Regional Report North West Europe

A new round of frontier exploration hot spots challenges the industry’s technical prowess in several offshore areas.

ELIZABETH LLOYD and ANDRÉ SHARMA, Deloitte’s Petroleum Services Group

The northern basins of the Barents Sea, the West of Shetlands, and the deepwater basins along the Irish coast, are all becoming areas of increased exploration and licensing activity, as companies seek to explore frontier areas. These new areas of interest, however, come with harsher operating environments, lack of infrastructure, and technical challenges. Future, successful exploration activity in these three frontier areas may revive interest in North West Europe and attract operators and companies that are exploring other frontier parts of the world. BARENTS SEA The Arctic Continental Shelf contains some of the least-explored basins on Earth. The Norwegian Barents Sea is one of the few areas of the Arctic Circle with a year-round, ice-free zone. It is attracting interest, with a recent increase in both drilling and licensing activity. The Barents Sea has the potential to become a successful oil and gas region with significant resources yet to be discovered. Total undiscovered resources in the Barents Sea are now estimated to amount to 7.9 Bboe, according to the Norwegian Petroleum Directorate (NPD), and represents 42% of all undiscovered resources offshore Norway. Compared to other Norwegian waters, the Barents Sea is underexplored. In total, approximately 80 exploration wells have been drilled in this region, compared to almost 200 in the Norwegian Sea and over 700 in the North Sea. Geological exploration of the Norwegian sector of the Barents Sea started with seismic surveys in the 1970s. A decade later, in 1980, exploratory drilling commenced, when both Norsk Hydro and Statoil spudded wells, both of which were completed with hydrocarbon shows. Exploration activity in the area has increased since 2005. Drilling success has also increased, and 50% of the wells spudded since 2005 have successfully discovered hydrocarbons. Statoil has operated 11 of the wells; Eni has drilled four; and Lundin has spudded two. In 2008, Statoil targeted the Obesum prospect, and discovered oil and gas in Middle Triassic sandstones. However, it was deemed to be too small to prove commercial at the time. In the same license, Statoil also discovered gas from a wildcat well on the Middle Triassic Caurus prospect. Caurus has estimated reserves of 155 MMboe to 375 MMboe. In 2011, Total discovered gas in the Middle Triassic Kobbe formation on its Norvarg prospect, which has also now been appraised successfully. Lundin discovered gas at its Skalle prospect, with the first well drilled in license PL438. In 2012, Eni discovered gas in the Cretaceous Knurr formation, and in the Jurassic Stø formation at the Salina prospect. Discoveries made recently have proven plays as well as the existence of working hydrocarbon systems in the Barents Sea that have helped generate renewed interest in the region. However, recent interest in the Barents Sea can be attributed largely to Statoil’s success in license PL532, and the Skrugard and Havis oil discoveries made in 2011 and 2012, respectively, Fig. 1. These finds were the largest, and first, commercial finds in the Barents Sea for a decade. The Skrugard (renamed Johan Castberg in April 2013) and Havis twin discoveries have combined recoverable resources estimated at between 400 MMboe and 600 MMboe. The field is approximately 100 km north of the Snøhvit producing field and 150 km from Goliat field, which is under development. Statoil expects to have a field development plan for Johan Castberg in place in 2014. Production is anticipated to start in 2018.

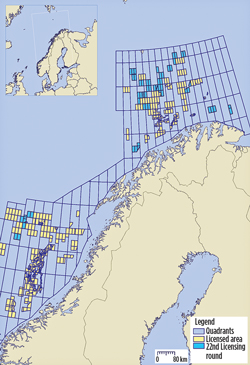

Goliat field was the first oil find to be developed in the Barents Sea. The field was discovered in 2000, and the plan for development was approved in June 2009. The operator, Eni Norge, plans to bring the field onstream before the end of 2014. Goliat is expected to produce for at least 15 years. It has estimated recoverable oil reserves of 174 MMbbl of oil. Total development costs are roughly $5.01 billion. Acreage in frontier regions offshore Norway, such as the Barents Sea, is awarded through licensing rounds held approximately every second year. During these rounds, acreage is offered in immature areas of the Norwegian Continental Shelf (NCS) to promote exploration. The most recent licensing round to cover the Barents Sea, the 22nd Round, awarded blocks in June 2013, Fig. 2. Twenty new licenses were granted in the Barents Sea. The awards resulted in 29 different companies being offered participating interests in various licenses, 14 of which were also offered operatorships. This was the most successful licensing round for the Barents Sea, and it has increased the number to over 70. The companies being offered operatorship of licenses in this region include a mix of majors, such as Shell, Total and ConocoPhillips, and independent oil companies, including RWE, E.ON and Edison. This mix has increased the number of companies acting as operator in the Barents Sea, proving the region’s attractiveness.

