JOHN TARRIS, Deloitte’s Petroleum Services Group

|

| Venerable Ashtart oil field (left) was discovered offshore Tunisia in 1971 and has been in production since 1974. The field is operated by SEREPT, a 50-50 JV owned by state firm ETAP and Austria’s OMV (photo courtesy of OMV). Since DNO took over Tasour oil field (center) in Block 32 of southern Yemen in 1998, recoverable reserves have quadrupled, from 5 MMbbl to 20 MMbbl (photo courtesy of DNO). In the Dohuk PSC (right), just outside the city of Dohuk, in the far northern portion of Kurdistan in Iraq, DNO is exploring actively, with some efforts showing promising results (photo courtesy of DNO). |

|

There has been a profound impact from the Arab Spring on the Middle East and North Africa (MENA) region since the initial uprising in Tunisia during December 2010. Two-and-a-half years later, a huge amount of uncertainty remains, particularly the recent ousting of former President Mohamed Morsi in Egypt. Other difficulties have risen of late, with the terrorist attack on the In Amenas facility in Algeria being one of the most significant.

Despite the on-going instability, oil and gas production reached record levels of 32.23 MMbpd and 67.8 Bcfd, respectively, in 2012, reportedly the highest levels to date (as cited in BP Statistical Review 2013). Also encouraging is the 11.3% growth in oil reserves to 872.6 billion bbl. Although there has been no growth in gas reserves, reported at 3,128.6 Tcf, the figure still reinforces the region’s reputation as one of the world’s premier oil and gas regions.

Here follows a review of the key developments in the region’s major countries over the last 12 months.

TUNISIA

There were 11 exploration wells drilled in Tunisia during 2012, with a further six wells reported in first-quarter 2013. These include Exxoil’s Bou Argoub-1 well, drilled on the Grombalia permit in fourth-quarter 2012. Cooper Energy also drilled the Hammamet Ouest-3, in the Bargou permit, during second-quarter 2013. It was testing, as of August 2013. However, the company has since announced plans to divest its interest in Tunisia for strategic reasons.

Other recent drilling includes Dualex Energy’s Bouhajla North-1 well, spudded in June 2013. Dualex Energy announced in July that the well was to be tested, with production tubing being installed. Chinook Energy has drilled the El Bell-1 on the Sud Remada permit, with the well cased and suspended as of July 2013. Discoveries in Tunisia remain few; however, OMV drilled the Amani-1, in the Anaguid concession, which was put on an extended production test in August 2012.

Deal and licensing activity continued in second-half 2012 and first-half 2013, with several new entrants and existing companies increasing their acreage. Gulfsands Petroleum increased its interest in Tunisia, taking an additional 30% in the Chorbane licence and 10% in the Kerkouane licence during November 2012. Circle Oil has also increased its position taking the remaining 30% of the Mahdia Offshore permit from Tethys Oil, and 30% of Exxoil’s interest in the Beni Khaled production concession in July 2013. Resource Ventures announced a Letter of Intent for 25% of the Tebourosouk Block from Petroskandia and ETAP in April 2013.

Similarly Norway’s DNO International entered into a farm-out agreement with Atlas Petroleum Exploration Worldwide and Eurogas International in June 2013. DNO will take an 87.5% operated interest in the Sfax Offshore exploration permit, which contains the Ras El Besh development license.

In August 2013, Viking Energy, executed a farm-in agreement with Sonde Resources, taking a 66.67% interest in Zarat field and a 50% interest in the surrounding Joint Oil exploration block. Zarat field straddles the boundary of the Enquest-operated Zarat Block, which lies to the south. The partners of the two blocks have agreed to a 50:50 unitization, with the revised development plan to be submitted for approval. Enquest made its entry into Tunisia in May 2013 by farming into the aforementioned Zarat Block, taking a 70% operated interest from PA Resources. Enquest also farmed into PA Resource’s Didon development block, taking a further 70% operated interest that includes 2 MMboe of net, producing, 2P oil reserves.

ALGERIA

In 2012, state firm Sonatrach reported 31 new discoveries, with 24 made by Sonatrach, alone. Despite this relative success, oil production is stagnant, at 1.46 MMbpd (World Oil estimate, published in the September 2013 issue), and gas production is down 1.7% to 7.9 Bcfd (BP Statistical Review 2013). To counter this, Sonatrach announced that it will triple its exploration budget from 2013 to 2017. Oil and gas account for 97% of exports in Algeria. It has been reported that Algeria’s earnings from oil and gas exports have fallen 7.05% in first-half 2013, and that reserve replacement is running at around 30%. Algeria is an OPEC member, and with its current planned domestic expenditures, is said to require an oil price of $121/bbl to cover costs. However, average Brent prices in first-half 2013 have been $107.90/bbl.

