STALE ROMUNDSTAD, IVAR MEISINGSET, THOMAS FORDE and DARIA KRASOVA, Aker Solutions, and SVERRE TRESSELT, IPRES

|

| A field development concept by Aker Solutions for Statoil’s Gjøa field in the Norwegian North Sea. To test the parallel field development concept, an Aker Solutions team created a synthetic dataset identified as Aker field. |

|

A number of cost-intensive, technically crucial decisions need to be made in oil and gas field development. A broad range of issues is involved, within geology and geophysics (G&G), reservoir management, drilling/completion technology, production strategy, facilities size/solutions, infrastructure, and transportation to the market. Deciding on the right field development option requires an organization that works together closely across the disciplines. This article presents a parallel, probabilistic approach to field appraisal and development concept selection, rather than the conventional, sequential approach.

PARALLEL PROCESS

Instead of waiting for appraisal drilling to confirm and finalize the reservoir model, front-end concept selection work is started at an earlier stage, based on a model with a high degree of uncertainty. Stochastic depth conversion uncertainty analysis is used to calculate P10-P50-P90 structure maps and gross rock volumes, thus quantifying the uncertainty. A series of field development concepts is estimated to handle the entire uncertainty span. An optimized appraisal drilling program is then proposed, for the purpose of eliminating those uncertainties, which would swing the field development concept selection. This combination of geophysical and engineering disciplines leads to a field development scenario with a minimal drilling cost spent on appraisal, and with an assurance that the optimal field development concept has been chosen.

We have, for the purpose of this study, constructed a synthetic data set, Aker field, in the Norwegian North Sea, which is in the early stages of field development planning. The latest exploration well has made a significant oil discovery. The reservoir is situated relatively shallow, at a depth of about 4,675 ft at a 660-ft water depth. Current data indicate that the reservoir has excellent flow properties in clean sands, with no indications of complex faults and barriers. However, there is still significant uncertainty with regard to top reservoir depth, and as a consequence, the lateral extent of the field. Based on seismic mapping, and reservoir properties from wells in the area, Aker field looks very promising, and plans for appraisal drilling and development are being made.

The conventional (sequential) approach would be to start with appraisal drilling, confirming the reservoir model of the field, and then hand that model over to engineering as the basis for development concept selection. The alternative, which we are exploring in this article, is, instead, to use a parallel, probabilistic approach, where early phase development concept selection is started before appraisal drilling, when the reservoir model still is very uncertain. This is challenging, because people from disciplines who normally do not interact closely have to cooperate, but it can be very rewarding, because the problems are being looked at from additional angles, pulling in expertise that normally is not used at this stage. It is very likely that this approach will lead to improvements in the appraisal program, and in the field development, and thus to significant economic gain.

With the parallel approach, it is not necessary to have a final, fixed model of the reservoir. Instead, it is necessary to understand, and be able to quantify, the most significant G&G and reservoir engineering uncertainties. From this, a small number of reservoir models are made, each with associated probabilities. For the purpose of this article, we have chosen to concentrate on depth conversion uncertainty, and to construct three reservoir models, at P10, P50 and P90 probabilities. Based on these models, we evaluated different appraisal and field development scenarios. In turn, we derived an optimized appraisal strategy, together with a field development program that includes the entire uncertainty span, reaching the best development solution.

METHODOLOGY

The problem of field development concept selection was formulated as follows:

- Evaluate different field development options, including the full span of uncertainties

- Adjust for the proposal of an appraisal strategy to reduce the geophysical uncertainties

- Decide on the best field development scenario, in terms of technical robustness and the best economic value.

The different geophysical maps resulted in different outcomes. An initial appraisal program was proposed by the G&G team for the purpose of reducing subsurface uncertainties. In generating the different development schemes, including the project economics, the team used the IPRiskField computer program. In this program, every parameter is input in a probabilistic manner. Subsequently, every simulation results in a full uncertainty span. Interpretation of these results formed the basis for deciding a preferred development solution, as well as a preferred appraisal program with respect to field development decisions.

GEOLOGY & GEOPHYSICS

A synthetic dataset was created for Aker field, with properties typical for the North Sea. The reservoir is a Lower Tertiary basin floor fan, residing unconformably on Cretaceous limestones. The top and base horizons are well-defined from seismic data. It is a massive sand body of regional extent, which pinches out toward the west. Excellent aquifer support can be expected. Within Aker field, there are no continuous shales or faults, which could act as barriers during production.

