|

JIM REDDEN, Contributing Editor

|

| A state-of-the-art H&P FlexRig 5, working for BHP in its Black Hawk field. Courtesy of BHP Billiton Petroleum |

|

Just as the Eagle Ford shale is poised to become the nation’s premier onshore liquids producer, operators continue to re-delineate the South Texas play, turning their attention outward, and downward, in the hunt for prospects that extend beyond its 13-county core.

Much of the buzz, of late, has centered on the play’s eastern expansion, where the Eagle Ford intersects the prolific Woodbine sandstone, the celebrated reservoir for the seemingly ageless East Texas field. As the so-called Eaglebine continues to emerge, the triple-window Eagle Ford also is serving as the springboard for a reawakening of sorts for the underlying Pearsall shale, which operators had largely abandoned, when gas prices collapsed. Farther to the south, some operators are looking with cautious optimism at Mexico’s new presidential administration, which they believe could finally open the doors to more U.S. participation in exploiting potential Eagle Ford reserves across the border.

For the time being, however, activity for the most part continues to focus on the fairway of the Eagle Ford that, as currently delineated, stretches 50 mi wide and 400 mi long from the southernmost portion of Texas to the east. The formation produces natural gas, condensate, oil and NGLs, with margins that have been described as more favorable than other shale plays. As of July 22, Baker Hughes listed 233 rigs active in the core counties, compared to 250 at the same time last year—a decline attributed in no small part to increased emphasis on more rig-efficient pad drilling.

|

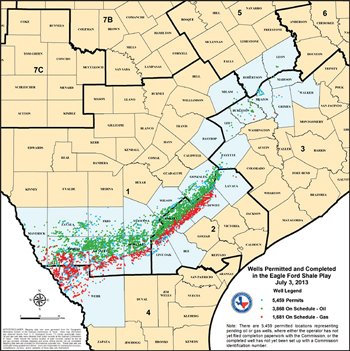

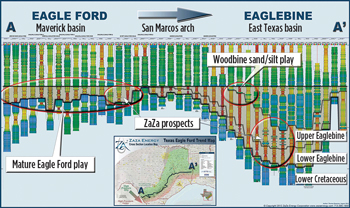

| Fig. 1. Wells permitted and completed within the Eagle Ford fairway, as of July 3. Source: Texas Railroad Commission. |

|

Offsetting the slight drop in the rig count is a year-on-year increase in the drilling permits issued by the Texas Railroad Commission (TRCC), the state’s chief regulator, Fig.1. A survey of the 13-county core shows the TRCC approving 3,453 drilling permits between Jan. 1 and July 8, a 12.7% increase, compared to the 3,064 permits issued for the like period last year.

BAKKEN IN THE CROSSHAIRS

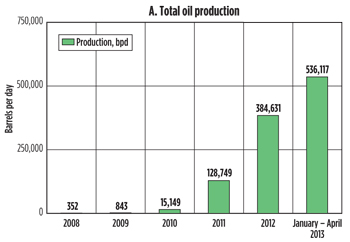

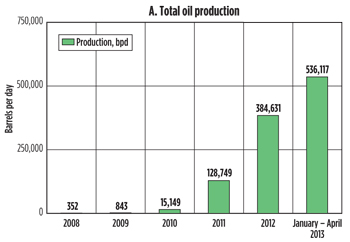

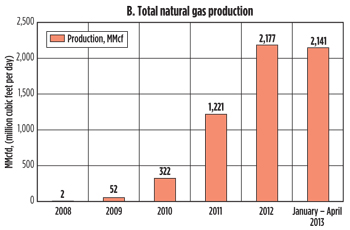

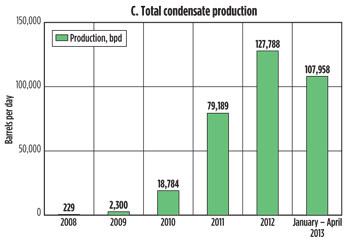

While there seems to be general agreement that the Eagle Ford will supplant North Dakota’s Bakken shale as the nation’s top unconventional liquids producer sooner, rather than later, what is less clear-cut is the precise volume that South Texas operators are putting in the production stream, Fig. 2. The latest data from the TRCC show oil production of 536,117 bpd between January and April, compared to 384, 631 bpd for all of 2012. For the same period, TRCC documented production of 107,958 bpd and 2,141 MMcfd, which likewise, promises to surpass last year’s aggregate total.

