DR. ROGER H. BEZDEK, Contributing Editor, Washington

Elections have consequences. For the upstream oil and gas (O&G) industry, the consequences of the November 2012 U.S. election are not good. There is no way to sugarcoat the fact that the major consequence for the industry is that it backed the wrong horse. President Obama won a second term, the Democrats unexpectedly increased their control of the Senate, and, while the Republicans maintained control of the House of Representatives, the Democrats gained eight seats. Nationwide, the results unpleasantly surprised Republicans (and surprised just about everyone else, as well)—almost uniformly grim, and for Republicans are potentially ominous for the future. For example:

-

President Obama was re-elected with a large Electoral College majority, in a year when he was supposed to be vulnerable on the economy and jobs.

-

The Senate elections were an unexpected disaster for Republicans, who lost races that they could have won in half-a-dozen states.

-

Republicans retained control of the House. However, 49% of votes cast were for Democrats, and 48% were for Republicans.

-

This is the fifth out of the past six presidential elections where the Democratic nominee received more votes than the Republican nominee.

-

Republicans are in danger of becoming a party of whites concentrated in the South, whereas the U.S. is rapidly becoming increasingly more diverse, with minorities voting mostly for Democrats.

-

Once solidly Republican Colorado and Virginia may be turning into Democratic states. Other once-Republican states (Florida, Georgia and North Carolina) may become toss-ups.

-

Republican leadership is rudderless or nonexistent. Mitt Romney has disappeared; House Speaker John Boehner (Rep.–Ohio) could not control even his own Republican members in the “fiscal cliff” negotiations; and Senate Minority Leader Mitch McConnell (Rep.–Ky.) is worried about his own re-election next year. No other obvious Republican leader is in sight.

Unenviably, the industry publically and overwhelmingly backed the losers. The industry made no secret of its preference for Romney over Obama, and its campaign contributions followed, accordingly. Similarly, in Senate and House races, O&G campaign contributions were lopsided in favor of Republicans. In House races, the industry’s campaign contributions favored Republicans 10-to-1. Of the top 20 Senate candidates receiving O&G campaign contributions, only two—Joe Manchin (W.V.) and Mary Landrieu (La.)—were Democrats, and they received relatively little money. API was the largest O&G political funder, with its television ads avoiding explicit endorsements of any candidate, although they clearly echoed Romney/GOP policy stands. Energy trade associations targeted swing states like Ohio, Colorado, Virginia and Pennsylvania—all of which Obama won.

The industry had no Plan B. In previous elections, it supported candidates of both parties to maintain influence and options. Now, however, the implications of siding with the Republicans include:

-

A less-friendly White House, and less-friendly Executive agencies

-

A Senate controlled by the party that the O&G sector vigorously opposed

-

An administration and Democratic party beholden to environmentalists, who strongly supported them and now expect to be rewarded

-

More subtly, an administration and its officials no longer constrained (as they were last year) by an upcoming election.

I summarize below what this may mean for some major issues affecting the oil and gas industry.

|

| Newly elected President Barack H. Obama feels emboldened to challenge the oil and gas industry. |

|

OIL AND GAS TAXES

The last minute “fiscal cliff” deal enacted on Jan. 1 did little more than kick the can down the road for several months. Most of the major revenue and spending issues are not resolved. Over the past four years, President Obama has repeatedly advocated eliminating “special tax breaks” for O&G companies. Although none of these were included in the tax bill that avoided the “fiscal cliff” in January 2013, the President still wants to get the tax changes enacted into law. Last year, he backed elimination of eight oil-and-gas-related tax provisions, but that proposal died in Congress. Nevertheless, trillions of dollars of revenues and spending still need to be addressed. So, a newly emboldened White House will target O&G tax provisions.

In the past, the Obama administration has proposed, among other things, to levy an excise tax on Gulf of Mexico production and to limit excess royalty relief; to repeal the EOR credit; repeal the marginal well tax credit; repeal the expensing of IDCs; and repeal the tertiary injectant deduction. It estimates that eliminating these and related tax provisions would raise $30 billion over ten years.

