JIM REDDEN, Contributing Editor

|

| The CNOOC-ConocoPhillips Peng Bo FPSO, China’s largest, on location at the Penglai 19-3 oil field in Bohai Bay, courtesy of ConocoPhillips (left); the Liwan gas field Central Platform (CEP) during the commissioning stages, courtesy of Husky Energy (center); and CNOOC’s HYSY981 drilling platform on the Liwan gas field, courtesy of Husky Energy. |

|

Even as its once-ethereal economy returns to the real world, China continues to wield tremendous clout in global oil and gas markets, as it looks outward and inward to narrow an ever-widening divide between consumption and domestic production. “Rapidly increasing energy demand has made China extremely influential in world energy markets,” stated the U.S. Department of Energy’s (DOE) Energy Information Administration (EIA).

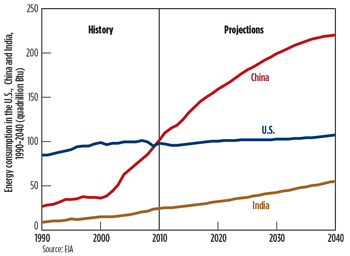

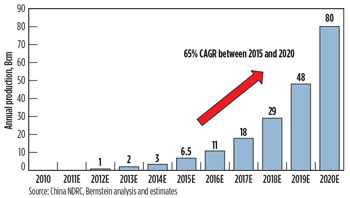

To be sure, as the world’s largest aggregate energy consumer by a wide margin (Fig. 1), and second only to the U.S. in oil consumption, China is expected to devour an additional 420,000 bpd of liquid fuels this year and a further 430,000 bpd in 2014, according to the EIA’s Short-Term Energy Outlook, released in October. The most recent EIA data had China consuming roughly 6.3 million bbl more in September than its onshore and offshore fields produced, officially pushing it past the U.S. as the world’s largest net oil importer. Chagrined that imports are expected to soar to some 9.2 million bpd by 2020, rumblings out of Beijing have the relatively embryonic administration of President Xi Jinping reportedly moving to relax some of the licensing requirements, and liberalizing pricing, to help boost domestic production.

|

| Fig. 1. China’s energy consumption is expected to continue to surpass, by a wide margin, that of both the U.S. and India. Source: U.S. Energy Information Administration. |

|

China’s leaders also remain steadfast in their official proclamation to double natural gas consumption by 2015, to ease dependence on imported oil, but more importantly, to accelerate the pending divorce from coal, to relieve notorious and widespread air pollution. While a major step in China’s ambitious plan of engineering a more gas-directed energy base is unfolding with its first deepwater field coming online, exploitation of its world-leading onshore shale reserves has barely gotten off the starting blocks, owing to myriad geological, logistical and cost constraints. Moreover, China already is one of the planet’s premier markets for liquefied natural gas (LNG), and is hedging its bets on a complete turn-around in homegrown production, with China National Offshore Oil Corp. (CNOOC) laying the groundwork to double LNG receiving capacity by 2015.

In the meantime, China’s well-moneyed state-owned companies show no signs of putting away their checkbooks anytime soon, as they persist on a multi-billion-dollar international shopping spree. While focusing largely on snapping up a bigger stake in North America, two of its national oil companies (NOC) in October were awarded a cumulative 20% interest in Brazil’s estimated 12-billion-bbl ultra-deepwater Libra field. That deal followed on the heels of the September purchase of a single-digit share in giant Kashagan oil field off Kazakhstan.

