|

JIM REDDEN, Contributing Editor

|

| An EnerVest drilling location on its Barnett acreage. Courtesy of EnerVest Operating LLC. |

|

Much like the once-hyperactive pensioner clinging to assurances that productive days remain, the granddaddy of the unconventional shale plays stubbornly refuses to fade into retirement.

To be sure, even as active drilling rigs in the core dry gas fairway of the Barnett Shale are becoming endangered species, daily production continues to rise year-on-year throughout the more than 6,000-sq-mi play underlying some 23 North Texas counties. The predominately gas-bearing Mississippian shale, widely heralded as the proven ground for hydraulic fracing technology, also is re-inventing itself, in a way, with most of the more recent drilling activity focusing largely on the oil-rich Combo play to the north.

Meanwhile, despite gas that shows no sign of rebounding anywhere near the double-digit prices operators enjoyed less than five years ago, many long-time devotees like Devon and Chesapeake remain faithful to the Barnett, even as other once-prominent players, most recently Pioneer Natural Resources, have elected to re-direct their bits to what they see as greener territories.

“By nature of our first-mover position, Devon has acquired the largest and best acreage and is the largest natural gas producer in the Barnett. Devon remains committed to the Barnett and can be expected to ramp up development as commodity prices permit,” the Oklahoma City independent said in a statement.

Operator departures over the past couple of years also have left the doors wide open for some farsighted newcomers, undeterred by the insufferably low commodity prices.

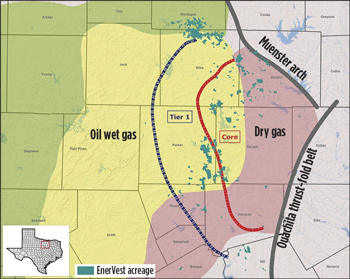

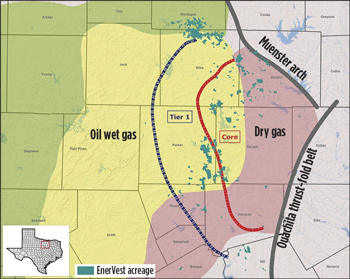

Count EnerVest Operating, LLC among those who see the Barnett as an attractive investment. By the end of 2011, EnerVest had shelled out more than $1.2 billion to gobble up Barnett acreage, amassing what is now an 113,000-net-acre position, encompassing both the wet and dry gas zones as well as the Combo play, Fig. 1. The Houston-based independent, which acquires and operates oil and gas properties for institutional investors, says that with the exception of its Combo play portfolio, most of its remaining acreage is held by production (HBP).

|

| Fig. 1. The 113,000-net-acre lease holding EnerVest amassed in separate transactions encompasses the Combo play as well as dry and wet gas zones. Source: EnerVest Operating LLC. |

|

“We’re not a (Barnett) pioneer, but what intrigued us about the Barnett is that we could come in post those kind of companies,” Lloyd Bruce, EnerVest senior vice president and general manager, told World Oil. “And, the fact is, this is a proven area, it’s derisked and there are still a lot of wells to drill and a lot of gas to recover.”

PRODUCTION UP, RIGS DOWN

The U.S. Energy Information Administration (EIA) agrees. In its latest assessment of domestic shale gas reserves, the EIA calculated that the Barnett holds more than 43 Tcf of undeveloped technically recoverable reserves, with an average estimated ultimate recovery (EUR) of 1.42 Bcf per well.

Yet, that appraisal was released in July 2011, and since then the 231 operators that the state’s chief regulator, the Texas Railroad Commission (TRCC), documents as having varying interests in the Barnett play, routinely set daily production records, surpassing even the 2008 high-water mark, when gas was selling in the $12/Mcf range.

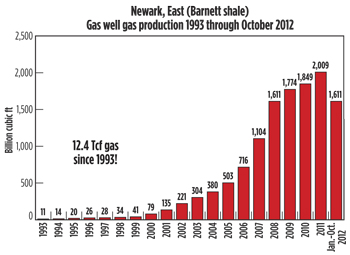

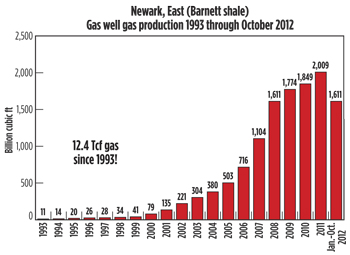

According to the most recent TRCC data available, Barnett operators produced an average of 5.8 Bcfd of gas as of September, eclipsing the then-record 5.6 Bcfd recorded the previous year. Cumulative Barnett production in the January to October reporting period stood at just over 1.6 Tcf, compared to around 2 Tcf at year-end 2011, Fig. 2. That, despite an active rig count that continues to drop weekly and is now a fraction of the more than 200 active rigs drilling on average in September 2009. According to Baker Hughes, as of Jan. 11, 37 rigs were drilling in its 13-county Barnett reporting area, down two from the previous week and 26 less than the like period of 2012, when 63 rigs were running. Of the rigs currently active, some 17 are collectively making hole in Montague, Cooke and Wise counties, which comprise the lion’s share of Combo play activity.