No doubt, some tax provisions benefit the industry, just as there are provisions that also benefit many other industries. However, it must be questioned whether these are somehow “special” tax breaks for O&G or are more general provisions applicable to all industries. For example, Section 199 of the U.S. Tax Code provides a deduction, available to nearly every American manufacturer, for building production facilities in the U.S. It applies equally to software manufacturers, drug manufacturers, automobile companies (such as Ford and GM), and even to the movie industry. It is, thus, not a special tax break designed exclusively for O&G. Similarly, the foreign tax credit benefits affect many businesses, not just O&G.

The industry should be prepared for new, continuing assaults by the administration and congressional Democrats on tax provisions. These will likely begin soon.

|

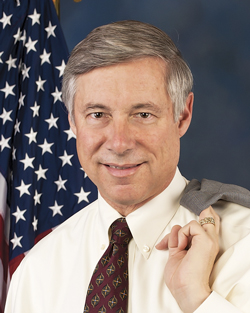

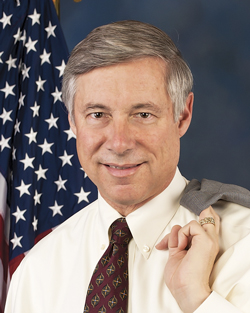

| In the House, Rep. Fred Upton (Rep.-Mich., left), chairman of the Energy and Commerce Committee, and Rep. Dave Camp (Rep.-Mich., right), chairman of the Ways and Means Committee, will ensure that President Obama does not strip away oil and gas tax breaks. |

|

EPA–PRIMARY ATTACK DOG

On Dec. 27, Environmental Protection Agency (EPA) Administrator Lisa Jackson announced her resignation, and most in the energy industry reacted to her departure with “good riddance.” Jackson was often a controversial figure, and EPA rules passed during Obama’s first four years under her tenure became a symbol of the President’s anti-business, regulatory over-reach. However, such reactions may be short-sighted and of the be-careful-of-what-you-wish-for variety.

Under Obama’s second term, EPA is unlikely to become more industry-friendly than under his first term. The effect at EPA of the O&G sector’s strongly opposing the President’s re-election, while environmentalists supported it, is obvious. Jackson’s likely successor will either be Robert Perciasepe, who headed EPA’s air and water offices during the Clinton administration and now serves as EPA’s deputy administrator under Obama; California Air Resources Board Chairwoman Mary Nichols; or Kathleen McGinty, a former Clinton official and former Pennsylvania state Environmental Secretary, who is also a protégé of former Vice President Al Gore. Any of these three may be as bad, or worse, than Jackson.

Jackson’s replacement will likely face a contentious confirmation process. The Senate Environment and Public Works Committee (EPW) will hold the confirmation hearings. The nominee will be confirmed, since Democrats control the committee. However, several EPA critics sit on EPW, including David Vitter (Rep.-La.), the incoming ranking member.

|

| As the current EPA deputy administrator, Robert Perciasepe would seem to have the inside track to succeed Lisa Jackson as administrator. |

|

EPA administrators have been given wide powers to implement rules that Congress chooses not to enact as law, such as GHG regulations. Jackson certainly used these powers during her tenure, implementing increased fuel efficiency rules for autos, and setting more stringent regulation of air pollution and soot. Perhaps one of Jackson’s greatest, but least appreciated, achievements was in not regulating hydraulic fracturing. While the administration remains skeptical of fracing, Jackson has remained somewhat neutral, publicly admitting that no study has ever shown a link between fracing and groundwater contamination. The next four years under a new EPA administrator will have important implications for the industry. The President’s energy agenda through 2016 includes finding new ways of regulating oil and gas, specifically fracing, where the next EPA chief will play a crucial role.

Finally, there is an 800-lb gorilla standing in the corner. Recent studies have purported to show that the GHG footprint of natural gas obtained from fracing is, due to methane venting and leaks, much higher than that resulting from conventional gas production, and even significantly higher than that from coal. The shale gas industry disputes this; nevertheless, the mischief that a determined EPA administrator—encouraged by environmentalists—could cause, can be easily imagined. As noted, be careful what you wish for.

