|

| A frac spread at work beneath a South Texas sunset within the estimated 300,000 net acres that BHP controls in the Eagle Ford (courtesy of BHP Billiton). |

|

It was one of the seminal observations that provided a pivotal stimulus in BHP Billiton’s methodical completion and stimulation strategy, aimed at increasing reservoir recovery within its considerable North American shale operations.

“In one of our dry gas fields, we started seeing an acceleration of decline rate in quite a few wells, often at about the same bottomhole flowing pressure,” said Rod Skaufel, BHP asset president of North American Shale. “Our (frac) modeling suggested only 36% of vertical frac height was effectively propped. We saw an opportunity to increase EUR (estimated ultimate recovery) by 20%–60%, with improved vertical coverage and frac conductivity.”

Today, BHP has extended that scientifically oriented approach to all four of its onshore unconventional plays, including the Eagle Ford. There, improving proppant placement and frac geometry are just two elements in a multi-component completion and frac evaluation, which includes both numerical and analytical modeling with diagnostics validation, directed at optimizing completion designs.

“We hear a lot of discussion about IP (initial production) rates, but IP is not the game. A sustainable rate is the game. In shale, you need to be relentless at this,” he said. “We’re a technical company, and we believe technology drives innovation, innovation drives performance, and that’s what we’re all about. There’s some really high-end technical work being done in our teams, and I’m very proud of the technical aspects of the work that we do.”

The technology-centric focus is reflected in its studied and—BHP admits—more expensive approach to its frac and completion programs, an approach that the company says is starting to pay significant dividends. In the fiscal year ended June 30, BHP’s Eagle Ford leasehold produced more than 130,000 boed, well on track toward its target of breaking 200,000 boed by FY2016. Cumulative, 90-day, sustained production rates of select BHP wells, meanwhile, are trending appreciably higher than comparative offsets.

“We could do a cheap completion using slickwater, but if our productivity is lower, ultimately we would be better served by funding a more expensive completion, to have better productivity on a well. We’re willing to spend more money to get more EUR,” Skaufel told a Houston media gathering in June. “Shale is about continuous, year-on-year improvement. I want my next well to be cheaper than my last well, but I want my next well to be more productive than my last well. This puts a premium on your organization’s ability to learn and learn fast.”

Skaufel echoed BHP Billiton Petroleum and Potash President Tim Cutt, who told a similar media assembly in late December that experimentation with new completion techniques and technologies has increased up-front costs, but also ultimate reservoir drainage. “In the Eagle Ford, our completions are probably $1 million to $1.5 million more expensive than some of our competitors, but we also are seeing higher EUR.”

ROOM TO STUDY

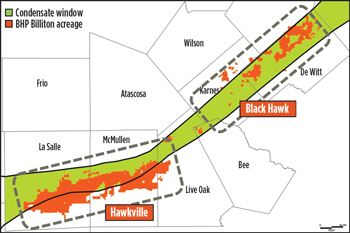

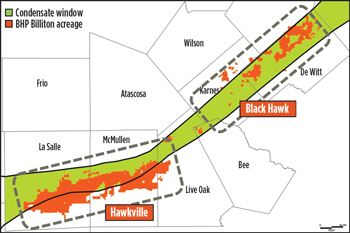

BHP’s field lab comprises a leaseholding of about 300,000 net acres, spread out between its Hawkville and Black Hawk fields, Fig. 1. Late last year, the operator also “accessed options” for an additional 70,000 net acres prospective for the underlying Pearsall formation, where the first well was undergoing testing at year-end. “We believe the Pearsall holds potential for additional liquids production,” Cutt said last year.

|

| Fig. 1. BHP’s Black Hawk and Hawkville Eagle Ford leaseholding. |

|

And, like most of its peers, liquids are the commodities of choice for BHP, which holds an aggregate 1.5 million net acres within the oily Eagle Ford and Permian basin, and the dry gas-dominant Haynesville and Fayetteville shales. BHP has earmarked some $4 billion per year for its U.S. shale operations, and roughly 75% of its activity is focused on the liquids-rich Eagle Ford.