|

| Fig. 2. Eagle Ford oil, natural gas and condensate production figures to April 2013. Source: Texas Railroad Commission. |

|

Veteran shale observer Gene Powell, publisher and editor of The Powell Shale Digest, and others contend that the TRCC consistently reports lower production, by not including its “pending file” in the overall mix, which comprises some 20% of Eagle Ford production. Moreover, the TRCC, Powell says, does not report condensate from gas wells as oil or, unlike other state agencies, record casinghead gas in the cumulative natural gas production tally. All this means a shortfall of approximately 121,825 boed from the reported numbers, Powell says.

Consequently, while TRCC reports aggregate January-to-April oil and condensate production of 643,830 boed, on June 25 Powell reported that his well-by-well research shows average production of 765,655 boed through March. By comparison, the North Dakota Department of Mineral Resources (DMR) said that the state’s oil and gas production reached a milestone in May with a record 810,129 bpd and 900 MMcfd, respectively.

Powell’s assertion was echoed by RBC Capital Markets analyst Scott Hanold, who, in a client note on May 29, said that the TRCC production numbers are a bit off-base. “While the trend is correct, we believe actual production in the Eagle Ford is higher than what is being reported,” Hanold said.

Regardless, now-retired Mark Papa, former CEO of EOG Resources, the premier producer in the Eagle Ford, said in early May that U.S. shale oil supremacy boils down to a two-play race, and he has no doubt as to who will very soon cross the finish line first. "We think there are only two major driving forces of the U.S. oil growth: the Bakken and the Eagle Ford. The Eagle Ford is going to surpass the Bakken, likely this year, with the biggest oil growth rate,” he said.

VALUE-RICH PLAY

The Cretaceous carbonate-rich Eagle Ford shale is defined as the world-class source rock for the overlying and heavily explored Austin Chalk formation, as well as the East Texas Woodbine field. The Eagle Ford, which overlies the Buda Limestone, and the Pearsall shale, has well-defined oil, wet gas and dry gas windows. Setting it apart from other North American shales, the formation has an average thickness of 250 ft, with some sections as thick as 330 ft.

In a research report released last summer, IHS handicapped the Eagle Ford-Bakken race, in favor of the former. IHS Director of Equity Research Andrew Byrne concluded that, on average, Eagle Ford wells out-produce their Bakken counterparts “by a margin of two to one.” He predicted that the value inherent in the play would accelerate acquisition and mergers, particularly with properties held by the smaller operators.

“You go through the initial land speculation stage, where the plays are occupied and dominated by a lot of smaller E&P companies. But then, when you get to the highly capital-intensive development stage, it makes lot of sense for these very small E&Ps to sell out to larger, better capitalized players,” Byrne said.

During the past year, both small and not-so-small operators saw a prime opportunity to cash-in while asset values were nearing an apex. Chesapeake was one of the latest to take advantage of the increased value, selling off about 55,000 net acres that it held in the northern counties of Zavala, Dimmit, LaSalle and Frio, to suddenly aggressive Exco Resources. Exco also acquired Chesapeake’s interest in 9,600 net acres in the Haynesville shale, with the combined sale netting the Oklahoma City, Okla., operator $1 billion.

Chesapeake retained ownership of around 435,000 net acres and drilled 91 new Eagle Ford wells in the first quarter. Chesapeake reported production of 75,000 boed in its Eagle Ford holdings during the first quarter, representing a 225% year-on-year increase.

