Offshore in depth

|

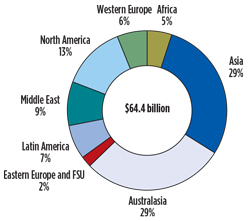

The use of floating facilities to produce, liquefy and ship natural gas, which has been developing slowly over the last decade, is due to explode in the next few years, according to a recent study by energy analysts Douglas-Westwood (DW), Kent, UK. Total expenditures on floating LNG (FLNG) facilities will total $64.4 billion from 2014 to 2020, the analysts say, with two-thirds going to liquefaction infrastructure, and the remainder spent for import and regasification facilities.

“The previous seven-year period saw minimal investment in floating liquefaction infrastructure,” says author Amanda Tay, “but now with the introduction of floating LNG vessels, global FLNG capex is expected to increase significantly over the next seven years. Year-on-year growth over this period is forecast to average 64% per year, and DW expects the increase to be more pronounced after the successful start-up and operation of the pioneer FLNG vessels, such as Shell’s Prelude and Petronas’ PFLNG 1.” The interest in FLNG is growing, primarily because of the advantages it offers. Murray Dormer, the report editor, notes that, “When compared to its onshore alternative, FLNG offers higher security, a cheaper alternative, shorter lead time and the ability to monetize stranded gas fields. While there are inherent risks, FLNG is undoubtedly a prospective market that, in the long-run, is poised to drive many future gas developments.” Being a cheaper alternative is a major advantage. Pumping gas to shore can be prohibitively expensive, but FLNG makes it much more economically viable. Future FLNG projects are expected to open up new offshore gas fields that would otherwise remain stranded, such as those off the coast of East Africa. DW anticipates that more floating regasification units are to be sanctioned, with Asia and Latin America being the dominant regions. In North America, however, discovery of large supplies of shale gas has resulted in the shutdown of many of its operational LNG terminals and cancellation of upcoming import facilities. This development, DW says, should reverse North America’s traditional status as a net importer to that of an exporter. Shell’s Prelude project. At this point, Shell leads the way with its Prelude FLNG vessel, which was floated out of Geoje Island shipyard in Korea for the first time in December 2013. In addition to being the first, the Prelude boasts a number of superlatives: Longer than four soccer fields and displacing six times as much water as the largest aircraft carrier, it will be the biggest floating production facility in the world. The Prelude FLNG will produce at least 5.3 million mt per year (MMtpy) of liquids. That includes 3.6 MMtpy of LNG—enough to easily satisfy Hong Kong’s annual natural gas needs: 0.4 MMtpy of liquefied petroleum gas, and 1.3 MMtpy (35,000 bpd) of condensate. Once complete, the facility will have decks measuring 488 × 74 m (1,601 × 242.7 ft). More than 600 people worldwide spent over 1.6 million hr working on different design options for the facility. Despite its impressive proportions, the facility is one-quarter the size of an equivalent plant on land, since components will be stacked vertically to save space. Indications are that the Prelude FLNG will not be the last for Shell. In July 2009, Shell signed a 15-year umbrella contract with the Technip Samsung Consortium for a program of generic FLNGs. The original agreement has been extended to cover innovations for the next generation of Shell FLNGs, which are at design stage now, in Paris La Défense in France. Petronas’ PFLNG 1. Meanwhile, Petronas is not far behind. The keel-laying process for Petronas’ PFLNG 1 at the Daewoo Shipbuilding and Marine Engineering shipyard in Okpo, South Korea, began in January. The first block of the keel, the basic structure around which the hull of the vessel will be built, was laid on Jan. 6, 2014, in the presence of the integrated project team led by Petronas and its partners, Technip and DSME. Construction of the facility, which began in June 2013 with the cutting of the steel for its hull, is scheduled to be completed in fourth-quarter 2015, making it the world’s first to be in operation. The PFLNG 1 facility will operate in Malaysia’s Kanowit gas field, 180 km offshore Sarawak. When operational, the facility will weigh about 125,000 mt and measure 365 m in length. It will be the first to use the dual-row cargo containment system to ensure limited sloshing within its hull. The facility will produce 1.2 million mt of LNG per year and will play a significant role in Petronas’ efforts to unlock the gas reserves in Malaysia’s remote and stranded fields. More projects. DW expects a continuing stream of investments and sanctioning of FLNG projects, post successful operation of PFLNG 1 and Prelude. Financing is expected to become easier and cheaper, while contracting structures will become more mainstream. Floating LNG can also be expected to increase representation in the global gas mix. For the full report, World FLNG Market Forecast 2014-2020, contact admin@douglaswestwood.com. |

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)