PRAMOD KULKARNI, Editor

|

| The Ensco 8503 semisubmersible drills a wildcat prospect for Cobalt International Energy in the Ardennes prospect (left). Neptune is a permanently moored tension leg platform (TLP) in the Gulf of Mexico operated by BHP Billiton Petroleum (center). The hull for Chevron’s Big Foot extended TLP was delivered to a shipyard in Corpus Christi by the Dockwise vessel Mighty Servant I for fitting of the topsides, for what is expected to be the deepest TLP in the world. |

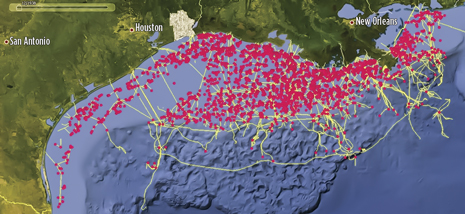

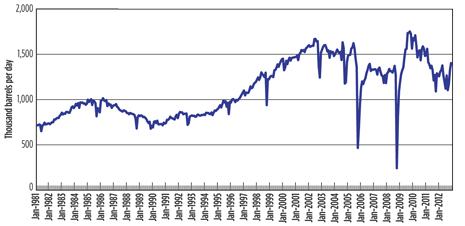

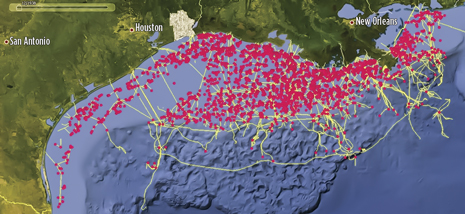

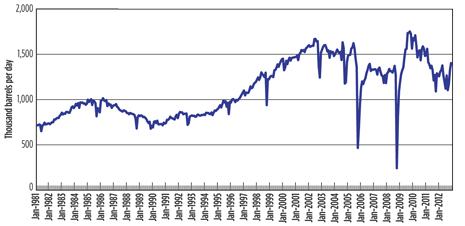

The Gulf of Mexico has survived an onslaught of hurricanes—Irene in 2011, Isaac and Sandy in 2012—and a six-month deepwater moratorium imposed by the Obama administration during 2010-2011, and is now returning to pre-Macondo activity levels. By all the leading indicators—leasing, permitting and discoveries—the Gulf of Mexico is experiencing a new wave of resurgence, Fig. 1. The activity is led by majors, including Shell, BP and Chevron, and large independents, such as McMoRan, Noble and Anadarko. A new slate of IOCs is also increasing their stakes, and some have become operators, such as Petrobras, Statoil, Total and Eni, who see the Gulf of Mexico as a safe harbor for their oil and gas investments. Several relatively new independents have emerged, such as Cobalt International and Venari Resources. The lagging indicator of crude oil production in the Gulf of Mexico is also heading in a positive direction, Fig. 2.

|

| Fig. 1. Activity in the Gulf of Mexico extends from the Western Gulf to the eastern edge of the Central Gulf area, and from shallow-water shelf to the ultra-deepwater Lower Tertiary plays. The image shows active fields (pink dots) and pipelines (yellow lines). Image courtesy of Skytruth. |

|

| Fig. 2. Gulf of Mexico crude oil production in Federal offshore waters. The downward spikes are caused typically by hurricanes. Source: U.S. Energy Information Administration. |