|

| Fig. 2. Aggregate Barnett gas production from January to October 2012. Source: Texas Railroad Commission |

|

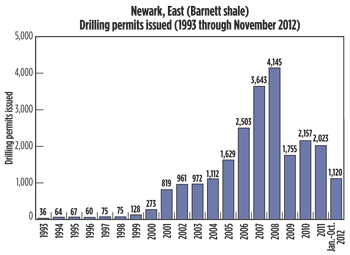

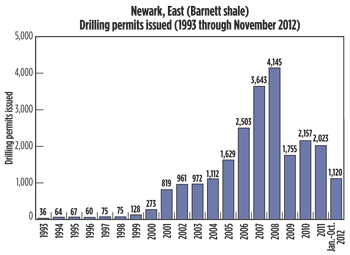

If newly issued drilling permits are any indication, a significant near-term recovery in the Barnett’s active gas-directed rig count does not appear to be in the offing. Between January and November, the TRCC approved 1,120 new permits, compared to 1,231 permits issued for all of 2011, Fig. 3. Both of those yearly totals are a far cry from the 4,145 new drilling authorizations issued in 2008. Furthermore, of the latest permits issued, an aggregate 950 were for wells to be drilled in oily Montague, Wise and western Cooke counties.

|

| Fig. 3. Barnett 2012 drilling permits approved from January to November, 2012. Source: Texas Railroad Commission |

|

While the EIA assessment did not take into account potential oil reserves, EOR Resources, the Barnett’s premier crude producer and the largest leaseholder in the Combo area, estimated in 2011 that the play holds in-place reserves of 70 MMbbl of oil and 175 Bcf of gas for every 640-gross-acre section. Chairman and CEO Mark Papa even described the Barnett Combo as being “one of the richest oil deposits we’ve ever encountered.”

For EnerVest, the tremendous multi-product reserve base, a well-developed infrastructure and comparatively low well costs make the Barnett an opportunity ripe for the taking, even with the low dry gas prices. “Our business model is different from some of the earlier players in the Barnett in that we are a producing property acquirer,” said Executive Vice President and COO Stephen McDaniel. “We try to exploit and fully develop those assets and get incremental recovery from them. That’s why we looked at the Barnett and came in behind some of the earlier players. It’s a proven play and now we’re seeing other companies entering the play with a business model similar to ours. We see that trend continuing.”

EXTENDING THE CORE

The 1981 discovery of the Newark East field by Mitchell Energy, which Devon acquired in 2002, laid the foundation for the Barnett shale play. After MEC earlier perfected hydraulic fracing in the tight gas play, the Newark East field emerged in 2006 as the largest natural gas field in Texas and the nation’s third largest. The core of the Newark East, which still defines the currently delineated Barnett gas fairway, runs beneath most of Wise, western Denton and northwestern Tarrant counties along the Bend Arch-Fort Worth basin. According to the EIA, as the development of the low-temperature and low-pressure Barnett reached beyond the Newark East field, the active section of the Barnett was likewise extended.

Within the core gas production area, the shale ranges in thickness from 50 ft in the south to more than 1,000 ft in the northwest portion of the basin with well depths between 7,500 to 10,000 ft. Conversely, within the predominant boundaries of the liquids-prone Combo play, the shale ranges between 1,400 and 1,700 ft thick. As delineated, the hub of the more-than-90,000-acre Combo play in eastern Montague and western Cooke counties is characterized by middle Ordovician Viola limestone formation that forms a seal beneath the Barnett shale, which helps facilitate multi-stage fracs.

As of October 2012, the TRCC had recorded a total of 16,346 currently producing gas wells in the Barnett. And, contrary to widely held perceptions, once on line those wells tend to remain producing at a reasonable clip over the long haul, says Ed Ireland, director of the Barnett Shale Energy Education Council.

