|

Oil production in this South American country is going through a tough time, due to restricted operations and sabotage attempts by terrorists, which have resulted in a net decline of 9,400 bpd. The oil industry registered a production drop in October, due to operational restrictions and public order issues in several production areas, as well as problems with the transportation infrastructure.

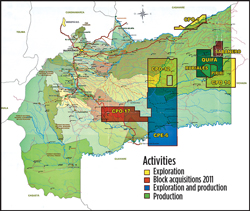

According to Colombia’s Ministry of Mines and Energy, production during October 2013 averaged 986,000 bopd, which, even though it shows a 2.6% increase over the same month a year ago (961,000 bopd in October 2012), still reflects a 0.9% decline from the immediately previous month. This troubling trend began in September 2013, when production declined 36,000 bopd from the August level. The Colombian oil industry is showing stress, due to terrorist attempts to attack the petroleum transportation infrastructure in different areas of the country, as well as security issues in key production areas. The Ministry reports 374 attacks against infrastructure from January to August of this year. This represents a 21.4% increase over all attempts registered during 2012, which totaled 308. These transportation disruptions have greatly contributed to the country’s production decline. However, they are just one factor in the equation. According to the largest international petroleum company operating in Colombia, Pacific Rubiales Energy, its total field production for third-quarter 2013 was 311,450 boed, which was 1,385 boed greater than second-quarter 2013’s figure. This new level of production represents a 28% increase over the same period in 2012. However, the market did not take the news well, and stock prices declined 7.3%, due to the fact that projected after-tax revenue was expected to be $700 million, but came in at only $610 million. One spot of good news in the Colombian oil industry is the negotiations between Ecopetrol and Venezuelan state firm PDVSA, to create a JV to increase oil production in the latter country’s mature oil fields. This project will benefit both companies and allow Ecopetrol to expand its international operations. Venezuela is an obvious choice for Ecopetrol to expand, allowing the company to add additional output to its dwindling local crude production, and allow it to increase oil exports, which are currently not meeting its goals. This joint agreement with PDVSA is a result of Ecopetrol’s success in increasing production in mature oil fields. Ecopetrol reported that in La Cira Infantas oil field, it was able to recover 38,196 bopd, a production level which had not been achieved since 1951. The technologies applied to this oil field have increased production 700%, from 5,000 bopd in 2005 to the current 38,196 bopd. However, even with these new extraction technologies, other E&P difficulties in the Colombian oil industry remain. It is predicted that oil production this year will decline 12%. What is worse news, is that this rate could accelerate in the coming years. According to the Colombian Petroleum Association (ACP), the rate of drilling exploratory wells, which has been increasing 15% to 20% in recent years, will begin to decline, due to complications in continuing these activities. ACP President Alejandro Martinez stated that in 2013, the oil industry will have drilled 115 new exploratory wells, nearly achieving the government-set goal of 135 wells. The report presented by ACP to the Petroleum Services Board in May pointed out that the number of drilling rigs in operation had declined 5%. These statistics indicate that Colombia is on a downward production curve, due to the lack of new, important discoveries in recent years, decreasing production levels and the drop in exploratory drilling. This decline in exploratory activity is a worrisome trend, especially when one considers the overall, increased growth of the general economy, which, in the second quarter, was 4.2%. All of this indicates that the Colombian oil industry is not keeping production at a level that will sustain expansion of the overall economy. The only hope that Colombia has of reversing this dismal outlook would be good news from Pacific Rubiales Energy, which recently received two environmental licenses from the National Environmental Licensing Authority (ANLA) in November. These licenses allow the company to proceed with production of two new fields, CPE-6 and Guama, which are 70 km southeast of Campo Rubiales oil field and encompass 593,000 hectares. Pacific Rubiales has 50% equity in these two fields along with Talisman Energy Inc. Pacific-Talisman has already drilled six stratigraphic wells in the lease, as well as 10 exploratory wells that have confirmed the presence of important hydrocarbon deposits in the region. It is important to point out that the environmental license is global in nature, and permits exploration and development of CPE-6 oil field in the future. The two partners plan to drill additional exploratory wells and test production flows in the existing wells during the remainder of 2013. Pacific-Talisman plans to drill 19 additional wells in 2014, including two exploratory wells and 17 producers, to evaluate output potential. |

- Regional Report: Guyana-Suriname (July 2023)

- Regional Report: Brazil (February 2023)

- International Forecast: Some noticeable recovery is finally underway (September 2022)

- Guyana-Suriname Regional Report: The overly generous PSA may be history (July 2022)

- Characterizing seismic facies in a carbonate reservoir, using machine learning offshore Brazil (June 2022)

- 2022 Forecast: Activity outside North America will lead global recovery (February 2022)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)