JIM REDDEN, Contributing Editor

|

| Encana drilling location in Fort Nelson, British Columbia. Photo courtesy of Encana Corp. |

|

On the heels of an upraised assessment of potential reserves, which Canada says stacks up nicely with its southern neighbor’s most prolific shale plays, tight oil is expected to play an ever-increasing role in the nation’s overall production mix. The identified liquids-rich plays in the Western Canada Sedimentary basin also have become case studies on the evolution of frac design and completion strategies in emerging unconventional plays.

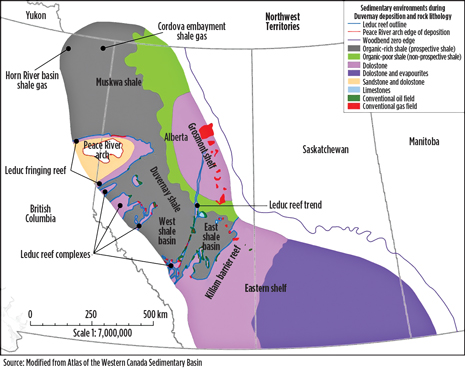

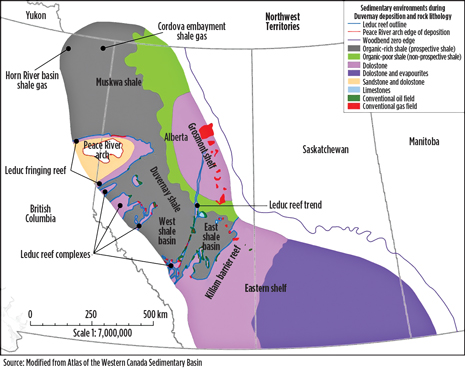

Much of the excitement in the ultra-competitive tight oil community has centered on the Eagle Ford-like Duvernay formation, clustered mainly within the rich-gas fairway in and around the Kaybob area, Fig. 1. After a recent evaluation of well results, Wood Mackenzie said the prospect “holds the potential to become one of North America’s most attractive liquids-rich shale plays.” Though still in its infancy, the Duvernay, which traverses most of west-central Alberta, has already drawn the attention of major players, including ExxonMobil, Chevron, Encana and Talisman, each of whom has assembled significant acreage positions.

|

| Fig. 1. Sedimentary environment of the liquid-rich Duvernay shale of Alberta. Source: PackersPlus. |

|

“It’s uncharacteristic of Canada to have the big operators step in this early, as historically the smaller companies will first do a huge amount of the delineation and development,” said Dan Themig, president and CEO of Calgary-based PackersPlus Energy Services Inc. “There’s still a bit of geological uncertainty as to the true size and scope of the play. Right now, it’s a little bit like what the Montney was about four or five years ago, when only a handful of operators were drilling Montney wells.”

“While it doesn’t have the aerial extent of the Montney, we think the Duvernay as an economically viable prospect looks really, really good,” he added.

The Duvernay assessment followed the November release of a joint Alberta Energy Resources Conservation Board (AERCB) and Alberta Geological Survey (AGS) study that adds weight to government assertions that tight oil will play an ever-increasing role in Canada’s unconventional hydrocarbon production, long dominated by the Athabasca oil sands and British Columbia’s Montney and Horn River shale gas plays. By next year, the tight oil plays, primarily in Alberta, Saskatchewan and Manitoba, are expected to deliver a cumulative 170,000 bopd, according to National Resources Canada. Liquids-rich shale plays are currently contributing roughly 160,000 bopd to overall production, according to the federal agency.

The triple-play Alberta evaluation pegged Canada’s largest producing province as holding estimated in-place shale reserves of 423.6 billion bbl of oil, 3,324 Tcf of gas and 58.6 billion bbl of liquids. According to the investigators, results of the collaborative assessment, which specifically examined the province’s portion of the Montney play, the rapidly emerging Duvernay and its stratagraphic equivalent, the Muskwa shale, contain resources on par with the largest U.S. unconventional plays. “The numbers fall in line, more or less, with many of the other shales, whether it’s Eagle Ford or Marcellus,” Andrew Beaton, one of the study authors, told Reuters.

On the downside, Alberta’s attractive shale reserve estimates do not appear to be enough to stave off what is expected to be another down year for new well construction. In its April 16 weekly report, the Canadian Association of Oilwell Drilling Contractors (CAODC) listed 141 active rigs in Alberta, British Columbia, Saskatchewan and Manitoba. For the like period of 2012, the CAODC reported a cumulative 157 active rigs in the four provinces.