For the first time, awards have also been made to two Russian companies. Lukoil and Rosneft have been offered interests in two, and one licenses, respectively. Elsewhere in the Arctic Circle portion of North West Europe, activity has increased in recent years. At the end of 2012, Iceland awarded its first-ever hydrocarbon exploration licenses. Twelve blocks were awarded as two separate licenses to operators Ithaca Energy and Faroe Petroleum. In addition, recent news suggests that CNOOC will also be awarded acreage, later in 2013. In May 2013, Exxon Mobil increased its interest in license L016, offshore the Faroe Islands. License L016 contains a large, four-way dip structure called Kúlubøkan, with potential at various stratigraphic levels. A 3D seismic survey was acquired during 2012, to further the understanding of the structure. The license partners are expected to make a decision on drilling by the end of 2014. The last well to be drilled in Faroese waters was in 2012, when Statoil drilled exploration well 6104/21-2 on the Brugdan II prospect. Due to concerns over bad weather, Faroese authorities ordered a suspension of the well until the end of 2013. Overall, Statoil is the most active player in the Barents Sea, with an extensive exploratory drilling campaign to date. It includes nine planned exploration wells over the next two years. Statoil is targeting four prospects northeast of the Skrugard and Havis discoveries, with back-to-back exploration drilling conducted by the drillship, West Hercules, Fig. 3. Upon completion of this drilling campaign, Statoil plans to select a development concept for the area, targeting first oil in 2018.

Both Statoil and Lundin have exploration wells planned in the Barents Sea over the next few years. Lundin plans to drill two exploration wells in 2013—one on PL492, the Gohta prospect, which has gross prospective resources of 226 MMboe, and one on PL659, the Langlitinden prospect, which has gross prospective resources 155 MMboe to 375 MMboe. In addition to their current drilling campaign, Statoil and partners have plans to also drill the Apollo and Atlantis prospects in license PL615, and the Wisting Central prospect, in some of the most northerly licenses in the Barents Sea. Given the ongoing work commitments from the recent 22nd Round, as well as further exploration drilling already planned in this region, interest is expected to continue to rise. WEST OF SHETLANDS The North Sea is considered by many to be a mature region in terms of oil and gas exploration activity. Infrastructure is well-established, and the region has had a long, successful history of exploration. However, the West of Shetland basin is an area within the North Sea that is still considered frontier. West of Shetlands water depths are much greater than those in the gas-prone southern North Sea province, and coupled with a harsh winter climate and less established infrastructure, exploration activity remains relatively sparse. The West of Shetlands is a proven petroleum basin, with production from fields that include Clair, Foinhaven and Schiehallion, Fig. 4. The UK government introduced a new class of field allowance in 2012, targeting deepwater fields in the West of Shetlands, to encourage further frontier exploration in this area.

