The good, the bad and the over-budget

The LNG industry continues to expand and diversify amid significant market changes, short-term supply constraints, and the prospect of medium-term oversupply.

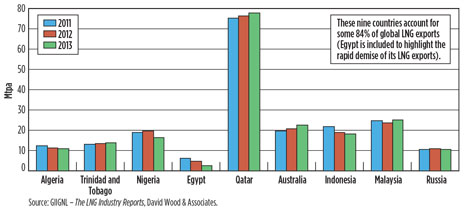

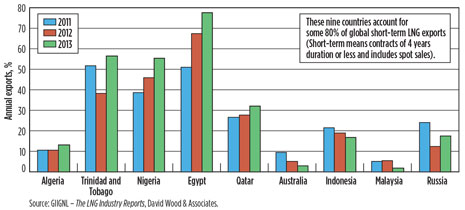

Significant activity has occurred worldwide in the LNG sector over the past year. This includes progress on large-scale, import/export projects, short-term trading, shipping and small-scale uses of LNG for marine bunkering and road vehicle fuel. Figures 1–3 and Tables 1–2 highlight emerging trends in large-scale LNG supply chains from 2011 to 2013, which set the context for the 2013–2014 activity discussed in this report. Since 2011, the global liquefaction capacity has grown very little, with exports dominated by Qatar and eight countries responsible for 83% of the supply. This has resulted in supply constraints that have sustained high Asian prices and a growth in short-term LNG trading of LNG. This supply constraint is set to be reversed in the medium term, with several, high-capacity and high-cost (over-budget), liquefaction projects in Australia coming on stream in the next several years.

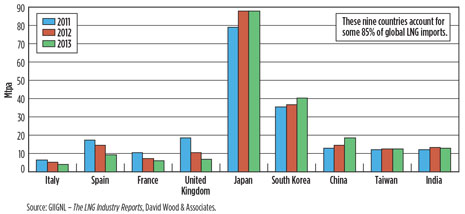

On the demand side, the number of LNG receiving terminals increased 15% from 2011 to 2013, with a significant increase in floating plants, which now constitute almost 15% of the terminals available worldwide. Japan, followed by South Korea, are the major LNG importers. Both countries increased their demand from 2011 to 2014, as did other Asian consuming nations. On the other hand, all European LNG consumers sharply reduced LNG imports from 2011–2013. Utilization of global regasification capacity fell 33%, due to three key factors: 1) higher Asian LNG prices encouraged cargo diversions and re-exports from long-term LNG supply chains to Europe; 2) cheaper coal prices than natural gas prices in Europe, spurred by increased coal imports from the U.S.; and 3) continued economic recession across much of Europe, inhibiting energy demand growth. It is in this context that the contrasting LNG fortunes of the regions over the past year are presented.

ASIAThe most significant event for the LNG sector over the past year was the early start-up of the PNG LNG liquefaction facility in May. This 6.9-mtpa facility operated by Exxon Mobil for partners Oil Search, Santos and JX Nippon Oil, exported its first cargo to Japan making Papua New Guinea the 20th nation to export LNG. Time will tell whether that project managed to stay within its $19-billion budget. Another important development in PNG was the closing of a deal between InterOil Corp and Total for the large, yet-to-be-developed Elk-Antelope gas fields, which is likely to pave the way for an additional liquefaction project. Indonesia has continued to plan and progress both LNG export and import projects in recent months. The 2.1-mtpa Donggi-Senoro liquefaction project under construction in Banggai, Central Sulawesi, although delayed is approaching completion for first deliveries in 2015. Foreign partners in that project are Mitsubishi and Kogas and some of the gas production is designated to supply Indonesian industrial gas consumers. The proposed expansion of the BP-operated Tangguh liquefaction plant from 7.6 mtpa to 11.4 mtpa, by adding a third train, is progressing through the government approval process, but is unlikely to deliver additional LNG before 2017, if approved in 2014. Inpex and Shell continue to conduct FEED studies on the Abadi FLNG project, but FID seems some way off. Meanwhile, a number of projects continue to study the feasibility of a coal-seam-gas-to-liquefaction in Indonesia, but no investment commitments have yet been made. Pertamina has agreed to two contracts with Cheniere’s planned Corpus Christi LNG plant to each supply 0.76 mtpa commencing in 2018 and 2019, respectively, when it is likely to become an LNG importer. Pertamina is in the process of converting the old Arun liquefaction plant in North Sumatra to a 3-mtpa import facility to be ready in 2015. Following the success of its West Java FSRU, supplied by LNG produced in the Tangguh liquefaction plant, feasibility studies are advancing on at least three more FSRUs for deployment close to major energy-consuming centers. Malaysia continues to make progress with the two Petronas FLNG projects. The PFLNG 1 is on schedule to produce 1.2 mtpa of LNG in 2015 from the Kanowit gas field, 180 km offshore Sarawak, Fig. 4. The PFLNG 2 plans to produce 1.5 mtpa of LNG in 2018 from the Rotan field offshore Sabah. Significant gas discoveries have recently been announced offshore Malaysia by Mubadala and Shell, suggesting that further FLNG projects are likely. The construction of a ninth liquefaction train at the Petronas liquefaction plant at Bintulu continues, along with the rejuvenation of trains 4, 5 and 6 led by JGC. The Melaka LNG import terminal has received LNG cargoes under short-term contracts from Brunei, Qatar, Nigeria and Norway, but expects to cease imports in 2016 when additional Malaysian liquefaction capacity, mentioned above, comes on stream.

