|

|

| One of the six rigs that BHP Billiton is running to appraise its 74,000-acre Delaware basin leasehold. Courtesy of BHP Billiton. |

|

While the drop in oil prices has sent shivers through Wall Street, for the time being at least, the reaction has been a bit more lukewarm along the well-worn arteries crisscrossing the ageless and again resurgent Permian basin.

Granted, even though 2015 capital expenditures remain under the microscope, and an appreciable decline in the torrid rig count lingers on the horizon if prices continue to slide, no one expects the Permian to take a back seat as the nation’s premier oil producer anytime soon.

The one thing that operators and analysts can agree upon is that the Phoenix of the oil field can weather reasonable price slumps better than some fellow liquids-rich unconventionals, suggesting a larger shift of resources from other plays. The chief of Occidental Petroleum Corp., which controls some 2 million acres across the multi-horizon theater stretching across most of West Texas and eastern New Mexico, told analysts as much during the third-quarter earnings call.

“Regarding our interest in the Williston (Bakken) and Piceance basins (Colorado), given the current product price environment, we plan to operate these assets with less capital, in order to generate free cash and shift our investment towards our higher growth and higher return on operations in the Permian basin,” said Oxy President and CEO Steve Chazen. “The issue in the Bakken is it simply can’t compete for the returns being earned in the Permian.”

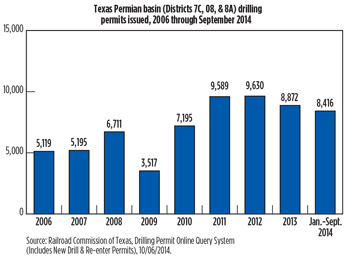

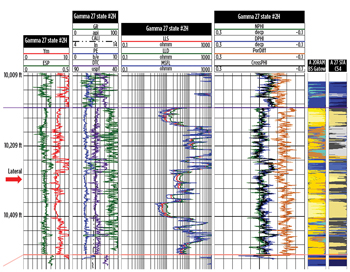

Oxy is among the largest of the scores of operators, representing the full gamut of market caps, many of whom hold legacy acreage positions within the 86,000-sq-mi liquids-rich, and geologically diverse, Permian basin. Among these firmly entrenched players, the immediate response to sliding oil prices should come as no surprise as they, perhaps better than anyone, are well accustomed to the fickleness of cyclical oil prices, Fig. 1.

|

| Fig. 1. As evidenced by recent trends in new drilling permits issued, the Permian basin has rebounded remarkably from its recent low during the height of the 2009 recession. |

|

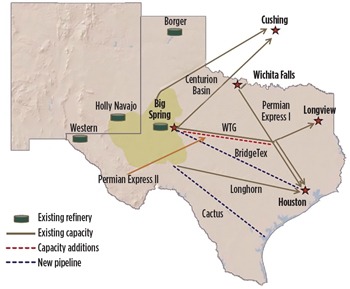

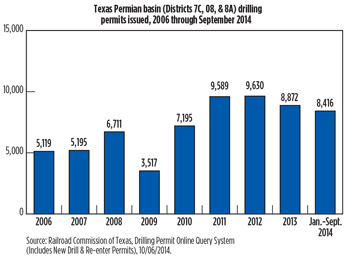

The Permian basin, one must remember, is described as having it all: a comparatively low-cost environment; world-class rock characteristics with no less than 14 prospective, stackable horizons; and a play where vertical and horizontal wells co-exist fabulously. As an added bonus, the 300,000-bpd, BridgeTex oil pipeline went on-line at the end of September, cutting into a takeaway bottleneck that by August had given rise to price differentials as high as $21/bbl, Fig. 2. The expected start-up of the 310-mi Cactus Pipeline in first-quarter 2015 will provide at least 200,000 bbl of additional takeaway capacity and further balance Permian prices relative to the West Texas Intermediate (WTI) benchmark.

|

| Fig. 2. Combined, the new BridgeTex and Cactus pipelines will add some 500,000 bpd of takeaway capacity to the Permian basin infrastructure. Source: Concho Resources. |

|

“The Permian basin in Texas is not only the largest of the shale fields, but also probably the lowest cost. We think they (operators) can make a 10% return on their investment, even at prices below $60,” respected analyst Wilbur L. Ross, Jr., told Bloomberg in October.