FEDERAL FRACING REGULATIONS

EPA is only one of 14 federal agencies involved in fracing regulation. In the coming months, EPA, alone, may issue guidance for the use of diesel fuels during fracing (which will strip from states the primacy granted to them under the Safe Drinking Water Act); complete a study that may link fracing to water contamination; answer numerous petitions filed by environmental organizations (often with EPA encouragement), potentially leading to back-door regulation of fracing through three separate, existing acts; and introduce Effluent Limitations Guidelines for both shale gas and CBM.

Jackson’s successor will have to refine those rules, which makes O&G companies anxious. The new EPA administrator will have to regulate the fracing boom that has revolutionized the O&G sector but also raised fears over possible contamination of water supplies. It has become a flashpoint issue, placing EPA in the middle of a fight between environmentalists and O&G companies. Both sides await a major EPA research project into fracing’s effects on water supplies, due in 2014, as well as final rules on issues, including the disposal of wastewater and the use of “diesel” chemicals.

While fracing was exempted from the Federal Clean Water Act in 2005, operations that use diesel fuel, which contains toxic chemical compounds, were not exempted. However, what exactly constitutes “diesel” has been highly controversial—should “diesel” be defined broadly or narrowly? It is potentially a very significant issue, especially for Bakken producers in North Dakota, where crude oil output has tripled in two years. EPA published a draft definition in May, but it will up to the new EPA administrator to set a final definition.

|

| Federal and state regulations governing frac jobs, like this one for Swift Energy last year in the Eagle Ford shale of South Texas, will be a constant issue for producers in 2013. |

|

The industry is warning the administration not to impede drilling and the resulting economic benefits. However, environmentalists are pressuring Obama to ensure that fracing does not endanger water resources. The administration would like to encourage economic growth to enhance its legacy, and the O&G sector is one of the few bright spots in the U.S. economy. Even some Democrats note that the U.S. shale gas boom is playing a positive economic and environmental role, with carbon emissions down 12% since 2007, partially because natural gas has been displacing coal.

Nevertheless, after years in which states were mostly responsible for regulating onshore drilling, the new EPA administrator may take a more central role. A recent Gallup poll found that drinking water contamination is Americans’ leading environmental concern, and environmentalists were quick to take advantage of these findings.

A year ago, in the first U.S. governmental report of its kind, EPA drew a potential link between water contamination in Pavillion, Wyoming, and fracing, based on area groundwater samples. That study has been contested, and subsequent research has been inconclusive. A more definitive finding on the impact may not emerge until 2014, when EPA releases the first exhaustive, in-depth governmental study of the long-term effects of fracing on drinking water.

EPA also plans to begin regulating—probably in 2014—millions of gallons per day of wastewater withdrawn from wells after fracing is finished. However, EPA eventually could face pressure to backtrack on previous initiatives. In April 2012, the agency relented to pressure from the industry, giving drillers until January 2015 to end the practice of “flaring” excess natural gas from wells that were not connected to pipelines. It had initially proposed that firms cease almost immediately.

STATE FRACING REGULATIONS

Whatever actions federal agencies take, states will maintain a key role in fracing regulation. Confronted with concerns about potential environmental and health impacts, states have responded with a patchwork of different regulations that have significant variation among them. In all, 31 states have implemented fracing regulations that differ in coverage and stringency. For example, some states require full disclosure of chemicals, whereas others do not. More importantly, states enforce their rules with different levels of vigor.

The adequacy of state fracing disclosure laws is mixed. In many states with regulations requiring disclosure of fracing chemicals, companies can evade the transparency requirement by unilaterally declaring that a chemical is a proprietary “trade secret.” For example, in Texas, companies claimed that chemicals used in fracing were a secret 19,000 times, and that was just in the first eight months of 2012. On average, five chemical ingredients were withheld in each well.