GEOLOGICAL BONANZA

|

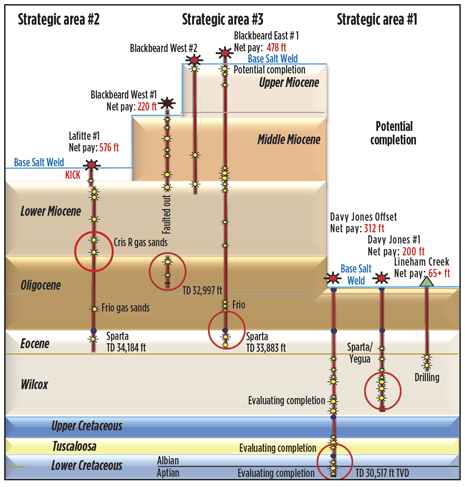

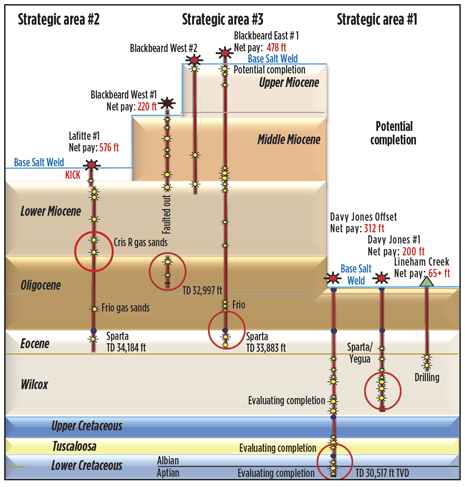

Fig. 3. Energy XXI has identified exploration opportunities from the Upper Miocene to the Lower Cretaceous.

Petrobras is using the BW Pioneer FPSO for production from the Cascade and Chinook fields, among the deepest to date in the Gulf of Mexico. |

The Gulf of Mexico owes its longevity to high-porosity sandstones in several geological sequences. The exploration opportunities extend from discovering bypassed sweet spots in the Upper Miocene to unexplored riches in the Lower Wilcox, Fig. 3. A single well can often contact pay zones in multiple formations. The ability to properly image subsalt plays through advanced depth imaging, and then to drill through salt to reach subsalt targets, has opened up sought-after areas that were once considered off-limits.

LEASING ACTIVITY

In late March 2013, the U.S. Department of the Interior (DOI) held a 39-million-acre lease sale for the Central Gulf of Mexico. A total of 52 operators bid more than $1.2 billion for 407 leases. The high-bid dollar volume was achieved, despite the Bureau of Ocean Energy Management (BOEM) having raised its minimum bid requirement in deep water from $37.50 to $100 per acre. The highest bid in the sale was $81.8 million for Walker Ridge Block 271 by Statoil and Samson. Another highly contested area was Walker Ridge Block 187, where Venari Offshore’s $45.5-million bid edged out a $43.5-million bid from Anadarko. Statoil was the winner on 15 blocks and now holds 340 leases in the Gulf of Mexico. BOEM estimates that the areas available for sale could result in the production of up to 890 MMbbl of oil and 3.9 Tcf of natural gas. The Obama administration is planning to hold four additional lease sales in the Central Gulf over the next five years. In November 2012, BOEM made available 20 million acres in the less lucrative Western Gulf that attracted more than $133 million. Chevron submitted the highest bonus bid of $56 million for 28 tracts, including $17 million for East Breaks Block 546.

PERMITTING ACTIVITY

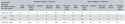

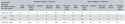

| Table 1. Gulf of Mexico permits issued by BSEE, 2012-2013 |

|

|

Permits to Drill issued by DOI’s Bureau of Safety and Environmental Enforcement (BSEE) were steady for the shallow-water area (<500 ft) from 2011 to 2012 with 170 permits for new and revised new wells granted in 2011 and 171 granted in 2012, Table 1. For deep water, the permits increased from 165 for new and revised new wells in 2011 to more than double to 395 in 2012. The permitting process is now stricter and more onerous. Before a Permit to Drill can be granted, many direct and related approvals must be in place, including those associated with environmental compliance and new standards for well design, casing and cementing. The documents must be certified by a professional engineer. Operators must also comply with the new Drilling Safety Rule and demonstrate that they are prepared to deal with the potential for a blowout and worst-case discharge.

STRICTER ENFORCEMENT

BSEE is responsible for conducting investigations and preparing public reports of incidents associated with federal offshore oil and gas operations. In February 2013, BSEE filed a criminal complaint against alleged unlawful discharges of oil and unpermitted chemical dispersants from a floating oil and gas production platform, the ATP Innovator. At about the same time, BSEE told rig contractors in the Gulf of Mexico and offshore Brazil to inspect BOPs after a faulty bolt in a connector to the wellhead was deemed responsible for a leak of drilling fluid in January.