In other recent acquisitions, Penn Virginia Corp. in April reached an agreement to acquire around 19,000 net acres held by Magnum Hunter Resources for $401 million. The estimated net production from the acreage in February was reported as roughly 3,200 boed. Magnum Hunter told The Wall Street Journal on April 3 that it will hold onto about 7,000 net acres in Fayette, Lee and Atascosa counties. Magnum Hunter has joined forces with Marathon Oil in a Pearsall shale well in Atascosa County.

On March 18, Houston’s Sanchez Energy Corp. executed a definitive agreement with Hess Corp. to acquire some 43,000 net acres in Dimmit, Frio, LaSalle and Zavala counties for $265 million in cash. The acquired acreage holds proved reserves of approximately 13.4 MMboe, with current production of 4,500 boed. In July, Sanchez subsidiary SN Marquis snapped up a bargain with its $28.8-million acquisition of 10,300 net acres held by ZaZa Energy within its Moulton prospect in Fayette, Lavaca and Gonzales counties. In late March, ZaZa Energy formed a joint venture with EOG to explore Eaglebine prospects.

NEXT TARGET: EAGLEBINE

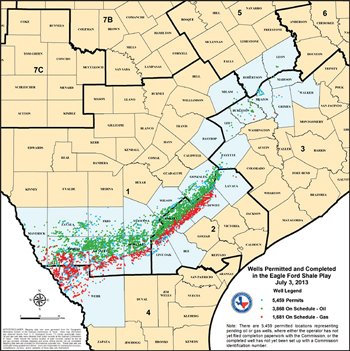

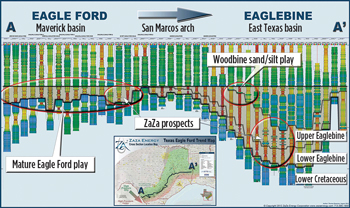

Over the past year, interest has intensified on a chunk of the Eagle Ford that overlies the Woodbine formation, a mixture of sandstone and marine shale in the East Texas basin. Singularly, the Woodbine, the well known reservoir for the still-producing East Texas field discovered in 1930, has been developed conventionally for several decades, but where leases so permit, operators now are focusing on redeveloping the play horizontally by tapping into the underlying Eagle Ford and in a single-wellbore completion.

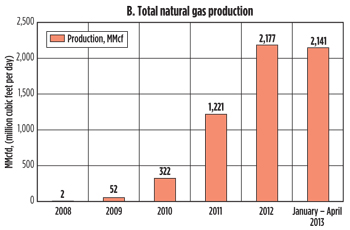

Known colloquially as the Eaglebine, activity in the rapidly emerging play is centered primarily in the East Texas counties of Madison, Brazos and Leon, and, to a lesser extent, Grimes, Walker and Milam, Fig. 3. While the TRCC online W1 permit query does not record Eaglebine wells per se, an examination of the horizontal drilling permits issued for those counties suggests the prospective Eaglebine is quickly gaining operator favor. Between January and July 12, the TRCC issued an aggregate 174 new horizontal drilling permits in the targeted counties, compared to 92 for the same six-month period last year. To further put the suddenly increased interest in perspective, a total 130 horizontal well permits were issued for those six counties during 2011.

|

| Fig. 3. Cross-section of the Eagle Ford-Woodbine intersection. Source: ZaZa Energy |

|

As the eastern extension of the Eagle Ford is in the very earliest stages of its emergence, scant well data are available. “We’re testing some concepts over there. But, we've really not thought much about that, and are not really prepared to talk much about that kind of play at this point,” new EOG CEO William R. Thomas, who replaced Papa upon his retirement on July 1, told analysts during an August earnings call. Nevertheless, in late March, EOG signed a joint exploration and development agreement with ZaZa Energy that covers the 73,000 net acres held by the latter in Walker, Grimes, Madison, Trinity and Montgomery counties.

For now, Houston’s Halcón Resources takes top billing as the biggest cheerleader of the Eaglebine. Halcón is essentially a recreation of the late Petrohawk, which is largely credited with launching the Eagle Ford. BHP Billiton Petroleum acquired Petrohawk in July 2011, and that November, former chairman Floyd Wilson created Halcón, which now holds roughly 235,000 acres across East Texas that the operator says is prospective for the Woodbine, Eagle Ford and other formations. As of July, Halcón had nine producing wells in its acreage. This year, the firm plans to operate five to seven rigs, and spend approximately $490 million on drilling and completions.