Although drilling activity typically picks up in the fourth quarter and well after the so-called “Spring break-up” when melting snow restricts the movement of rigs and equipment, the CAODC nonetheless forecasts a 6% drop in drilling this year. Operators are expected to drill 10,409 wells in 2013, compared to the estimated 11,070 new wellbores drilled last year. In a statement, the CAODC said it arrived at the 2013 forecast “based on continued uncertainty around commodity prices” and, at the same time, pointed out that the industry is “engaged in complex drilling programs that require more time to drill.”

PLAY-BY-PLAY HIGHLIGHTS

The ERCB/AGS study places the Duvernay at the midpoint of its estimates with potential reserves of 61.7 billion bbl of oil, 443 Tcf of total gas in-place and 11.3 billion bbl of natural gas liquids (NGL). To the northwest, its Muskwa geological equal is projected to contain in-place reserves of 115.1 bbl of oil, 11.3 billion bbl of NGL and 419 Tcf of gas. The Alberta extension of the Montney, Canada’s most productive shale play, holds an estimated 136.3 billion bbl of oil, 2,211 Tcf of dry gas and 28.9 billion bbl of NGL.

The province-wide reserve estimation further reinforces Canada’s contention that it has the resources that will enable it to approach the dazzling success of the U.S. in exploiting its shale resources. While myriad prospective shales, with widely divergent geological and technical characteristics, have been identified throughout many of the nation’s semi-autonomous provinces, up to now nearly all exploration and development has focused on plays within the 540,000-sq-mi Western Canada Sedimentary basin. Along with Alberta’s Duvernay/Muskwa and Montney shales, activity also is concentrated in the Montney, Horn River and, more recently, Liard gas plays of British Columbia; the Canadian Bakken that spreads across Saskatchewan and Manitoba; and the Cardium shale/sandstone formation that extends from Alberta and into eastern British Columbia.

To the east, the potential of Canada’s version of the Utica shale, the Frederick Brook, and other prospective plays is being stymied by provincial restrictions. These include a supposedly temporary fracing ban in much of Quebec, and New Brunswick regulations that have been described as “onerous.”

DUVERNAY EXPECTATIONS HIGH

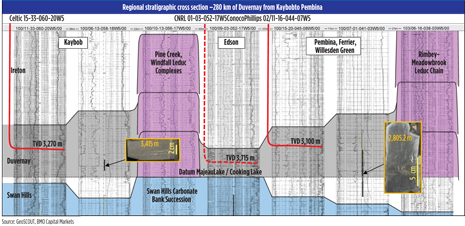

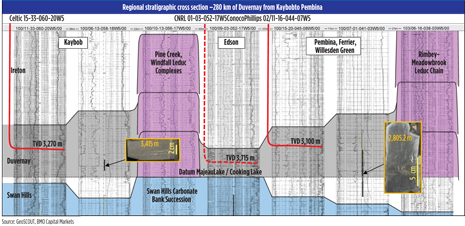

Recognized as the source rock for the Devonian-aged Leduc Reef, Keg River and Slave Point formations and oil sands bitumen, the Duvernay shale covers roughly 162,137 sq mi, lying between the Peace River Arch and Calgary. A gas play with an exceptionally high liquids component, the Duvernay is described as comprising interbedded bituminous shales, calcareous shales and dense argillaceous limestones, Fig. 2. Formation depths range from around 8,200 to 13,126 ft, with thickness varying from just under 33 ft to approximately 230 ft. The play is said to become shallower and more liquids-rich as it moves from west to east.

|

| Fig. 2. Regional stratigraphic cross-section of the Duvernay shale play. Source: PackersPlus. |

|

Themig says the high liquids content and reasonably attractive initial production (IP) rates of wells tested, thus far, have drawn strong comparisons to the triple-window Eagle Ford shale of South Texas. For example, Duvernay Kaybob and Eagle Ford wells have exhibited identical 2 to 6% total organic content (TOC) levels. “Though there’s quite a bit of geological variability in the Duvernay, but its high liquids content has gotten everyone excited. If you had to liken it to any significant play in the U.S. it would be the Eagle Ford.”