Of the international oil companies (IOCs) active in Algeria, PTTEP has made the news frequently in the last 12 months. This is due chiefly to successful results at eight of nine wells in a recent exploration campaign on the Hassi Bir Rekaiz permit, in the Illizi-Ghadames basin. Gazprom also made a discovery last January at the Zemlet Er Rekkab Nord-1 well in the El Assel Block, while Repsol reported two gas discoveries at THIS-1 and TGE-1 which could lead to a large-scale gas production facility on the block.

Aside from exploration activity, IOCs operating in Algeria have remained focused on large development projects. Eni announced that Menzel Ledjmet East field went onstream early in 2013, four years after the firm acquired the project. A contract has also been signed with Técnicas Reunidas for engineering, procurement, construction and commissioning for Touat natural gas field, a project being developed jointly by Sonatrach and GDF Suez. The project is due onstream in 2016, with 159 Bcfg and 630,000 bbl of condensate to be produced annually.

|

| Fig. 1. Statoil continues to share operatorship of Algeria’s In Amenas gas project with BP and Sonatrach, in a joint venture (photo courtesy of Statoil). |

|

Despite attacks on foreign oil workers at the In Amenas field area (Fig. 1) last January, Statoil remains committed to participation there, as well as the In Salah and Hassi Mouina licenses.

Meanwhile, Petroceltic also announced in August 2012 that its Ain Tsila field has been approved for development. Petroceltic farmed-out an 18.375% interest to Enel in February 2012 and a further 18.375% to an unnamed partner, leaving Petroceltic with a 38.25% interest in the field.

ConocoPhillips also announced its intention last December, to sell the company’s Algeria business unit to Indonesian state oil company, Pertamina. Last June, Pertamina said that it expected the deal to be completed within a couple of months.

New licenses have been scarce in Algeria, with the last international bidding round held in 2010. However, officials may schedule a round for the end of 2013 or in early 2014, to boost exploration levels. This follows the new hydrocarbon law, approved in February 2013 which, among other things, allows for the exploitation of unconventional resources. Gas from shale is big on Algeria’s agenda, with the U.S. Energy Information Administration (EIA) assigning Algeria the world’s third-largest shale gas resources, currently estimated at 707 Tcf (Editor’s note: World Oil’s current estimate of Algeria’s proved gas reserves is 159.1 Tcf, in line with figures carried by Cedigaz and OPEC).

LIBYA

Since the uprising in 2011, Libya has focused on restoring oil production to pre-war levels, which at that time stood at around 1.65 MMbpd. Last April, Deputy Prime Minister Awad al-Baraasi announced that production levels had reached the target. However, production is believed to have fallen to 650,000 bopd during August 2013 (Editor’s note: On Aug. 3, 2013, Awad al-Baraasi resigned as deputy prime minister, slamming the government as “dysfunctional” and unable to put an end to ongoing violence.

Subsequent strikes at Libya’s oil-export terminals during mid-September depressed the country’s crude output to just 150,000 bpd. The labor disputes were reportedly settled, and oil production resumed at Sharara and Elephant fields, following an agreement reached with protesters on Sept. 17, according to what Mustafa Sanalla, a director with the country’s National Oil Co., told local media. Libya expected to increase output to 700,000 bopd by Sept. 20).

|

| Fig. 2. The gas oil separation plant (GOSP) near the Jakhira oasis in Libya has been a key installation in Wintershall’s attempts to maintain production, despite problems with infrastructure, oil field services and strikes (photo courtesy of Wintershall). |

|

Wintershall, the second largest in Lybya after Eni, reported last June that its production level was still 15,000 bopd below its pre-war figure. Wintershall ascribes this to difficulties with infrastructure, a lack of oil field services and strikes, Fig. 2.

There is also a concern over the security situation in the country, with OMV reporting a drop in second-quarter profits relating to violent attacks on the oil industry and its fields coming to a standstill. BP also announced in May 2013 that it was withdrawing non-essential staff from Tripoli. BP had been expected to drill a well in Libya since 2010. In November 2012, the firm announced plans for 17 new exploration wells. However, since withdrawing staff, BP was reported to be reconsidering these plans.

Prior to the civil war, there had been little new licensing activity. There has, however, been a stream of companies leaving Libya following Shell’s exit in May 2012. INPEX Corporation has left the country, and other companies are rumored to be looking to sell their assets. Regardless, Libya announced in April 2013 that a committee had been formed to draft up a new oil law, with a view to launching a new licensing round before the end of this year.

Exploration levels in Libya, since the civil war, are still very low, with approximately four wells drilled in 2012, much lower than the 50 or so exploratory wells drilled a year before the uprising. Eni spudded the A1-108/4 well last December in the Sirte basin. PGNiG also announced in March that it was hoping to drill its first exploration well, while Total has been expected to drill for offshore gas this month. Eni also has made further commitments to Libya, investing $8 billion over the next 10 years for new exploration and current production projects.

