|

| Rig drilling on Stiles Ranch in the Granite Wash basin. Photo courtesy of Apache Corporation. |

|

The Anadarko basin stretches across the Texas and Oklahoma panhandles, and a portion of southern Kansas. This report will focus on the Panhandle Liquids plays in western Oklahoma and northern Texas. Traditionally, this region was developed by conventional vertical drilling. In recent years, these plays have been redeveloped with horizontal drilling and hydraulic fracturing.

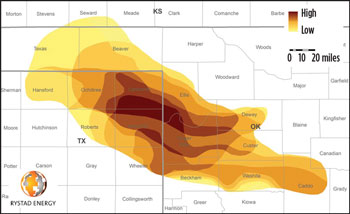

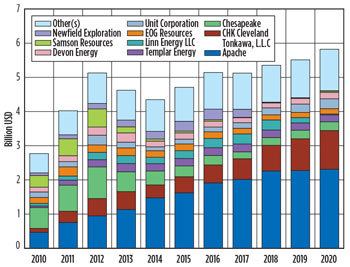

In geologic terms, the Panhandle Liquids plays consists of stacked submarine fans of mainly Pennsylvanian age sediments. Operators started drilling horizontal wells in the Granite Wash area in 2004, which is considered a tight gas play with liquids-rich zones. Due to low gas prices, activity has since shifted exclusively toward the liquids-rich zones of the Granite Wash and the shallower, tight oil formations. Rystad Energy considers these liquids-rich formations as the Anadarko tight oil plays and includes the Douglas, Tonkawa, Cottage Grove, Hogshooter, Cleveland and Marmaton formations, and the Cherokee group of sands. A prospectivity map (Fig. 1) displays the ranking, based on the optimal combination of factors such as thickness and multi-stacked potential.

|

| Fig. 1. Map with the Panhandle Liquids play acreage valuations by Rystad Energy. The rankings are based on a combination of factors, such as thickness and multi-stack potential. |

|

OPERATOR ACTIVITY

In terms of reporting, companies generally communicate the formation acreage in this area, to illustrate the multi-stacked potential. The number of operating rigs has decreased from ~140 in 2011 to ~100 at the end of 2013. Rig activity increased again in 2014, reaching 117 units in July 2014. The rig activity is mainly in Wheeler and Hemphill counties in Texas, and the Roger Mills and Ellis Counties in Oklahoma. The rigs operating in Roger Mills, Hemphill and Washita counties are mainly targeting the Granite Wash play. The rigs in the remaining counties are mainly targeting the Anadarko tight oil play. Historically, Chesapeake was the operator with the largest number of rigs; however, the company has dramatically reduced activity in the area since July 2013. Since then, Apache is the operator with the largest number of rigs running.

|

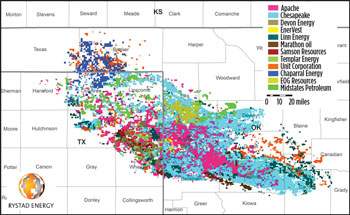

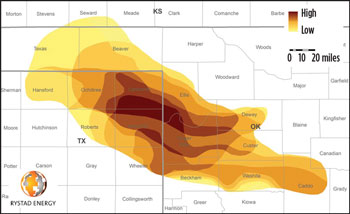

| Fig. 2. Company acreage map, depicted for a selection of companies in the Panhandle Liquids plays, from Rystad Energy, as of July 2014. |

|

Apache is the company with the largest net formation acreage position. It is also the most active in exploring new formations within its position. Samson Resources, a private E&P company, has acreage holdings in Hemphill and Wheeler counties in Texas. The company is targeting Granite Wash and also other liquids-rich formations in Anadarko tight oil plays, such as Hogshooter and Cottage Grove.