However, differentiating the rapidly emerging play from its well-established counterpart to the south is a host of technical challenges that has pushed some well costs to as high as $17 million. “The Duvernay is a little deeper than most of the shale work that has taken place in Canada, thus far. We also are seeing very high differential pressures, though not on every well. Generally, however, across the board, we encounter higher stimulation and fracturing pressures than we’ve seen in almost any other play, here in Western Canada,” says the PackersPlus CEO.

Despite the daunting technical and economic issues, the budding play has gotten the attention of some of the largest multinational players. Last October, ExxonMobil fueled heightened expectations with its $2.9-billion acquisition of Duvernay first-mover Celtic Exploration Ltd. The deal gives the major 104,000 net acres in the Duvernay as well as a 45,000-net-acre position in the Montney shale gas play. No 2013 activity plans have been made public. Specific drilling plans likewise have not been released.

Chevron also has built up a 250,000-net-acre position in the Duvernay, where it plans a three-year exploration program to evaluate the properties. Chevron, like ExxonMobil, has not announced specific drilling plans for this year.

Elsewhere, Talisman drilled five horizontal wells last year, in its 347,000-net-acre Duvernay leasehold, four of which were put on production in late December. The operator plans to drill four or five wells this year to further appraise the acreage.

In its first quarter earnings report, Encana said it had commenced production from, what it calls, “the strongest industry well to date” in the Duvernay, recording a restricted 30-day IP rate of 1,400 bpd oil and 4 MMcfd gas.

In December, Encana entered into a more than $2.12-billion JV with wholly owned PetroChina subsidiary, Phoenix Duvernay Gas, which gives the Chinese operator a 49.9% non-operating interest in 460,000 gross acres in the Duvernay. Encana has identified 1,000 to 1,600 gross well locations and plans to participate in 20 Duvernay wells this year. Canada’s largest producer estimates its Duvernay acreage holds more than 9.1 billion boe of petroleum initially in place (PIIP).

BC WELL COUNT DROPS

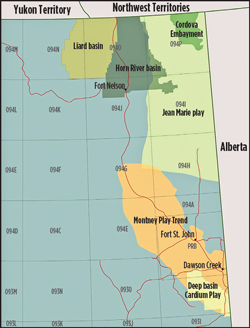

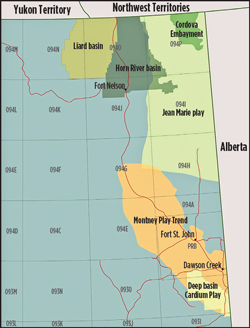

It should come as no surprise that new well construction in British Columbia, particularly in the core gas fairways of the Montney and Horn River shales (Fig. 3), declined appreciably last year, as operators chose to follow the tight oil. Despite the relatively higher liquid content of the Montney, particularly as it moves eastward and into neighboring Alberta, operators reportedly drilled about 205 fewer wells in British Columbia last year. According to statistics provided by the Canadian Association of Petroleum Producers (CAPP), 363 wells were drilled in the province in 2012 compared to the 568 in the prior year.

|

| Fig. 3. Core areas of activity in the Montney, Horn River and Liard basins of British Columbia. Source: British Columbia Ministry of Energy and Mines. |

|

However, if the active rig count is any indication, a rebound of sorts could possibly be on tap for this year. The CAODC reported 26 active drilling rigs in the province as of April 16, up five from the like period last year. Once more, Encana and Apache (Fig. 4), former partners in the Kittimat liquefied natural gas (LNG) project under development, reign as the province’s most active operators.

|

|

Fig. 4. An Apache drilling operation in its Horn River acreage. Photo courtesy of Apache Canada.

|

|

In October 2011, the British Columbia Oil and Gas Commission reported Montney gas production at 1.5 Bcfd and by June 2012 it had approached a cumulative 1.3 Tcf, which the National Energy Board (NEB) projects will “double or triple” by 2020. If all goes as planned, by then at least one of two planned LNG export plants could delivering more than 10 MMT of liquefied British Columbia tight gas to Asian buyers, annually.

In late December, Chevron paid a reported $1.3 billion to acquire a 50% stake in the Kittimat LNG export facility from Encana and EOG Resources. Apache still holds the remaining 50% interest in the LNG plant under construction in northwestern British Columbia. It is expected to be up and running by 2016. As part of the Kittimat LNG deal, Chevron also receives interests in the nearly 288-mi Pacific Trail Pipeline and 644,000 gross undeveloped acres in the Horn River and Liard basins.

