MAURO NOGARIN, Contributing Editor, Latin America

|

| Romulo Almeida is one of four oil tankers Petrobras is building in Brazil to handle pre-salt production (left). The giant vessel was built with record 72% local content. Continuation of Hugo Chavez policies by successor Nicolas Maduro does not bode well for a resurgence in oil and gas activity in Venezuela (center). Despite the nationalization of Repsol’s interests, Apache is continuing its drilling activity in the prospective Neuquén basin. Photos courtesy of Petrobras, Helmrich & Payne and Apache. |

Latin America has much potential for oil and gas production. Brazil is in the early stages of exploiting its pre-salt bonanza. There are other hydrocarbon riches throughout Latin America: heavy oil in Venezuela, shale gas in Argentina’s Neuquén basin and unexplored possibilities onshore and offshore Colombia. With each of these promises, there are pitfalls: declining production from mature fields in Brazil, political hurdles in Venezuela and Argentina and rebel activity in Colombia. Here’s a country-by-country explanation of recent oil and gas activity in Latin America.

BRAZIL

Brazilian crude oil output declined for the third-consecutive month in 2013 as maintenance shutdowns at several offshore platforms sapped production, according to the National Petroleum and Biofuels Agency (ANP). Brazil produced an average 1.853 MMbopd in March, down 8% from February and 11% from March 2012. Oil production was expected to decline in the first half of 2013 because of ongoing maintenance work at Petrobas’ aging offshore platforms and productivity declines at mature fields in the offshore Campos basin, which still accounts for more than 85% of the country’s crude oil production. Planned stoppages occurred at three key platforms, Shell’s Espirito Santo floating platform at the Ostra and Argonauta fields, Maersk Peregrino platform and the Petrobras P-54 platform at the Roncador field.

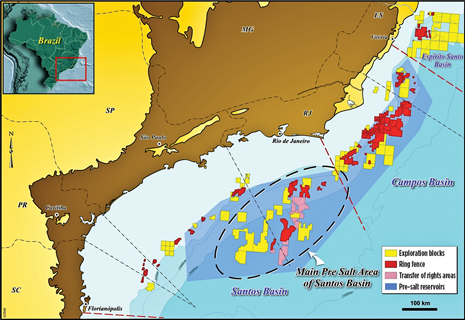

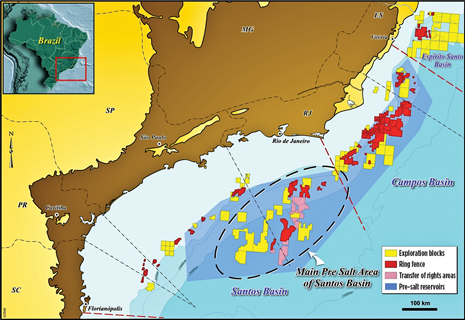

However, production from the ultra-deepwater pre-salt fields increased to 289 Mbopd and 9.7 MMcmd in March. The pre-salt area contains about 100 billion barrels of recoverable oil according to the National Oil Institute, enough to provide all current U.S. oil needs for about 14 years, Fig 1. In a speech to Brazil’s senate on March 14, ANP superintendent José Gutman said increasing oil output would reflect rising production from pre-salt fields and blocks to be tendered this year within the Equatorial Margin in the country’s north and northeast coast. Gutman estimates that production output in the next seven years will expand by 214%. He added that $18.9 billion would be collected by the government this year in oil royalties, up 5.4% on the 2012 figure.

|

| Fig. 1. Brazil’s pre-salt fields. |

VENEZUELA

Venezuela remains one of the world’s largest exporters of crude oil and the largest in the Western Hemisphere, despite an annual decline in production from its peak of 3.46 Bbbl in 2000 to 2.5 Bbbl in 2012. As many of Venezuela’s fields are mature, state oil company PdVSA must spend some $3 billion per year to maintain production levels at existing fields, given a typical decline rate of 25%. Such an investment level is difficult for the socialist government that has passed its mandate from Hugo Chavez to his loyal successor, Nicolas Maduro.

During Chavez’s reign, PdVSA created links with state-owned oil companies in Ecuador, Bolivia and Argentina through subsidized bilateral oil supply and E&P agreements. An increase in Venezuela’s oil production will have to come from the Orinoco heavy oil belt. An implementation of the nationalization policy in 2007 led to the exit of ConocoPhillips and ExxonMobil from Orinoco projects. While Total, Chevron and BP remain minority stake holders, PdVSA has brought in operators from the Eastern Hemisphere such as Rosneft, Petrovietnam and India’s ONGC. Rosneft has a joint exploration and development agreement with PDVSA to develop a new oilfield with estimated reserves of 40 Bbbl. Rosneft and its Russian partners in the consortium own 40% of the project, which is expected to produce 400 Mbopd that will require investment of $1.5 billion.

