its 2014 Block Offer. Statoil bagged four permits, while Chevron will take operatorship in three other tracts. The Petroleum & Minerals agency will launch its 2015 block offer in March. Due to the surge in exploratory interest, New Zealand’s drilling will be up slightly. ![]()

- The last barrel (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- International drilling and production: Growth outside the U.S. continues at measured pace (February 2023)

- U.S. reserves: U.S. proved reserves experience significant increase (February 2023)

- U.S drilling: U.S drilling activity to climb as supply disruption continues (February 2023)

- Canadian E&P: Canada’s upstream on track to strengthen during 2023 (February 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)