WELL ECONOMICS

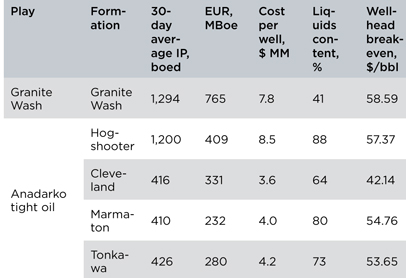

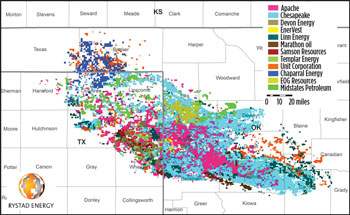

Table 1 shows the average horizontal well configuration for different formations across the Panhandle Liquids plays. Rystad Energy estimates an average liquids content of 41% for a typical Granite Wash well, with an average well cost of $7.8 million. Among the Anadarko tight oil plays, Hogshooter has the highest initial production (IP) as well as the highest decline rate. Rystad Energy estimates an average 30-day IP of 1,304 boed for Hogshooter wells, with an average well cost of $8.5 million. Data for the Cleveland, Tonkawa and Marmaton formations are based mainly on Apache’s reporting and Rystad Energy’s analysis. Rystad Energy estimates the break-even oil prices for these three plays at $42.14, $54.76 and $53.65/bbl, respectively. (Wellhead break-even oil price is the wellhead oil price used to obtain an NPV of 0 at a 10% discount rate. It is assumed that gas and NGL prices are fixed at 3 $/Mcf and 36 $/boe, respectively).

| Table 1. Well economics for different formations, based on Rystad Energy analysis and company reporting. |

|

|

PRODUCTION AND SPENDING FORECAST

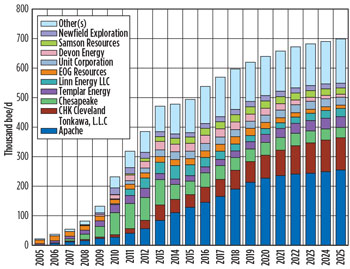

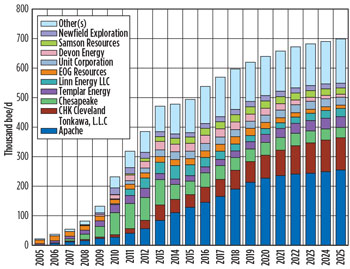

Figure 3 shows the production forecast for the Panhandle Liquids plays, split by company. The production forecast is generated by analyzing the number of producing wells, future drilling inventory, typical well performance and companies’ future drilling schedules.

|

| Fig. 3. WI production, before royalties (2005-2025), by top 10 operators. |

|

Rystad Energy forecasts the production from the Panhandle Liquids plays in 2014 to be ~480 Mboed. Production growth is limited from 2013 to 2015, due to a reduction in activity by Chesapeake. Apache, CHK Cleveland Tonkawa and Chesapeake are expected to be the top three producers in this play for the next 10 years.

|

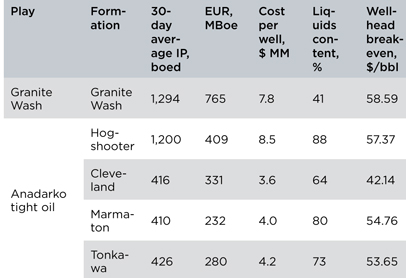

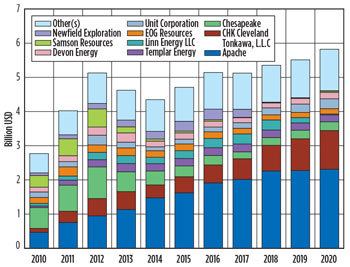

| Fig. 4. Total drilling and completion costs by top 10 operators. |

|

Figure 4 shows the total drilling and completion costs in this area, split by company. Total capital spending in the Panhandle Liquids plays is estimated to be ~$4.7 billion in 2014. The spending level will increase steadily in the next decade and reach about $6 billion by 2020. As a result of this spending, production from this play is projected to reach ~700Mboed by 2025.

|