“A common misconception about Barnet Shale gas wells is that they come online with high flowrates and then fall off quickly, giving them a relatively short productive life,” said Ireland. “Data from the TRCC, the Powell Shale Digest and RigData, shows that Barnett shale natural gas wells are very productive for long periods of time, and production stays very level after initial declines in the first few years.”

URBAN ISSUES

Ireland has documented upwards of 1,681 producing wells within the Fort Worth city limits and many more within the boundaries of other municipalities. Consequently, the remaining Barnett operators are left to confront the residential pitfalls of operating in urban environments, even in über-drilling-friendly Texas, Fig. 4. While the past year was marked by continual skirmishes with the EPA over proposed fracing regulations, operators also had to contend with local governments on everything from air emissions and setback regulations to water.

|

| Fig. 4. An earlier Carrizo Oil & Gas drilling location, near the campus of the University of Texas at Arlington, reflects the challenges of drilling in an urban environment. Source: Carrizo Oil & Gas. |

|

The EPA says it plans to complete its sweeping study on the impact of fracing on drinking water supplies by next year. The Barnett, in particular sites in Wise County, was one of five shale plays the EPA chose as part of its multi-faceted fracing review.

Meanwhile, local government bodies also got into the act by considering revisions to many long-held drilling regulations. Dallas, for instance, began hearings late last summer on changing setback rules for rigs punching holes within the city limits. City regulations currently call for 300-ft setbacks from any community or institution, but a task force is recommending 1,000-ft setbacks “to a protected use measured from the property line of the pad site.” In neighboring Fort Worth, the setback within its jurisdiction is 600 ft as measured from the wellhead.

Trinity East Energy also has Dallas in its cross-hairs after the City Planning Commission decided to reconsider earlier approved permits the independent received for a gas drilling program on city parkland in a northwest flood plain.

Residential complaints on air emissions, likewise, have become focal points within the Barnett. The Texas Commission on Environmental Quality (TCEQ) has since responded with no less than seven continuous air monitors scattered throughout the play. TCEQ Chairman Bryan Shaw, said installation of the automatic gas chromatographs make the Barnett Shale “the most monitored air in the county” and thus far, he said, “air testing results have revealed no adverse effects from drilling or fracing operations on air quality.”

“The air emission attributable to gas drilling and production do not approach health effects levels,” Shaw concluded. “The air measured by these monitors in the Barnett shale is not significantly different than in areas that have no natural gas production.”

COST PRESSURES

Meanwhile, with gas prices still dwelling in the cellar, operators also face pressure to keep a rein on well costs, even though at an average high of around $3.5 million/well, the Barnett is a comparatively less expensive operating environment than some of the other shale plays. Thanks largely to its business model, EnerVest says its per well costs are appreciably lower than fellow operators, all of whom are enjoying pricing relief from job-starved drilling contractors and other service providers.

Oftentimes, costs pressures intersect with the challenges of operating in urban environments. Fresh memories of severe drought conditions throughout Texas has made the sourcing and management of water a substantial cost center, particularly for the multi-stage frac jobs common to plays like the Barnett.

Mark Clevenger, director of consultancy Alvarez & Marsal, said in late August during the World Oil ShaleTech Conference in Houston that some Barnett operators have reduced their overall water costs by upwards of 40%. He added the costs of treating and disposing of flowback and produced water has been cut by as much as 35% by consolidating salt water disposal service providers.

MIXED SIGNALS

Devon Energy, which holds a commanding 620,000 net-acre position throughout the Barnett, increased year-over-year net production by 8% at year-end 2012 to 1.4 Bcfed fourth quarter gas production. Liquids production jumped 11% to 51,000 bpd, accounting for upwards of 22% of Barnett production, a spokesperson said. The recognized pioneer in the Barnett Shale, Devon continues to claim its role as the play’s top producer.

The large independent operated 10 rigs throughout the past year, worked primarily in the liquids-rich core and the oil window in Wise County. Devon drilled an estimated 300 wells during the year. The Devon spokesperson said 2013 drilling plans have not yet been announced.

In a related development, Devon says it plans to have its expansion of the Bridgeport gas processing plant completed early this year. The plant capacity is being expanded by 140 MMcfd to handle Devon’s growth in Barnett liquids production, according to the spokesperson.

Chesapeake Energy says it will continue to reduce drilling activity in the Barnett shale, where it holds approximately 220,000 net acres, much of which is under a joint venture with Total E&P USA. In the third quarter, Chesapeake was operating two rigs, down from the six it was running earlier in the year, and was drilling on average two wells a month. Owing to the decreased activity, Chesapeake said last summer that it was shifting “a couple hundred” jobs out of Fort Worth.

