ShaleTech: Woodford - Play extensions result in more liquids production

In 2005, when shale exploration was taking off, with the Henry Hub gas price above $13/Mcf, Woodford was just plain Woodford. After gas prices cratered in 2009, operators focused their attention on the Cana Woodford, the liquids-rich shale play in Canadian County, Okla. The continuing search for liquids opened up a new area called SCOOP (South Central Oklahoma Oil Project), featuring a 400-ft, liquids-rich shale section with two targets—upper and lower Woodford.

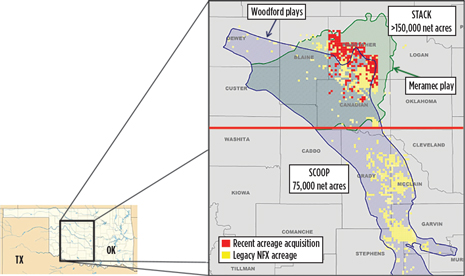

In 2005, when shale exploration was taking off, with the Henry Hub gas price above $13/Mcf, Woodford was just plain Woodford. After gas prices cratered in 2009, operators focused their attention on the Cana Woodford, the liquids-rich shale play in Canadian County, Okla. The continuing search for liquids opened up a new area called SCOOP (South Central Oklahoma Oil Project), featuring a 400-ft, liquids-rich shale section with two targets—upper and lower Woodford. Most recently, Newfield Energy has extended its operations north of Canadian County into an area it calls STACK, which provides access to 700 ft of an oil-saturated column in several Woodford shales and—get this—Meramec shale, Fig. 1. As such, the Woodford is growing both geographically, throughout south-central Oklahoma, and geologically into deeper shales. Newfield and other operators will now be able to exploit stacked shales to produce oil and condensates for decades to come. If the Henry Hub natural gas price remains above $4/Mcf for a sustained period, some of the dry gas areas of the Woodford will, once again, become commercially viable.

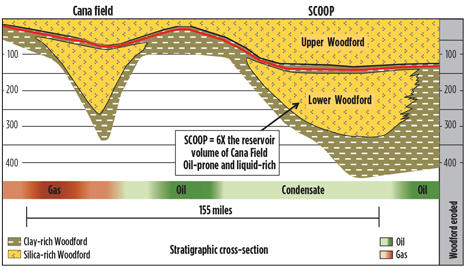

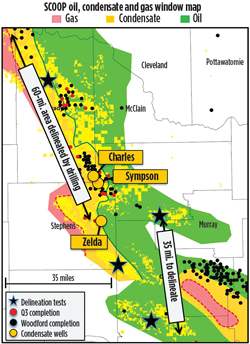

EXTENSIVE RESOURCESThe Woodford shale is primarily a Devonian source rock that extends 11,000 sq mi in central and southern Oklahoma across the Anadarko, Ardmore and Arkoma basins. Distinguished between upper, middle and lower members, the shale thickness ranges from 75 ft to 400 ft at a depth of 6,000 ft to 14,000 ft. The total organic content (TOC) ranges between 6% and 12%. According to the Oklahoma Geological Society, the Woodford shale has a thermal maturity of 1.1% to 1.5% Ro, which is conducive to shale exploitation. According to a 2010 USGS assessment, the Devonian Woodford shale has undiscovered resources of 16 Tcf of gas, 400 MMbbl of oil and 250 MMbbl of condensate. In particular, Continental Resources believes the SCOOP area has six times the hydrocarbon resources, as compared to the Cana Woodford, Fig. 2.

