|

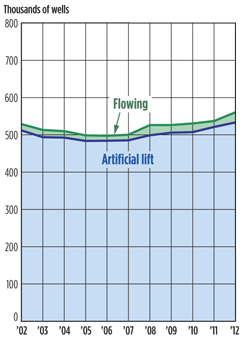

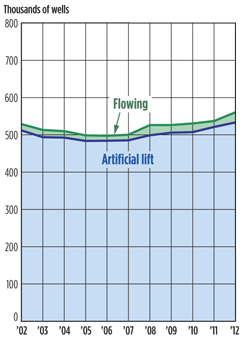

Last year, the number of U.S. wells producing oil grew 2.6% (up 14,225 wells), boosted by increases in oil-directed drilling. Producing oil well activity showed signs of growth in every U.S. region (see map on page 63) during 2012.

The total U.S. average for naturally flowing wells was 4.9% (27,228 wells). The Rocky Mountain region had the greatest percentage of flowing wells in the country at 8.4% (4,693 wells). The Gulf Coast region had 8.3% flowing oil wells (16,032 wells), while the West Coast had 7.3% flowing wells. The Midwest brought this average down with a national low of 0.3% flowing wells (262 wells). The East Coast had 1% naturally flowing wells, while the Mid-Continent region had 1.5%

The Federal OCS has the most naturally flowing wells of any area in the U.S at 49.7% (1,357 wells). Mississippi had the next greatest share of flowing wells at 39.0% (852 wells), followed by North Dakota at 36.1% (2,200 wells). The West Coast region’s flowing well count benefitted from Alaska, which had 25.6% (439 wells) not requiring artificial lift. Oklahoma, conversely, said that none of its 86,000 oil wells were flowing naturally.

The Rocky Mountain region added the greatest percentage of active oil wells at 4.1% (up 2,163 wells). This increase was carried largely by Colorado, which increased its count by 1,114 wells. Colorado also overlies parts of the Niobrara shale, where oil activity is expanding.

| Estimated U.S. wells producing oil at the end of 2012* |

|

|

New Mexico increased its number of producing oil wells 3.8% (up a sizeable 873 wells), followed by Utah which increased its count 11.8% (up 449). Montana posted a gain of 134 wells, while Wyoming was the only state in the Rocky Mountain region to see its active well count reduced in 2012, falling 4.2% (down 416).

The Mid-Continent region added 4,237 producing oil wells (up 2.8%). Most of these gains took place in Kansas, which increased active wells 3.1% (up 1,865 wells), and North Dakota which boosted its producing oil wells 28.1% (up 1,821 wells). North Dakota is home to the Bakken shale, where there is a major boom underway.

The East Coast increased its producing oil well tally by 653 wells (2.6%), the third-best performance among the regions. Pennsylvania accounted for nearly all of this increase. The state added 630 producing wells (up 3%), while New York gained 26 wells (up 0.7%). West Virginia’s active count fell nine wells.

Texas led the Gulf Coast in producing oil well growth, contributing an impressive 4,652 wells to the region’s overall 2.4% increase (up 4,493 wells). This accounts for over half the activity on the Gulf Coast and over a quarter of all producing oil well gains in the U.S. during 2012. Producing oil wells in the liquids-rich Permain basin (Districts 8 and 8A) showed significant growth, jumping 2,892 wells. Additionally, producing wells in the oily Eagle Ford shale area (Districts 1, 2 and 4)were up 6.2% (1,102 wells). Alabama increased its active oil wells 3.7% (33 wells), while Arkansas actually lost 61 wells.

|

| Estimated U.S. oil producing wells |

|

The Midwest brought a net gain of 1,652 oil wells onstream, growing 2.2%. These increases took place mostly in Kentucky. Ohio chipped in with 55 additional wells. Michigan lost 330 active wells, falling 7.9%, while Illinois lost about two dozen wells.

California and Alaska brought the West Coast region almost one thousand new oil wells, contributing to a 2.1% increase. The Pacific OCS added three more producing wells.

|