Technip is in the process of upgrading and debottlenecking the aging liquefaction facility in Brunei for Total. That project involves a new onshore pipeline to transport some 2 Bcma of gas from the Maharaja Lela and Jamalulalam South (MLJS) gas fields, 50 km offshore to Brunei LNG at Lumut. This project is expected to complete in 2015. Energy World Corporation is in the process of building the onshore Pagbilao LNG receiving terminal in Quezon Province, Luzon Philippines with some 3-mtpa capacity to feed an adjacent gas-fired power plant to deliver 200 MW in 2015 and expand to 650 MW in 2016. Separately, Shell continues to plan a FLNG receiving terminal to eventually replace gas supplies from the declining offshore Malampaya gas field. Philippines’ First Gen Corp announced plans in 2014 to bring another LNG receiving terminal at Batangas online by the end of 2019. The continued nuclear shutdown has meant strong demand for LNG in Japan and projects to build significant additional gas-fired power plant capacity. Japan has continued its efforts to encourage Asian LNG buyers to cooperate in reducing their vulnerability to high LNG spot prices and to support North American export projects selling LNG indexed to North American gas prices rather than crude oil prices. In a related development, the Japan OTC Exchange has launched an LNG derivatives trading platform to improve LNG trading liquidity and to reduce price volatility through the use of futures and swaps contracts. Late in 2013, Inpex commissioned its 31st LNG import terminal in network, the Naoetsu terminal in Joetsu City (Niigata). The building of a new LNG terminal at the Soma Port in Shinchi, Fukushima was sanctioned by Japex late in 2013 to most likely receive cargoes from a planned British Columbian In South Korea, the 6.8-mtpa Samcheok and 1.5-mtpa Boryeong terminals are under construction and expected to be operational by 2015, adding to the capacity of the four existing terminals. This will enable the growth in LNG consumption experienced in recent years to be sustained in the medium-term. The newly adopted second, long-term National Energy Basic Plan for the period 2014–2035 also gives a boost to LNG and coal in the energy mix as the target for nuclear in the energy mix for 2030 is reduced from 41% to <29%. Upward price negotiations in long-term LNG contracts with Petronas, Sakhalin LNG and Yemen LNG, mentioned elsewhere in this report, are likely to see South Korea’s cost of LNG supply increase in the short term. However, along with other Asian LNG consumers, it is likely to see prices soften in the medium term, when supplies from North America become available. Singapore commissioned its first power plant to run solely on LNG in 2014, supplied by the Singapore LNG terminal on Jurong Island, with three tanks of 6-mtpa capacity and plans to add a fourth tank by 2017 to increase its capacity to 9 mtpa. The terminal has used its third tank to handle and re-export spot LNG cargoes in 2014, which is helping it towards its medium-term aspiration to become Asia’s LNG trading hub as well as supplier of LNG to the Singapore gas market. PetroVietnam and Gazprom signed a 1-mtpa gas supply agreement in 2014 for the Thi Vai LNG terminal project to be built near to Ho Chi Minh City, Vietnam, and scheduled to be operational by 2017. PetroVietnam and Shell also announced early plans to cooperate in the building of a second 3.6-mtpa LNG import terminal in Binh Thuan province, central Vietnam, scheduled for completion by 2020. China’s LNG imports have grown significantly in recent years. The 3.5-mmtpa terminals in Zhuhai and Tangshan, the 2.2-mtpa floating facility at Tianjin and the 1-mtpa terminal at Dongguan were commissioned over the past year. The Tianjin facility uses a shuttle and regasification vessel chartered by GDF Suez and is the first floating terminal in operation in China. Four other terminals are under construction, with the 2-mtpa Hainan and 3-mtpa Qingdao terminals due for completion in 2014, along with the addition of a fourth storage tank at the Guangdong terminal. The Russia-China gas pipeline deal, signed in 2014, seems unlikely to dim the appetite of China’s coastal cities for imported LNG, which has risen in recent months as spot prices have softened. China’s liquefaction industry, consisting