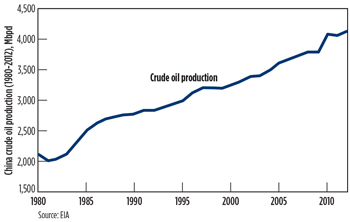

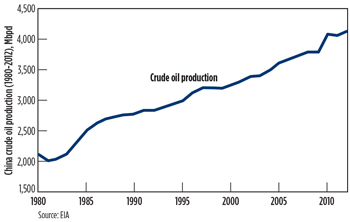

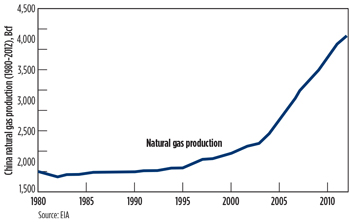

Despite year-on-year production that vacillates from modest increases to flat, China continues to reign as the world’s fourth- largest oil producer. The latest data available from the International Energy Agency (IEA) show China producing 3.98 million bpd of oil and NGL as of August, down from an August 2012 average of 4.18 million bpd. EIA, meanwhile, said aggregate production in both July and August declined, with flooding in the southwest and north restricting output from the mature-but-still-fertile Changging and Daqing fields. According to the most recent EIA assessment, China averaged oil production of 4.42 million bpd for 2012, although the outlook for both oil and gas production, at least in the near-term, suggests domestic output will do little to close the supply-demand gap, Fig. 2.

|

|

| Fig. 2. China’s oil and gas production through 2012. Source: U.S. Energy Information Administration. |

|

Reflecting the national trend, CNOOC reported in its yearly U.S. Securities and Exchange Commission (SEC) filing that net offshore domestic oil production rose modestly to 615,122 bpd in 2012, from 598,590 bpd the previous year. However, gas went in the other direction, dropping year-on year to 663.1 MMcfd at the end of 2012 from 689.9 MMcfd the year prior. The SEC Form 20-F is required of all international companies with equity listing on U.S. stock exchanges.

Though CNOOC continues to spearhead an aggressive offshore drilling campaign, concentrating to a large extent on the perennially disputed South China Sea, roughly 85% of in-house production still flows from aging and rapidly depleting interior fields, particularly in the Xinjiang Uygur Autonomous Region in the northwest and the central Ordos basin. To coax more oil out of these graybeard reservoirs, a host of enhanced recovery projects, including water and polymer flooding and CO2 injection, have been initiated over the past few years. China National Petroleum Corp. (CNPC) launched the country’s first CO2 EOR and sequestration project in 2009 at Jilin field in Songyuan, where it is injecting some 200,000 tpa of CO2 captured at a gas processing plant. Plans call for increasing CO2 injection to 800,000 tpa by 2015 as part of a second development phase.

China is estimated to hold between 20.35 and 25.6 Bbbl of proved oil reserves, but the Xi regime is especially keen on producing what the EIA, in its most recent assessment, said is the world’s largest, technically recoverable, shale gas resources, estimated at 1,275 Tcf. The state-controlled Xinhua news agency said CNOOC, CNPC, and China Petroleum and Chemical Corp. (Sinopec) will spend $13.07 billion this year on domestic offshore and onshore exploration programs, in an attempt to establish yet another annual drilling record. According to World Oil statistics, the Big Three drilled 26,349 wells during 2012, up 8.4% from 2011, and are on pace to increase by another 2.9% this year, with 27,125 new wells forecast to be constructed.

NO END TO BUYING BINGE

The capital that Chinese operators plan to invest at home, however, pales in comparison to what they continue to spend well outside their borders. Following on the heels of blockbuster deals over the past few years, China’s appetite for non-domestic oil and gas shows no indication that it is close to be satiated. By the end of October, Brian Lidsky, a managing director of Houston data provider PLS Inc., said in a CNN broadcast that more than 20% of all global oil and gas deals in 2013 have involved a Chinese company.

While the buying binge traverses the world, North America has been a particularly attractive target for Chinese companies, which have collectively forked over some $44 billion in U.S. and Canadian acquisitions over the past five years, often paying a premium in the process, according to data compiled by The Wall Street Journal. Nearly a third of that aggregate expenditure went to CNOOC’s late 2012 acquisition of Canada’s Nexen, a whopping $15-billion transaction that gave China a substantial foothold in the oil sands, as well as a non-operating stake in the Gulf of Mexico. In addition to its other new holdings, CNOOC also acquired the Nexen-operated Rochelle gas-condensate field in the UK North Sea, which initiated first production in October.