Like its neighbour, Algeria, Libya also has looked into the possibility of exploiting unconventional resources. PGNiG has expressed interest in initial exploration, and Talisman is reported to have held talks.

EGYPT

Approximately 144 exploration wells were drilled during 2012, while around 50 wells have been drilled so far in first-half 2013, less than the level experienced during first-half 2012. Apache Corporation, which holds gross acreage of ~39,000 sq km in Egypt, has continued to dominate success in the Western Desert, announcing several new discoveries in second-half 2012.

Also in the Western Desert, Eni last February struck a discovery the Rosa North-1X well. This follows the Emry Deep discovery made in May 2012. Both fields are part of Eni’s current campaign to target deeper oil plays. In October 2012, Dana announced a discovery at the West Sama-1 well onshore in the Nile Delta, with in-place resources of 4-6 Bcfg, followed by the Alyam-1 and Balsam-1 finds last January, and Begonia-1 in July 2013.

In the offshore Nile Delta, BP made two discoveries during August 2012 in the North El Burg offshore block with the Taurt North-1 and Seth South-1 wells. BP went on to announce that it will invest $10 billion in Egypt over the next five years, with 20% additional output slated to be added to countrywide gas production.

Also of significance is Petroceltic’s Mesaha-1 well in the vastly underexplored, Mesaha Block. The well was the first drilled in the concession, and the first to test the Mesaha basin, one of East Africa’s biggest sedimentary basins. The Mesaha-1 was plugged and abandoned after no hydrocarbons were found. Petroceltic gained operatorship of the Mesaha Block in October 2012 after merging with Melrose Resources. The merger also saw Petroceltic pick up several assets in the Nile Delta, including 12 producing fields, 15 development leases and the South East Mansoura exploration block.

A&D activity. Other deals in Egypt include Sea Dragon Energy, which acquired all the issued and outstanding shares of National Petroleum Company Shukheir Marine in December 2012. This saw Sea Dragon gain 100% interest in Shukheir Bay and Gamma oil fields, in the Shukheir Marine concession of the Gulf of Suez. BG also has expanded its presence in Egypt, farming into 40% of Total’s East El Burullus license last January. Some companies, however, have shrunk their portfolios, Gujurat State Petroleum Company and its partners, Hindustan Petroleum and Oil India, opting to not sign for the South Quseir and South Sinai PSCs that were originally awarded in 2008. Premier Oil also decided to withdraw from the South Darag Block which was awarded following an EGPC 2009 bid round but never ratified. Premier also relinquished interest in the North Red Sea Block.

Licensing. In terms of licensing rounds, the most recent EGPC and EGAS rounds have now been awarded, but they have not been ratified. The EGPC bidding round, originally launched in September 2011, saw a lot of interest, with 11 out of 15 blocks awarded during November 2012. Nine companies picked up acreage. Among that group, Petroceltic and Dove Energy were new entrants. The other successful companies include Shell, TransGlobe Energy, Vegas Oil & Gas, Dana Petroleum, Beach Petroleum, RWE and Apache.

Similarly, blocks from the EGAS bidding round, launched in June 2012, were awarded in April 2013. A total of 57,000 sq km was on offer, with some blocks at the furthest extent of Egypt’s territorial waters. Of the 15 blocks on offer, two onshore tracts and six offshore parcels were awarded to seven different companies, including Petroceltic, Edison, Sea Dragon Energy, Dana Gas, Eni, BP and Pura Vida Energy.

Alongside these two bidding rounds, Ganoub el Wadi Petroleum Holding Company launched a round for 20 exploration blocks in December 2012. The acreage includes blocks in the underexplored Upper Egypt region and Red Sea, as well as the more-developed Gulf of Suez and Eastern Desert. Bids were originally due in May 2013, but the round’s closure was extended to June.

Production. Despite numerous new exploration agreements set for ratification; companies expanding their portfolios; and new discoveries continuing to be made; hydrocarbon production has dropped in Egypt. Gas production in Egypt (BP Statistical Review 2013), which grew quickly from 2 Bcfd in 2000 to a peak of 6.1 Bcfd in 2009, has since lowered and plateaued at 5.9 Bcfd for 2010-2012.

Oil production which peaked in the early 1990s at around 940,000 bpd, has since declined to around 728,000 bpd during 2012. LNG exports have also declined in Egypt, with the focus for gas moving to the domestic market, where demand is growing quickly. A moratorium has been in place since 2008 on new export contracts, and Egypt has also announced a tender for a regasification plant to allow the importation of LNG cargoes. Qatar recently announced that it will supply Egypt with five LNG shipments to ensure supply for the summer. With consumption rising in the summer months, power cuts and blackouts can be common. As Egypt also has no import capacity, the cargoes will replace Egyptian exports, with gas scheduled for export to be used for domestic consumption, instead.