of small-scale plants selling mainly trucked LNG, has also grown in recent years. However, these plants have suffered in 2014 from feed gas price increases imposed by the large, state-owned companies, which has curtailed further expansion. Petronet is in the process of increasing the capacity of the Dahej receiving terminal in India from 10 mtpa to 15 mtpa by building two new storage tanks to be completed by 2016. From 2017, some 50% of the capacity in Dahej terminal will be leased to other state-owned entities (e.g., GAIL). A 5-mtpa liquefaction facility, under construction for Gujarat State Petroleum Corp at Mundra, is scheduled to be completed in 2016. Meanwhile, Shell has acquired a 26% stake with GAIL and GDF Suez in the proposed Kakinada FSRU LNG terminal, to supply gas-starved power projects in the south Indian state of Andhra Pradesh. The project will have 4.5-mtpa capacity and joins other FSRU projects proposed for the region. These additional terminals will help to further diversify the LNG industry in India, which has struggled to grow in consumption terms in recent years due to the high Asian LNG prices it has had to pay to secure cargoes. GAIL is hoping to improve on his situation, with deals signed for U.S. LNG (e.g., Sabine Pass and Cove Point) linked to lower Henry Hub prices. GAIL has also stated its intentions to build three of the nine new ships required for those supply chains in India. No LNG carriers have previously been built in India. In mid-2014, Bangladesh operator Petrobangla agreed to a 15-year charter for an FSRU from Excelerate Energy with 138,000 m3 of storage and some 5-bcma sendout capacity. The facility will be located near Moheshkhali Island in the Bay of Bengal and is scheduled to be operational in 2016 with initial supply likely to come from Qatar. Pakistan has been in discussions with Qatar for several years for the supply of 3.5 mtpa of LNG, but failed to agree on price or to build the necessary receiving terminal. The supposed fast-track Port Qasim receiving terminal project has made slow, but positive progress in 2014. It involves a 5-bcma FSRU inked by pipeline to the existing gas network near Port Qasim and with possible IFC debt funding is expected to be completed in 2015, but doubts remain as to whether that can be achieved. In mid-2014, a project to build a second 5-bcma LNG receiving terminal at the port of Gwadar, and associated onward gas pipeline, with Chinese funding was proposed. Both of these projects undermine the progress on the Iran-to-Pakistan gas pipeline link, also discussed for many years. AUSTRALIAAustralia has more liquefaction projects under construction than any other country in the history of the industry. Between 2014 and 2018, more than 60 mtpa of additional capacity is due to come on stream, which would make it the largest LNG producing nation. Several liquefaction projects continue to advance their construction with some approaching completion in coming months. Nearly all have suffered painful budget and schedule overruns and are set to deliver LNG to Asian customers at some of the highest costs of supply yet experienced by the industry. The high skilled labor costs have led to several potential new liquefaction projects being shelved (e.g., Browse and Bonaparte). The success of the completing projects undoubtedly requires high Asian LNG prices for the next few years, and several may be adversely impacted by competition from some North American supply chains in development. At least, the recent repeal of the Australian carbon tax provides some financial relief for these projects. The BG-led Queensland Curtis Island LNG (QCLNG) plant is likely to produce its first LNG in fourth-quarter 2014. The Santos-led Gladstone (GLNG) project and the Origin Energy/ ConocoPhillips-led Australia Pacific (APLNG) project are scheduled to commence in early and mid-2015, respectively. Bechtel is building all three of these coal-seam gas to LNG plants on adjacent sites in Gladstone Queensland. On the Northwest shelf, the Chevron-led 15.6-mtpa Gorgon liquefaction project has seen its start-up schedule slip by one year to mid-2015, with some partners suggesting the schedule may slip again to 2016. In addition, the Gorgon project’s costs have grown from its initial budget of $27 billion to $54 billion. Chevron’s 2016 schedule for its Wheatstone LNG project also seems likely to slip. Meanwhile, Samsung floated the hull of Shell’s giant Prelude FLNG out of dry dock in Geoje, South Korea in late 2013 and the construction and installation of its topsides continues, Fig. 5. Also, the FPSO component for the Inpex-led Ichthys liquefaction project has now been launched and the 890-km pipeline tie back to Darwin is underway.