NO SLOWDOWN, YET

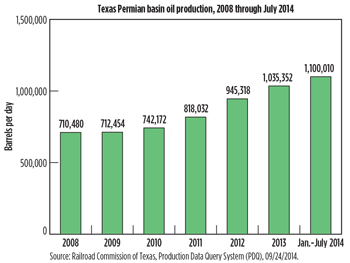

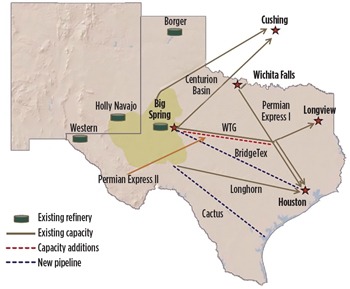

Thanks largely to the still-emerging transition from conventional drilling to horizontal development, production since 2008 has jumped some 60%, according to the U.S. Department of Energy’s (DOE) Energy Information Administration (EIA), which expects the dual-state basin to deliver more than 1.8 MMbpd by the end of this year. In the Texas sector, the latest data from the Texas Railroad Commission (TRC), the state’s chief regulator, show Permian operators producing an estimated 1.1 MMbpd in the first six months of 2014, with condensate production jumping to 16,211 bpd from a recent low of 6,714 bpd in 2011, Fig. 3. Across the border, a sizeable chunk of New Mexico’s oil production, likewise, flows from that state’s segment of the Permian. As of August, New Mexico had delivered more than 10.5 MMbbl, compared to around 8.9 MMbbl in 2013, according to EIA data.

|

| Fig. 3. Six-year oil trends. |

|

As with production, drilling activity has risen to unprecedented levels, with Baker Hughes data showing 568 active rigs working, 475 of which were making hole in the Texas sector, as of the week of Nov. 16, up one from the week prior. The year-over-year rig count is nearly 100 units higher than the same period of 2013, when 469 rigs were turning to the right. According to Baker Hughes, those rigs also drilled 2,701 new wells during the third quarter, up 20% from the 2,351 wells drilled during the third quarter of last year.

Yet, despite comparatively lower break-even prices, continuing at this pace into the new year appears doubtful, as operators begin to consider near-term spending curtailments. The 2015 capital budgets of ConocoPhillips and Shell are the first publicly announced casualties of the weaker pricing regime, with both saying they are looking to dial back spending in the Permian next year. Meanwhile, Apache, on Nov. 20, said it would cut $1.4 billion from its North America onshore expenditures, but was not play-specific.

At the other end of the spectrum, Canada’s Encana doubled down on the Permian with its $7.1-billion acquisition of Athlon Energy, giving it control of some 140,000 net acres in the core Midland basin. The deal, which closed on Nov. 13, is expected to generate average production of 50,000 boed in 2015, with a fifth horizontal rig slated to be added by the end of this year.

In addition, Exxon Mobil’s XTO Energy subsidiary in September acquired 17,000 net acres in a property swap with LINN Energy LLC, which in exchange received the major’s operating interests in California’s South Belridge field. With the February acquisition of 34,000 gross acres from Endeavor Energy Resources within Texas’ prolific Midland and Upton counties, XTO now holds just over 1.5 million net acres.

PLAYS WITHIN A PLAY

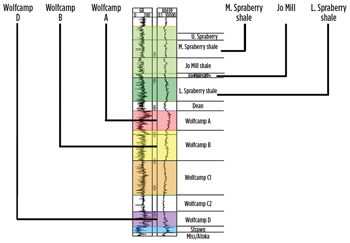

The Permian basin is unique, in that it does not fit into a single geographic or geological basket, with activity split between the more mature and easterly Midland basin and the ascending Delaware basin, which stretches across far West Texas and southeastern New Mexico. Within these sub-basins are myriad prospective, and continually stacked, pay zones, including the multi-bench Wolfcamp and Spraberry formations, which have been producing for nearly 70 years. According to the EIA, the Wolfcamp and Spraberry join the Bone Springs, Glorieta, Yeso and Delaware as the six low-permeability formations most responsible for the recent meteoric rise in Permian production.

A one-time bypassed zone, Bone Springs underlies some 1,313 sq mi across the Delaware basin of southeastern New Mexico, and extending into West Texas. The complex and much-targeted formation, which overlies the Wolfcamp shale, the Ellenburger Group and the Morrow, at depths ranging from 6,000 to 13,000 ft, is described as a thick sequence of interbedded sandstones, carbonates and shale. Stratigraphically, each layer of the three-bench Bone Springs comprises equally productive sand carbonate layers. It is often stacked with the Wolfcamp in what has become known as the Wolfbone.