MOROCCO

Exploration levels in Morocco have remained low during 2012 and first-half 2013. Activity has continued to focus on licensing, with further acreage awarded and several new entrants to the country. For example, Genel Energy acquired Barrus Petroleum in May 2012, gaining an interest in the Juby Maritime license. Genel expanded its position by farming into the Sidi Moussa license during August 2012. The company was awarded the Mir Left license in November 2012.

Fastnet Oil & Gas acquired Pathfinder Hydrocarbons, gaining an interest in the Foum Assaka license. The firm subsequently was awarded the Merada license in November 2012. Through the acquisition of Nautical Petroleum, in July 2012, Cain Energy gained interests in the Juby Maritime license, and subsequently farmed into the Foum Draa license in August 2012. Chariot Oil and Gas made its entrance to Morocco with the acquisition of the Loukos, Casablanca/Safi and Rabat Deep licenses in October 2012.

Last December, Portugal’s Galp Energia farmed into Tangier Petroleum’s Tarfaya Offshore license. In January 2013, Gulfsands acquired Cabre Maroc from Caithness Petroleum, and Chevron was awarded the Cap Cantin Deep, Cap Walidia Deep and Cap Rhir Deep licenses. Also in January, Freeport McMoran, farmed into the Mazagan Offshore license, although this was not ratified until July 2013.

With so much licensing activity, there are several high-profile exploration wells expected in the coming months, with Cairn expecting to drill between two and four wells during 2013/2014, and Genel planning to drill two wells in first-half 2014.

MIDDLE EAST–ISRAEL

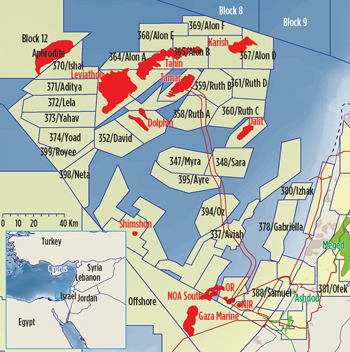

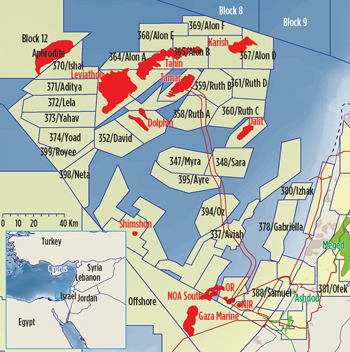

March 2013 saw a major landmark for Israel, with first production from Tamar field (map, Fig. 3) introduced to the domestic market. Discovered in 2009, at the start of the exploration boom in Israel, Tamar has undergone a rapid development program, resulting in production after only four years, at rates of 300 MMcfgd from five subsea wells. The field’s development also led to its gross resource estimate increasing from 9 Tcf to 10 Tcf. Israel’s largest gas field, Leviathan, is also scheduled for development and estimated to be due onstream in 2016. Following the drilling of the Leviathan-4 appraisal, the field consortium announced that estimated reserves have now risen to 18.9 Tcf.

|

| Fig. 3. Noble’s Tamar field is in the center of the main productive area offshore Israel. |

|

Successful exploration in Israel continued during July 2012, with the announcement by ATP Oil and Gas that the Shimshon-1 well encountered 19 m of gas pay from the Bet Guvrin sands. The discovery has estimated reserves of 550 Bcf. However, development plans have yet to be established and could be delayed by a lengthy period, due to a number of issues. These include ATP’s filing for bankruptcy protection in August; the seizing of ATP’s Israeli gas licenses by a Tel Aviv court in September; and the subsequent bid in January 2013 by Isramco (a fellow Shimshon licensee) to acquire ATP’s rights. The acquisition will require approval from the courts, ministry and antitrust authority before the transaction can proceed.

In exploration activity, Aphrodite-2 was drilled at the beginning of November 2012 on the Ishai license, adjacent to Noble’s Aphrodite discovery in Cyprus’ Block 12. The well operator, AGR, reported 15 m of gas shows at the beginning of January 2013. Nevertheless, following a final resource report from independent consultants in April, the well was deemed non-commercial, with negligible quantities of gas. In contrast, in May 2013, Noble announced that the Karish-1 exploration well on the Alon C license was a successful natural gas discovery, with 56-m pay from Lower Miocene sands. A resource evaluation report for the discovery, published in July 2013, stated 2C, unrisked, contingent gas resources as being 1.28 Tcf, and 2C, unrisked, contingent condensate resources as being 12.7 MMbbl.