At the center of China’s attraction for North American assets is its well-documented interests in the U.S. shale plays, where the state operators desperately hope to acquire operational insight to help jump-start China’s own fledging onshore unconventional plays. The most recent case-in-point is Sinochem Petroleum USA LLC’s $1.7-billion acquisition of a 40% interest in Pioneer Natural Resources Co. acreage in the Permain basin’s Wolfcamp shale. The May 31, 2013, West Texas transaction covers some 207,000 net acres that Pioneer controls in the southern portion of the Spraberry Trend.

Outside of North America, CNPC and CNOOC each snapped up 10% stakes during the politically charged auction for the ultra-deepwater Libra field in Brazil’s Santos basin. The late October sale gave the two a combined 20% interest in the Petrobras-led multi-company consortium that will develop what has been described as Brazil’s largest oil discovery.

With more operators wanting to grab a larger toehold in the flourishing U.S. shale plays, prospects are becoming available elsewhere, which petroleum-hungry Chinese firms are more than eager to scoop up. Further evidence of that trend came in August, when Sinopec and Apache Corp. formed a “strategy partnership” that gives the former a non-operating 33% interest in the U.S. independent’s Egyptian assets. Apache Chairman and CEO G. Steven Farris said the $3.1 billion that his firm received under the agreement, which is expected to close at year-end, will be ploughed into its North American E&P operations.

The joint venture covers 9.7 million gross acres in the Western Desert, only 18% of which has been developed. In 2012, the acreage recorded gross oil production of 213,000 bpd and 900 MMcfgd. Ferris suggests that the Sinopec partnership in Egypt could be the first of many, as Apache continues to add heft to its North American activities.

“We are pleased to launch a global partnership with Sinopec, and to welcome them into our business in Egypt. Sinopec is an ideal partner for us, and we look forward to the growth and value generation ahead for both companies through the expansion of our collaboration to other projects,” Ferris said upon announcing the JV.

Elsewhere, CNPC thus far this year has reportedly shelled out roughly $10 billion to acquire interests in prolific oil and gas fields in Mozambique and Kazakhstan. Among its new holdings is an 8.33% interest in the estimated 11-billion-bbl Kashagan oil field in the Caspian Sea, offshore Kazakhstan. The September announcement of the estimated $5-billion CNPC stake was welcome news in China, which was stifled in its earlier attempts to secure a position in the Asian states of the former Soviet Union.

In a related development, Russia’s Rosneft claims that it has reached agreement with Sinopec to provide 100 MMt of crude oil over the next 10 years, worth an estimated $85 billion.

DOUBLING DOWN ON GAS

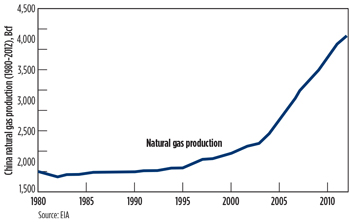

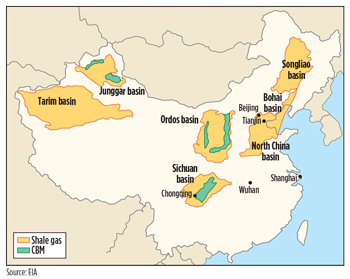

As China weans itself from a passionate attachment to coal and toward a more gas-centric fuel mix, the nation is hedging a good portion of its bets on what has been assessed as the world’s largest shale reserves. The EIA assessment, released earlier this year, has China holding potentially recoverable shale gas reserves of 1,115 Tcf, compared to 665 Tcf in the U.S., locked primarily in seven core basins, Fig. 3. In addition, the nation’s interior is estimated to hold 32 billion bbl of technically recoverable tight oil.