EAST AFRICASome key final investment decisions (FIDs) are pending for new liquefaction projects in Mozambique and Tanzania following large, deepwater gas discoveries in recent years. With more than 100 Tcf of gas now discovered, Mozambique is closer to FID with two separate projects: Anadarko’s Golfinho two-train onshore project; and Eni’s FLNG for the Coral gas discovery. Some key issues are yet to be resolved, i.e., government participation and the unitization of the large Prosperidade gas discovery straddling the Anadarko and Eni permit areas. The involvement of Indian and Chinese state companies as equity holders in the projects and as buyers of the LNG suggest that competitive supply chains to Asian markets can be linked to these projects. In Tanzania, discovered gas has risen to some 50 Tcf and the large IOC permit holders—BG, ExxonMobil and Statoil—are cooperating in the planning a two-train onshore liquefaction project, with what is likely to be a 2020 delivery timeline. The significance of these potential East Africa export projects is that they should be able to compete on delivered-Asian-LNG price, with projects being planned and under construction in Australia and North America. Plans to build a LNG receiving terminal at Mossel Bay, South Africa, consisting of an FSRU and LNG carrier dual-berth jetty in approximately 15-m water depth, have completed a FEED study, but run into objections concerning the project’s environmental impact study. If that project progresses, then South Africa could also become a secondary market for the proposed East African liquefaction projects. EUROPEThe sluggish economy and competition from cheap imported coal and expanding renewable energy capacity continue to drive Europe’s declining gas consumption. As Gazprom has been keen to point out, Europe’s current utilization of its main LNG regasification capacity is a mere 15%, and it questions the need to build more. However, with the high cost and geopolitical uncertainties associated with building long-distance gas pipelines from Central Asia and the Middle East, rapidly declining indigenous gas production, and, in the light of Russia’s 2014 actions in Ukraine, a political urgency to reduce dependency on Russian gas supplies, LNG offers Europe its best option to secure its long-term gas supply. It is for these reasons, and contrary to the current market conditions for LNG in Europe that plans for LNG receiving infrastructure projects to expand and diversify supply continue to gain traction in Europe, particularly those capable of securing new sources of supply from North America in the medium term. The Baltic region has seen most recent activity in terms of LNG receiving infrastructure development. In Lithuania, the Klaipeda FSRU is scheduled to be completed at the end of 2014. It involves a new Hoegh vessel under a 10-year time charter, offering 170,000 m3 storage capacity and between 2 and 3-Bcma throughput capacity, Fig. 6. That project prompted Gazprom to announce plans to build a 3.3 Bcma LNG receiving terminal in Kalingrad, Russia’s western enclave adjacent to Lithuania to receive LNG in 2017. Meanwhile, completion of Poland’s Swinoujscie LNG terminal has been delayed by a further year to mid-2015 and further delays cannot be ruled out.