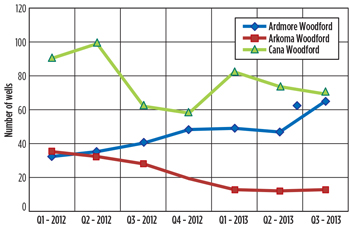

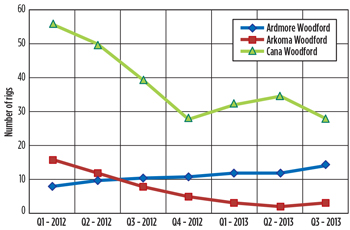

COMPLEX RESERVOIRUnlike the Bakken and Barnett shale plays, the Woodford presents complex shale structures with multiple faults that can make it difficult to ascertain sweet spots and determining optimal lateral placement and length. Operators typically depend upon 3D seismic, well logging and core analyses to map faults and discern dip orientation. Furthermore, the Woodford shales are deeper than other shale plays, so it is necessary to drill vertically 6,000 ft to 11,000 ft before making the horizontal turn. As such, the well can cost $3 million to $6 million to drill and complete, making some areas uneconomical. OPERATOR ACTIVITYDrilling operations in the Woodford are driven by economics. Baker Hughes data for wells (Fig. 3) and rigs (Fig. 4) show how the operator focus has shifted from predominantly gas (Arkoma) to predominantly condensate (Cana) and now to oil (Ardmore). The leading operators are all U.S. independents—Devon Energy, Continental Resources, Marathon Oil, Newfield Energy and Cimarex Energy. Majors, who have an interest in the Woodford, include XTO Energy, a subsidiary of Exxon Mobil, and BP.

Devon Energy. The Oklahoma City-based independent is divesting its assets in the gas-prone Arkoma Woodford (despite production of 4,000 boed) and focusing its activities in Cana Woodford and Mississippian-Woodford oil shale. In the Cana, Devon has 248,000 net acres, with a production rate of 342 MMcfed that is being maintained by operating nine drilling rigs. In the Mississippian-Woodford, Devon has leased over 650,000 net acres with access to multiple oil-bearing intervals. In September, the company was producing 11,000 boed, an increase of 60% over June 2013. The company had planned to drill 350 wells by the end of 2013 by operating 15 rigs. According to Devon, drilling and completion costs in the Woodford oil shale are in the order of $3 million. The 30-day initial production (IP) rate ranges between 300–350 boed, with an estimated ultimate recovery of 300,000 to 400,000 boe. The oil-to-NGL ratio is about 35%. In contrast, for the Cana Woodford, drilling and completion cost for a well is about $8 million. The 30-day IP rate is 5 MMcfed, EUR is 9–10 Bcfe and the oil-to-NGL ratio varies from 10% to 30%. As such, the focus on Mississippian-Woodford oil shale makes eminent economic sense. Continental Resources. Also headquartered in Oklahoma City, Continental Resources has drilling and production operations in the Anadarko and Arkoma Woodford. In this area, now identified as SCOOP, Continental holds 320,000 leased acres with 920 MMboe of proved reserves. Continental produced 20,100 boed of net production during third-quarter 2013, a 14% increase from the previous quarter and nearly three times the production over the same quarter in 2012. The independent operates 12 rigs in the play and expects to add six more rigs by mid-2014. Five of the rigs are drilling cross-unit wells (each unit consisting of 640 acres) with 2-mi laterals. A typical cross-unit well costs $13 million, saving the company $3 million from the cost of having to drill two wells. The company is also switching from 160-acre to 80-acre spacing to essentially double contact with the shale reservoir. Continental has allocated $100 million for SCOOP exploration and $720 million for development in 2014. For its SCOOP wells, Continental has provided production results, based on a 1-mi lateral. In the condensate fairway, the EUR is 1.2 MMboe with typical breakdown of 39% gas, 37% NGLs and 24% oil. In the oil fairway, the EUR is about 526,000 boe with 25% gas, 23% NGLs and 52% oil. With current Henry Hub price above $4/Mcf and oil price at $90/bbl, the company is enjoying a condensate well-rate-of-return above 60% for a typical well cost of $9 million. Newfield Energy. The Woodlands, Texas-based independent has 225,000 total acres in the Anadarko—175,000 net acres in the STACK area and 75,000 in SCOOP. According to Newfield, the company is able to target a 700-ft oil-saturated column in the STACK play with an EUR range of 800,000 to 1 MMboe/well. The production consists of 70% liquids, of which 40% is oil. The company is operating eight wells with average IP of 961 boed and 90-day average rate of 597 boed. Newfield’s SCOOP acreage is divided into 45,000 acres in the oil window and 30,000 acres in the wet gas window. In the SCOOP oil area, Newfield reports that its recent wells (seven in total) are producing above the typical decline curve at the IP rate of 1,511 boed (55% oil) and 90-day rate of 1,134 boed (48% oil), Fig. 5. In the SCOOP wet gas area, Newfield is operating 11 wells, with average IP of 1,805 boed (24% oil) and a 90-day rate of 1,430 boed (22% oil).