In a related development, the NEB, in February, approved an export license for a second proposed Kittimat LNG plant to be operated by the LNG Canada Development Inc. consortium, comprising Shell Canada, Korea Gas Corp. (KOGAS), Mitsubishi Corp. and PetroChina. The consortium said the plant would be designed to process up to 12 million tons a year, but could double output with the addition of a second train. As it now stands, the facility would not be exporting LNG until at least the end of the decade, say the principals.

After giving up its share of Kittimat, Encana says the lion’s share of its 2013 Montney exploration plans will focus on the more liquids-rich Cutback Ridge area, where it holds 982,000 gross acres, Fig. 5. Encana, which operates the holdings under a 60-40% partnership with Mitsubishi, plans to drill around 46 gross wells in its leasehold this year. Encana estimates its Cutback Ridge acreage holds a potential 1 to 2 billion bbl liquids and 130 tcf gas.

|

|

Fig. 5. An Encana fracing operation in the Montney shale of British Columbia. Photo courtesy of Encana.

|

|

Meanwhile, its former partner, Apache, finally took the wraps off three wells that it drilled last year in the remote, high-cost Liard Basin, due west of Horn River. Of those, the D-34-K well, drilled to 12,600 ft TVD with a 2,900-ft lateral and six-stage frac completion had 30-day initial production averaging 21.3 MMcfd , or 3.6 MMcfd per frac stage, the operator said. Apache put the estimated ultimate recovery (EUR) of the Liard well at 18 Bcf. As part of the Kittimat acquisition, Chevron holds a 50% in the Apache Liard prospects.

Elsewhere, just prior to its $15.1-billion acquisition by CNOOC in February, Nexen began production on its 18-well pad in the Horn River in September. While no specifics have been announced, the now wholly-owned CNOOC subsidiary said completion activity on the acreage will continue “over the next several months.”

BAKKEN DRILLING SLIDES

Activity in the Canadian extension of the Bakken shale, which spreads across much of Saskatchewan and Manitoba, is expected to drop slightly this year. In its April 16 reporting period, the CAODC documented six rigs working, compared to nine active rigs at the same time last year. All current drilling activity is centered in Saskatchewan, mostly around the Viewfield area, some 35 mi from the U.S. border, where operators have focused on a stratagraphic trap involving a siltstone member in the lower part of the Middle Bakken.

The Canadian Bakken averages depths of 2,200 to 7,700 ft and lies due north of the thermal “kitchen” of North Dakota and Montana. The average reservoir depth is 5,500 ft, with thickness ranging from 30 to 60 ft. and average permeability and porosity of 12% and 0.4 to 0.6 md, respectively. The NEB describes it as essentially the same rock formation as the Exshaw shale, which runs throughout Alberta and eastern British Columbia, both of which are part of a wide- ranging, relatively thin accumulation of siltstone and sandstone, sandwiched between organic-rich shales.

Crescent Point Energy and aptly named PetroBakken are the premier leaseholders and most active operators in the Bakken play. PetroBakken, which holds 450 gross sections in the Bakken, drilled 97 net wells last year, of which 67 were bilateral wellbores. PetroBakken says its single wellbores, on average, are drilled to a 4,953-ft TVD/9,842-ft MD, compared to its bilateral designs that feature wellbores drilled to 5,249 ft TVD/14,435 ft MD, with 4,593-ft laterals.

The second-largest Bakken stakeholder recently put 43 wells on production, which by the fourth quarter were averaging 19,741 boed, up from 25% recorded in the previous quarter.

While no information was available on the wells expected to be drilled this year, PetroBakken said much of its focus is on the five enhanced oil recovery (EOR) projects ongoing in the Bakken play in “various stages of implementation.”

Crescent Point Energy, likewise, is focusing on EOR within its Bakken resource, where it holds estimated original oil-in-place (OOIP) of 4.6 billion bbl with only 1.9% recovered to date. Crescent Point says its Bakken holdings have upside reserve potential of more than 200 million bbl, which does not take into account the possible increases from ongoing waterflood EOR projects.

CARDIUM IS NEWEST PLAYER

One of the latest entrants in the horizontal tight oil play, the Cardium shale/sandstone is being targeted in a wholesale field re-development campaign largely concentrated around the prolific and long-in-the-tooth Pembina field near Edmonton, Alberta. “They only started drilling horizontally there in the last three years or so,” said Mike Kenyon, Canada regional manager for PackersPlus. “They couldn’t drill and produce vertical [Cardium] wells economically. Now, it’s one of our (PackersPlus) busiest areas.”