Consequently, of the 25 rigs that BHP is operating in its onshore U.S. drilling campaign, a fleet of 17 new-generation H&P Flex rigs, Fig. 2, with walking/skidding packages is stationed in the Eagle Ford, where they will drill an estimated 294 wells in the current fiscal year. In FY2014, BHP averaged 19.3 rigs in the play and drilled a cumulative 305 wells.

|

| Fig. 2. The advanced H&P Flex rigs with walking/skidding packages have been widely recognized as key contributors to BHP’s drilling efficiency gains in the Eagle Ford. |

|

Reflecting the emphasis on liquids, Skaufel said 14 of the Eagle Ford rigs are making hole in the condensate-laden Black Hawk field in DeWitt County, which BHP now operates under a 50-50 joint venture with Devon Energy (which earlier this year acquired former JV partner GeoSouthern). “The Black Hawk is as good as it gets in the Eagle Ford. It is the best of the best. We’ve got 58,000 net acres there, and much of our technical work is focused in this area, just because this is where our activity is so high.”

SETTING THE PACE

Skaufel acknowledges BHP faced more than its share of growing pains upon entering the U.S. shale sector, which required scaling a steep learning curve, and quickly. The petroleum arm of the Australian mining conglomerate made its onshore U.S. shale debut in 2011, with the purchase of Chesapeake Energy’s Fayetteville shale holdings in Arkansas, which it followed shortly afterward with the $12.1-billion acquisition of Eagle Ford pioneer Petrohawk Energy. Skaufel acknowledged that despite its extensive experience in deep water, BHP was a bit surprised at the remarkably different set of dynamics in the shale theater.

“We were primarily a deepwater company going into an onshore game, where your systems and processes really were built around that. Our costs were high initially, as I don’t think we really had an appreciation for how intricate the work environment is and how well coordinated it needs to be,” he said.

Compared to the offshore arena, Skaufel said the then-new shale player also had to cope with a third-party workforce that was relatively inexperienced in the oil and gas industry, with many workers having transitioned from other industries. Accordingly, the incident rates were considerably higher than the average elsewhere within BHP’s global petroleum operations. Thus, the early emphasis was on working closely with contractors to bring the total recordable incident frequency (TRIF) rates more in line with the rest of the organization. By 2012, he said the H&P rigs drilling for BHP had become “the safest rigs in their entire fleet, which we attribute to the partnership we have with our contractors.”

“Our total reportable incident rate for petroleum is about three incidents per million man-hours. When we got into shale, we saw incident rates of six or seven. We’ve quickly worked that down to where it’s competitive with the rest of our business.”

Since its conception, BHP’s Houston-based shale organization has grown exponentially, now boasting a workforce of more than 2,000, including “engineers and geologists recruited from nearly every major shale player,” Skaufel said. The petroleum division also broke ground last year on a new 30-story office tower in Houston.

In addition, to help maximize efficiencies, Skaufel said the Eagle Ford shale group also focused on establishing strategic partnerships with select contractors and service providers, namely H&P and Schlumberger, which he described as “philosophically well-aligned around what we want to do.”

Skaufel cites the distinctive pacesetter initiative, in tandem with benchmarking best practices, as key elements in driving both drilling and completion efficiencies. The pacesetter program individually evaluates the surface casing, production casing and horizontal laterals of the typical, three-string Eagle Ford wellbore. Benchmarking takes over from there and explores which rig drilled each section the fastest.

“We look at how they did it, and then we try to replicate that across our entire rig fleet,” he said. “We’ve seen a 25% improvement in both time and cost. We’ve done that through retendering of contracts, fit-for-purpose specifications, elimination of waste and reducing variability in our drilling. But, it all got started with the benchmarking exercise that we started about a year-and-a-half ago.”

“What we try to do with benchmarking is ask if the things we’re doing are working. Or is somebody doing it better? If you’re going to benchmark in the Eagle Ford, you’ve got to be very geographically specific, because the variability across the play is tremendous.”

One should count V.P. of Drilling and Completions Derek Cardno among the most ardent devotees of both the pacesetter and benchmarking initiatives. “When you’re running 17 rigs, everybody has an opinion of what works best. We use facts to tell us what is the best, which we adopt and combine with the drive for continual improvement in each section of the well.”

The results are clearly evident in the comparatively deeper and hotter Black Hawk field, where average rig time, from spud to release, has dropped more than 26% since the first quarter of FY2013. Skaufel said drilling costs for Black Hawk wells, likewise, have dropped year-on-year by more than 24%, to an average of just over $4 million.