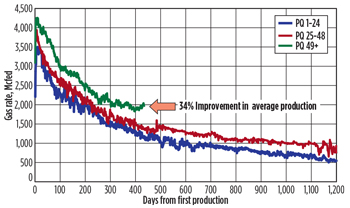

Cimarex Energy. The Tulsa-based independent applied a capital budget of $475 million to drill about 55 net wells in the Cana Woodford area, where it has 75,000 leased acres that are held by production. The company’s production has grown from 81 MMcfed in 2010 to 221 MMcfed, year-to-date, in early December 2013. Cimarex is running three operated rigs in the area and hopes to drill 660 net wells with a future capex of $5 billion. Through drilling efficiencies, Cimarex has reduced the cost of its wells from $7 million to $6.5 million, each. Marathon Oil. The Houston-based independent holds 180,000 net acres in resource plays across the Anadarko basin, with 40% of the acreage having access to stacked reservoirs. The total resource potential is about 1.2 Bboe. Marathon has reported growing acreage by 21% during 2013, at what it considers to be a low cost. Also in 2013, Marathon shifted its operations to SCOOP, to focus on condensate and oil production. The company has improved drilling and completion efficiency by increasing the fracing from 12 to 14 stages, and improving understanding of geosteering, landing intervals and stimulation design. As a result, Marathon has reduced its drilling time to TD, from 73 days in 2011 to 46 days in 2013. During 2014, Marathon plans to drill 20–25 wells through a four-well program. PetroQuest Energy. The Louisiana-based independent has leased about 89,000 acres in the Arkoma basin, of which 28,000 acres are in the liquids-rich area, and 60,000 acres are in the dry gas area. Petroquest planned to drill 16 wells in 2013 and 50 wells in 2014. It is producing 1,000 boed of NGLs. The average IP rate is 2.8 MMcfgd and 275 boed. The company has achieved continuous improvement in production, a 34% improvement between the first 24 wells and the 49-plus wells, Fig. 6.