Venezuela had 195 Tcf of proven natural gas reserves in 2012, the second largest in the Western Hemisphere behind the U.S. In 2011, the country produced 1.1 Tcf of dry natural gas, while consuming nearly 1.2 Tcf. The supply deficit is covered by imports from the U.S. and Colombia. Much of the gas is re-injected for enhanced oil production.

COLOMBIA

Colombia passed a milestone in 2012 of pumping record 1 MMbopd. However, since then the state oil company Ecopetrol has missed production targets and has failed to discover any major fields. Rebel forces have renewed their efforts to sabotage oil pipelines, despite political efforts to secure a peace accord. The company has blamed its weak results on additional security costs. A peace agreement could open up unexplored areas in southern Colombia.

Despite the difficulties, the Colombian oil industry is focused on increasing oil reserves by increased exploration. Proven oil reserves currently are at 2.25 Bbbl. Ecopetrol has announced a capital investment plan for investing $9.5 billion this year. As much as 62% of this investment will be dedicated to exploration and production.

Pacific Rubiales, the Canadian oil and gas company, is investing $1.26 billion in operations and production facilities in Colombia. Most of this investment will be for the development of infrastructure, such as oil and gas pipelines and marine terminals. Pacific Rubiales anticipates that crude oil production in 2013 will reach 360 Mbopd from 296 Mbopd in 2011 and a record production level of 307 Mbopd in 2012.

Another Canadian company, Petroamerica, produces more than 4,500 bopd from two oil discoveries, has one new discovery under appraisal and has interests in seven exploration blocks, all located in Colombia’s Llanos Basin.

PERU

Peru is making steady progress in expanding its natural gas industry. Peruvian natural gas production will increase by 6% in 2013 from 418 MMcf, which itself was a 4.4% increase of 20111, according to a study by the Economic Studies Department of Scotiabank. The increase is mainly due to three reasons: an increase in production in Lots 56 & 88 in Camisea, start of production at Lot 57 operated by Repsol and an expansion of the main gas pipeline originating in the south of the country operated by Transportadora de Gas del Peru (TGP), which will accommodate increased production in the southern part of the country. Due to these production increases, the Peruvian Energy Ministry has announced an investment of $448 million by the Camisea Consortium to refurbish its production facilities in Lots 56 & 88. Repsol plans to invest $400 million for exploration in Lot 57.

BOLIVIA

According to a report by Bolivia’s Ministry of Exploration and Development of Hydrocarbons, proven reserves on December 31, 2009 were 9.94 Tcf, probable reserves were estimated at 3.71 Tcf and possible reserves were 6.27 Tcf. During 2012, YPFB and its international partners invested $2.243 billion to increase oil and gas reserves, intensify exploration and the industrialization of natural gas. Due to these capital investments, YPFB is currently exporting 31.6 MMcmd to Brazil and 16 MMcmd to Argentina.

ECUADOR

Oil royalties generated $2.8 billion in additional income for the Ecuador government due to renegotiation of 24 existing contracts. Petroecuador’s crude oil production increased in 2012 by 8.2% in comparison to the previous year, from 201 to 206 Mbopd. However, the sector that showed the most significant increase was the natural gas production for the domestic market, which increased from 8.5 MMcf to 15.2 MMcf, and the production of derivatives increased from 70.6 to 71.5 MMbbl.

The Ecuadorian ambassador to China announced in March 2013 that Ecuador is prepared to offer 13 additional blocks for exploration and development in the deep Amazon area. These blocks will be auctioned off via a bid process to private and state-owned companies in Asia. This is being done in hopes of attracting Asian investment capital for exploration and development of crude oil deposits. These new blocks, known as Ronda Suroriente, have calculated reserves of between 370 MM–1.6 Bbbl of heavy crude (API 15° grade). The blocks cover an area of 200,000 hectares and contracts with the winning foreign companies will be direct. Last year, Ecuador exported 8 out of every 10 barrels produced for Chinese companies through direct contracts not requiring a bidding process.

CUBA

Although attempts to locate oil deposits in the Gulf of Mexico have been unsuccessful, Cuba is expanding its refinery capacity, doubling its capacity at the refinery in Cienfuegos, which operates using imported Venezuelan crude oil. Financing for this expansion and the construction of a natural gas separation unit is expected to come from China under the terms of a preliminary agreement signed in 2011. The investment required for the expansion of the refinery will be around $5 billion and an additional $1.2 billion for construction of a gas separation facility.