EXPLORATION PROGRAMS

Over the last 50 years, seismic contractors have conducted extensive surveys of the Gulf of Mexico, from shallow-water transition zones to the deepest Lower Tertiary targets. Periodically, the areas have been re-surveyed with new technology and changing operator interests to create massive multiclient and proprietary 2D and 3D data libraries. Wide-azimuth (WAZ) 3D seismic surveys, in conjunction with advanced data processing techniques, such as prestack depth migration and reverse time migration, have been the primary exploration tool for the discovery and development of deepwater Gulf of Mexico fields.

WesternGeco began its first WAZ 3D seismic survey in the Central Gulf area in 2006. In 2010, the company began conducting a series of surveys with its full-azimuth (FAZ) Dual Coil Shooting technique under the name “Revolution”. WesternGeco now has Revolution multiclient surveys covering several subsalt Western and Central Gulf, Lower Tertiary, Miocene and Pliocene plays. CGGVeritas offers WAZ multiclient surveys for specific areas, such as Garden Banks, Green Canyon and Walker Ridge, including Chevron discoveries at Big Foot and Jack. In December 2012, TGS commenced a 3D multi-client survey covering 7,000 sq km in the Central Gulf of Mexico. The survey is on the eastern side of the Central Gulf of Mexico through the Lloyd Ridge, Desoto Canyon and Atwater Valley areas. The data have been acquired by Fugro seismic vessels. PGS also offers prestack time and depth migration data for many areas of the Gulf of Mexico.

OPERATOR ACTIVITY: SHELF TO DEEP WATER

| Table 2. Drilling rigs operating in the deepwater Gulf of Mexico. Source: BSEE, March 2013 |

|

|

There is not a clear demarcation between operators working on the shelf and in deep waters. Some of the majors have farmed out their shelf properties to independents and moved on to the challenges of deepwater plays. On the other hand, independents, such as Anadarko, Noble and Hess, are holding their own as deepwater operators. Even on the shelf, there are plenty of challenges, as prospects are often at ultra-depths. Table 2 lists drilling rigs operating in deepwater areas of the Gulf.

McMoRan Exploration is targeting ultra-deep hydrocarbons on the shelf. The company made news with its Davy Jones discovery in 2010. Due to the extreme pressures and temperatures at depths of 30,000 ft and below, McMoRan has had to develop proprietary technologies and equipment to handle HPHT conditions. The Davy Jones No. 1 well logged 200 net ft of pay in multiple Wilcox sands, which were all full to base. The Davy Jones No. 2 appraisal well, 2.5 mi southwest of Davy Jones No. 1, confirmed 120 net ft of pay in multiple Wilcox sands, suggesting continuity across the major structural features of the Davy Jones prospect. The well also encountered 192 net ft of potential hydrocarbons in the Tuscaloosa and Lower Cretaceous carbonate sections. As the end of January 2013, the company was pumping a hydraulic fracture treatment, including proppant, into the Davy Jones No. 1 well to facilitate hydrocarbon movement into the wellbore. Based on the results of the fracing operation, McMoRan will plan the completion of the Davy Jones No. 2 well. MacMoRan is also drilling an onshore well at Lineham Creek, about 50 mi northwest of Davy Jones for additional core and well data. McMoran is also drilling ultra-deep prospects, including Blackbeard and Laffite. The high costs of such wells led to Freeport-McMoRan Copper & Gold in 2012 to acquire McMoran Exploration and Plains Exploration & Production Co. in transactions totaling $20 billion.