XTO Energy. Exxon Mobil doesn’t report its Woodford shale activity as a separate line item. In Oklahoma, as a whole, XTO Energy has 773,000 acres that include conventional leases in the Panhandle and shale leases in south-central Oklahoma. The company operates 13 rigs throughout the state, and was producing 308,000 cfgd and 6,000 bopd in December 2012. In September 2013, XTO acquired BNK Petroleum’s Woodford shale gas assets in south-central Oklahoma for $147.5 million. BP. In 2008, BP acquired 90,000 acres in the Arkoma Woodford from Chesapeake Energy for $1.75 billion, which at the time, was producing 50 MMcfgd. In April 2013, BP won a lawsuit against Chesapeake worth $22 million as compensation for problems with about 7% of the leases. ENVIRONMENTAL ISSUESWith oil and gas being the mainstay of Oklahoma’s economic activity, the industry enjoys friendly relations with both the regulatory agencies and the public-at-large. Nevertheless, the state has established regulatory standards for hydraulic fracturing, and expressed concerns about water management and the possibility of fracing-induced earthquakes. Hydraulic fracturing. Oklahoma’s regulatory standards for hydraulic fracturing provide a general prohibition against pollution of surface or subsurface fresh water from well completion activities. The rules specify minimum casing and cementing standards. Oilfield-grade steel casing is required for all casing strings. Production casing is required to be cemented a minimum of 200 ft above producing zones. The operator is required to contact the district office within 24 hrs of discovery of a casing problem and requires the operator to take immediate action to repair surface or production casing that fails. With the Woodford shale development, it became necessary for the Oklahoma Corporation Commission to approve the use of larger pits (over 50,000 bbl capacity) to store flowback fluids and water for hydraulic fracturing. These larger pits have a longer design life. Water management. Devon Energy’s water recycling efforts date back to 2008, shortly after the drilling of the first Cana wells, when the company realized that the flowback water was of sufficient quality to be reused. During 2012, when Oklahoma experienced a severe drought, Devon was able to reuse 3 MMbbl of water. Devon built the water recycling facility after working with the Oklahoma Corporation Commission to establish new rules to build a large reservoir. The project includes a 500,000-bbl storage reservoir and a series of pipelines that connect wellsites to the recycling facility. As a result, Devon reduced the amount of water drawn from the North Canadian River. Also, in the first three months, alone, transporting the recycled water via pipeline eliminated the need to dispose off about 7,400 truckloads of wastewater. Newfield Energy has been using Ecosphere’s Ozonix technology for frac water recycling since 2008. A single Ozonix advanced oxidation system can process up to 3,300 gpm, treating water to a level that is suitable for re-use. The process saturates contaminated water with ozone using hydrodynamic cavitation, acoustic cavitation and electrochemical oxidation to oxidize and destroy micro-organisms, while generating no harmful disinfection byproducts. As water cycles through the reactor, bacteria cell walls are destroyed and contaminates are oxidized, returning clean water that is ready for re-use. Earthquake risk. Oklahoma has several fault lines, leading to frequent earthquakes. The frequency has increased from about 100 per year until 2010 to about 1,000 in 2011. A portion of the increase could be attributed to the installation of seismometers across the state. Nevertheless, the Oklahoma Geological Survey investigated the possibility of a fracturing-induced earthquake in 2011, in response to a complaint from a resident in Garvin County, Okla. At the time, fracturing operations were underway at the Picket Unit B Well 4‐18 well in Eola field. A report by geologist Austin Holland concludes that, while there was a strong possibility that fracturing operations could have triggered the earthquakes, it is impossible to achieve a direct correlation without further study.1 TECHNOLOGY APPLICATIONSThe Woodford shale play has been the subject of numerous research studies focusing on reservoir delineation, and improving drilling and completion operations. REE as transformation indicators of organic matter. Researchers at Kansas State University suggest that rare earth element (REE) distribution patterns and total concentration of organic matter in Woodford shale rock suggest a possible avenue to investigate hydrocarbon source rock maturation in the source rock.2 Ten samples of the organic matter fraction of the Woodford shale were analyzed to reveal that REE concentration levels in an average shale range from 170 ppm (parts per million) to 185 ppm, and concentration levels in modern-day plants occur in the parts per billion (ppb) levels. The REE concentrations in the organic matter of the Woodford shale samples analyzed ranged from 300 to 800 ppm. Technology advances in the understanding of Woodford shale reservoir performance. In the Arkoma basin, BP experienced initial stabilized production rates from 2 to 8 MMcfgd and EUR from 2 to 7 Bcf per well. To assist in understanding and predicting this large variation in well performance, BP designed and conducted closely controlled operational experiments in determination of optimal well spacing, selection of horizontal well lateral lengths and variation in frac stage spacing. Through analysis of all the available production and operational data, BP has constructed a Performance Indicator (PI) tool, through which production variations across the field could be visualized.3 SHALE WORKHORSESince 2005, both independents and majors have made a strong commitment to the Woodford shale play. This commitment is evident through extensive leasing of which a majority is now held by production, and extensive theoretical research and practical experiments to improve exploration, drilling and production efficiency. Growing liquids production has resulted in the construction of gas processing facilities in the region. While the Woodford does not receive the publicity that the Bakken and Eagle Ford garner, it is a valuable workhorse of the U.S. shale oil and gas industry. REFERENCES

|

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)