Since exploration in the West of Shetlands began in 1972, there have been 171 exploration wells spudded, 26% (45 out of 171) of which have been completed as successful hydrocarbon discoveries. Drilling activity has been increasing since 2006—last year, 10 wells were spudded in the region. Over the last 10 years, 29 exploration wells have been drilled. In recent years, a number of new discoveries have been struck. In 2008, Hess discovered the Amos oil accumulation, and in 2009, Dong discovered gas at its Glenlivet prospect. It has since been evaluated successfully by two appraisal wells that have confirmed an excellent-quality, gas-bearing reservoir. In 2011, Faroe Petroleum hit a discovery at its Fulla prospect, discovering oil in Clair and Whiting reservoir sands. During 2013, BP discovered hydrocarbons at its North Uist prospect. BP’s North Uist exploration well has been one of the most high-profile exploration campaigns in the West of Shetlands basin in recent years. The parent well, targeting the Upper Jurassic North Uist prospect, and its five sidetracks were drilled over a 12-month period. The well was completed as a gas-condensate discovery in March 2013 and has proved another working hydrocarbon system in the basin. It should encourage further exploration in the area. Competition for West of Shetlands acreage has been fierce in recent years. Recent UKCS licensing activity has resulted in the doubling of total, licensed acreage in the West of Shetlands. Prior to the 27th UK Offshore Licensing Round, approximately 90 blocks and portions of blocks had been licensed. Following the results of the 27th Licensing Round announced in October 2012, 80 new blocks were licensed, bringing the total licensed blocks to almost 170. West of Shetland licenses are operated by a variety of companies, including a mix of majors, super-majors and smaller independent companies. BP operates the largest number of licenses at 10, while Total and Dong each operate nine, making these companies the most dominant in the region. Hurricane Exploration operates three licenses in the West of Shetlands, covering 18 blocks and partial blocks. Hurricane Exploration’s strategy differs from that of other companies operating in the region. Hurricane actively explores fractured basement reservoirs, in a search for significant untapped resources, and has had some recent success. In 2009, Hurricane drilled the Lancaster prospect and discovered oil in its fractured basement rocks, with estimated 2C contingent resources of 207 MMboe. In 2010, Hurricane drilled its second basement prospect, Whirlwind, and found hydrocarbons of a similar volume to those at Lancaster. In addition, Hurricane has identified a well location on a third basement prospect, Lincoln, and work is underway on the Typhoon prospect. The West of Shetlands is also home to the UK’s largest oil field, Clair. It is 75 km west of the Shetland Islands, in water depths of up to 150 m and extending over an area of 220 sq km. Clair is the UK’s largest hydrocarbon resource, with initial, in-place volumes across the entire field estimated at more than 7 Bboe. The Clair reservoir was discovered in 1977 by the 206/8-1a exploration well, which penetrated an oil column in a sequence of Devonian to Carboniferous sandstones. Subsequent to extensive appraisal activity, and following review of several development plans due to high costs, development of the field was finally approved in 2001. First oil was achieved in February 2005, and BP and its partners have produced approximately 90 MMboe. BP has started the second phase of development, called the Clair Ridge project. It is designed to target the northern area. In March 2013, BP commenced a two-year appraisal program with plans to include at least five wells that will look at developing a third phase of Clair. The Clair Ridge project should begin production in 2016 and produce an estimated 640 MMbbl of oil over 40 years while providing a hub for future expansion. A prospect that has been in the limelight in recent months, due to associated deal activity, has been the Ithaca Energy-operated Handcross prospect. The Handcross prospect lays across licenses P1631 and P1832, about 12 km east of the UK-Faroese border. In March 2013, RWE acquired a 20% interest in the prospect, while Edison in June 2013 acquired a 25% share, as Ithaca Energy farmed down its original 90% interest. Handcross is a Palaeocene channelized fan prospect, with estimated resources of approximately 115 MMboe. The prospect is close to the Suilven and Tornado discoveries, and 20 km from BP’s Quad 204 redevelopment. A firm slot on the Stena Carron drillship (Fig. 5) has been contracted to drill an exploration well on Handcross, which is anticipated to spud during fourth-quarter 2013.

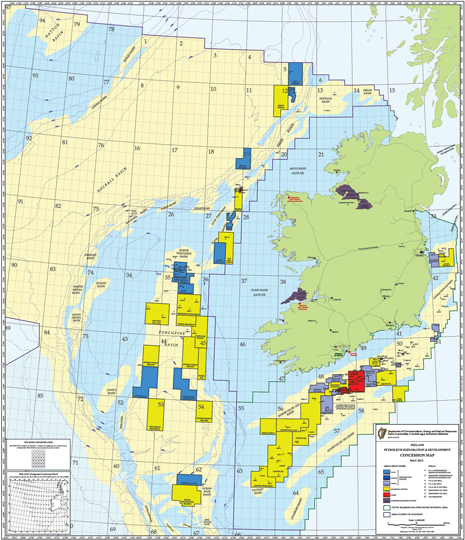

With continued successful drilling, and high levels of interest from a variety of companies, the West of Shetlands is likely to remain a hot spot with some exciting exploration activity to come. IRELAND According to the Irish Offshore Operator’s Association (IOOA), only about 5% of the Irish offshore area is under license, Fig. 6. From 1970 to date, 146 exploration wells have been spudded by a number of different operators offshore Ireland. The IOOA states that the commercial success rate for Ireland is approximately one in 25. However, more recently, offshore Ireland is becoming a focus for IOCs. With ever-improving technology, higher oil prices and discoveries elsewhere on the Atlantic Margin, interest in the area’s potential has grown recently. In 2012, five deals were announced in Ireland, all in the form of farm-ins. This was the same number that was reported in 2011. So far in 2013, eight farm-in offers or deals have been announced, with a number of independent companies entering the region, such as Cairn Energy and Kosmos Energy.