In Sweden and Finland, the focus is on developing small-scale LNG terminals for LNG bunkering operations (e.g., a terminal at Gothenberg being built by Swedegas and Vopak for operations in 2015). Finnish gas company Gasum, partly owned by Gazprom, has announced plans to further integrate Nordic LNG for transportation operations and build further terminals at Pori in Finland and in Sweden. Wartsila has begun construction of its Manga LNG facility at Tornio in Finland. That facility will involve an unloading jetty for vessels up to 20,000 m3 capacity, a LNG vaporizing facility, a 50,000 m3 storage tank, a gas pipeline connection to the Röyttä industrial site and LNG truck loading and bunkering facilities. Estonia and Finland have agreed in principle to each build LNG receiving terminals on opposite sides of the Gulf of Finland linked by pipeline, but a schedule for this project is yet to be released. For existing LNG terminals in Europe the story in 2014 has been mainly one of fewer imports and, for those terminals able to do so, re-exports of contracted cargoes. The Montoir terminal in France has added re-export capabilities, and announced its first trans-shipment to an Asian customer in April. The Zeebrugge LNG terminal in Belgium entered into a provisional deal with Yamal LNG to eventually become a trans-shipment terminal for cargoes routed from Yamal via Europe to Asian and other distant customers. In Russia, Gazprom and Gazprombank confirmed their intentions to develop and finance the planned 10-mtpa Baltic and Vladivostok liquefaction plants, with schedules to be completed in 2018. That schedule seems ambitious as there is little sign of FIDs being made. The Shtokman project continues to languish since the failure of Statoil and Total agreeing to fund it in 2012. Gazprom is also in dispute with Rosneft over providing access to infrastructure that would enable the Rosneft/Exxon Mobil Far East LNG project to progress towards development and export of the gas resources in the Sakhalin-1 permit. The Yamal LNG project, sanctioned in 2013, and led by Novatek in a joint venture with Total and CNPC, continues to progress. Technip and JGC are working on the EPC contract to build the first of three 5.5-mtpa liquefaction trains in this remote Arctic location for a 2017 start-up. Plans to build about 16 icebreaker-class LNG carriers to support the Yamal LNG project are also progressing. Deteriorating relations between Russia, most of Europe and the U.S. over Russia’s interventions in Ukraine, which have led to economic and trade sanctions on Russia being progressively stepped up in recent months, are likely to impact costs and delay the LNG development activities. LATIN AMERICAAlthough still a niche market for LNG, the Latin American region continues to diversify its LNG infrastructure and become more dependent upon LNG. The ongoing expansion of the Panama Canal, due to be completed in 2015, has been beset by problems over the past year due a dispute with the contractors, leading to delays and cost overruns. The expansion is important for the LNG sector, particularly the Gulf of Mexico liquefaction projects under development looking to ship cargoes to Asian markets and to Chile. Currently, less than 10% of the fleet can pass through the canal, whereas when the expansion is completed, more than 80% of the fleet should be able to make the transit. However, the attractiveness of the Canal’s tolling fees and scheduling for LNG carriers is yet to be confirmed, and the commercial and timing benefits for shipments through the Canal may not be as significant as was initially expected. Argentina received cargoes at its Bahia Blanca and Escobar terminals in mid-2014 from several sources reportedly paying significant premiums to the Henry Hub price. Brazil commissioned its third LNG receiving terminal using an Excelerate Energy FSRU vessel in Bahia, northeastern Brazil, and announced plans to build a large, integrated gas-fired power plant and LNG import terminal at Suape in northern Brazil. Chile revealed plans in 2014 to add a third LNG receiving terminal south of its two existing facilities, Mejillones and Quintero, in a strategy to increase its reliance on LNG imports. Some Chilean mining companies have already lined up supplies from U.S. liquefaction projects under construction that are indexed to Henry Hub prices. GDF Suez has begun using a newly constructed onshore LNG storage tank associated with Mejillones terminal. Pacific Rubiales has agreed to a contract to supply some 0.5 mtpa of LNG for five years to Gazprom from the second quarter of 2015 through FLNG facilities, under construction in China, and to be located near Corvenas on Colombia’s Caribbean coastline. That project has also secured World Bank funding through the International Finance Corporation. A group of Colombian power generators is also planning to secure LNG supplies through an FSRU to be located near Cartagena. Marubeni and GDF Suez have agreed to construct a large FSRU terminal in Uruguay to be operational by