Denver’s SM Energy is one of the few to release specific well results, telling investors in April that its first horizontal Eaglebine well in San Jacinto County flowed at an initial 24-hr production (IP) rate of 740 boed, at 1,520 psig casing pressure on a 27/64-in., choke. At the same time, the independent announced that it has increased its East Texas acreage position to some 105,000 net acres and continues to actively lease “in this exciting play.”

PEARSALL REAWAKENED?

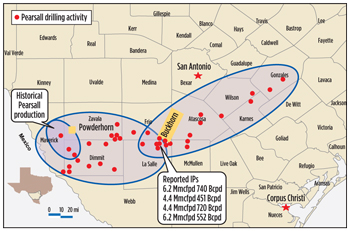

Meanwhile, the gas-prone Pearsall formation, that lies at depths between 7,000 ft to 12,000 ft beneath the Eagle Ford and Buda formations, and traverses a large swath of the South Texas Maverick basin, is starting to breathe new life, spurred in no small part by a major acquisition last summer. All of the recent Pearsall wells reported are being drilled by operators holding overlying Eagle Ford acreage positions, where lease depth severance provisions allow for testing the deeper horizon. Historically, a number of wells were drilled conventionally in the shale-like Pearsall formation, but it was largely ignored after gas prices tanked, though some later wells had shown attractive oil shows, which has helped to inspire the latest turn in activity.

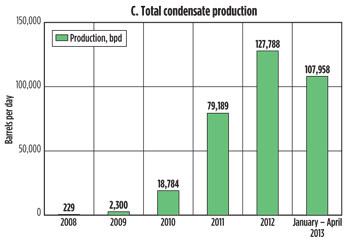

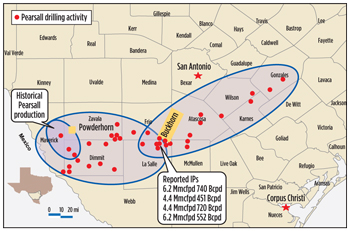

Some eyebrows were raised in July 2012, when Cabot Oil and Gas sold a 35% non-operated working interest in 50,000 net Pearsall acres to a U.S. subsidiary of Japan’s Osaka Gas for $250 million, Fig. 4. The acquisition of the Pearsall acres, which are spread out between Atascosa, Frio, LaSalle and Zavala counties, does not affect the 100% interest that Cabot holds in more than 60,000 net acres in the overlying Eagle Ford oil window.

|

| Fig. 4. Cabot Oil and Gas holdings within the Pearsall shale. Source: Cabot Oil and Gas. |

|

During a first-quarter earnings conference call, Cabot Chairman, CEO and President Dan Dinges said that the operator plans to run up to three rigs and drill 15 horizontal Pearsall wells in 2013. To date, Cabot has nine producing Pearsall wells, he said, with average IP of 600 boed. “The Pearsall is still a young play and remains a science project for us,” Dinges told analysts. “We have a thick hydrocarbon column, and continue to work on all aspects of drilling and completing a cost-effective well.”

In May, Murphy Oil Corp. was to begin fracing operations on the first of two Pearsall wells that it intends to complete in the first half. The well was to be completed with a 2,000-ft lateral. Murphy holds more than 158,000 net acres over the Eagle Ford, including some 48,000 acres prospective for the Pearsall.

MEXICO ON THE HUNT

Mexico, meanwhile, recently announced its first-ever shale gas production from an Eagle Ford well, drilled directly across the border in the Burgos basin. In a first-quarter earnings report issued on April 26, state-owned Pemex said the Chucla 1 well recorded IP of 1.9 MMcfgd and 24 boed of oil and condensate, and “confirmed the existence of hydrocarbons in the Eagle Ford formation” of Mexico. Pemex said it continues to evaluate the production potential of shale resources in Mexico through the Chucla 1 well. Energy Minister Pedro Joaquin Coldwell told Reuters on May 8 that Pemex plans to drill up to 10 shale wells this year to further investigate its potential reserves.