Apache. During fourth-quarter 2012, Apache produced 98.9 Mboepd, a 7% increase over the fourth-quarter production in 2011. Drilling operations during the quarter consisted of operating five rigs and constructing nine wells. In late February, the company had prevented a near-blowout at its Main Pass 295 well, due to migration of natural gas. In mid-March 2013, Apache announced a joint venture with Energy XXI to explore pay sands associated with salt dome structures in Block 135 of the Central Gulf. As part of this transaction, Energy XXI acquired a 25% working interest in 21 non-producing primary-term leases. A new WAZ seismic program is underway to define the potential of the area of mutual interest, covering approximately 633,000 acres.

Energy XXI produced 44.6 Mboed of oil and gas during 2012 from its properties on the shelf. In 2013, the company is drilling one exploration well, and planning eight recompletions and 16 development wells. Most of these are horizontal wells to assure increased contact with multiple pay zones.

LLOG. Privately-held LLOG began its Gulf of Mexico activity on the shelf and has steadily progressed into deeper waters. It is recognized for its Who Dat field in the Mississippi Canyon area, which began production at the rate of 60 Mbopd from a unique floating production system at a 3,000-ft depth. LLOG’s Mandy field, also in Mississippi Canyon, is producing via a tieback to W&T Offshore’s Matterhorn TLP production system. Son of Bluto 2 and Marmalard are LLOG’s first two exploration wells since the end of the drilling moratorium. Son of Bluto 2 (Mississippi Canyon 431) was drilled to a TD of 18,500 ft and encountered an oil-bearing zone and a separate gas bearing zone. Marmalard (Mississippi Canyon 300) was drilled to a TD of 18,100 ft and encountered two oil-bearing zones. LLOG and its partners are now working on a development plan.

W&T Offshore is a Louisiana-based company with operations both on the shelf and in deep water. In 2012, W&T won 78 federal lease blocks consisting of 432,700 gross acres, including 65 blocks in the deep water. At this time, W&T has nearly 711,000 acres on the shelf and 481,000 acres in deep water. During 2013, the company is planning to spend $450 million on offshore exploration and development projects. In the Ship Shoal area’s Mahogany field, W&T offshore is drilling two wells. Well A14 is drilling at 11,000 ft, with target oil at 17,200 ft, TVD. First production from this well is expected in mid-2013 at 2,000 boed. Subsequently, Well A-15 will be drilled during third-quarter of 2013 in the same block to target five separate sands. Two additional exploration wells are underway in the Main Pass 108 Block. The company is also in the midst of development drilling at Mississippi Canyon Matterhorn, High Island and West Cameron blocks.

Hess. In March 2013, Hess announced its decision to divest its downstream operations to become a pure play E&P company. Hess is developing two projects in the deepwater Gulf of Mexico: Pony and Tubular Bells. Production from the Pony development is expected later in 2013. Having acquired operatorship from BP in October 2011, Hess is planning to produce first oil from the Tubular Bells field in 2014 from three subsea production wells and two injection wells. Gross production is expected at 42,000–45,000 boepd.

Noble Energy has shifted its Gulf of Mexico operations to deep waters, primarily targeting the subsalt Miocene targets. Noble and BP are partners in the Galapagos project (250 MMboe, gross), which is composed of Isabela, Santa Cruz and Santiago fields. Production from these fields (14.5 Mboed net to Noble) is connected via tieback to BP’s Na Kika hub. Two major fields scheduled for production are Gunflint and Big Bend. Noble is drilling its second appraisal well at Gunflint, with first production scheduled for 2015. Big Bend field is in the Rio Grande area with 30–65 MMboe potential. Noble is evaluating production options for Big Bend, including a subsea tieback to nearby hubs such as Thunder Hawk, Blind Faith and Na Kika. Success at Big Bend has encouraged Noble to explore the adjacent Troubador field.