Depending on the area and who’s doing the analysis, per-barrel break-even points for the Permian vary widely, from a low of $52.56 in the Midland North Wolfcamp to a high of $75.00 for the South Wolfcamp, according to an Oct. 23 Reuters’ comparative examination of three major research organizations. In a Nov. 5 Houston presentation, Norway’s Rystad Energy said break-even prices in the Permian Delaware are generally are lower than its eastern counterpart. The Rystad analysis shows Occidental breaking even at a Delaware basin low of around $40/bbl.

“Even though the Wolfcamp shale is deeper in the Permian Delaware than in Midland, Wolfcamp wells deliver higher IP (initial production) and oil content than those in the Permian Midland. Other targets in the Permian Delaware, such as Bone Springs, deliver well results comparable with the Wolfcamp at a shallower depth, hence lower costs,” according to the analysts.

Oxy remains one of the top producers and among the most active operators in the Permian basin, saying it will exit 2014 with 34 rigs while planning to drill 80 wells within its core leasehold. The operator delivered 77,000 boed in the third quarter, which was 7% higher than the prior three months, said Vicki Hollub, president of Oxy Oil and Gas, Americas.

She said Oxy has a three-fold approach aimed at reaching 120,000-boed production by 2016, which begins with “correlating rock and fluid properties to production performance across Oxy’s entire Permian acreage position.”

Chazen said Oxy has managed to lower total well costs in the Midland sub-basin to around $7.0 million to $7.5 million, while wells in the Texas Delaware basin are being put on production at costs of around $8.6 million to $8.7 million. “Our drilling costs have been improving through some of our efficiency initiatives, but it’s really the completion costs that are driving our total well cost right now,” he said. “What we’ve done recently is increase the size of our frac jobs, which is giving us better productivity and what we think will be better ultimate recoveries.

BHP Billiton, which is operating six rigs, including a spudder, within its 74,000-net-acre position in the Texas Delaware basin, said it likewise has managed to reduce drilling costs, in some cases, to below $4 million/well. “Over the last six months, we’ve drilled some wells with 7,500-ft laterals and measured depths of more than 19,000 ft,” said Rod Skaufel, BHP asset president of North American Shale. “We’ve been able to drill quite a few wells for less than $4 million. We’ve gone from a three-string to a four-string casing design and optimizing around that, so we clearly see our costs as being very competitive.”

BHP put 44 wells online during fiscal year 2015, and has established a production target of more than 100,000 boed for its Delaware basin holdings, which are delivering approximately 20,000 boed. Skaufel said BHP is continuing its ongoing appraisal program, which now includes vertical wellbores, with the Wolfcamp and overlying Bone Springs as the primary targets. “We’ve actually moved from appraising via horizontal to vertical wells. We frac a small section and extrapolate the results from a vertical well into what a horizontal well would do. It’s been very effective, in that it allows us to quickly appraise multiple zones,” he said. “Our targets in the area primarily are the Wolfcamp and Bone Springs, as we like both of these zones. Over the next year or so, we’ll start moving toward more development drilling, which entails four to six wells per pad. We’re also continuing to tweak our completion designs.”

As of now, BHP has no plans to reduce its rig count in the face of lower prices. “We take a longer-term view on price. If the lower price is sustained, we would certainly re-evaluate, but right now our objective is to maintain stability, as that allows you to drive improvements in your organization,” he said.

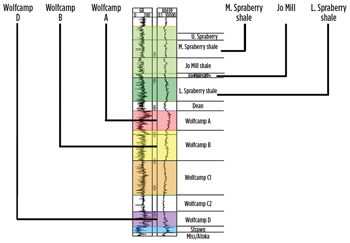

In the Midland basin to the east, Pioneer Natural Resources this year completed the horizontal transformation of its core 825,000-acre position in the greybeard Spraberry/Wolfcamp play, which began production when Harry Truman was U.S. president. Pioneer has concentrated its activity in the Spraberry/Wolfcamp (Fig. 4) since the early 1980s, and after its three-year transition from predominantly vertical to horizontal wells, managed to double production in the third quarter to 103,000 boed. In a $70-to-$80/bbl price environment, Pioneer says it remains on target for 16-21% year-over-year production growth through 2016.

|

| Fig. 4. Pioneer has transitioned successfully to a horizontal drilling and development program on its legacy Spraberry/Wolfcamp play. Source: Pioneer Natural Resources. |

|

“We’ve successfully transformed our Spraberry/Wolfcamp acreage from a vertical play into a world-class horizontal play, appraising six highly prospective stacked intervals,” said Chairman and CEO Scott Sheffield.