A mixture of sandstone and shale, the predominately light oil Cardium fairway runs from Alberta and into northeastern British Columbia. The NEB estimate that the Cardium, which extends below and to the west of the Exshaw formation, contains OOIP of up to 10.6 billion bbl.

ConocoPhillips is the play’s largest leaseholder with a reported 2.4 million gross acres, primarily targeting Cardium prospects in the Deep basin of northwestern Alberta and northeastern British Columbia, Fig. 6.

|

|

Fig. 6. A ConocoPhillips-operated rig targeting Cardium prospects in the Deep basin. Photo courtesy of ConocoPhillips.

|

|

PetroBakken, likewise, holds a prominent position in the Cardium, where it holds interests in 350 gross sections. The operator’s activity is concentrated on its East Pembina, West Pembina, Garrington and Lochend holdings. During the fourth quarter, PetroBakken drilled 33 Cardium wells and put 41 on production. Production during the quarter averaged 19,055 boed, up 29% over the third quarter. The operator says it has identified more than 580 net drilling locations in the play.

PetroBakken says it transferred its experience in drilling bilateral wells in the Bakken to its Cardium properties. The operator’s bilateral Cardium wells are drilled to average depths of 6,807 ft TVD/11,440 MD, with the same 4,593-ft laterals characteristic of its Bakken wells. Along with ConocoPhillips, Talisman, Forrest Oil, ExxonMobil and Devon are listed among the larger players targeting the Cardium formation.

UTICA ON HOLD

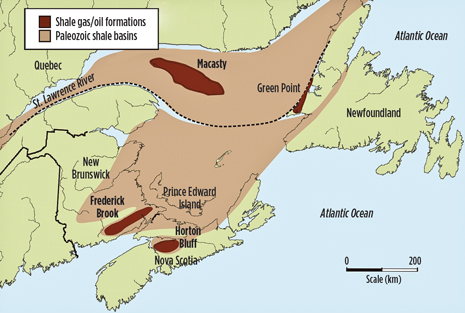

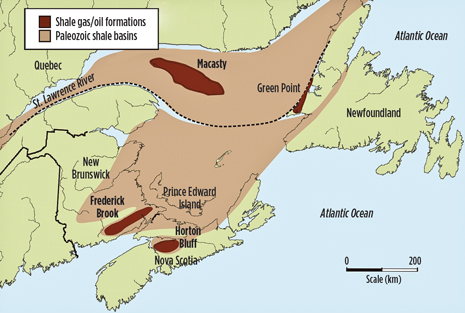

To the east, an environmental backlash has stymied development of the Canadian version of the Utica shale and other prospects, Fig. 7. New Brunswick recently enacted what some decry as overly restrictive fracing regulations, while Quebec has placed a moratorium on the practice throughout much of the province, pending the outcome of an environmental review.

|

|

Fig. 7. The delineated geographic range of the Macasty and Frederick Brook shales of eastern Canada. Source: Corridor Resources.

|

|

“The regulatory environment here, insofar as the shales are concerned, is really just now evolving,” said Andrew Noseworthy, senior advisor to the president of Atlantic Canada Agence de Opportunities. “It’s been quite a divisive issue up here. New Brunswick has really been challenged to get its act together and just came out with a very substantive process, both on the regulatory and royalty side.”

To date, Halifax-based Corridor Resources is, by far, the most prominent player in the eastern shale scene, with a lease position of some 2 million gross acres. Last year, Corridor and partner Petrolia Inc. launched an exploration program on Quebec’s Anticosti Island, where it targeted the Utica-equivalent Macasty formation within its 1.5-million-acre leasehold.

The JV drilled three stratagraphic coreholes within the Macasty oil window, which a subsequent comparative analysis showed had most of the same characteristics as Ohio Utica wells.

Corridor also is seeking farmout opportunities for its gas-rich Frederick Brook shale prospect, near its conventional McCully field in New Brunswick.

COMPLETIONS EVOLVING

The comparatively recent exploitation of Canada’s shale plays, especially with respect to tight oil, has promoted a steady evolution of frac design and overall completion strategies. “I think one of the keys to the success of a lot of these types of plays is only partly due to the geology, but also the evolution of the completion technology,” said PackerPlus CEO Themig.