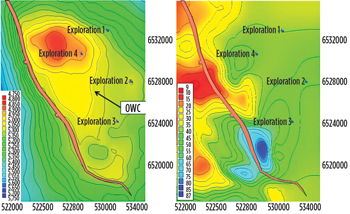

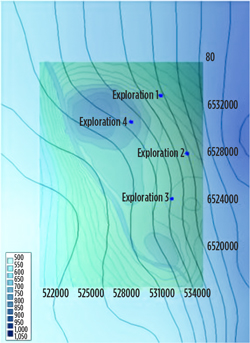

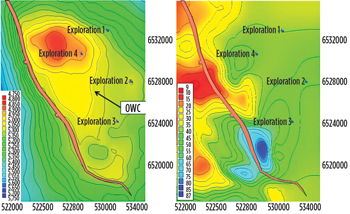

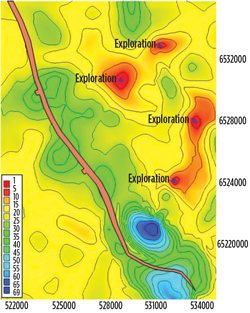

Four exploration wells have been drilled, targeting structures at a deep level, Fig. 1. No oil or gas was found there, and the first three wells were completely dry. Exploration well 4, the discovery well, unexpectedly found oil in the Lower Tertiary. It penetrated 44 ft of oil in a massive, clean reservoir sand. The oil-water contact (OWC) is at 5,007 ft. This well controls the northern part of the structure, but the lack of crestal wells in the south and center leaves a significant depth and volume uncertainty. This uncertainty was studied, using a self-optimizing depth conversion method that uses seismic processing velocities and well data.

|

| Fig. 1. Base case depth (left) and reservoir isochore (right). |

|

Seismic processing velocities are commonly used for depth conversion down to top reservoir in the North Sea. A seismic processing velocity field is a direct measurement of the average velocity, but it also includes noise. The self-optimizing method searches a large number of noise filter realizations, and finds the best deterministic depth case, measured in terms of depth prediction error in the wells. The method can also be used for stochastic velocity uncertainty modeling. With proper parameter search boundaries, the set of realizations scanned for optimal results will span the full range of realistic modeling solutions. It is then possible to calculate meaningful statistical parameters, including standard deviation, mean, minimum and maximum depth maps.

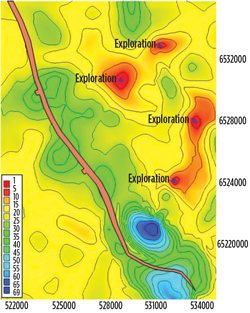

Figure 2 shows standard deviation of depth to top reservoir in Aker field. It is zero in the wells, because all realizations have been well-tied. The largest uncertainties are along the fault. This is partly a consequence of soft sediment deformations, and partly an effect of shallow gas, both related to the zone of weakness created by the fault. (A real velocity data set was used to make this map.)

|

| Fig. 2. Standard deviation of top reservoir depth. |

|

Depth uncertainty is the sum of velocity and seismic interpretation uncertainties. In this study, no seismic interpretation uncertainty estimate was available. Instead, the total depth uncertainty was set to twice the velocity model uncertainty. Based on this setting, and assuming normal distribution, P10 and P90 depth maps were calculated from the mean depth map, adding/subtracting 2 × standard deviation × 1.28.

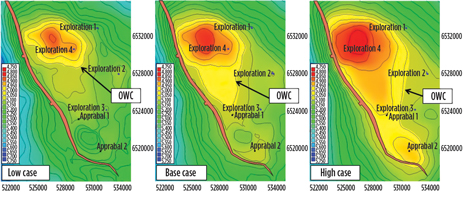

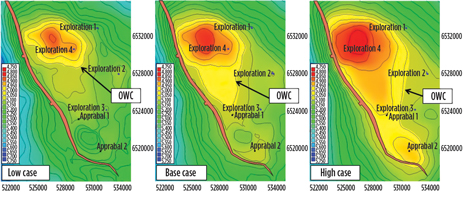

The depth conversion Base Case will give the most likely gross rock volumes, and should form the basis for a field development decision. There are two outputs from the optimization routine, which can be used as Base Case—either the best deterministic case, which has the smallest depth prediction errors in the wells, or the mean case, which is centered (P50) in terms of velocity uncertainty. In Aker field, the analyst used the mean. The P90 (Low Case), P50 (Base Case) and P10 (High Case) depth maps are shown in Fig. 3. The structural uncertainty is evident from this figure. The northern part of the field has a robust closure. The middle and southern parts are flat, and can either be above or below the OWC.

|

| Fig. 3. Low (P90), Base (P50) and High (P10) case depth maps. |

|

An appraisal program consisting of two wells has been proposed by the G&G team to eliminate this uncertainty. Without appraisal, only the northern part of the field, which is above the contact in the Low Case, can be developed.

