|

As any service company veteran can attest, the release of the weekly U.S. land rig count often brought more than a little bit of trepidation, particularly during a periodic down cycle, as investment decisions all-too-often hinged on which direction active rigs were trending.

|

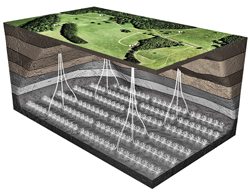

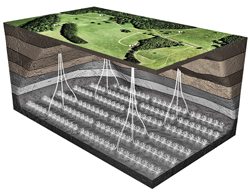

Artist’s conception of the new normal in the U.S. land drilling market. Source: Statoil.

|

|

Beginning in 1943, the iconic Hughes Tool, now Baker Hughes, weekly onshore U.S. rig count has been the go-to barometer for service company business planners. While other rig tallies have sprung up over the years, the Baker Hughes count remains the most identifiable and quoted indicator of the health of the U.S. onshore market. These days, however, the rig count ain’t what it used to be.

Industry’s Feng Shui. Baker Hughes is the first to admit that while tallying up rigs actually turning sideways is a decent measuring stick of how the industry is faring, it falls short of presenting a complete picture. Depending on your perspective, the credit or blame can be laid on multi-well pad drilling, which in 2011, the Colorado Oil and Gas Association (COGA) labeled as the industry’s Feng Shui. Coinciding with the meteoric growth in unconventional shale activity, pad drilling continues to take a larger share of the onshore landscape, with more wells being drilled with fewer rigs. Natural evolution mandated the rig count change accordingly.

This summer, Baker Hughes said it was complementing its weekly rig count report with a metric that counts how many wells those rigs drilled in the 13 primary pad-dominant basins it tracks. The namesake of the rig count said 2013 projections clearly justify the additional computation, with the U.S. rig count expected to fall 8% this year, while only 4% fewer wells are predicted to be drilled. In its second quarter earnings report, Baker Hughes predicts a year-end count of 1,765 rigs drilling roughly 35,000 wells. Much of the 4% drop in new wells can likely be blamed on dry gas drilling, as Baker Hughes estimates only 380 of the cumulative active rigs will be gas-driven at the end of 2013.

During the second quarter earnings call, Martin Craighead, Baker Hughes chairman, CEO and president, said the new well count measurement was necessitated by both the intensification of pad drilling and seasonal characteristics that the rig count, by itself, does not reflect.

“As industry trends evolve, you can expect new features and information sources to be added to the Baker Hughes well count index periodically,” said Craighead. “We can see from the data, for example, that drilling efficiencies vary by basin. In the Williston, the Marcellus and the Eagle Ford, we’re seeing about 20% more wells per rig compared to this time last year, whereas in the Permian, wells per rig have hardly changed. Additionally, the Baker Hughes well count shows seasonality that wasn’t evident in the rig count alone.”

An overdue metric. From environmental and drilling efficiency perspectives, it has been accepted for some time that using a single rig to construct multiple wellbores from a central location is the way forward for the land market. The U.S. Department of Energy (DOE), in a June 2010 report on Quantifying Drilling Efficiency, singled out pad drilling as a game changer, as did COGA a year later, citing the enabling technologies it inspired, such as AC rigs with “walking” packages and microseismic surveying that maps the distance and extent of stimulated fractures.

Consequently, unlike bygone days when a slide in the rig count brought consternation in service company conference rooms, today it is taken in stride, reflecting an industry that is giving new meaning to efficiency, says Halliburton Chairman, CEO and President Dave Lesar.

“We are now expecting the rig count to remain relatively flat for the remainder of the year, as we absorb a meaningful switch to multi-well pad activity among our customer base,” he said during the company’s second quarter earnings report. “We currently estimate that pad drilling represents as much as 50% of the activity across key U.S. basins. As an example, we’ve seen the Eagle Ford growth of less than 40% pad activity last year to over 60% today. Ultimately, we believe this efficiency trend bodes very well for us in the long run, as our scale and expertise allows us to lead the industry in executing factory-type operations.”

Even drilling contractors, who on the surface would appear to be most wounded by having fewer rigs working, say that the benefits of enhanced efficiencies of the new normal in U.S. onshore drilling will filter throughout the industry. Hans Helmerich, Chairman and CEO of H&P Inc., suggested as much in a transcript of the drilling contractor’s third quarter earnings call posted on the investment blog, Seeking Alpha.

“Operators are getting more bang for their buck,” Helmerich told analysts. “That, in our mind, is not a bad thing. Efficiency is not the enemy; efficiency is what helps differentiate our offering from the group.”

|