“Our costs have come way down over the last year, and it’s because now we’ve got time to actually be able to look at what we’re doing, analyze our data, and improve,” Skaufel added. “Last year, we were running 45 rigs in all our shale plays, and today we’re running 25, and we’re drilling almost as many wells with 25, as we did with 45 rigs. When we were running at that higher pace, it was just unsustainable.”

“Our floor is a lot lower than $4 million a well. Again, I think we’ve got a mentality right now in the organization that helps drive that performance.”

Meanwhile, cost containment even extends to how BHP monitors its daily unconventional well operations. Rather than rely on elaborate and cost-intensive remote operations centers, BHP provides its pertinent engineers Tablets downloaded with readily available software. This allows them to monitor drilling and completion and critical operations “anywhere and at anytime,” Cardno said.

Well placement is another area occupying much of the evaluations nowadays, in particular the avoidance of inter-well communication and the ensuing frac hits that can occur, as wellbores become more tightly spaced. “Frac hits are a real problem, both for completions and drilling,” said Cardno. “We’re developing what we call focus areas, where we drill and complete all the wells in a given area. We try to build up stresses, when we complete them and break up as much rock as possible. Otherwise, what we’ve found is that when you drill a well to hold acreage by production, you typically get a frac hit when you go back and complete other wells, which hurts the parent well. Also, when you drill into a fracture, you will likely have a well-control issue.”

OPTIMIZING COMPLETIONS

Capturing production-enhancing wellbore stresses and altering frac geometry are among the completion optimization experimentation that BHP is undertaking in the Eagle Ford. At the foundation of the operator’s steadily advancing evaluations of completion and stimulation designs is extensive use of numerical and analytical modeling. “We truly believe that you can use both numerical and analytical models to drive your trials, and to guide your pilots. We also invest heavily in diagnostics, in order to validate our models and to gather additional insights,” Skaufel said.

As a case in point, BHP has used fracturing and reservoir simulation models to determine that “very poorly propped fracs” were at the root cause of rapid decline in select wells. “These were slickwater jobs, and so you were getting a little bit of gel without a lot of carrying capacity. The frac modeling suggested that you’re only getting sand transport on the very bottom of the frac. You’re not getting much carrying capacity throughout the entire vertical section.”

The reservoir simulation model, which he said were consistent with parameters used in the frac model, showed a spike in EUR proportionate with propping higher percentages of the vertical frac height. “Right now, we are test-driving alternative completion designs in this field under the premise that if we can improve the vertical propped coverage in this frac, we have got a huge opportunity,” Skaufel said.

In addition, after microseismic and production logging data confirmed disproportionate contribution by individual frac clusters, BHP turned to the Schlumberger BroadBand Sequence fracturing technique, which essentially creates chemical diversion to improve stimulated rock volume and create a more uniform distribution across clusters.

According to Schlumberger, the BroadBand technique uses a composite fluid, comprising a proprietary blend of degradable fibers and multimodal particles to enable sequential stimulation of perforated clusters or open-hole intervals. In the Eagle Ford, Schlumberger claims that the capacity to maximize wellbore coverage and reservoir contact has resulted in more than 20% increases in per capita production from new completions, and up to a 600% increase in the productivity index from refracing operations.

“We’ve done a lot of diagnostic work, both in terms of production logging as well as microseismic. What it implied is that we’re not getting uniform distributions of the frac. Production logs show that one or two clusters are providing the predominance of flow. In fact, you’re not seeing flow from multiple clusters when we go ahead and log this. You want uniform distribution. So what we’ve done is experiment with both mechanical and chemical diversion. Early results have been encouraging,” Skaufel said.