The first appraisal well, Appraisal 1, is in the center of the structure, directly south of the OWC in the Base Case. If this well is successful, it will prove the Base (or High) Case here, and allow the middle of the field to be developed. The second appraisal well, Appraisal 2, is on the structural crest at the southern end of the field. This well's purpose is to test the High Case. If successful, it will allow the southern part of the field to be developed. Seeing a need to confirm the most likely volumes before field development, and believing that the additional high-case potential in the south could wait until later, G&G proposed to drill Appraisal 1 before concept selection, and wait on Appraisal 2 until after start of production.

The geophysical uncertainty estimation method used in this study is a stochastic process, which determines uncertainty directly from the data. Together with other objective uncertainty estimation methods, it is well-suited for field development studies, where accurate, quantified uncertainties are extremely important as the basis for field development decisions.

RESERVOIR CHARACTERIZATION

The Exploration 4 well, drilled in 2011, proved oil in the Lower Tertiary with the discovery of sand possessing excellent reservoir properties. The reservoir is undersaturated, with a low gas-oil ratio (GOR) and a slightly viscous oil type, based on the analyses of fluids from the well. analyses. Core analyses reveal excellent rock properties. The reservoir parameters used in the volume estimate are shown in Table 1.

| Table 1. Basic reservoir parameters. |

|

|

Even though the reservoir properties from the discovery well showed high quality, there are expected to be variations between different parts of the field. As such, the field is divided into three parts, North, North-S and South. The permeability and porosity of the sands are believed to remain more or less the same. What could differ are potential shale intrusions toward the south, from the North segment into the middle North-S segment, and further into the South segment. The presence of shales between the sands could easily reduce the recovery factor. Another factor that could easily reduce recovery is the fact that both the North-S and the South parts are structurally deeper, opening up the potential for more water encroachment. Based on these thoughts, the recovery factors have been adjusted accordingly, relative to the expected recovery factors in the North (Low Case lowered, due to some thinner sands). Despite the relatively small adjustments, the well count and architecture are kept unchanged. These variables would be adjusted as more data becomes available. Estimated recovery factors and wells for the individual parts are shown in Table 2.

| Table 2. Estimated recovery factors and wells (well figures used in estimating CAPEX for the different scenarios). |

|

|

The oil tests showed somewhat higher viscosity than most oil in the North Sea. A slightly unfavorable mobility ratio would then be expected. Consequently, the plan is to increase the number of oil producers and keep low drawdowns through moderate production rates. Water injection is planned as a recovery mechanism to sustain close to original pressure and stay above saturation pressure. To avoid too early water encroachment, the planned water injection would have to be under strong surveillance.

DRILLING

A decision was made to not pre-drill any wells for the different scenarios. The main reason is the high-risk exposure of drilling development wells without any production history. This decision was evaluated against the upside potential of earlier production, but also the downside potential of contracting expensive drilling rigs in a demanding market. Different drilling rigs were accounted for in the scenarios, including wellhead platforms (one for the small development scenario and one for the large development scenario in the southern part of the field). The wells, which are all vertical/deviated, will be completed one by one. Average drilling time is estimated to be 35 days within the central area and up to 75 days for some of the extended-reach wells being drilled in the South part.

PRODUCTION

The production scheme selected for Aker field involves the use of vertical/deviated oil producers for reservoir development under water injection. The best production scenario, based on current subsurface knowledge of the field, involves oil withdrawal with minimum reservoir drawdown. Even with pressure maintenance from both aquifer and water injection, certain parts of the reservoir will most probably experience some energy loss.

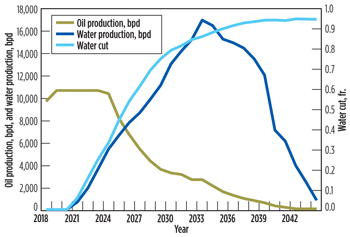

|

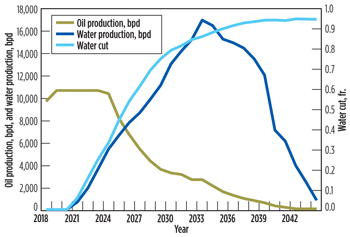

| Fig. 4. Average oil, water production profile and water cut. |

|

Furthermore, the production strategy includes keeping the reservoir above saturation pressure. When the completion waters out, owing to either influx and/or water injection, accountable amounts of oil might be left behind the front. To reduce this risk, the team decided to use somewhat smaller well spacing, combined with moderate withdrawal. Moderate production from this high-productivity reservoir with Darcy sand will then demonstrate a long life production profile. However, produced gas, which is of a smaller order, would be handled and reinjected into a shallower formation. A set of average production profiles (oil, water) is shown in Fig. 4.