In what it now describes as “Bakken 3.0,” PetroBakken said its completion methodology in Bakken wells has advanced systematically, and today features bilateral horizontal wells with 15 fracs per horizontal leg. Its earliest Bakken wells were completed with eight-stage fracs in nearly 5,000-ft laterals. The operator says the bilateral approach is more cost-effective, as it eliminates one vertical well and requires only a single surface location.

Also in the Bakken, a three-point benchmarking exercise ultimately saved an operator more than 50% in completion costs, said Eric Schmeltzl, Calgary-based vice president of strategic business for NCS Oilfield Services, developer of the Multistage Unlimited technology.

The coiled tubing-deployed NCS technology is used in conjunction with an isolation system that allows the delivery of an open sleeve string from the toe of the well, with each sleeve location fraced individually. Incorporating an abrasive jet cutter to the bottomhole assembly (BHA) gives the operator the flexibility to add a frac stage at any point in the wellbore, where a sleeve has not be installed.

The company recently placed 50 stages in a single-well completion, which it repeated over three consecutive wells. Schmeltzl said the three-well project was part of an operator’s comparative study of different fracing approaches for 2-mi. laterals. For the first well, the operator employed jet cutting entirely. In the completion of the second well, the operator incorporated a mixture of 15 jet-cut stages and 35 sleeve stages. The final well was completed wholly with 50 sleeve stages, which Schmeltzl said proved to be the most cost-efficient methodology.

“The operator used this comparative exercise to measure the cost savings between using just sleeves or abrasive jet cutting, or a combination of both. Being able to place 50 stages in two-mile laterals allows the operator to access more of the reservoir with fewer wells,” he said.

Owing to its high differential pressures, the Duvernay, in particular, has forced operators to re-evaluate their initial completion approaches. PackersPlus, for one, has modified its equipment specifically to meet the play’s distinct characteristics. Themig said that today 15,000-psi working pressure is the standard rating for the company’s Duvernay completion technologies. These include the StackFRAC Titanium multi-stage fracturing system. By comparison, he said in the Canadian portion of the Bakken, hydraulic fracturing using 6,000-to-7,000 psi equipment “would be more than adequate,” while the Montney requires ratings of no more than 10,000 psi.

“The Duvernay has a bit of unpredictability as to what the pressures will be for hydraulic fracturing,” continued Themig, “We had some operators that were convinced they would not see high bottomhole treating pressures, but right away we started seeing pressures that made breakdown difficult. Consequently, we evolved to where 15,000 psi equipment has become the standard,” he said.

In the first wells drilled in the play, Themig said operators tried both open-hole and cemented plug-and-perf completions. Some operators switched to cemented perf-and-plug completions after unexpectedly high pressures resulted in casing failures after four or five open hole stages. However, he said, “operational issues fairly unique to this formation” propelled the perf-and-plug-completed wells far over budget, forcing a return to the open-hole approach. Themig said those drawbacks inspired the introduction of the 15K, titanium, multi-stage fracturing technology. “From an engineering standpoint, we basically had to design our equipment specifically for the Duvernay formation.”

Elsewhere, with the Cardium being a comparative neophyte with respect to horizontal well construction, it is to be expected that completions will be fraught with trial and error. PackersPlus’ Kenyon said operators have progressed quickly, going from earlier completions that utilized conventional liner hangers and now are designed entirely with monobore systems where 40-stage fracs are the norm. “The number of stages has come up dramatically. “They are now doing a lot of slickwater designs that are allowing them to get better frac complexity with higher production results.”

Furthermore, microseismic monitoring techniques also have made their way into the budding tight oil plays and are being used to help optimize reservoir drainage, says Ontario-based ESG Solutions. Recently, the company acquired and processed microseismic data from a 14-stage horizontal sliding sleeve program in a tight oil prospect near Grande Prairie, Alberta.

|

|

Fig. 8. Microseismic events recorded during a 14-stage horizontal fracture stimulation in an Alberta tight oil well. The individual events are colored by stage. Source: ESG Solutions.

|

|

An ESG spokesperson said the program relied on a single monitoring well to capture microseismic activity associated with the multi-stage stimulation, revealing pertinent data on the local stress regimes and potential geological structures that may impact production efficiency, Fig. 8. According to ESG, during a further inspection of results from Stages 12-14, an issue with the sliding sleeve completion was identified, which suggests a productive area of the well had been bypassed during stimulation.  |