Oil and gas in the capitals

|

As of early 2014, more than two dozen nations and sub-national jurisdictions have imposed carbon restrictions. Carbon restrictions are working “perfectly” in every country that has tried them: They are ruining economies, devastating industry, destroying jobs and impoverishing citizens, particularly in the European Union (EU).

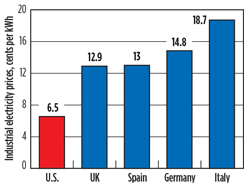

The EU Emissions Trading Scheme (ETS), launched in 2005, is a case study in inefficient, ineffective and economically disastrous policymaking. The world’s first cross-border greenhouse gas emissions (GHG) trading scheme regulates more than 11,500 installations—45% of total EU CO2 emissions. European companies buy and sell permits to emit CO2 under the ETS. If they emit less than their permits allow, they can sell the excess for a profit. In theory, the scheme incentivizes efficiency and innovation; in practice, it acts as a massive tax that has hobbled EU industries in a competitive global marketplace. EU industrial electricity prices are already two to three times higher than in the U.S. (see chart), and are headed much higher. Once hailed as a global blueprint, ETS was intended to be the single largest driver of emissions reductions under the EU Climate Package. Instead, it is now the package’s weakest link. Europeans have spent over €600 billion ($850 billion) on renewable energy subsidies to support it. The ETS is flawed by every measure. It has not reduced emissions, but it has dramatically raised energy prices, increased national debt, driven businesses out of Europe, and been plagued by fraud and corruption. Europe’s middle class is being pushed into energy poverty. The ETS has sent energy costs soaring, with electricity prices rising 37% higher than those in the U.S. At least 1.4 million additional European households will be pushed into energy poverty by 2020. For example, in 2003, roughly 6% of the UK population qualified as “fuel-poor” by paying more than 10% of household income on energy. A decade later, nearly 20% of the UK is fuel-poor. As EU energy costs continue to rise, energy-intensive manufacturers are leaving in record numbers. Member states have collectively lost 7 million out of 37 million manufacturing jobs since 2005, as the industrial price of electricity steadily rises. In the UK, large industrial facilities increasingly pay heavy prices for power. A UK governmental forecast of added costs of $28/MWh by year 2020 is contrasted with a Confederation of British Industry projection of $200/MWh. The most sobering example is Spain, where job losses are closely correlated with high household electricity costs. Spain’s unemployment rate is 27%, the highest among EU member states, and up sharply from just 11% in 2008. The EU states illustrate the economic consequences of emissions trading policies. Meanwhile, ETS has delivered virtually none of the promised environmental benefits. ETS was expected to reduce 2.8 billion tons of CO2 from Europe’s power stations and factories when compared to business-as-usual projections. Instead, EU states’ net emissions actually increased during this period, and the scheme’s integrity is deeply compromised by a huge volume of surrendered offset credits. Proposed “reforms” called for by EU Climate Commissioner Connie Hedegaard amount to “backloading,” a desperate maneuver to prop up the ETS by withholding emission allowances from auction to artificially create scarcity and increase carbon prices and energy costs for families and businesses. By changing the rules, inflating energy prices, imposing additional renewables subsidies and mandates, and penalizing fossil fuels further, activists hope to resuscitate this dying scheme. The necessity of a radical policy change seems to be recognized by everyone except the EU bureaucrats. For example:

The ETS impact on the EU member states thus offers a preview of the energy and economic consequences of implementing similar emissions trading policies globally. These policies should be avoided and, where implemented, reversed. |

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)