Harsh cuts await as the oil field slips into recession

The year ahead is set to be transitional for the upstream industry, marking the second recession in a 15-year, global E&P spending upcycle. With 2014 spending finishing stronger than expected, and a significantly changed price environment, Evercore believes that near-term capital expenditure (capex) revisions put its survey’s modest 5% contraction for 2015 at risk. The company expects near-term capex announcements to reflect about 30%–40% cuts to previous plans, bringing full-year North America spending closer to a 30% contraction and international spending to a 15% contraction.

SPENDING UPCYCLE

Global E&P spending in 2014 was stronger than anticipated. Spending totaled $729 billion, up 11% year-over-year, despite a sharp second-half pullback in the Russia/FSU region. Evercore had forecast a 6% increase in global spending for 2014, but actual results for North America were higher than anticipated, at +20%, as compared to a +8% forecast.

International spending was modestly higher. Stronger growth in Europe and Latin America more than offset lower growth in Asia, and contraction in Russia. Reflecting sanctions and the sharp depreciation of the ruble in recent months, spending in Russia reversed from +8% in the mid-year survey to -6% for the year. With another pullback expected in 2015, Russian E&P spending is poised to fall almost 10% from 2013’s peak levels.

While the survey suggests that global E&P spending will dip below $700 billion in 2015, the authors believe downward near-term revisions could put this hurdle at risk further, particularly in the U.S.

Rapidly changing commodity prices can impact spending plans quickly, and Evercore expects near-term capex announcements to disappoint over the coming weeks and months. This puts the survey’s 5% contraction at risk, particularly as prices are tracking well below the assumptions—WTI at $78/bbl, Brent at $85/bbl and Henry Hub at $3.73—reported in the survey.

Oil companies are, historically, conservative when setting their price assumptions to establish their capex budgets, with the survey showing initial WTI and Brent assumptions that are well below actual full-year results for almost every year in the survey’s 15-year history. The prior year was a notable exception, however, with the year-end drop in oil prices dragging the full-year average well below initial and mid-year assumptions for both WTI and Brent.

Heading into 2015, the reported WTI and Brent price assumptions for capital spending budgets were well above their respective 12-month strip prices, suggesting a risk to budgets, if companies revert to their conservative ways. Furthermore, prices are, currently, below the $65/bbl average most often cited as the level where companies would decrease spending.

Natural gas price assumptions are only modestly higher than current 12-month strip prices, suggesting relatively lower risk to budgets for natural-gas driven activity. Companies are fairly split over the gas price level at which they would cut spending, with the average at $3.38/MMbtu.

CAPEX REVISIONS

Fifteen companies revised their 2015 capex figures in December, after announcing initial plans in November, with all of the revisions trending downward by an average 38%. The majority of these revisions occurred during the back half of the month and came from Canadian companies. Evercore expects downward revisions to accelerate in 2015 from both Canadian and American operators, especially those focused on the Bakken, Granite Wash and Mississippian shale plays.

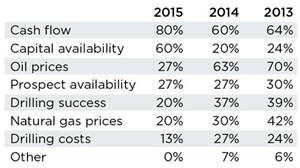

Cash flow. While oil price was the key determinant of spending in the prior three years, 2015 budgeting decisions will be dominated by cash flow and access to capital, Table 1. Eighty percent of respondents cited cash flow as the leading driver of their 2015 spending plans. Notably, 60% of respondents also cited capital availability as a key determinant to spending, a sharp uptick from the 20%-35% range of the prior five years. Oil prices and prospect availability tied for third place.

Cash flows have always been an important determinant of E&P spending, but Evercore believes that they may be particularly important in 2015, as 47% of companies spent above their cash flows last year. This is up from the 33% that spent above their cash flows in 2013, with the variance coming from respondents that spend in line with their cash flows, as those that spend less than their cash flows have been remarkably steady at 33% the prior two years. Whereas a third of respondents spent in line with cash flows in 2013, only 20% were cash-neutral in 2014. With oil companies taking a more fiscally conservative position in 2015, 27% are planning to spend in line with cash flows, while 40% still expect to spend above their cash flows.

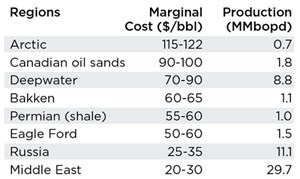

Marginal/frontier plays. The precipitous drop in oil prices has rendered several frontier plays uneconomic, Table 2. Chief among them is the Arctic, which requires $115/bbl. The authors believe the risk to the Arctic is demonstrated by Rosneft’s delayed transaction with North Atlantic Drilling and Shell’s delayed decision on its 2015 Alaska drilling program.

While ConocoPhillips, Statoil and Chevron have already made the decision to halt their respective Arctic programs, Shell will disclose its Alaska drilling plans in March. Exxon has yet to make a final decision on its proposed drilling campaign in Canada’s Beaufort Sea, which could commence as early as 2020. However, despite poor near-term fundamentals, rig companies continue to talk about potential demand for harsh environment units.