Sheffield illustrates the multi-generational makeup of many Permian basin operators, as his son, Bryan Sheffield, is CEO of the nearly seven-year-old Parsley Energy Inc, which in the third quarter averaged 15,300-boed production. Parsley holds an estimated 120,000 acres in the Midland basin, where it targets the stacked play fairway of the Spraberry, Wolfberry and Wolftoka Trends. The younger Sheffield, incidentally, named his company in deference to his grandfather, Joe Parsley, who drilled a number of production wells in the Midland area during the 1960s and 1970s, according to a Nov. 3 Forbes profile.

OPTIMIZING SPACING, COMPLETIONS

Given the risk of communication between countless vertical wellbores drilled over more than 100 years, and the multiple zones now in play as the Permian transitions toward horizontal development, a number of downspacing and completion optimization pilots are underway throughout the Permian sub-basins.

As part of its wholesale transition to horizontal development, Pioneer began multi-well pad drilling earlier this year (Fig. 5) and says early test results suggest spacing could effectively be reduced from 140-acre to 110-acre spacing, and “in some cases, a little less,” said Dove. “We’re learning what’s optimal, and the most significant optionality is making sure that we limit the amount of offset wells that are off production at any given time, as well as make sure that we understand the interference between the wells. Right now, we think, we can easily frac and complete (Wolfcamp) A and B wells, though, in a staggered sense,” he told analysts.

|

| Fig. 5. Pioneer began multi-well pad drilling and development this year, as illustrated by these four rigs on its Hutt lease. Courtesy of Pioneer Natural Resources. |

|

Devon Energy plans to conduct downspacing pilots in the first half of 2015 that it hopes will increase its inventory of prospects, in its campaign to target the second Bone Springs interval. Owing to significant contributions from its Bone Springs wells, Devon increased Permian basin production to 98,000 boed in the third quarter, a 20% increase over the same quarter last year. Devon ran an average of 21 rigs on its 1.3-million-acre leasehold.

Devon COO Dave Hager said the operator has identified unexploited additional zones within the second Bone Springs, as well as an upper Bone Spring sand. “There are not only downspacing opportunities, but there are stacked lateral opportunities in the Delaware basin that again could significantly increase our inventory,” he said.

Complementing its plans to initiate multi-zone spacing tests, BHP recently contracted Halliburton’s Pinnacle to conduct a microseismic survey that will comprise both surface and subsurface arrays. “We’re using microseismic to evaluate both the horizontal extent of the fractures as well as the vertical growth,” Skaufel said. “We’ll actually run a couple of different types of pilots over the next six months to get a better sense of well interference, and what type of spacing we should be looking at. We’ll also do a stacked pilot between multiple zones to, again, evaluate the interference effects of developing multiple zones on the same pad.”

OPERATOR SNAPSHOTS

A sampling of the most recent earnings reports of some of the other most active operators in the Permian basin shows a high level of momentum going into what may be a very cloudy year.

Chevron controls roughly 1.5 million acres, spread out across the Midland and Delaware basins, where it has been running a cumulative 29 rigs this year. Most of its activity has been centered in the Midland sub-basin where the major operates 18 rigs, with plans to end 2014 with some 370 new wells. To the west, Chevron is running 11 rigs within its 1-million-acre Delaware leasehold, where its 2014 plans called for around 180 new wells.

The operator says it intends to exit 2014 with Permian oil production 10% higher than projected earlier in the year.

With more than 3.3 million gross acres prospective for several horizons, Apache ranks among the largest leaseholders in the Permian, and at the end of the third quarter, had nearly doubled its earlier-forecasted production for the year. Chairman, CEO and President Steve Ferris attributes much of the increase to the operator’s shift to more horizontal drilling in the basin, adding that at the end of the third quarter, 28 of the 43 rigs Apache was operating were constructing lateral wellbores.

|

| Fig. 6. Apache delivered 155,244 boed from its wide-ranging Permian basin holdings in the third quarter. Courtesy: Apache Corp. |

|

In the Delaware basin, EOG Resources says the newest wells targeting the second Bone Springs sand, underlying the Leonard shale and overlying the Wolfcamp, is delivering production ranging from 500 to 1,400 bopd. EOG, which holds 73,000 net acres prospective for both the second Bone Springs interval and Leonard shale, ran a two-rig program with plans to drill nine wells.