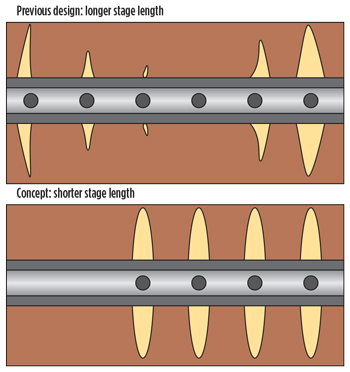

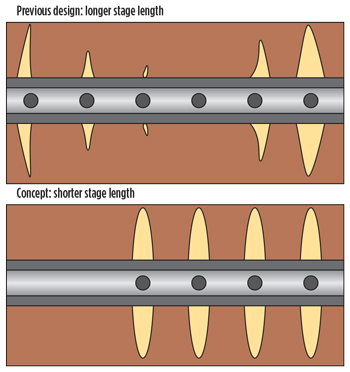

“We used to run longer stages, but now they’re shorter with fewer clusters, Fig. 3. The concept is that if we can get higher rates per cluster, then we may mechanically divert and achieve a more uniform fracture distribution. The shorter stage length is now standard in our operation. We also continue to test chemical diversion, and the results have been promising.”

|

| Fig. 3. Production log and microseismic data prompted BHP to alter its frac designs from longer to shorter stages with fewer clusters, with the aim of creating uniform frac geometry. |

|

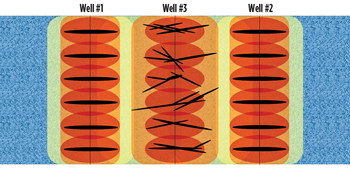

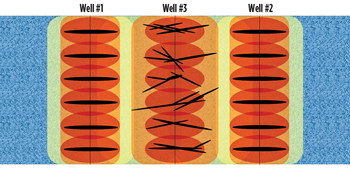

Also standard in BHP’s Eagle Ford completion toolbox is a methodology for capturing in-situ stresses, with the aim of generating more complex fracturing, which, in turn, the theory holds, should contribute to higher and longer production rates, Fig. 4.

|

| Fig. 4. Field observations supported the modeling results seen as part of the BHP-University of Texas stress shadow study. |

|

“Our standard of development right now is that we frac from the outside in to capture in-situ stress. The concept is that when we drill the first well and frac it, a stress field is generated. You drill the second well and frac it, and it also generates a stress field. Because you’ve generated in-situ stresses, the middle well is more highly stressed, so it will have more complex fracturing. That’s the concept, but, of course, production performance is the variable that’s going to determine whether it’s successful. But, we’re encouraged enough to where this is our standard practice,” he said.

“We’ve been doing some work with the University of Texas, and they’ve got a program, where they’re looking at a concept called stress shadowing. They’ve been doing some modeling work on our behalf.”

GOOD NEIGHBOR POLICY

In July, the American Petroleum Institute (API) issued community engagement guidelines that direct operators on how to “build lasting and successful relationships with the local residents.” Skaufel said that BHP had developed its own societal initiatives much earlier, employing the same methodical exercise that it uses to optimize efficiencies and maximize production to foster relationships with community stakeholders throughout its U.S. onshore operations.

“The communities that we work in are extremely, extremely important to us, and I just can’t emphasize that enough. You’re in people’s back yards. We go through a very, very rigorous process in terms of determining where we are willing to put our time, and where we put our money. It starts with a social baseline study, and then we move to a community perception survey, in order to be able to assess what are the key quality-of-life indicators. Of course, you’ll always see a push to minimize environmental impacts,” he said.

FOCUS ON VALUE

Preceding all its top-drawer technical experimentations, BHP conducts equally analytical calculations to determine which assets will deliver the most incremental value, based on current commodity price levels. Consequently, immediate priority today is given to the liquids-rich assets, as illustrated in the higher activity levels in the condensate- and oil-rich Black Hawk field, as opposed to the gassier Hawkville to the south.

“For every single operated well, we calculate the optimum timing to drill that well, based on our views for price projections, as well as the forward cost learning curve. Then, we look at it to see how sensitive it is to timing. So what we’ve seen, as we’ve run through this, is that you typically have three groups of wells—those you want to accelerate and develop now; wells that are insensitive to timing; and wells that you defer for value,” Skaufel said. “This capital allocation methodology drives you towards drilling your liquid-rich wells now. The returns on those wells are also significantly better than dry gas.”

According to Cutt, it all boils down to not necessarily drilling and completing the most wells, but rather getting the most out of the wells that are drilled. “We concentrate on value over volume, and we see real opportunity in the shales, which have a great deal of economic flexibility. The shift to liquids reflects our focus on value, though we do produce a huge amount of gas. We make prioritized investment decisions, based on maximizing shareholder value, while conserving the value of other opportunities for the future. That is where the flexibility of the shale plays gives us real advantages.”

|