The fiscal terms for Irish offshore activity are favorable. The Irish government’s corporation tax is 25%, no bonuses are due on the discovery of hydrocarbons, and there are no royalty taxes or PSAs on new licenses. Exploration results offshore Ireland have been mixed in recent years. Since 2008, there have only been six exploration wells spudded west of Ireland, in either the Rockall or Slyne-Erris Troughs or the Porcupine basin. In 2008, Shell targeted the West Dooish prospect in the Rockall Trough with well 12/2-2. However, the well failed to encounter any hydrocarbons, unlike the Dooish exploration well 12/2-1 to the east, which discovered gas/condensate in 2003. Also in 2008, Statoil drilled a well on the Cashel prospect, about 144 km southwest of the Dooish discovery in the Slyne-Erris Trough. However, it failed to encounter hydrocarbons. The Serica-operated Bandon exploration well and its subsequent sidetrack discovered oil in 2009. The discovery was made in Jurassic Sherwood sands. Shell became active again in 2010, and tested an extension prospect northwest of Corrib gas field. The well proved to be unsuccessful. In 2011 and 2012, no exploration activity occurred offshore Ireland. In 2013, Exxon Mobil spudded the highly anticipated Dunquin exploration well off the southwestern coast, in the Porcupine basin. There has been great interest in the Porcupine basin recently, and the operators and partners that have become involved include Exxon Mobil, Cairn Energy, Antrim Energy Inc., Kosmos Energy, Europa Oil and Gas, Bluestack Energy, and Petrel Resources. For detailed information on activity in the Porcupine basin, please see the article by Contributing Editor Ian Lewis, immediately following this regional report. A number of fields and discoveries offshore Ireland have proved to be commercially viable since the early 1970s, Table 1. Kinsale Head gas field was discovered in 1972. The well targeted the Lower Cretaceous Greensand and Wealden sandstones, and it tested gas at a rate of 12.4 MMcfgd from the Lower Cretaceous, with production beginning in 1978. Cairn Energy’s Burren and Spanish Point discoveries lie in adjacent blocks in the Porcupine basin.

The Shell-operated Corrib gas field, on the west coast, was discovered in 1996. It represented the first commercial find offshore Ireland, since Kinsale Head in 1972. Following five successful appraisal wells drilled between 1998 and 2001, the field’s development plan was approved in April 2002. The Serica-operated 27/4-1 well in the Slyne basine was spudded during May 2009, to test the Bandon prospect. It reached a TD of 6,233 ft in the Sherwood sands. No gas was found; however, an oil accumulation in Jurassic sands was encountered, and a sidetrack well, 27/4-1Z, was drilled to confirm the discovery. The discovery of oil has opened a new play in the Slyne basin and enhanced the prospectivity of the blocks. The Providence-operated Barryroe oil field underwent successful appraisal drilling in 2012. Previous operators had drilled five wells on the field, all of which logged hydrocarbon-bearing intervals, and three were flow-tested successfully. In 2011, having acquired a new 3D seismic survey over the field, Providence began drilling a sixth well on the field. In March 2012, the partners announced testing results from this well, which far exceeded the pre-drill expectations. This led to a substantial upgrade in field size to over 1 Bbbl of oil-in-place, with over 300 MMbbl (on a P50 basis) of recoverable oil. Providence and Lansdowne are planning the development concept. They began their farm-out campaign in first-half 2013, with drilling planned for 2014. Eni has been given the go-ahead to shoot an 18,000-km, 2D seismic, full-fold program on the Irish Atlantic Margin this year. The survey is thought to be the largest regional seismic shoot, to date, offshore Ireland. The survey is designed to infill data gaps that exist, particularly in the southern Porcupine basin and Rockall Trough. It also will allow the Irish government to evaluate future licensing opportunities. In the Rockall Trough and Slyne-Erris Trough, Serica Energy believes that there is a major resource opportunity with multi-Tcf gas potential. Muckish is analogous to the nearby gas-condensate-bearing Dooish structure drilled by Enterprise in 2002, which encountered a 214-m hydrocarbon column and has a gross P50 resource potential of 1.3 Tcf of gas and 85 MMbbl of condensate. In the same basin, the Boyne and Liffey prospects are interpreted as two deeper Jurassic oil prospects, each with an underlying Triassic gas prospect in the Sherwood sandstone. Serica and partner RWE Dea plan to drill a well in 2014 and will begin a farm-out campaign in 2013. On the southeast coast, Lansdowne Oil and Gas has a number of prospects in the Celtic Sea Graben system, with drilling expected to take place in 2013 and 2014. The Middleton prospect lies along a trend of inverted structures, along the northern margin of the basin that includes Ballycotton field. Amplitude brightening from fluid anomalies is interpreted as Greensand reservoirs, similar to those seen on seismic lines across Ballycotton. Middleton has been assessed as having potential P50 recoverable resources of 268 Bcf of gas. The East Kinsale prospect lies to the southeast of Middleton, and a number of low-relief, anticlinal closures have been mapped, some of which may form extensions of the Old Head accumulation. A NW-SE-trending, faulted anticline may form a separate structure, and this shows evidence of gas escape on seismic. To the north of Barryroe field, the Rosscarbery, Amergin and Eremon prospects are thought to have good potential. Rosscarbery is in LO 5/7, which also contains the Gally Head and Carrigaline gas discoveries, with potential for 86 Bcf of recoverable gas. Amergin and Eremon are two large structures mapped at the Jurassic level. Amergin has potential for 231 MMbbl of recoverable oil. San Leon Energy has four offshore, Atlantic Margin licenses, and four offshore Celtic basin licenses. On the west coast of Ireland, San Leon operates all four licenses, covering an area of 2,880 sq km, which contain a number of prospects and leads.

|

|||||||||||||||||||||||||||||