URUGUAY

Uruguay continues to import crude oil from PDVSA at advantageous prices and recently cancelled its outstanding balance with the Venezuelan state oil company. ANCAP, the Uruguayan state company paid PDVSA $517 million in January 2013 in advance for future purchases of crude oil.

GUYANA

Pacific Rubiales intends to inject $1 billion into offshore exploration off the coast of Guyana. The agreement between Pacific Rubiales and CGX Energy was announced after the Government of Guyana renewed the licenses for CGX Energy to continue exploration. Pacific Rubiales will provide $35–40 million to help CGX Energy pay off certain outstanding debts related to failed exploration activity in the Guyana basin.

TRINIDAD AND TOBAGO

Trinidad and Tobago is looking at the markets of Latin America and the Caribbean to sell its gas production, since exports to the U.S. have taken a sudden fall due to increased shale gas production. Gasfin, the English company that developed LNG facilities, has signed a memorandum of intent with the government of Trinidad and Tobago last year to build a new plant at a cost of $400 million to process 500,000 mtpa to supply the Caribbean markets.

Centrica, another British company, plans to develop Block 22, which is estimated to contain 37 MMcm of natural gas. The proposed marketing plan includes building a LNG plant. The oil and gas sector contributes 40% of the GNP of Trinidad and Tobago and relies on export sales to the Dominican Republic, Puerto Rico, and recently, to Argentina and Chile.

GUATEMALA

Nine companies submitted bids in March 2012 for exploration and production of seven new oil and gas blocks. The bids were presented to the Ministry of Energy and Mines. If all the blocks were allotted, the country would increase its production capacity from 10,000 to 50,000 bopd.

|

The author

MAURO NOGARIN is Latin America correspondent for World Oil. Based in Bolivia, Mr. Nogarin started his career in journalism as a correspondent for Press Agency ASCA. He has reported on Latin America’s energy sector for several international oil industry and business publications.

PETER HOWARD WERTHEIM is an international journalist based in Rio de Janeiro covering the oil and gas industry in Brazil and other Latin American countries for the past two decades. He did post-graduate work in literature at the University of Essex, Colchester, UK. Mr. Wertheim is co-authoring a book about Brazil’s oil industry in an international context with his wife, Dayse Abrantes. / peterhw@frionline.com.br. |

|

Brazil’s 11-13 auctions: Deepwater pre-salt

and onshore shale leases

PETER HOWARD WERTHEIM, Contributing Editor, Brazil

Brazilian President Dilma Rousseff has authorized three rounds of bidding this year. This is Brazil’s first acreage offering since 2008. The private sector considers the auctions to be a huge boost for oil and gas producers, who have effectively been cut off from acquiring new acreage. “The blocks up for auction will include acreage located in the Equatorial Margin of Brazil, an area that recently received a great deal of attention due to the belief that its petroleum geology is similar to that of offshore West Africa, where large oil discoveries took place in recent years,” revealed Magda Chambriard, ANP director general.

|

| Magda Chambriard, director general of the National Petroleum and Biofuels Agency (ANP) |

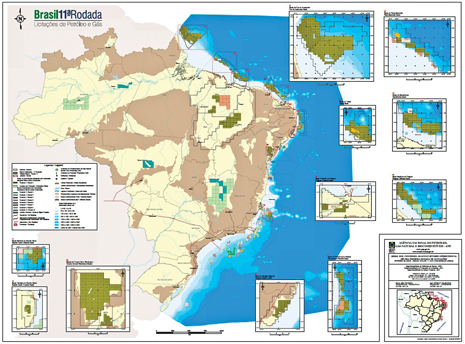

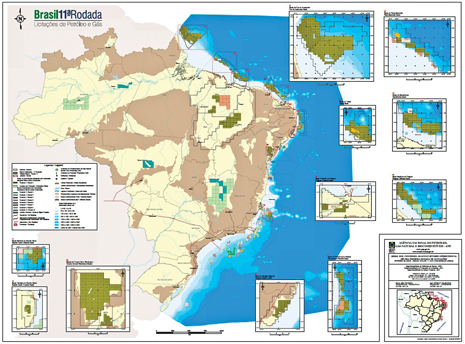

Through the three auctions the agency will offer blocks in several sedimentary basins: Potiguar, Ceará, Barreirinhas, Pará-Maranhão;Foz do Amazonas (Equatorial margin), Parnaíba (onshore Maranhão state), Pernambuco-Paraíba, Sergipe-Alagoas; Recôncavo and Tucano-Sul (onshore Bahia state); and offshore Espírito Santo and Rio de Janeiro states.