DEVELOPMENT AND FACILITIES

A large number of scenarios were considered. Table 3 shows the scenarios that remained after initial screening. Table 4 lists some of the key screening factors. Another factor was the water depth (Fig. 5), which is about 660 ft in the center of the field, increasing steeply toward the east. As such, we have assumed this field to be beyond the capacity of jackup rigs.

| Table 3. Different development scenarios (figures used in estimating CAPEX for the different scenarios). |

|

|

| Table 4. Key factors for choosing development solutions. |

|

|

Aker field is not in the vicinity of any hub or large complex, but for the purpose of this study, we have assumed that a Tora field exists about 25 km from Aker field. Tora field is at a mature stage, and a PDO (Plan for Development and Operation) submittal is planned during 2015.

Aker field has sizeable reserves, and could be developed, based on either a tie-back solution or a stand-alone solution. A tie-back solution requires that a host and a transportation system be available. Additional tie-back issues include capacity, fluid quality, flow assurance, physical distance, timing and, certainly, cost. The cost would include the investments needed to bring the fluid to the host, and the cost of processing, operations and possible modifications to the host platform. For a stand-alone solution, there are several options. One option is permanent structures connected to the seafloor, and another one is floating devices. A third one might be complete subsea systems connected directly to export pipelines.

The team ended up with three scenarios, small, middle and large, which were optimized for the reserves in the P90, P50 and P10 reservoir models, respectively. A small development is a smaller wellhead platform (15 slots), where the wellstream is routed through a pipeline, with tie-back to Tora field. All processing is conducted at the host platform, with further export through the pipeline system. Middle development is a 20-slot platform with processing and accommodation capabilities. Here, the wellstream goes to a floating storage unit (FSU), for further shipment to the market. Large development includes a 30-slot, full processing platform. A wellhead platform (10 slots) placed in the south is tied back to the main platform. The total processed wellstream then goes from the main platform to the FSU, for further shipment and export.

| Table 5. CAPEX and OPEX figures for the development scenarios. |

|

|

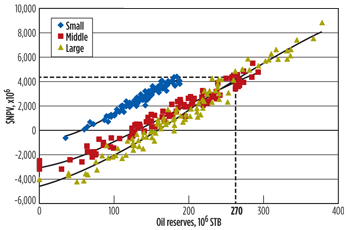

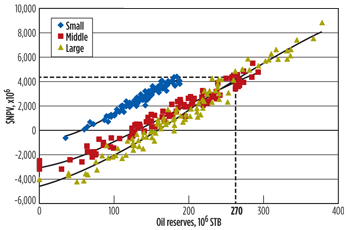

Table 5 shows the Capex (excl. drilling cost) and Opex figures used in the economic analyses. These numbers are input to the program as mode values and include full distribution within the uncertainty span. An NPV analysis of the three scenarios shows the small and large to be the most favorable, Fig. 6

|

| Fig. 6. Cross-plot of oil reserves vs. NPV, for three different development scenarios. |

|

DISCUSSION OF RESULTS

Economics were run probabilistically to define the results in evaluating the different development scenarios. The program being used acquires data from different sources and models the various uncertainties. The probabilistic results being calculated give a good overview of how the different parameters contribute to overall uncertainty. The cross-plot in Fig. 6 shows the reserves vs. NPV for different development scenarios. The figures show that the small development, which reaches a maximum NPV at 200 MMbbl of reserves, has a higher NPV than other scenarios, up to 270 MMbbl. The investments are relatively minor for the small wellhead platform, with the assumption of minimum topsides. Additionally, oil production is being transported to the host, which includes some hook-up cost.

The other two development scenarios have to exceed 270 MMbbl, before they show higher NPV values than the small development. In this volume range, the middle scheme has been passed by the large development. The middle development is not the best choice, in terms of NPV in any volume range. Therefore, only two realistic development scenarios remain, the small and the large. This means, when compared to the P10, P50 and P90 reservoir models, which were derived from depth conversion uncertainty, that the small development is the best for the P90 and P50 cases, and that the large development is best for the P10 case, with the dividing line, at 270 MMbbl, at the midpoint between P50 and P10.