Opposition to fracing has emerged in many states, including some that traditionally support the industry, such as Colorado, Idaho, New Mexico, Utah and Wyoming. For example, in Colorado, gas mask-wearing protesters are confronting city and county officials considering fracing limits or bans. At hearings across the state, opponents have harassed O&G representatives. Even Colorado’s governor, a Democrat and former geologist who believes that fracing is safe, has been heckled. The anti-fracing movement hit a watershed in the 2012 elections, when Longmont, a town of 85,000, 30 mi from Denver, voted overwhelmingly to disobey state law and prohibit fracing within its limits. This set up a legal showdown over whether individual communities can challenge the Colorado Oil & Gas Conservation Commission, which regulates the industry statewide.

The dispute is shifting to the Colorado capitol, where lawmakers tried, and failed, to resolve the issue. During the legislative session that ended last May, Colorado’s Democratic Senate and Republican House agreed on nothing related to fracing. However, the new legislative session could be different. Both chambers are now under Democratic control, and some type of regulation and limits is likely to be enacted.

In New York state, after more than four years of environmental review marked by escalating battles between industry officials and anti-fracing protesters, regulators appear likely to complete strict new regulations for shale gas development by the end of February. Whether drilling actually begins, remains to be seen. Governor Andrew Cuomo (Dem.) and his Department of Environmental Conservation have refused to say whether a 4 1/2-year fracing moratorium will be lifted, when regulations are completed.

LNG EXPORTS

A battle is shaping up over U.S. LNG exports. With record volumes of shale gas being produced, and domestic prices well below international prices, the O&G sector is eager to begin LNG exports. LNG in Asia sells for about four times the U.S. price. However, large industrial gas consumers, including Dow Chemical, Alcoa and Nucor, have formed an alliance to limit such exports. The new organization, America’s Energy Advantage, plans to “educate policymakers on the potential risks to the U.S. economy of unfettered natural gas exports.” Its members fear that exports could drive U.S. gas prices higher.

Firms favoring exports include the BG Group, ConocoPhillips, ExxonMobil and Dominion, which are building LNG plants. Thus far, only one company, Cheniere Energy, has been awarded a license to export LNG to countries with which the U.S. does not have a free trade agreement. Fifteen more proposed projects have been filed with the Department of Energy. If all 16 facilities were to be constructed, export capacity would be 24.8 Bcfd, about a third of total U.S. gas production. DOE approval of applications for LNG export terminals is required.

|

| Cheniere Energy’s plan for an LNG export facility at Sabine Pass, Texas, is, so far, the only project of its kind licensed by DOE. Diagram courtesy of Cheniere Energy. |

|

A recent study by NERA Economic Consulting, commissioned by DOE as part of the review process, concluded that unrestricted LNG exports would increase U.S. natural gas prices by, at most, $1.11/MMbtu after five years, and would result in a net benefit for the U.S. economy that could total nearly $50 billion by 2020. DOE said that it would consider export license applications on a “case by case” basis. The Obama administration seems willing to allow increased gas exports, but opposition is increasing, and the issue is politically sensitive. Some members of Congress consider energy exports a threat to national security, while others fear that LNG exports would lead to price increases that would harm manufacturers and homeowners.

While recognizing the seriousness of the debate, I nevertheless find it difficult to believe much of what I am hearing. For decades, the U.S. has had serious balance-of-trade problems. Now, thanks to industry innovation, technology and investment, the U.S. may be on the verge of an LNG export boom, yet politicians are seriously considering restricting the exports? Hopefully, common sense will prevail here.

KEYSTONE XL PIPELINE

With the election campaign and its associated voter concerns behind him, Obama may finally decide whether or not to approve the Keystone XL pipeline. Environmental groups are lobbying against it, and the President’s new Secretary of State, former Sen. John Kerry (Dem.-Mass.), is no fan of XL. More than 70 environmental groups signed a letter to the President urging him not to approve the pipeline. The groups, including Greenpeace, Defenders of Wildlife, the Environmental Defense Fund, Sierra Club and League of Conservation Voters, urged the President to “use your executive authority” in enacting new pipeline regulations.