Shale oil. While U.S. shale oil provides superior returns, such activity is also at risk from lower prices. Key North American resource bases—such as the Bakken and Eagle Ford—offer superior risk-adjusted returns to the OPEC-9 (which excludes Saudi Arabia, Kuwait and UAE) at $80/bbl Brent, but Evercore analyst Doug Terreson believes 2015 production from U.S. shale is likely to exhibit a modest slowing in growth between $60 and 90/bbl. At a persistent price of $60/bbl, total U.S. production could decrease, whereas output would continue to grow at $80/bbl, but remain relatively flat at $70/bbl.

3D/4D seismic. For the first time in seven years, 3D/4D seismic was the most commonly cited technology to impact E&P spending plans. While seismic led for much of the prior decade, fracturing/stimulation and horizontal drilling were the most commonly cited in the prior six years. Artificial lift was also mentioned.

REGIONAL BREAKOUT

North America. Spending was stronger than anticipated in 2014, increasing 20% for the year, as compared to Evercore’s forecast of 8.3% growth. However, the authors believe that the survey’s 11% spending contraction for 2015 is likely to deteriorate, as companies revise their budgets lower.

Made up predominantly of independents, Canadian operators have been quick to revise their spending plans. During December, 12 Canadian independents revised their capex plans lower by an average 35%. While this group made up less than 15% of total spending in 2014, their net E&P spending for 2015 is now expected to fall 40%, year-over-year, versus 7% previously. Currently, our survey indicates E&P spending in Canada is expected to fall 30% in 2015.

In the U.S., independents had planned to cut just 10%. Operators, largely, delayed announcing their 2015 budgets, but with cash flow being the key determinant for this year’s spending, Evercore expected companies to revise sharply lower ahead of fourth-quarter results.

Even operators who form alliances with private sources of capital are likely to revise spending sharply lower, such as LINN Energy’s 53% year-over-year cut.

Middle East. Evercore had forecast the Middle East to increase spending by 7%–9% in 2015, decelerating from 15.5% growth in 2014. However, 2015 spending growth appears stronger than expected at +15%, driven by projects in Oman, Kuwait and Saudi Arabia. Despite lower oil revenues, the governments of both Saudi Arabia and Kuwait plan to maintain spending levels in 2015, with both countries willing to draw on their huge reserves, if necessary.

Despite the government’s roughly $85/bbl break-even figure, Saudi Aramco has no plans to cut oil production to boost prices, and, instead, is forging ahead to increase production capacity in key natural gas projects. Meanwhile, Kuwait plans to spend billions on oil and gas exploration over the next five years to meet its 4-MMbopd production target by 2020, up from about 3 MMbopd.

Latin America. Evercore had forecast Latin America to lead with 10% spending growth in 2015, accelerating from about 5.5% growth in 2014. But with Petrobras likely to cut spending roughly 10% in 2015, we now expect spending in the region to fall 3.5%, making 2015 the first time that spending has contracted in the past decade.

The biggest change in the 2015 estimate comes from Brazil, where spending could decline for the second straight year, due to lower oil prices and ongoing investigations. Meanwhile, spending in Argentina should remain strong, with Vaca Muerta now the second most active unconventional resource development. And Mexico’s first public oil and gas tender should proceed as planned, with a successful first bid round marking a potential turning point for the nation’s industry.

Russia/FSU. Spending deteriorated sharply in the back half of 2014, dragging the full year down 6% versus the +8% forecast. Off of a lower base, relative E&P spending in 2015 appears to be holding up better than expected at 3% lower, as compared to the forecast of down 7%–9% previously. However, on an absolute basis, spending is down 9% from the 2013 peak versus our prior estimate for 2015 spending to be roughly flat with 2013 levels. Russia’s efforts to seek new production resources have been hampered by sanctions over Ukraine.

Europe. Evercore previously forecast spending in Europe to be flat in 2014 and down 20% in 2015, but 2014 expenditures actually fell 4%, with capital discipline calls from a select group of European companies. Spending for 2015 is likely to fall more sharply than the 5% currently reflected in our survey, though the outcome could depend on several major development projects awaiting FIDs. Statistics Norway believes spending likely peaked in 2014, and has forecast spending to fall 14% during 2015. With a threat to lower revenue, the UK plans to introduce a series of reforms to bolster activity in the North Sea.

Asia/Australia. Spending should fall 3% in Asia. However, this compares against a lower base, as spending increased just 4% in 2014, below our +8% estimate and a sharp deceleration from 19% growth in 2013. While the region may be a bigger factor for global demand, particularly for oil and LNG, spending by key regional companies has been an increasing driver of oil services demand in recent years.

Africa. Spending should increase 6% in Africa, generally in line with Evercore’s previous forecast of 5% for 2015, decelerating slightly from solid 9% growth in 2014. Spending in Africa was stronger than expected last year, accelerating mid-year as Sonangol and Sonatrach ramped up activity. Both of these NOCs are leading spending growth again in 2015, with development projects in Angola moving ahead, including the development of the Block 15/06 East Hub with Eni. Shell continues to move ahead with its $12-billion Bonga South West development. ![]()

- The last barrel (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- International drilling and production: Growth outside the U.S. continues at measured pace (February 2023)

- U.S. reserves: U.S. proved reserves experience significant increase (February 2023)

- U.S drilling: U.S drilling activity to climb as supply disruption continues (February 2023)

- Canadian E&P: Canada’s upstream on track to strengthen during 2023 (February 2023)