Offshore in depth

Deepwater potential: One factor behind Mexico’s reforms

|

Mexico’s Congress recently made history by voting to change the country’s constitution to allow foreign investment in its oil and gas industry, ending Pemex’s 76-year monopoly. The vote came despite strong public opinion in Mexico that national control over the country’s natural resources should be maintained.

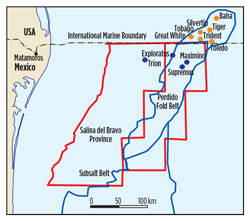

Three factors drove this change: the decline in Pemex’s oil production (which accounts for 30% of the Mexican government’s revenues); huge potential reserves in the deepwater Gulf of Mexico and the unconventional shale reservoirs; and Mexico’s lack of experience in developing deepwater fields and unconventional shale plays. Crude oil production in Mexico peaked in 2004 at nearly 3.4 MMbpd, of which 2.1 MMbpd came from the prolific Cantarell field. By 2012, Mexico’s crude production had fallen to 2.5 MMbpd, with Cantarell producing just 454,000 bpd. In a recent Wall Street Journal article, Pemex said that its crude output for 2014 would fall to 2.34 MMbpd. Pemex has worked hard to stabilize production with significant investment, aggressive drilling, and field maintenance, but both 1P and 3P reserves have fallen significantly over the last decade. With the participation of foreign firms, the Peña administration expects oil production to rise to 3.5 MMbpd and gas production to double to 14.6 Bcfd by 2025. From 2002–2012, Pemex acquired 122,727 sq km of 3D seismic offshore. Since 2011, Pemex has had up to four deepwater rigs operating in the Gulf of Mexico in the Perdido Fold Belt, about 50 km south of the Shell-operated Great White field in Alaminos Canyon. Pemex has drilled 27 deepwater exploratory wells, 12 of which found commercial gas reserves. Four Perdido oil discoveries include the Trion-1, Supremus-1, Maximus-1 and Exploratus-1 wells. Pemex has estimated that these four wells found recoverable reserves of between 0.8–1.13 Bboe. Considering 3P reserves, Trion could be among the five largest discoveries in the Paleogene of the deepwater Gulf, according to Pemex. Pemex also estimates that prospective reserves for Mexico’s portion of the Perdido Fold Belt are nearly 26.5 Bboe, including 5 to 15 Bcf of gas. If the Perdido Fold Belt live ups to its potential and can be brought onstream, it would reverse Pemex’s production decline and bolster the Mexican government’s treasury. While Pemex has managed a successful exploration program, the company doesn’t have the technology or expertise to develop fields in water depths ranging from 2,450 m to 2,900 m. To exploit the reserves within a reasonable time frame, the company needs help from major international operators, who have experience in meeting deepwater challenges. Options include a tie-back of the Pemex discoveries to the existing production system and pipeline-in-place in U.S. waters, or producing to an FPSO. In August, Mexico’s Energy Secretariat assigned 83% of the country’s 1P and 2P reserves to Pemex, and also granted the state-owned company 21% of prospective reserves. This “Round Zero” allocation contains 90,000 sq km and an estimated 20.6 Bboe. It is expected that Pemex will retain ownership of its Perdido Fold Belt discoveries. The “Round One” auction, open to international investors, will take place in February 2015, covering 165 blocks and 28,500 sq km. Pemex told the Financial Times that it has enough prospects for 10 bidding rounds of 20,000 sq km. In sync with the Mexican oil reforms, the Obama administration, with support from both houses of Congress, signed an agreement with Mexico concerning Transboundary Hydrocarbon Reservoirs in the Gulf of Mexico. According to the Bureau of Ocean Energy Management (BOEM), the agreement allows leaseholders on the U.S. side of the boundary to cooperate with Pemex in the joint exploration and exploitation of hydrocarbons. The agreement ends the moratorium on exploitation along the boundary in the Western Gap (nearly 160,000 acres) and would provide U.S. leaseholders with legal certainty regarding the exploitation of transboundary reservoirs along the entire boundary (1.5 million acres). This area contains an estimated 172 MMboe of reserves. Major oil companies already producing near the boundary are most likely to participate in developing the southern portion of the Perdido Fold Belt. In May 2014, BOEM awarded the first three oil and gas leases in the Gulf of Mexico area, subject to the U.S.-Mexico Transboundary Hydrocarbons Agreement, to Exxon Mobil, which bid for the blocks in the Alaminos Canyon during Western Planning Area Sale 233 in August 2013. In the August 2014 Western Gulf of Mexico lease auction, about a quarter of the bids were for blocks in Alaminos Canyon and other territory near the U.S.-Mexico maritime border. BP, BHP Billiton and ConocoPhillips leased the most blocks. Chevron won Alaminos Canyon Blocks 215 and 431, and Shell won Alaminos Canyon Block 905, adjacent to its existing Perdido development, where the company already produces from 14 wells.

|