Mexico has been slow to exploit its recoverable shale gas reserves that the U.S. Energy Information Administration (EIA) estimates at 681 Tcf.

While a ranking official of the U.S. Department of Energy (DOE) says Mexico’s neighbor is more than willing to lend a hand, the nation must first relax the ultra-nationalistic policies of Pemex, which has kept a firm lid on E&P rights. Some, however, are cautiously optimistic that the administration of recently elected Mexican President Enrique Peña Nieto may sufficiently liberalize policies to clear the way for more international cooperation.

“We are very interested in working with our colleagues in the government of Mexico to put in pathways for the better development of that resource,” Christopher Smith, DOE acting assistant secretary for fossil energy, said in May 2013 during the Offshore Technology Conference. “We are taking steps to create the right types of collaboration, to ensure we develop that play in a way that is efficient and environmentally sound.”

In the meantime, Houston’s NET Midstream said it is installing a 124-mi pipeline that will deliver Eagle Ford gas to the growing Mexican market. The pipeline is expected to go online in December 2014, delivering up to 2.1 Bcfgd across the border.

CORE REMAINS HOT

The University of Texas at San Antonio’s Institute for Economic Development recently released an updated study that showed the play delivering more than $61 billion in total economic impact. A sampling of operators, with notable leaseholds, suggests that impact will rise in the foreseeable future.

EOG Resources holds a commanding 639,000-net-acre position and reigns as the largest oil producer in the Eagle Ford. At the end of the first quarter, the Houston-based independent produced an estimated net 153,000 boed and had increased by 38% the potential reserves in its properties.

EOG is running 25 rigs and plans to drill 425 net wells this year, compared to year-end 2012 that had the company operating 23 active rigs and drilling 305 net wells. EOG, which has reduced its per-well drilling time to less than 13 days, says its inventory will provide 12 drilling years, based on current technology.

Of its cumulative leasehold, 569,000 net acres are contained within the oil window, where EOG consistently has recorded some of the play’s highest IP rates. In a recent filing with the TRCC, EOG recorded a play-high 7,513 bopd during an initial 24-hr test of its Burrows Unit 5H in Gonzales County, which was completed in mid-April. In the first quarter, EOG documented 18 wells with IP of more than 2,500 bopd, and nine with more than 3,500-bopd initial flowrates.

Anadarko Petroleum, which holds 400,000 net acres in Dimmit, LaSalle, Maverick and Webb Counties, delivered a net sales volume of 42,200 boed during the first quarter, representing a 55% increase over the identical 2012 reporting period. The Woodlands, Texas operator recorded total liquids volumes of 28,000 bpd during the quarter—a 60% jump from the first quarter of last year. Anadarko operated an average of eight rigs and drilled 70 wells during the quarter.

BHP Billiton Petroleum controls 341,000 net acres, where it operated 31 rigs in the first quarter in its Hawkville and Black Hawk fields, compared to 24 active rigs in late May 2012. For its fiscal year ended June 30, BHP said its 2012 U.S. onshore drilling and development expenditure totaled $4.8 billion, more than 80% of which was directed toward its Eagle Ford play and Permian basin holdings. The operator says that with drilling efficiency improvements it expects to reduce its average count in fiscal year 2014. Owing to a management re-organization spurred by the July retirement of CEO J. Michael Yeager, no specific 2013 drilling plans have yet been released. Tim Cutt, president of the Australian mining giant’s diamond division, was tapped to replace Yeager.

