Offshore in depth

Watch what’s happening in the Arctic

|

The Arctic region is shaping up to be one of the most interesting oil and gas frontiers, with huge potential, but also with major technical, environmental and political challenges. According to Wood MacKenzie the largely unexplored Arctic holds as much as 166 Bboe, mostly offshore, representing 20% of the planet’s undiscovered, recoverable oil and gas.

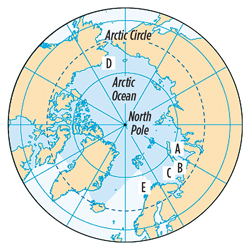

For decades, the industry has operated successfully, and responsibly, above the Arctic Circle, on land, and on ice and gravel islands in shallow water. Developing the Arctic’s sizeable offshore reserves poses a number of technical challenges, including drilling in ice-bound waters during a short drilling season and being able to respond to spills or accidents, far from distant shore bases. Environmentalists maintain that Arctic oil and gas exploration will irreparably damage a fragile ecosystem and accelerate global warming. Melting polar ice, and the plight of polar bears, gives their arguments emotional appeal. Sanctions imposed by the U.S., related to Ukraine, have stalled major projects in Russia that were made possible by technical collaboration and investment from Western super-majors. But, despite these obstacles, the industry consensus is that the potential is real, and that hydrocarbons north of the Arctic Circle eventually will be developed on a large scale. Recent Arctic efforts. The joint Kara Sea project (point “A” on accompanying map) between Rosneft and Exxon Mobil spudded the Universitetskaya-1 well on Aug. 9, 2014, despite looming U.S. sanctions over the Ukrainian crisis. On Sept. 20, Exxon Mobil agreed to “wind down” operations by Oct. 10, on the insistence of the U.S. government. On Sept. 26, the Financial Times reported that the well had struck oil. This first well, with an estimated cost of $700 million, is part of a 40-well, planned program that was expected to be implemented through 2018. Rosneft’s website notes that its seismic program in the Kara Sea found an estimated reserve base of 87 Bbbl, and potentially more oil than Saudi Arabia. It may be months, or years, before the current impasse ends, but with so much oil to be produced, expect Exxon Mobil to resume the exploration program when sanctions are lifted. Other Russian activity. Gazprom, the other Russian energy giant, has had its own successes and setbacks in exploring and developing offshore Arctic fields. Gazprom’s Prirazlmnoye field (point “B”), in the Pechora Sea, achieved Russia’s first offshore Arctic production in 2011. Protesters from a Greenpeace vessel boarded the platform in 2012, making international headlines. Gazprom’s Shtokman field (point “C”), with potential reserves of 134 Tcf of gas and 410 MMbbl of condensate, was discovered in 1988, but has not yet been developed. The field is 340 mi from shore, in a Barents Sea area prone to icebergs. The most recent of several project plans includes subsea wells, an FPSO, an LNG terminal near Murmansk, and a pipeline from the Barents Sea to the Baltic. Although foreign partners, Statoil and Total, have pulled out of the Shtokman project, Gazprom expects it to produce by 2019. U.S. Arctic projects. Since 2012, Shell has spent an estimated $6 billion exploring the Beaufort and Chukchi Seas (point “D”). Shell completed top-hole drilling of two wells in 2012, in the Beaufort and Chukchi, marking the industry’s return to drilling offshore the Alaskan Arctic after more than a decade. After the drilling season, Shell’s Kulluk rig ran aground in a storm while being towed south for repairs. It was subsequently sold for scrap. In July 2014, Shell submitted plans to BOEM, for the 2015 season, that call for two rigs to drill simultaneously in the Chukchi Sea. Shell’s plans, and its application for permits to drill, are under review by federal regulators. Meanwhile, environmental advocates continue to protest any development in U.S. Arctic waters, and federal lawsuits are pending. Norwegian activity. The Norwegian Barents Sea (E), where Statoil has drilled more than 100 exploration wells since 1980, is considered the “workable Arctic,” because it is warmed by the Gulf Stream and seldom has sea ice. Explorers in Norwegian Arctic waters had mixed results in their recent drilling campaigns. In the Hoop area, 186 mi north of Hammerfest, OMV hit the Wisting Central oil discovery in 2013, followed by the Hanssen find in 2014, identifying potential reserves of 200 MMboe to 400 MMboe. Statoil’s Arctic results were disappointing this year. Of Statoil’s three Hoop area wells, drilled to the north of Wisting Central, Apollo and Atlantis were dry holes, and Mercury was only a small gas discovery. Statoil’s Pingvin well, drilled near the Johan Castberg and Havis discoveries of 2011-2012, struck a small oil discovery, but, so far, insufficient hydrocarbons have been found in the Castberg area to justify investing in the infrastructure to bring production to shore. Still, given the vast unexplored area of the Barents Sea and the relatively few wells drilled in the far North, Statoil reports that it has just begun exploring the Arctic’s potential. |