|

| Fig. 3. Location of China’s primary shale and CBM basins from latest assessment. Source: U.S. Energy Information Administration. |

|

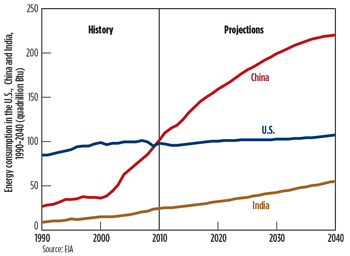

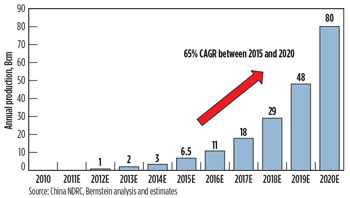

The National Energy Administration (NEA) has established, what some say, is an unachievable target of producing 6.5 Bcm of shale gas by 2015, or roughly 6% of China’s current total gas production, Fig. 4. Reaching that aggressive objective, however, has thus far proven to be a frustrating proposition. The latest data available show shale gas accounting for less than 1% of the country’s total gas production, which as things now stand, does not bode well for domestic unconventional production making a noticeable dent in the country’s ambitious plan to double gas consumption, from around 130 Bcm in 2011 to 260 Bcm in 2015.

|

| Fig. 4. China has established what some contend are unrealistic goals for shale gas production by 2020. Source: Seeking Alpha from China National Development and Reform Commission (NRDC), Bernstein analysis and other estimates. |

|

For one thing, the NOCs admit that they lack the experience and technical know-how required to fully exploit their unconventional reserves, hence the growing footprint in the North American shale plays and partnerships at home with shale-savvy Western operators. Shale experience is most definitely a premium in China, where a host of geological complexities, thus far, have helped thwart full-blown exploitation.

The Sichuan basin to the south is the country’s most active shale theater, but it poses a number of technical and economic challenges. The eastern portion of the basin contains extensive steep folding and faulting that can make horizontal drilling a daunting proposition, while the western part of the Sichuan is characterized by deeper wells. All this combines to increase drilling costs, which run as high as $16 million/well, according to a newly released Deloitte analysis. Would-be China shale producers also face stiff environmental barriers, due primarily to severe water shortages in the largely arid interior basins. The only exception is the Sichuan basin, which has ready access to water supplies.

Nonetheless, despite the barriers, China expects to be the most successful nation in developing shale gas outside North America. So says BP in its Energy Outlook 2030, which has shale gas projected to grow to 6 Bcfd by 2030, accounting for 20% of total Chinese gas production. Though paltry by comparison, Wood Mackenzie says a record 400 shale wells are expected to be drilled outside the U.S. in 2014, specifically citing China and Russia as the dominant players.

Sinopec claims that it has made a significant move in that direction with a major breakthrough in the challenging Sichuan basin, with first production from its Jianghan unit in the Fuling area, which covers some 311 sq mi. Both Sinopec and state-controlled media say six of the Jianghan wells reportedly are producing steady test flows at an aggregate 1.06 MMcf, or roughly 180 Mcf per well, while another has notched up production as high as 547 Mcfd. Sinopec also claims to have surmounted some of the technical difficulties, pointing to one Jianghan well completed with a 22-stage frac job at a depth of 4,921 ft.

The NOC purportedly plans to drill up to 50 wells in the Jianghan complex next year, as it attempts to increase field production to 5 Bcm/year by year-end 2015. Reaching that target, however, would require some 170 new wells with each producing at a 100-Mcfd clip, according to Reuters, which reported that Sinopec, as of now, has drilled roughly 30-odd exploration wells in the Fuling area play.

Sinopec also claims that the cumulative costs of at least one Sichuan well have been reduced to around $14.7 million, and says it intends to cut costs even more through domestic sourcing of rigs and other drilling equipment, recycling frac fluids and turning toward more batch drilling.