In the first nine months of the year, Cimarex drilled 36 gross (27 net) wells on its Texas and New Mexico Permian Delaware acreage, with recent targets being the Wolfcamp A and D intervals, the second and third benches of the Bone Springs and the Avalon formations. At the end of the third quarter, Cimarex had booked Permian oil production of 33,090 bpd, 117.6 MMcfd of gas and 11,144 bbl of NGLs, representing across-the-board increases from the prior three quarters. The Denver-based independent also is examining results of a stacked lateral test of the Wolfcamp A and B intervals, and an 80-acre spacing pilot in the 100,000 net Wolfcamp acres it holds in Culberson County, Texas.

Despite the impact of the September floods, Concho Resources, which controls 605,000 net acres spread throughout Texas and New Mexico, still managed to produce a record 10 MMboe in the third quarter. Concho said it averaged 113,500 boed during the quarter; of which, 55,200 boed came from its multi-zone Delaware basin holdings. During the quarter, Concho, which operates 34 rigs, including 30 that drill horizontal wells, drilled 79 wells in the Delaware basin, split between 57 targeting the Bone Springs sands, 16 in the Wolfcamp shale, and five in Bushy Canyon, which immediately overlies the Avalon shale, where the operator targeted one well.

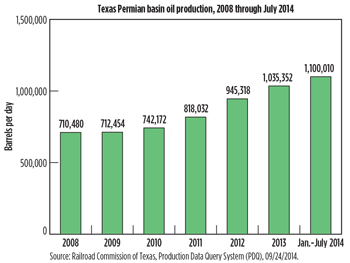

‘BOUTIQUE FRAC’ METHOD AIMED AT INCREASING BONE SPRINGS RECOVERIES

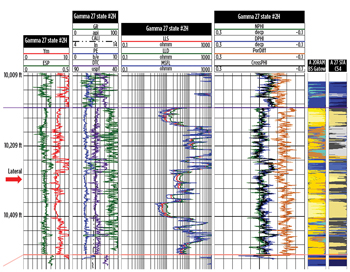

|

| Typical log of a Bone Springs well indicating the lateral landing position. Source: STRATAGEN |

|

A novel methodology featuring boutique designs engineered for every frac stage, using readily accessible mud logging response data, shows promise in optimizing reservoir drainage from the Bone Springs, a former back-out zone and now the premier horizontal target in New Mexico’s Permian Delaware basin.

The once-ignored Bone Springs emerged quickly when advanced logs revealed a much thicker horizontal pay zone than that seen in earlier generation logs. Thus, the placement of laterals with several frac stages gained steam, boosted in no small part to the superb well control realized when landing horizontal sections between mature and deeper vertical wells.

The fully interconnected stimulation methodology developed by STRATAGEN, a CARBO business, essentially customizes individual frac stages to quantify permeability and reservoir quality throughout the lateral. Preliminary results have shown “appreciable increases in per-well recoveries,” said Lyle V. Lehman, STRATAGEN managing principal consultant.

Lehman said the boutique design addresses a major drawback of a typical homogenous strategy where every frac stage is stimulated identically, thereby resulting in inadequate coverage of the total play. “Fracing uniformity across the lateral left little opportunity to optimize stage efficiencies, as both lower and higher permeability zones were equally stimulated, which considerably restricted cumulative reservoir drainage. The key to optimizing production is to precisely determine the permeabilities in each zone of the lateral, and tailor each frac stage to capitalize on the identified degree of permeability in individual zones.”

Lehman said one of the primary advantages of the boutique fracing approach is that it does not rely on premium logging suites. Rather, it exploits mud log data response and historical frac data analysis to “quantify permeabilities and reservoir quality throughout the lateral.”

In a related development, Lehman said evenly distributing fluid across all frac stages assumes all perfs are sufficiently open. However, more recent data from Bone Springs wells suggests only a 48% efficiency rate, meaning some clusters are under-stimulated and others not stimulated at all. “In other words, if you shoot 100 clusters, you may only have 48 open and after awhile the whole cluster is lost and you are not sufficiently contacting the reservoir,” he said.

He pointed to recent work by NCS Energy Services, which used single-point injection to deliver predictable frac spacing and consistent propped volume, with the end result being improved production response.

|

|