July 2015. The FSRU is to be located about 2 km offshore near Montevideo and is planned with a storage capacity of 263,000 m3, and a regasification capacity of 15 Mcmd. MIDDLE EASTLNG supply in the region, and globally, is now led by Qatar, which has delivered some 2,000 LNG cargoes to Japan alone since 1997. However, as demand for spot LNG cargoes in Japan, and elsewhere in Asia, softened during 2014, accompanied by lower spot prices, Qatar has diverted some of its cargoes to Europe, particularly the UK, further weakening gas prices there. Qatar is clearly mindful that competition to supply LNG from North America to major European gas customers is growing and is keen to protect a share of that market. Oman’s two operating liquefaction companies merged late in 2013, which to an extent has helped address a shortage of feed gas that has constrained LNG export volumes in recent years. Gas supply deals to Oman from Iran by pipeline were announced in 2014, but as other such announced deals have failed materialize over the past decade, and no price for the gas is yet agreed, there is scepticism that these will progress. It is understood that the proposed pipeline would be a spur to the larger-scale pipeline planned to export gas from Iran to Pakistan. Yemen LNG has suffered rocket-propelled grenade attacks in the past year, but has reportedly managed to renegotiate significantly upwards the LNG price it receives from Kogas of Korea from one of its long-term sales agreements. Yemen LNG was one of several companies that have recently engaged in price indexation renegotiations associated with deals signed with Asian buyers a decade ago. Other liquefaction projects pressuring Asian buyers to agree to long-term price LNG increases in 2014 include Petronas, Sakhalin LNG, BP (Tangguh LNG, Indonesia) and Woodside (NWS, Australia). Unconfirmed reports suggest that deals are being struck in the range between 10% and 15% of Japan’s JCC oil price. Kuwait National Petroleum Company (KNPC) awarded a FEED contract to Foster Wheeler in March 2013 for a new onshore LNG import and regasification terminal to be built in Kuwait. The terminal is designed initially with four full-containment LNG storage tanks, each of 180,000 m3, and with four to be added later, for send-out gas to expand from 1.5 bcfd to 3.0 bcfd. The building of this facility will confirm Kuwait’s long-term commitment to import LNG. Its short-term commitment was emphasized with new LNG supply deals signed in 2014 with Qatargas, BP and Shell, for one-, five- and six-year terms, respectively. In Jordan, the Aqaba LNG terminal is under construction 18 km south of Aqaba and due to take its first deliveries in 2015. The facility involves a single-berth jetty will be designed for berthing an FSRU and unloading gas. Bahrain, which has been evaluating LNG import options since 2010, issued in mid-2014 a request for proposals (RFP) for a 400-Bcma floating LNG import facility connected to a regasification unit on an artificial-island jetty for a 2017 start-up. The gradual development of LNG receiving capability across the Middle East illustrates that this currently niche market for LNG is set to expand over the next decade as consumption of gas is forecast to expand rapidly there over the coming decade. NORTH AFRICA AND MEDITERRANEANA new 4.5-mtpa liquefaction train at the Skidda plant in Algeria was completed in early 2014 with a 4.7-mtpa train at the Arzew liquefaction plant expected to be completed shortly. It is unlikely though that these new plants will operate at full capacity for some time because of feed gas supply constraints. Continued political unrest in Libya makes plans for a new liquefaction plant to replace the old Marsa El Brega plant, which has been shut down since 2011, unlikely to materialize in the next few years. Increasing gas shortages and diversions of feed gas to supply the domestic market in Egypt have all but dried up LNG exports from its two liquefaction plants. In addition, attempts over the past two years to secure an FSRU, through which to import LNG to avert Egypt’s gas supply crisis, have failed. BG, having declared force majeure on its Egypt liquefaction operation early in 2014, subsequently entered into a provisional agreement with Noble Energy to import gas from the as-yet-undeveloped Leviathan field, offshore Israel. The political hurdles that would need to overcome to provide a sustainable supply of Israeli gas to Egypt’s Idku liquefaction plant are formidable. The preference for the Leviathan field partners to pursue pipeline gas exports and the high potential Israeli export tax burden on LNG, led Woodside in May 2014 to terminate its longstanding negotiations to take a percentage interest in that field with a view to installing a floating liquefaction plant. Leviathan field partners are also looking to supply gas by pipeline to a possible land-based liquefaction plant in Cyprus to be feed, in part, by the Aphrodite gas field discovered there. Recent cooperation agreements between Noble Energy, ENI, Kogas