In licensing, Adira Energy farmed out 5% of its Gabriella license and 10% of its Izhak and Samuel licenses at the end of October 2012 to Tohar Hashemesh Ltd., a private Israeli company, to reduce financial commitments on the licenses in the future. At the same time, Adira was granted another extension from Oct. 31, 2012, to March 31, 2013, to execute a drilling contract on the Samuel license. Last December, Australia’s Woodside, which has large-scale LNG operations experience, agreed in principle, with the partners of the Leviathan JV, to acquire a 30% interest in the Rachel and Amit licenses for $1.2 billion. Naturally, Woodside will operate any LNG development, while Noble will continue as the upstream operator.

As of the end of June 2013, completion of the deal was still pending, awaiting a decision on Israel’s gas export policy, following the Zemach Report recommendations. Edison International also made its entry to Israel by acquiring a 20% operated interest in the Neta and Royee permits. The acreage is adjacent to a block that Edison picked up from the 2012 EGAS Bidding Round, and it further advances the company’s interest in the eastern Mediterranean.

LEBANON

Following the discoveries and advances offshore Israel, Lebanon ratified the Offshore Petroleum Resources Law in 2010. Since then, a bidding round has been eagerly anticipated. However, it first required the formation of the six-member Petroleum Administration, subsequently announced in November 2012.

With the Petroleum Administration in place, Lebanon invited companies to prequalify for the First Licensing Round, which was then launched May 2, 2013. Terms were set, such that companies bidding to be operators were required to be joint stock companies conducting petroleum activities. They also needed to have total assets of $10 billion and at least one operatorship of a petroleum development in water depths exceeding 500 m. For those companies bidding to be non-operators, they also needed to be joint stock companies conducting petroleum activities, have total assets of $500 million, and have established petroleum production.

In all, 46 companies met the prequalification criteria, of which 12 can bid as operator and 34 as non-operators. The round is set to close on Nov. 4, 2013, with awards expected in early 2014. Ten blocks are on offer. However, it has been announced since that only a maximum of four blocks will be awarded.

JORDAN

Jordan has launched two bidding rounds this year, with the West Safawi Block put up on offer in November 2012, and the South Jordan Block open for bidding from April 2013, forward. Both rounds have since closed. In other licensing, Transeuro Energy was awarded a contract to enhance production at Hamza oil field last June. Hamza field went onstream in 1984 from four wells. However, current production has now declined to around 20 bopd. Korea Global Energy Corporation and Enegi Oil also made an entrance to Jordan in 2013, with the acquisition of the Dead Sea Block. The companies have reached a co-production agreement, with three exploration wells to be drilled in the four-year exploration phase.

Jordan has been exploring the unconventional option for some time, and is reported to have the fourth-largest oil shale resources globally. Shell, in particular, has a large project in the country. In September 2012, Global Oil Shale Holdings (GOSH) of Canada also signed a Memorandum of Understanding for oil shale exploration. GOSH will work on two study areas, the Attarat Um Ghudran and Isphere Al-Mahatain projects, with a view to assessing the feasibility of producing 50,000 bopd in a 40-year development.

SYRIA

Before the unrest began in March 2011, oil production was reported to be 380,000 bpd. According to the Syrian oil minister, production has since fallen by 95%. To relieve the situation, Syria arranged an agreement with Russia in August 2012, whereby Syria sends crude to Russia, in return for refined oil products. Since then, the European Union announced in April 2013, that it expects to relax the embargo on oil that has been in place since the uprising. This will allow purchases of crude, but only from the opposition, a move designed to offer support to Syrian rebels.

Despite the difficulties in Syria, Gulfsands Petroleum, whose permit is under force majeure, has still been able to monitor production levels at its fields. Gulfsands’ operations are run through a JV with Sinochem and the General Petroleum Corporation (GPC) called Dijla Petroleum Corp., which, as a result of sanctions, is run by only GPC employees. Gulfsands estimates that Khurbet East field produced around 1.7 MMbbl of oil in 2012, although it was shut in for considerable periods. Gulfsands’ Yousefieh field has also been on production, but only for around 46 days in 2012. Gulfsands reports a total of 100,000 bbl produced during that time, with peak production of around 3,500 bopd.

SAUDI ARABIA

Oil production in Saudi Arabia increased 3.7% in 2012, reported at 9.73 MMbpd (Saudi Aramco 2012 Annual Review). According to the International Association of Energy Economists, Saudi Arabia has exported approximately 1.27 billion bbl of crude so far in first-half 2013, generating respective revenue of $137 billion.