Talisman Energy/Statoil control roughly 74,000 and 73,000 net acres, respectively, which since 2010, the two have developed in a 50-50 South Texas Joint Development Agreement (STJDA), in which the former had functioned as operator. Effective July 1, Statoil will assume operatorship of the eastern half of the total acreage, mainly comprising leases in Live Oak, Karnes, DeWitt and Bee counties, while its Canadian partner will continue to operate the western acreage, mostly in McMullen, La Salle and Dimmit counties. With its transition to partial operator, Statoil has taken control of three of the seven active rigs running this year under the STJDA umbrella and will assume responsibility for producing wells, facilities, pipelines and infrastructure. At the end of 2012, the JV partners each recorded net production of nearly 21,000 boed.

ConocoPhillips, which completed its first year as an independent operator, holds 227,000 net acres, mostly in the liquids-rich core that it claims holds a 1.8-Bboe potential resource base. Executive Vice President of Exploration and Production Matt Fox told analysts that Eagle Ford production stands at 120,000 bopd, up slightly from 100,000 bopd at the end of 2012.

The operator said it is nearing the full-field development phase of its Eagle Ford program and expects to add around 130,000 boed to its production stream by 2017. ConocoPhillips ran an average of 16 rigs last year, but the active count is expected to be lower this year, as the operator moves to pad drilling, Fig. 5.

|

| Fig. 5. A ConocoPhillips-operated rig drilling within the estimated 227,000 net acres it holds in the Eagle Ford. Courtesy of ConocoPhillips. |

|

Marathon Oil, with the 2012 acquisition of Paloma Partners II, now holds an estimated 317,000-net-acre-position in the Eagle Ford, where its net production increased to 72,000 boed in the first quarter, representing a 22% jump over year-end 2012 output. During the first quarter, Marathon drilled 76 gross wells, while placing 68 gross wells into the sales stream.

Marathon says its “spud-to-spud performance” has improved from 28 days in the first quarter to 18 days over the first three months of this year, with further declines expected with the acceleration of pad drilling. The operator says it has also begun drilling wells in the Austin Chalk and Pearsall formations “to further test the resource potential of these horizons.”

Forest Oil formalized a 50-50 partnership with Schlumberger in April, and immediately afterwards, released details of an accelerated 2013 development campaign for its 27,500-net-acre leasehold. In conjunction with Schlumberger Production Management (SPM), the Denver independent will be operating four rigs by the third quarter and plans to drill 60 gross wells this year and 80 next year.

Forest said it is moving toward producing an average 6,500 boed in 2014, up from the 1,600 boed it produced last year from its Eagle Ford holdings. Under terms of the unique joint venture, SPM will pay a $90-million drilling carry in the form of future drilling and completion services, as well as related development capital, giving it a 50% equity. According to Forest President and CEO Patrick McDonald, upon completion of the phased contribution of the drilling carry, Forest and SPM will participate in future drilling on a 50/50 basis.

SM Energy has an estimated 144,804 net acres under lease in six operating areas spread throughout the play. The independent’s operated net production averaged 51,800 boed in the first quarter, a 15% sequential increase over fourth-quarter 2012 production of 45,200 boed. During 2013’s first quarter, SM Energy operated five rigs and completed 28 wells.

Pioneer Natural Resources and its minority partner India’s Reliance Industries drilled 37 wells in the first quarter within its estimated 212,000-net-acre lease holding. The joint venture plans to run a 10-rig drilling program and complete at least 130 wells this year. Pioneer said 80% of its drilling activity this year will be conducted from pads, up from 45% in 2012, allowing it to reduce its rig count from the 12 units it averaged last year. Pioneer increased production to 37,000 boed in the first quarter from 23,000 boed in the identical quarter last year.

Swift Energy held 75,892 net acres in the Eagle Ford, at the end of 2012. During 2012, Swift drilled 55 successful development wells in South Texas. During 2013, Swift has scaled back its drilling, due to “the low-pricing environment for natural gas and NGLs.” However, Swift continues to focus on drilling liquids-rich wells in identified brittle areas of the Eagle Ford. The initial plan for 2013 included 25 Eagle Ford wells and six Olmos wells. As of first-quarter 2013, the company had already completed nine operated wells, including four Eagle Ford wells and two Olmos wells in McMullen County, and three Eagle Ford wells in La Salle County.

|