If Obama decides against Keystone, he may pass the blame onto Secretary Kerry, who is willing to take the heat from O&G firms, and from many members of the public, who believe that killing Keystone means destroying jobs. The yet-to-be-approved segment crosses the border from Canada, and it must gain State Department approval. Secretary Kerry has given numerous speeches on the Senate floor, warning of the dangers of global warming. He has been described as a “champion for climate issues” by the same groups lobbying Obama to kill Keystone. As chair of the Senate Foreign Relations Committee, Sen. Kerry in an October 2011 statement vowed to “leave no question unanswered, including every possible economic and environmental consideration before a final decision is made on Keystone.”

|

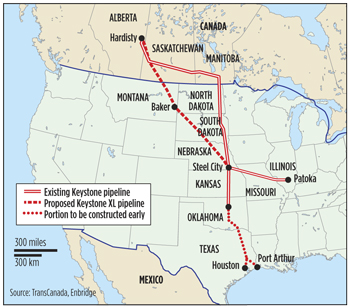

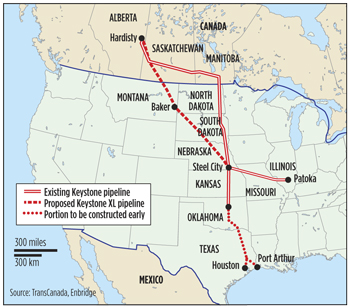

| As this map indicates, the only Keystone XL segment lacking approval and awaiting construction is the portion from the Canadian border, through Nebraska and down to Cushing, Okla. Map courtesy of TransCanada Corp. |

|

Keystone XL recently cleared a major hurdle when Nebraska’s Department of Environmental Quality issued a report finding that the pipeline’s route through the state would carry “minimal” environmental risks. Last year, Obama used Nebraska’s concerns about the route as his reason for rejecting the project in spite of a congressional deadline. However, Nebraska’s Republican Governor, Dave Heineman, last month approved a new route for Keystone through his state. The pipeline has been held up for more than a year, in large part because of Nebraska’s objections. The Republican governor’s approval is one of the last remaining hurdles that the pipeline has to clear before getting a final permit from the Obama administration. Gov. Heineman had originally opposed the pipeline, but the new route, plus the report’s findings that Keystone will create $418 million in economic benefits for Nebraska, while not impacting water quality, were enough to sway him.

The State Department is finalizing a supplemental environmental impact statement (SEIS) on Keystone, and signs point to the decision being delayed until the spring. Had the elections turned out differently, Barack Obama would not be President and John Kerry would not be Secretary of State, and approval of Keystone XL would be assured. Elections matter.

RETURN OF THE CARBON TAX?

Like a zombie who refuses to die, a carbon tax may be back on the agenda. The Democrats are ascendant, and even after the fiscal cliff deal, the U.S. is still searching for trillions of dollars of deficit reduction. HSBC Holdings Plc believes that Obama may introduce a carbon tax to help reduce the budget deficit. A tax starting at $20/metric ton of carbon dioxide equivalent, and increasing at about 6% annually, could raise more than $150 billion by 2021 and reduce the projected 2022 budget deficit by about half.

However, a carbon tax remains unpopular. A survey by the Institute for Energy Research found that the public remains opposed, and 78% understand that such a tax will increase energy prices. The U.S. Congress has not addressed climate change since efforts to pass “cap-and-trade” legislation imploded in the Senate in 2010. Nevertheless, some Democrats now hope that Obama will use his executive powers to address the issue, and he has cited climate change as a priority since being re-elected.

If Mitt Romney had won, or if the Republicans had gained control of the Senate, no one now would be thinking about instituting a federal carbon tax. Once again, elections have consequences that reverberate for at least several years.

|

The author

DR. BEZDEK is an internationally recognized energy analyst and president of Management Information Services, Inc., in Washington D.C. He has 30 years’ experience in research and management in the energy, utility, environmental and regulatory areas, serving in private industry, academia and the federal government. He has served as senior adviser in the Office of the Secretary of the Treasury, as U.S. energy delegate to the European Community and to NATO, and as a consultant to the White House, federal and state government agencies, and various corporations and research organizations. His most recent book is The Impending World Energy Mess. |

|