Also in the Sichuan basin, ConocoPhillips in January entered into a joint study shale assessment with the country’s largest gas producer, PetroChina, covering 500,000 acres in the Neijaing-Dazu Block. A similar agreement was inked between ConocoPhillips and Sinopec a month earlier for the 1-million-acre Qijiang Block in the Sichuan.

In July, CNPC and Hess also agreed to a joint shale exploration venture for the Malang Block of the Santanghu basin in Xinjiang to the northwest. Neither player has released any details of the JV. Statoil has also pointed to China as one of its possible targets for new prospective shale ventures.

Earlier this year, Shell received governmental approval for the company’s first shale gas production-sharing contract in China, joining BP, Chevron and other IOCs, which have acquired joint production stakes. The Shell-CNPC PSC takes in the Fushun-Yongchuan Block in the Sichuan basin. According to Bloomberg, Shell plans to spend upwards of $1 billion/year in China’s unconventional shale plays.

On Oct.30, Shell and CNPC also inaugurated a joint shale research center in Beijing to advance technology R&D cooperation, the operators said in a joint statement. Earlier, the two signed memorandums of understanding (MOU) for cooperative R&D that involves increased efforts in joint research on unconventional oil and gas development. The first phase of the research focus at the newly christened facility will center on marine facies, shale oil blocks in the U.S. and the continental facies, shale oil blocks in China. Research offices will be set up in the two countries, respectively. Theoretical basis of shale oil geology will be studied in the first phase that is expected to run three years, with the second phase to concentrate on engineering technology.

Total, which has maintained a presence in China for more than three decades, likewise is conducting a joint R&D program in China. In late September, Total inked a flagship research initiative with the Chinese Academy of Sciences (CAS) in Beijing, to examine “High Precision Multi-Scale Simulation for Multi-Phase Complex Systems.”

Adding more weight to its aggressive gas goals, China says it plans to hold a third round of shale gas auctions, possibly as early as the end of the year. The intention is to encourage more participation from small-and-medium-sized operators, according to a report in the Shanghai Securities News.

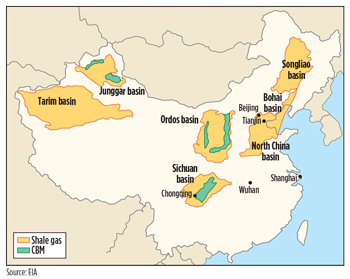

Like shale gas, production of China’s estimated 36.8 Tcm of coalbed methane (CBM) has barely taken off after two decades of exploration. Owing primarily to low gas saturation and permeability, China is still producing an average of only 150 MMcfd of CBM. State-owned Coal Bed Methane Corp. Ltd. says it has drilled roughly 5,000 CBM wells, primarily in its core Qinshui basin area and the eastern margin of the Ordos basin (Fig. 5), where it has identified 13.82 Tcm of CBM reserves. Last year, the company said it produced a cumulative 2.3 Bcm from surface boreholes in the southern portion of the Qinshui basin.

|

| Fig. 5. A coalbed methane drilling operation in the Qinshui basin. Source: China Coal Bed Methane Corp. Ltd. |

|

In August, China United Coalbed Methane signed a technical service contract with Canada’s Can-Elite Energy Limited, focusing on CBM reserves within the Su’nan area of Anhui Province.

Meanwhile, China’s intention to go all-in on domestic gas production sent jitters through Australia, Qatar, and other current and prospective LNG producers, which have invested billions in facilities. China has long been targeted as one of the primary markets for a substantial chunk of export capacity.

CNOOC allayed those fears with the recent announcement that it would add five LNG receiving terminals by 2015, effectively doubling its total capacity to 35-40 mtpa. The four terminals currently in operation have a combined receiving capacity of 18.7 mtpa, CNOOC says.

In its 2013 Oil and Gas Reality Check, Deloitte said LNG exporters have little reason to worry about losing a prime market in the foreseeable future. China’s 12th Five Year Plan has set shale gas production targets of 5.8 to 9.6 Bcfd by 2020, which Deloitte says would require 1,200 to 1,500 new wells, “but only 60 exploration wells have been drilled to date.”