According to the TRCC, Chesapeake as of October, produced just over 1.3 Bcf of gas, making it the second highest Barnett producer. Chesapeake projects its companywide gas production to be down 7% this year.

EnerVest plans to drill 65 wells in 2013, down from the 77 it completed last year. However, EnerVest’s Bruce said the reduced drilling will only account for “about a $10 million difference” in the budget allotted for the Barnett as the company will be focusing on workovers and facility-type work during the year. With cumulative Barnett production now standing at around 238 MMcfed, COO McDaniel said EnerVest “bounces between being the fifth or sixth” largest producer in the play.

EnerVest will continue to operate two to three rigs in 2013. Most of the wells drilled last year were in the nearly 30,000 net acres the company holds in the Combo play and in the wet gas areas that McDaniel said comprises some 65% of EnerVest’s total Barnett acreage portfolio. EnerVest said the only dry gas drilling it conducted in 2012 were for lease hold, and in 2013, the independent will again focus on its oil and wet-gas holdings.

EOG Resources holds 215,000 net acres, concentrated largely in the Combo play, where some of its most recent wells have recorded initial production (IP) rates of 870 boed. The TRCC shows EOG producing 16,191 bopd as of October, making it the play’s top oil producer by a wide margin. Last year, EOG extended the boundaries of its Combo play holdings, completing four wells with IP ranging from 412 to 705 bpd, including 43 to 57 bpd of NGL and 240 to 316 Mcfd of natural gas. EOG has 100% working interest in the Montague County wells. The play’s largest oil producer, EOG was slated to complete 200 Barnett wells in 2012. Drilling plans for 2013 or cumulative 2012 year-end production have yet to be released.

The Houston independent also is awaiting final approval from the TCEQ that would allow it to begin production at a planned 1,400-acre frac sand mine on the Cooke-Montague county line. EOG says the capacity to self-source frac sand would give it a significant cost advantage in the play.

XTO Energy, the ExxonMobil subsidiary, controls an estimated 280,000 net acres in the core gas zones and, according to TRCC data, is the third highest gas producer in the Barnett. For the first six months of 2012, XTO produced a total of just over 170.3 Bcf from its Barnett dry gas acreage. XTO reportedly averaged seven active rigs last year, but has released no information on its year-end 2012 activity or 2013 drilling and development plans. However, in early December, XTO pulled its permit requests to drill acreage it holds in the old Hensley field in southwest Dallas.

Pioneer Natural Resources plans to continue to run one rig as it seeks to sell off the estimated 120,000 net acres it holds, two-thirds of which are in the Combo play. Pioneer explained that the liquidation will allow it to focus primarily on its core Texas assets in the Sprayberry, Wolfcamp and Eagle Ford plays which it says offers higher returns.

Meantime, in its latest earnings report, Pioneer reported Barnett production of more than 8,000 boed, broken down into 55% liquids and 45% dry gas. The independent has 181 Barnett wells on production.

Quicksilver Resources announced at the beginning of the year that it was locked in “confidential negotiations with a potential buyer” for a minority interest in most of its 140,000 net acres it holds in the Barnett Shale. The Fort Worth operator said the Alliance-area acreage it operates with Italy’s Eni is not included in the minority offering.

Carrizo Oil & Gas now holds 12,500 net acres in its core area of Southeast Tarrant County after selling 35 MMcfed worth of assets last year to Atlas for net $187 million. All of the Fort Worth-based operator’s remaining acreage is held by production or operations. The operator suspended Barnett drilling operations in early 2012, and in its latest earnings reports, announced no plans for a resumption of exploration activities this year.

HOPE FOR GAS?

An EIA report issued in early January provides a glimmer of hope for long-suffering gas producers with its projection that prices could rise by nearly $1/Mcf this year. For EnerVest, the EIA report further validated its conviction that better days are ahead for the gas market.

“I think we may be a bit more bullish than other people on gas,” said McDaniel. “Obviously, the gas rig count has plummeted and we’re finally starting to see some turnover in gas production. It is down so far this month (mid-January) compared to last year, which is the first time in a long time that gas production has dropped. Coal-to-gas switching this summer also was way more than anybody expected and that will certainly help, if it continues. So, we’re relatively bullish that gas prices will head higher, though perhaps not a lot higher.”

“From a well economics standpoint, prices won’t rise to the point that it will be easy,” added Lloyd. “But, by the same token, it’s a good time to buy gas reserves.

|