and Total, with the Cyprus Government, indicate that the project has better chances of progressing. ElectroGas Malta, a consortium including Siemens, is at the early planning stages for an LNG-to-power project in Malta. NORTH AMERICAIn excess of 40 projects have now been proposed at various locations in Canada and the United States to liquefy primarily shale gas and export the LNG to range of customers around the world, particularly those in Asia. FIDs are pending regulatory approvals on many, but construction has commenced on just Cheniere’s Sabine Pass projects in the Gulf of Mexico. It is likely that only a fraction of the proposed projects will make it into production, as their costs of supply vary greatly. Those projects converting existing LNG import terminals into liquefaction and export plants have a huge cost advantage as much of the site pipeline and jetty facilities already exist. Those projects that need to build long-distance-feed-gas pipelines and develop greenfield liquefaction and port loading facilities are at a disadvantage, because of their high development costs; most Canadian projects and the Alaska LNG export project fall into this category. It is impossible here to discuss all the projects. The FERC website http://www.ferc.gov/industries/gas/indus-act/lng.asp provides maps and basic details of the approved, proposed and potential liquefaction projects in North America, updated as of 31 July 2013. The regulatory approval process for these projects has become highly political and a protracted exercise in Canada (east and west coasts) and the United States. This explains why only one project is currently under construction. A recent report by Ernst & Young (Competing in the global LNG market: Evolving Canada’s Opportunity into Reality, 2014) details the opportunities and uncertainties associated with the proposed Canadian projects. Securing land agreements with native tribes remains a challenge for most export projects from British Columbia (BC). In February, the BC government announced proposed legislation for a two-tiered LNG export tax. According to the proposal, the first-tier tax would be limited to a 1.5% rate during investment payback, rising up to a 7% rate for the second-tier tax, following payback. Potential investors are keen to see the details of how this extra cost burden will be calculated and the timeframe of any associated fiscal-stability guarantees. The recent filing with Canada’s NEB by Quicksilver Resources to export up to 20 mtpa from its proposed Discovery LNG site near Campbell River British Columbia from 2021 brought the number of proposed liquefaction export projects in Canada to 21 in August 2014. Of these proposals, 11 have been granted export licences; the NEB has not rejected any LNG export applications so far. However, a FID is yet to be taken on any of these projects. Sempra Energy and its Japanese and French partners announced in August 2014 their final investment approval of their Cameron liquefaction project at Hackberry, Louisiana. That three-train facility with 12-mtpa capacity is budgeted to cost $10 billion, and is expected to deliver its first LNG in 2018 with three-quarters of the funding secured from Japanese financial institutions. Although that project has received FERC approval, it still depends on final U.S. Department of Energy (DOE) approval by year-end 2014 to stay on schedule. The project has already secured long-term LNG supply contracts with Japanese and other buyers. Oregon LNG, which has been already approved by Canada’s NEB, received (end July 2014) a conditional licence to export LNG to non-Free Trade Agreement countries from the DoE. That project, as significant as it is, with the proposed Jordan Cove project, one of only two on the U.S. west coast and is planning to process and export mainly Canadian gas. Excelerate Energy applied to FERC in February for the first U.S. FNG export facility at Lavaca Bay, offshore Texas. It proposes to commence operations with a less than 4-mtpa facility in 2018, with the potential to expand later to 8 mtpa of LNG exports. At the high-cost end of the liquefaction export projects from North America is Alaska LNG, proposing to produce 20 mtpa from a three-train greenfield plant near Nikiski, linked by a new 800-mi gas pipeline to Prudhoe Bay, with cost estimate up to $65 billion for the integrated project. That project is in the pre-FEED stage, to be completed by 2016, with a subsequent two-year FEED study required to refine a detailed specification and budget. If the FEED leads to a prompt FID, then the project could be in production around 2025. Although the technical and cost challenges are formidable for the Alaska LNG project, it also has significant state tax issues to resolve. With Alaska’s history of fiscal instability for oil over the past decade, investors in Alaska LNG required clarification of the state tax burden on feed gas and LNG exports and fiscal-stability guarantees provided via legislation. In May, Alaska passed Senate Bill 138 into