Following Saudi Aramco’s capacity expansion program in 2010, which launched the 2.4-Bcfd Shaybah NGL project, Aramco nows plan to increase production capacity at Khurais and Shaybah fields to 550,000 bopd by 2017. The Manifa oil development is another focus for Saudi Aramco, as the field went into production three months ahead of schedule during April 2013. Manifa produces 500,000 bopd, and Aramco anticipates developing the field further to produce approximately 900,000 bopd by fourth-quarter 2014. Extra refineries are needed to cope with these production increases. As such, Aramco is involved in building the Jazan and Satorp refineries. Further to this, Aramco also plans to develop Midyan gas field in Tabuk province during 2013. Production from Midyan will be used to support Tabuk and local industrial activity.

In terms of countrywide natural gas production in 2012, Saudi Arabia produced 10.72 Bcfd, which is 8.3% more than in 2011 (Saudi Aramco 2012 Annual Review). Exploration levels are robust with Saudi Aramco reporting that it completed 199 oil wells and 100 gas wells in 2012, an increase on the 264 wells completed in 2011. Saudi Arabia generally looks to increase gas production levels, due to rising domestic demand. Accordingly, in 2012, Aramco struck the Sha’ur gas discovery in the Red Sea.

In addition to conventional resources, Saudi Arabia is also pushing solar power, particularly in the Dhahran and Al Midra region. Similarly, Saudi’s Oil Minister announced in March 2013 that Aramco will drill up to seven wells this year, to test the country’s shale gas potential. Baker Hughes has estimated current recoverable shale gas reserves at 645 Tcf.

YEMEN

According to the Petroleum Exploration and Production Authority (PEPA) of Yemen, 23 exploration wells were planned in 2012, and 28 for 2013. This included Calvalley Petroleum’s Ras Nowmah South-1 well, which discovered a 15-m, 19°API oil column in Block 9.

Yemen has experienced difficulties of late, with the U.S. and UK, and other key nations, evacuating their embassies, due to the threat of terrorism. For example, in August 2013, Yemen reportedly foiled a plot on oil and gas facilities planned by Al-Qaeda. Similarly, Yemen’s main oil export pipeline, situated in Maarib province, has been the focus of several attacks this year, with the last incident coming in August. The pipeline was reported to be pumping 125,000 bopd earlier in 2013.

|

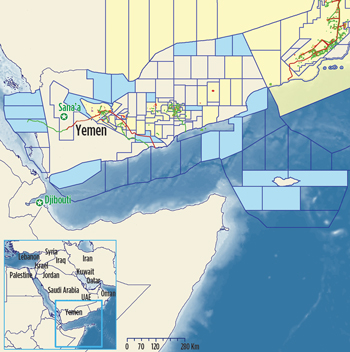

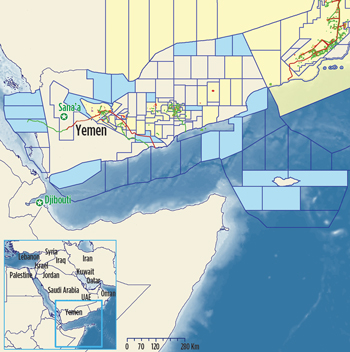

| Fig. 4. The 20 blocks announced in the 2013 Yemen International Tender are shown in green. |

|

Yemen has launched two bidding rounds in the last calendar year, with a five-block round launched in September 2012, and a 20-block round initiated in March 2013, Fig. 4. The first round included four onshore blocks and one offshore tract and was the first bidding round since 2010. The round is seen as an effort to attract more foreign investment and raise production levels. Among the 27 bids from nine companies, DNO was awarded Block 84 and KUFPEC Block 102. The second round, which initially contained 15 blocks, included 11 offshore tracts and nine offshore parcels. The round closed in May 2013, with 18 companies qualifying from the 45 firms that submitted applications.

Several companies have expanded their Yemeni portfolios. Otis Energy signed an agreement in May 2013, to acquire an 8.5% interest in Block 7, while Pakistan Petroleum Limited acquired MND Exploration & Production in April 2013, gaining an interest in Block 3. Kuwait Energy finalized a deal to acquire Jannah Hunt Oil Company, which held a 15% interest in Block 5, during February 2013. Finally, OMV signed an agreement for Block 86 in November 2012, and Medco Energi acquired a 25% interest in Block 9 during August 2012.

UAE

Development activity has dominated UAE headlines, with Abu Dhabi’s oil production rising to 2.49 MMbpd in 2012 from 2.46 MMbpd in 2011 (World Oil, September 2013). Sour gas also continues to be a priority, following the award of Shuwaihat field to OMV and Wintershall in July 2012, and Shell winning a contract in March 2013 to operate Bab field. Bab is expected to produce 500-800 MMcfgd, once developed. However, there is an estimated 15% H2S content that Shell plans to export. Occidental’s Shah gas project is also set to be completed in late 2014, with 20% of the drilling and 60% of the facilities complete, so far. The field should produce around 500 MMcfgd.

