|

End-of-year oil reserves increased for the third consecutive year, and gas reserves grew from 18.6 Bbbl in 2010 to 20.3 Bbbl in 2011, while gas reserves increased 4%, combined annual growth in the five-year period analyzed by Ernst & Young in its 2012 US E&P benchmark study. This compilation includes the 50 largest companies, based on 2011 end-of-year oil and gas reserve estimates. In the case of both oil and gas reserves, the largest portion of the increased reserves presumably came from tight formations. An increase in gas reserves is also attributed to unconventional shale gas formations.

|

|

|

Oil reserves. Extensions and discoveries were 2.4 Bbbl in 2011, the highest level of the five-year period and 58% higher than the 2010 level of 1.5 Bbbl. EOG Resources recorded the largest extensions and discoveries for the second year in a row (241.7 MMbbl in 2010 and 267.8 MMbbl in 2011), as the company continued its efforts to develop its oil and condensate and liquids-rich natural gas properties.

| U.S. oil reserves, year-end 2012, million bbl |

|

|

Oil production rose 3% in 2011 to 1,403.5 MMbbl. The largest production increases were reported by EOG Resources (18.5 MMbbl) and Chesapeake Energy (13.3 MMbbl). The largest declines in production in 2011 were experienced by integrateds—BP, ExxonMobil, Royal Dutch Shell and Chevron. Purchases of oil reserves were 339.9 MMbbl in 2011. Marathon Oil (89.0 MMbbl) and Occidental Petroleum (80.0 MMbbl) were the leading purchasers for their previously discussed acquisitions. Sales of oil reserves were 226.3 MMbbl in 2011. Sand-Ridge Energy reported the largest sales at 43.3 MMbbl, as it sold properties in the Permian basin and New Mexico.

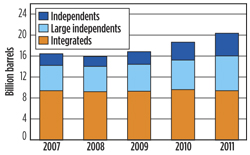

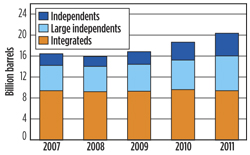

The growth in oil reserves over the five-year period has been driven by the independents and large independents. From 2007 to 2011, the independents’ and large independents’ oil reserves have grown 92% and 37%, respectively. The integrateds’ oil reserves have remained essentially flat.

Gas reserves. A 4% increase in gas reserves, which rose from 172.1 Tcf in 2010 to 178.2 Tcf in 2011. Extensions and discoveries were strong at 26.0 Tcf, but decreased 4% from 27.2 Tcf in 2010. For the third consecutive year, Chesapeake Energy recorded the largest extensions and discoveries (4.2 Tcf in 2011), as a result of its active drilling program. A decline in prices led to downward revisions of 4.2 Tcf being recorded in 2011.

| U.S. gas reserves, year-end 2012, Bcf |

|

|

Gas production was 12.9 Tcf in 2011 compared with 11.9 Tcf in 2010, representing a 9% increase. ExxonMobil accounted for 47% of the total increase as additional unconventional gas volumes led to a 497.0 Bcf increase in its production. Several other integrateds saw large declines in gas production in 2011—BP, Royal Dutch Shell and ConocoPhillips had production declines of 14%, 16% and 7%, respectively. Purchases of gas reserves were 4.3 Tcf, with Chevron (1.2 Tcf) and Occidental Petroleum (728.0 Bcf) as the top purchasers with their previously discussed acquisitions.

Chesapeake Energy accounted for 2.8 Tcf of the sales activity, primarily due to the sale of its Fayetteville shale assets.

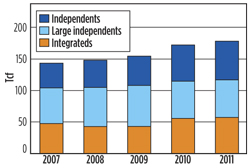

The integrateds’ gas reserves grew 20% while the large independents’ increased 5%—these results were significantly impacted by ExxonMobil’s acquisition of XTO Energy in 2010. The independents have benefited most from the uncoventional gas boom as their gas reserves increased 57% over the five-year period.

|