law, taking the unusual step for a U.S. state of securing a 25% equity share in the Alaska LNG project in return for fixing the Alaska gas production tax share for the equity gas providers for the 30-year project duration at a rate of 13% and limiting the pre-income-tax-state fiscal take to about 25%. Alaska LNG will require high Asian natural gas prices to be sustained through to 2019 for a positive FID decision. There is a significant chance that the lower-cost North American liquefaction projects sanctioned before then will undermine the Asian price to such an extent that Alaska LNG ceases to be commercially viable. On the LNG import side for the U.S., Clean Energy delivered the first LNG to Hawaii in April in the form of a small (i.e., 7,100 gal) container for use as back-up fuel for the Oahu synthetic natural gas plant. The LNG was loaded into an ISO container in Boron, California, transported to the Port of Los Angeles, and then shipped to Honolulu, Hawaii, where it was regasified and injected into the Hawaii Gas distribution pipeline. To import LNG on a larger scale, Hawaiian Electric received bids for LNG supply in May and is evaluating them, together with LNG infrastructure options in conjunction with Hawaii Gas, with a view to replacing expensive oil-product fuels. Excelerate Energy’s Aguirre Offshore GasPort project planned to import more LNG to Puerto Rico, in conjunction with the Puerto Rico Electric Power Authority, received its Draft EIS from FERC in August. Crowley was awarded a contract in April to supply containerized LNG to Coca-Cola bottling plants in Puerto Rica to replace diesel fuel. This involves 40-ft intermodal containers capable of carrying 10,000 gal of LNG being moved by road to Jacksonville, Fl., and then by ship to Puerto Rico. WEST AFRICAThe most disappointing news for the LNG sector in the past year has been the late start-up of Angola LNG (August, 2013) followed by various leaks and fires, leading ultimately to a long-term shutdown starting in April 2014, following a ruptured flare line, and expected to last until mid-2015. That Chevron-operated project has been beset by problems over and above technical issues impacting the plant. These include a capsized rig in 2013, delaying the tie-in of feed-gas supply and market changes meaning that original long-term contracts to U.S. destinations have resulted in the few cargoes loaded being re-directed to other destinations on a short-term basis. The delay to resolving the fiscal issues posed by the Petroleum Industry Bill (PIB) in Nigeria, which has now continued for more than five years, means that planned green-field liquefaction plants (i.e., Brass and Olokola) and expansions to the existing NLNG plant are firmly on hold and unlikely to progress at least until after the 2015 Presidential elections. ConocoPhillips pulled out of the Brass LNG project in 2014, leaving Total and Eni as the remaining foreign partners. Golar has recently entered into a provisional agreement to provide a 1.75-mtpa-throughput FSRU at Tema in Ghana by 2016. The objective of this project is to displace expensive oil-derived fuels for power generation. Earlier in 2014, Gasol had earlier announced its Benin FSRU project to be located in Cotonou harbor and deliver gas by 2017 to Benin, Ghana and Togo. OTHER LNG DEVELOPMENTSAbout 390 LNG ships are operating worldwide in 2014, with more than 100 being built or on the shipyards’ order books. Delays in some new liquefaction projects coming on stream and the long-term shutdown of Angola LNG have led to a short-term glut of LNG vessels, which has depressed LNG vessel charter rates in 2014 to about $60,000/day from above $100,000/day in 2013. Many Asian, European and North American ports have progressed LNG bunker-fuel projects and a wide-range of LNG-fueled vessels and bunker barges are entering the market. LNG road fuel usage has continued to expand rapidly in Europe and North America, along with other engine fuel uses (e.g., drilling rig fuel and plans for an LNG-fueled drillship), Fig. 7. This has led to an increased number of small-scale liquefaction plants and refueling infrastructure to meet the increased road-fuel demand.

CONCLUSIONSThe LNG industry continues to expand and diversify amid significant market changes, short-term supply constraints, and the prospect of medium-term oversupply. The increasing attraction of floating receiving terminals and liquefaction facilities is opening up new markets and supply chains. Coupled with the growing demand for LNG as a bunker and road transport fuel, the industry is entering a new era, where small-scale LNG opportunities abound. However, the enthusiasm for greenfield, large-scale liquefaction export plant, particularly in North America, to unlock stranded gas resources is tempered for investors by the massive cost overruns recently experienced by Australian projects, and concerns that medium- and long-term market demand, and prices may not be able to sustain such investments. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)