The consequence of this evaluation process is that it becomes unnecessary to drill Appraisal 1 (Fig. 3) before Aker field is put on production, because the results of this well will not have any influence on the field development concept selection. Without this well, all we have proven is the P90 case, with the Exploration 4 well. If Appraisal 1 comes in as prognosticated, then we would have proven the P50 case, but we would still go for the small development. And if Appraisal 1 comes in high, then we would not yet have proven the P10 case, because most of the additional volumes in that case would be in the southern part of the field, where depth uncertainty is larger than elsewhere, Figs. 2 and 3.

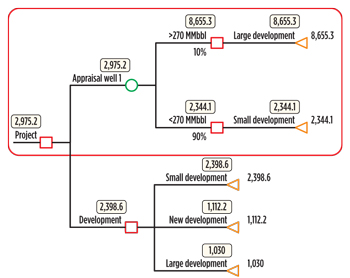

Instead, it becomes necessary to drill the Appraisal 2 well, which is in the middle of the southern portion. The purpose of this well is to test the P10 case. If it comes in high, proving the P10 case in that area, then it will prove up sufficient additional volumes to swing the optimal field development from small to large. This well must, therefore, be drilled before concept selection. This is a complete reversal of the appraisal drilling program originally proposed by G&G. They had proposed to drill Appraisal 1 before concept selection, and Appraisal 2 after production start.

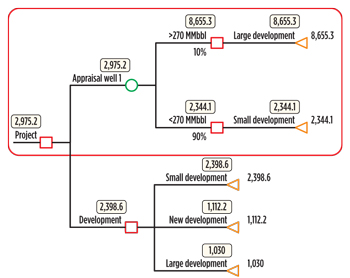

|

| Fig. 7. Optimal decision path for field development concept. |

|

| Table 6. NPV values for the different scenarios (NPVx106). |

|

|

The decision on whether or not to drill Appraisal 2 was based on a risked NPV analysis. The results show that by drilling Appraisal 2, the NPV becomes $2,875 billion, compared to an NPV of $2,398 billion with no appraisal. This is shown further in Table 6. Based on these results, the optimal decision path is shown in Fig. 7.

CONCLUSIONS

On an NPV basis, there were eventually two real development options left to compete out of three in total. The small development scenario showed best values, up to approximately 270 MMbbl in reserves. When the other two development scenarios came to that NPV level, only the large development could further improve the value. Scenario analyses showed that drilling the Appraisal 2 well would be beneficial and increase the overall value in choosing the large development option.

By going straight to Appraisal 2 and taking up the chances for larger volumes, we saved the work and cost of drilling Appraisal 1. Drilling Appraisal 1 would only prove up volumes, which could be handled by the small development scenario. This well could also be drilled later, directly from the platform to prove the volumes.

This study clearly shows the important role that the geophysical uncertainty has in evaluating field development concepts in early stages. Working with the entire uncertainty range could, early on, rule out some options, and converge to a certain solution relative to a deterministic approach.

One of the primary reasons for a successful field development study has been to have an innovative formulation of the problem. By this, we mean having a manageable number of decision constraints and variables as, well as effective workflows implemented for the problem solution. The workflows would provide frameworks for the solution of the field development problem.

This study also has proved the value of working in integrated teams. By working in parallel, and not sequentially, as the classical way, the team managed to pick up valuable information in an early stage. By having subsurface and facilities (engineering) teams working closely together, data and information exchange in the early phases become a valuable asset.

Having a parallel, probabilistic approach to the project covering the entire span of uncertainties improves the quality of the results and the field development decisions.

ACKNOWLEDGMENTS

This article is adapted from OTC paper 24246, presented by the authors at the Offshore Technology Conference in Houston, Texas, May 6-9, 2013. The authors thank the management of Aker Solutions and IPRES in granting permission to publish this article, and Rustem Ackora and Arne Borrehaug of Aker Solutions for valuable discussions.

|

The author

STALE ROMUNDSTAD is Manager, Americas, Integrated Field Development, for Aker Solutions. Mr. Romundstad has more than 20 years of international E&P experience within reservoir technology, field development, portfolio management, uncertainty and strategy management. He graduated from Tulsa University with BS and MS degrees, earned an MBA degree from the Norwegian School of Management and conducted post-graduate work at MIT Sloan School of Management.

SVERRE TRESSELT is a Senior Consultant at IPRES (Integrated Petroleum Resource and Economic Services), based in Oslo. Mr. Tresselt earned an MS degree in petroleum engineering and an MS degree in metallurgy, and worked at Norsk Hydro from 1974 until joining IPRES in 2007.

IVAR MEISINGSET is the Exploration Services Manager for Aker Solutions. An explorationist/geophysicist with 30-plus years of industry experience, Mr. Meisingset worked for Exxon Mobil and Norsk Hydro prior to joining Aker Solutions.

|

|