“China is moving from a dormant to a nascent stage of shale development, but is unlikely to be a globalizer,” according to Deloitte. “Over the short term, China will continue in a nascent stage with success in the Sichuan basin a critical indicator of its transition to an incubator.”

OFFSHORE MILESTONE

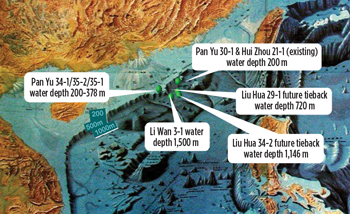

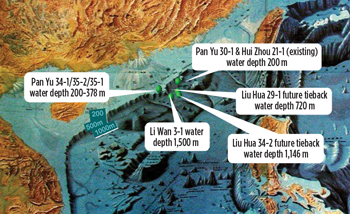

While China is banking much of its hope for a more gas-fueled economy on its onshore reserves, the national effort received a major boost with the expected initiation of production from its first deepwater gas field. Located in up to 4,921 ft of water in an undisputed portion of the South China Sea, the CNOOC and Husky Energy-operated Liwan-3 gas field is slated to begin the first phase of production by the end of this year. The second phase of production is anticipated for third-quarter 2014 with the planned subsea tieback of the nearby Panyu 34-1/35-1/35-2 gas fields (Fig. 6), Weiqiang Liu, CNOOC’s chief engineer for South China Sea Deep Water Development PMT, said in a presentation at September’s bilateral U.S.-China Oil and Gas Forum in Beijing.

|

| Fig. 6. Existing and 2014 tiebacks in the deepwater Liwan-3 gas field development. Source: China National Offshore Oil Corp. |

|

Located some 200 mi southeast of Hong Kong, the Liwan-3 field is expected to produce at an initial rate of about 300 Mcfd, increasing to around 350 Mcfd with next year’s tiebacks. The field is being produced from 10 subsea wells, which are tied back to a shallow-water central production platform. From there, gas flows to the onshore processing facility on Zhuhai’s Gaolan Island, adjacent to Macao, Fig. 7. The Gaolan plant was commissioned in October and ready to receive Liwan-3 production by the end of 2013, Weiqiang said. Husky is operating the deepwater portion of the development, while CNOOC operates the shallow-water and onshore processing components.

|

| Fig. 7. Liwan-3 onshore gas processing facility on Gaolan Island. Source: Husky Energy. |

|

Historically, offshore has accounted for around only 15% of China’s total production, with the bulk flowing from the mature Bohai Bay, a seaward extension of the onshore Liaohe, Dagang, and Shenglie oil fields. China appears determined to increase its overall offshore output with an aggressive drilling campaign that, as of early November, had 18 active rigs, up one from the like period last year, according to Baker Hughes.

More recently, along with Canada’s Husky, CNOOC has teamed with a host of international players, including Anadarko, BG Group, BP, ENI, ConocoPhillips and Chevron, to focus on deepwater blocks in the South China Sea. The U.S. Geological Survey (USGS) has estimated that the South China Sea, where some of the boundaries are being hotly contested by Vietnam and the Philippines, could hold some 28 Bboe.

Attention, of late, centers on the deeper waters of the northern South China Sea, mainly in the Pearl River Mouth (PRM) and the Qiongdonghan (QDN) basin, in water depths ranging from just under 985 to more than 10,500 ft. The QDN basin off Hainan Island Province is a daunting HPHT theater, with bottomhole temperatures up to 475°F and pressures requiring equivalent mud weights up to 19.5 lb/gal.

In January, Chevron’s China subsidiary entered into a PSA with CNOOC for two exploration blocks in the Pearl River Mouth basin. The PSA gives Chevron China Energy Co. a 100% working interest in Blocks 15/10 and 15/28. During the exploration phase, Chevron will operate the two shallow-water blocks, which cover an approximately 2,233-sq-mi. area.