THREE AUCTION ROUNDS

According to ANP, the 11th round and the first pre-salt auction will offer exploration areas with potential reserves of 19.1 Bbbl and 397 MMcf. This is the largest volume of crude oil and natural gas ever placed for tender by ANP. The first auction is scheduled to occur in Rio de Janeiro on May 14-15, 2013 and will auction petroleum exploration and development rights for 289 onshore and offshore exploration blocks.

The 11th round will use the concession contract model and the 2008 local content rules. Bids for acreage offered in the round are to include submissions for a signature bonus, minimum exploration program and local content commitments.

The 12th round for onshore gas areas, to be held in October 30-31, 2013 and will cover 66,219 sq km aimed at opportunities for unconventional and shale exploration.

The 13th round will offer pre-salt areas with production-sharing contracts. It is scheduled to take place in either November or December. ANP estimates a potential of 10 Bbbl in reserves.

EQUATORIAL MARGIN: NEW FRONTIER

The Equatorial Margin extends over an area that runs from the coast of Rio Grande do Norte State in Brazil’s northeastern area to offshore Amapá state, north of the Amazon River mouth, and includes Potiguar, Barreirinhas, Ceará, Pará-Maranhão and Foz do Amazonas basins. As such, the next bidding round might decentralize exploratory investments, now concentrated in the southeast of the country, mainly in Campos and Santos basins.

In offshore Potiguar basin, Petrobras estimates the in situ volume at 1.18 Bbbl and 60 Bcm of natural gas. Offshore potential reserves are of 105 MMbbl and 8.3 Bcm. The occurrence of hydrocarbon traces in several wells that were drilled in Barreirinhas basin leads to the expectation of light oil and condensates, says the ANP. Early estimates for the four fields that Petrobras has explored in the Ceará basin have potential reserves of 451.6 MMbbl and 5.8 MMcm.

SHALE GAS EXPLORATION

Tight oil and shale gas production are virtually nonexistent in Brazil due to the presence of extensive high-porosity sandstone reservoirs. At a recent press conference, Mines and Energy Minister Edison Lobão pointed out that the country should start exploring shale gas. The only project of this type was conducted by Petrobras in the state of Paraná, where it produces small quantities of oil through fracing. According to the minister, the five areas to be offered in the tenders are in Parnaíba basin (comprising the states of Maranhão, Piauí and Tocantins); São Francisco basin (in Minas Gerais and Bahia states); Recôncavo basin (also in Bahia); and Paraná basin, which cover an area that ranges from Rio Grande do Sul to Mato Grosso do Sul states.

ANP’s Chambriard said Brazil’s shale gas reserves have not been mapped, but initial studies show that the greatest potential for shale gas deposits in Brazil are in these areas and also in the Parecis basin, Mato Grosso state. ANP estimates Brazil may have around 500 Tcf of gas held in shale, Chambriard estimated last January. The executive added that “shale opportunities may outstrip the massive pre-salt discoveries if the estimates are correct.”

|

| Brazil’s 11th round offers extensive onshore and offshore areas. |

PRE-SALT AUCTION

The third auction of 10 offshore pre-salt areas again raised concerns by private Brazilian and international operators that are not happy with the fact that the Brazilian government was able to pass laws granting to Brazilian state-controlled oil company Petrobras the right to be sole operator in pre-salt areas. However, the acreage made available in the pre-salt bid round will once again be governed by a production sharing contract regime, under which, besides being the operator, Petrobras will have a minimum participating interest of 30%.

Petrobras is expected to spend $400 billion through 2020 on equipment, procurement, and construction. One example is the equipment contract worth $1.1 billion already signed with GE Oil & Gas for the sale of subsea wellhead systems and installations tools required for crude exploration.

AUCTION PARTICIPANTS

ANP reports that 71 companies have submitted documentation to qualify for the May 14-15 auction. Operators from 18 countries include international majors ExxonMobil, Chevron, BP, Shell, Total, and Eni. Nineteen Brazilian firms include Petrobras and OGX Petróleo, the operator with the second largest offshore acreage in Brazil after Petrobras, and HRT Participações em Petróleo, which is exploring 21 blocks in the Solimões basin in the Amazon region and acreage offshore Namibia. The list also includes Spanish companies CEPSA and Repsol, as well as Colombia’s Ecopetrol, Hupecol and Trayectoria and Panama’s Pacific and Petrosynergy.

|

|