As regards licensing, Abu Dhabi National Oil Company (ADNOC) announced that it has invited various IOCs to bid for renewal of a contract for some of the emirate’s largest fields. The contract, which produces 1.5 MMbopd and expires at the end of the year, is shared between ADNOC, BP, ExxonMobil, Shell, Total and Partex Oil & Gas. Aside from Partex, all of the existing partners have been invited to bid, alongside Chevron, Occidental, China National Petroleum Corp (CNPC), INPEX Corp, Korea National Oil Corp, Statoil and Rosneft. OMV also has increased its presence in the UAE by recently signing a new exploration agreement with ADNOC, whereby the two companies will explore for oil and gas onshore in the eastern portion of the emirate.

OMAN

Approximately 39 exploration wells were drilled in Oman during 2012, with about nine spudded in first-half 2013. A licensing round was launched in November 2012, offering seven blocks, including offshore Blocks 18, 41 and 59, and onshore Blocks 43A, 48, 56 and 57. Separate to any formal licensing round, Frontier Resources in October 2012 signed a six-year agreement for 100% interest in Block 38. PetroTel signed a PSC for Blocks 39 and 67 last March, while MOL signed for Block 66 in September 2012 and farmed in to the remaining 25% of Block 43B in March 2013. DNO has expanded its presence (Fig. 5) in Oman, farming in to Block 36 and assuming operatorship. Two exploration wells are to be drilled, and DNO will also acquire new 2D seismic.

|

| Fig. 5. Norway’s DNO already had a significant presence in Oman, including operatorship of Bukah field offshore, when it farmed into Block 36, onshore, earlier this year. |

|

BP announced that it has now reached agreement on a gas price for the Khazzan project, which the firm signed in 2007. The gas will be relatively expensive to produce, so BP had been in negotiations for months, to agree on a commercial price.

In other field projects, Odin Energy and its partner, Tethys Oil, have put Jebel Aswad field in Block 15 onto a long-term production test. Tethys Oil also reported a discovery at the Consolidated Contractors-operated B4EW4 well in Block 4, reporting combined rates of close to 3,000 bopd. This follows the B4EW3 discovery struck in September 2012, also in Block 4. The consortium’s field development plan for Blocks 3 and 4 has now been approved, with the license term extended for 30 years. Offshore, Circle Oil is hoping to complete a 2D seismic survey, to help delineate an aggressive drilling program, anticipated for 2014.

QATAR

Both oil and gas production in Qatar hit record levels during 2012, reported at 1.64 MMbpd (World Oil, September 2013) and 15.2 Bcfd, respectively (BP Statistical Review 2013). Operator activity remains focused on field development with Occidental committing, last July, to the Phase 5 Field Development Plan for Idd El Shargi North Dome field. This includes the drilling of more than 200 production, injection and water wells, plus the associated infrastructure to maintain the field’s production at 100,000 bopd until 2020.

Last November, Total and Qatar Petroleum also signed a new agreement, covering a further 25 years, for Al Khalij oil field. Qatar Petroleum also signed an agreement in July 2012 with GDF Suez and PetroChina for Block 4, whereby PetroChina acquires a 40% participating interest. The 2,500-sq-km block is in water depths, down to 75 m. In nearby Block 4 North, Qatar Petroleum announced a 2.8-Tcf discovery last March. The field is the first gas discovery since North Field in 1971.

KUWAIT

Kuwaiti oil production rose 13% in 2012, with levels reported at 2.53 MMbpd (not counting Neutral Zone output), the highest since 1972 (BP Statistical Review 2013). Kuwait eventually hopes to raise its output capacity to 4 MMbopd, and is planning to spend $100 billion over the next five years to do so.

|

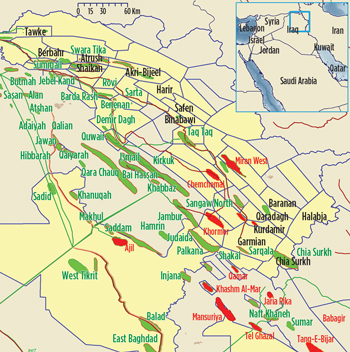

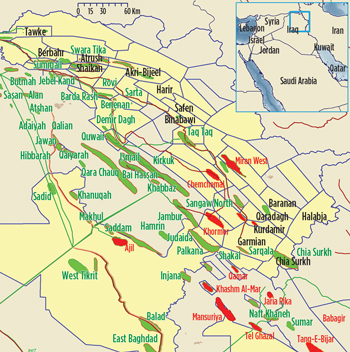

| Fig. 6. Oil and gas fields and licenses in the Kurdistan region of Iraq. |

|

Aside from conventional drilling, Kuwait looks to exploit heavier oil and shale gas over the next few years. The country plans to drill around 1,200 wells for heavy oil, with an aim of producing 60,000 bpd of heavy oil by 2017. In terms of shale gas, Kuwait is looking into the feasibility of producing from some of its northern fields, with the potential for an additional 150-200 MMcfgd.