“Exploration of these blocks builds on our strategy to grow our business across the Asia Pacific region, where we are developing LNG, deepwater, shale and sour gas resources,” said Chevron vice chairman George Kirkland.

In its 2012 SEC 20-F filing, CNOOC reported that it singularly drilled 38 offshore exploration and 58 appraisal wells, spread out among Bohai Bay and the South and East China Seas, which delivered nine new discoveries. Of those, 50 aggregate wildcat and appraisal wells were drilled in Bohai Bay. Those are in addition to the 40 wells drilled with international partners. CNOOC also reported proved developed and undeveloped offshore China oil reserves of 1,665.7 MMbbl and 4,459 Bcf of net proved gas reserves, which represents 69% of its global reserve base.

CNOOC said that its year-end 2012 home-grown production efforts were stymied by myriad adversities, including frequent typhoons, a decrease in new projects coming onstream, and a lengthy shutdown of the ConocoPhillips-operated Penglai 19-3 oil field in northern Bohai Bay (Fig. 8). Production was halted in September, 2011, but clearance was finally given to resume full output in February, following an environmental impact assessment and revised, overall development program. After the partners were approved to partially resume output last year, ConocoPhillips, which holds 49% interest in the field, recorded net third-quarter production of 45,000 bopd, down from 62,000 bopd recorded before the shutdown.

|

| Fig. 8. Domestic production in China in 2012 was stymied by outside factors, including weather interruptions and an extended shutdown of ConocoPhillips’s Bohai Bay operations. Source: ConocoPhillips. |

|

Things have looked up a bit for CNOOC this year, with the October discovery of what it described as a mid-sized exploration discovery in the Kenli 9-5/9-6 Block in Bohai’s Liaodong Bay. According to CNOOC, the shallow-water Luda 5-2 North and the LD 5-2N-4 wildcats encountered oil zones with total thickness of 394 ft and 279 ft, respectively. The latest report has the Luda 5-2N-2 well testing at around 1,040 bopd.

Announcement of the Kenli discovery preceded the production start-up of Phase II of the CNOOC Suizhong 36-1 oil field, also in Liaodong Bay. The second phase of the development includes four new platforms and is expected to hit peak production next year. No further details were made available.

Elsewhere, Reuters reported in early November that Anadarko Petroleum is considering selling its offshore China oil and gas holdings, in a potential deal valued at roughly $1 billion, which, like Apache, the Texas independent, would funnel back into its U.S. holdings. During its third-quarter earnings call, Anadarko said no further details were available on its China plans; partner and potential buyer CNOOC also would not comment.

Anadarko holds a reported 35% interest in Bohai Bay holdings and a 50% working stake in Block 43/11 in the South China Sea. Its China assets recorded third-quarter gross production of 33,000 bopd. During the quarter, Anadarko said it completed a successful nine-well drilling program, and in November mobilized a rig to drill the Liwan 21-1-1 well in the South China Sea, which was top-set earlier. The new well will test a 64,000-acre, four-way structure on the 43/11 block.

STILL HOLDS THE ACE

When China’s economy began to slow last year, dropping from the year-on-year double-digit growth that it had been recording, it brought with it not a small degree of uneasiness within the world oil and gas markets. With China holding the proverbial wildcard in the global price deck, industry observers caution that a significant cooling of its economy could do the same for commodity prices.

To add perspective to the weight that China carries in the global oil picture, consider how a higher-than-expected increase in domestic consumption of less than one percentage point can swing oil prices. That reality was driven home in August, when the Chinese industry’s output in the month prior rose 9.7% from the 9% growth that analysts had expected, which the IEA credited as the primary reason that September oil futures rose, snapping a decline that had continued over the five previous trading sessions.

Lest there was any doubt, analysts said afterward that China continues to be a chief driver of world oil prices.

|