IRAQ

Iraqi oil production rose 12.6% during 2012 to 2.97 MMbpd, although gas production is still the lowest in the Middle East, at around 100 MMcfd (BP Statistical Review 2013).

The Kurdistan (Fig. 6) Regional Government awards blocks on an ad hoc basis, while Iraqi federal officials conduct formal licensing rounds, the last of which was in May 2012, with the next scheduled for 2015. Results from the May 2012 licensing round were ratified in January 2013. Kuwait Energy, Dragon Oil and TPAO were awarded Block 9; Pakistan Petroleum won Block 8; LukOil and INPEX were awarded Block 10; and Bashneft gained Block 12.

The Petroleum Contracts and Licensing Directorate, and the Ministry of Oil, are also offering a different type of opportunity in Iraq—the Al-Nasiriya Integrated Project. It involves the development of Nasiriya oil field, together with the construction of a 300,000-bpd refinery; hence the project would require a consortium with exploration, production, development, engineering and maintenance knowledge.

There has been a large amount of licensing activity in Iraq. Last November, TAQA farmed into 52.2% of the Atrush Block, Fig. 3. Since then, an independent report has found the block to have 30% more contingent reserves than initially thought. January 2013 saw LukOil enter West Qurna 2, and Chevron signed for the Qara Dagh Block. Gazprom Neft joined the Halabja project last February. In 2012 Total acquired a 35% working interest in the Harir and Safen exploration blocks, and then went on to take an 80% stake in Kurdistan’s Baranan Block this year.

OMV declared commerciality of Bina Bawi field, where intense development drilling is anticipated for 2013/2014. Genel Energy entered Chia Surkh in January 2012, and made a discovery last April in the Chia Surkh-10 well. Genel intends to fast-track the appraisal and production of this discovery by second-quarter 2014.

Genel also made the Ber Bahr-1 discovery, encountering Jurassic oil shows with flowrates of 2,100 bpd.

Gulf Keystone had a new field development plan approved for Shaikan field in July 2013. The plan’s first phase involves increasing production from 20,000 bopd to 250,000 bopd by 2018. A second production facility is needed to accommodate such an increase in production, and this is due to be finished in fourth-quarter 2013. Aside from Shaikan, Gulf Keystone also has an aggressive program planned for the Akri-Bijell Block, with Bijell-4 and Bijell-6 planned to spud before the end of 2013.

In the nearby Tawke block, DNO has a production capacity target of 200,000 bopd by 2015 for Tawke field. This target has been developed after the recent success of Tawke-20, Tawke-17 and anticipated success of the forthcoming Tawke-23. Commercial declaration of Kurdamir and Garmian fields is also expected in 2014. In federal Iraq , LukOil has agreed to reduce output from the West Qurna 2 project by 33%, from 1.8 MMbopd to 1.2 MMbopd, to sustain the field’s life for 25 years, as opposed to 20.

IRAN

In August 2013, the U.S. passed further sanctions against Iran. However, in a statement from the head of the National Iranian Oil Company, it was declared that Iran has been bypassing the embargoes. Iran also has announced a significant deal, worth $3.7 billion, for gas exports to Iraq. The deal may run into difficulty, due to the sanctions, similar to U.S. opposition to the Iran-Pakistan gas pipeline project, agreed in 2010.

Relating to the sanctions, Schlumberger announced in 2010 that it would withdraw from Iran, when its contracts expired in 2013. In February 2013, Schlumberger made a further announcement, stating that it would now begin to wind down operations. CNPC has pulled out of the South Pars project after being accused of delaying its progress. CNPC replaced Total in 2009, which was also accused of delays. In May 2013, Total also settled allegations that it had paid bribes, to win oil and gas contracts in Iran.

CONCLUSION

In the face of continuing difficulty throughout the region, drilling figures and production levels have remained encouraging. New entrants have been seen in several countries, giving confidence to markets, and the region as a whole. The next 12 months will, no doubt, see further turbulence and challenges. However, with new bidding rounds anticipated, new acreage to be awarded and major capital investments announced, the MENA region continues to be one of the world’s most important and dynamic oil and gas sectors.

|

The author

JON TARRIS is the Middle East & North Africa Team Leader in Deloitte’s Petroleum Services Group in London. Jon joined the group in 2009 and currently leads the development of Deloitte’s information services in the region. He graduated from the University of Southampton with an MSci in Geology in 2009.

|

|