Anadarko Petroleum. A leading deepwater Gulf of Mexico operator, Anadarko’s fields are producing primarily from the Miocene to deeper Lower Tertiary and subsalt Pliocene structures. In March 2012, Anadarko announced first production from the Caesar/Tonga development (200–400 MMboe) in the Green Canyon. Production at Caesar/Tonga is ramping up to 45,000 boed from four subsea wells that are tied back to its Constitution spar, 10 mi to the east. Next for Anadarko Lucius field (300 MMboe), designated for first oil in 2014. The Lucius spar is under construction at Technip’s Pori field in Finland. Set for production in 2016 is the Heidelberg field (200–400 MMboe) with another Lucius-design spar. In late March 2013, Anadarko announced the results of its second appraisal well in the Shenandoah basin. Located in Walker Ridge Block 51, the 31, 405-ft well in 5,800 ft of water encountered more than 1,000 net ft of oil pay from multiple, Lower Tertiary reservoirs. Anadarko is now drilling five exploratory or appraisal wells, including a wildcat at its Norphlet prospect.

BHP Billiton has been operating the Shenzi facility near 100 Mboed nameplate capacity for more than three years. The company drilled a water injection well in May 2012 to sustain production. Appraisal drilling is also continuing to improve reservoir performance. BHP’s other interests in the deepwater Gulf of Mexico are the BP-operated Atlantis and Mad Dog fields. The company may have big plans in the Gulf of Mexico, having bid for leases in 24 Central Gulf blocks in the March 2013 sale.

ExxonMobil. In March 2013, ExxonMobil granted Neftegaz, a subsidiary of Rosneft, 30% interest in 20 deepwater Gulf of Mexico blocks as part of a strategic cooperation agreement to collaborate on exploration, both within and outside Russia. Seventeen of the blocks are in the Western Gulf and three in the Central Gulf, where there’s no production, but seismic analysis is underway. ExxonMobil is drilling at Hadrian field in the Keathley Canyon area at a 6,897-ft water depth using the Transocean drillship, Deepwater Champion.

Shell. In 2013, Shell is operating a strong drilling program with 12 deepwater rigs making hole. To concentrate on frontier deepwater projects, the company sold its mature Holstein development in late 2012 to Plains Exploration, which was subsequently acquired by McMoRan. Shell has drilled three successful appraisal wells at Appomattox, Vicksburg and Vito fields, which are expected to begin producing after 2015. The Appomattox well was drilled to 25,851 ft and encountered 150 ft of pay. Shell’s development projects include the Mars B field, where it will install its Olympus TLP in 3,000-ft water. The development will add six West Boreas/South Deimos subsea wells, with first production expected in 2015. Another development project is Cardamom, a subsea system with production achieved through a tieback to the Auger platform. Five development wells will be drilled on the prospect to achieve a 50,000-boed peak production rate.

BP is the white elephant in the Gulf of Mexico. Historically, the Gulf’s leading producer and most active operator, BP has had to curtail its leasing plans and limit drilling activity after pleading guilty to certain criminal charges related to the Gulf spill, and while a civil trial is underway in New Orleans. BP did not participate in the recent Western and Central Gulf lease sales. The company has decided to refocus its operations to four fields: Thunderhorse, Atlantis, Mad Dog and Na Kika. According to BP, these fields are at a very early stage in their life with 80% of their resources still remaining. BP will continue its non-operated partnerships, mainly with Shell. The company will continue appraisal of its Lower Tertiary discoveries and drill its remaining exploration inventory. In execution of this strategy, BP is drilling two development wells in Atlantis field and exploratory wells in the Mississippi Canyon Ariel and Panatella fields.

Cobalt International. A relative newcomer, Houston-based Cobalt International Energy includes several former Unocal executives. Cobalt is focusing exclusively on deepwater Gulf of Mexico and Africa prospects. In the Gulf of Mexico, the company is targeting Lower Tertiary plays. After acquiring leases in 2006, Cobalt drilled North Platte #1 as its first discovery well in 2012, encountering 550 ft of net oil pay. Appraisal drilling will begin at North Platte after interpretation of a 3D development seismic survey currently being acquired over the field. Meanwhile, Cobalt is drilling the Ardennes exploratory well, with results expected in mid-2013. Subsequently, the Ensco 8503 rig will move to the adjacent Aegean field to drill another exploratory well targeting Venari Resources, Miocene and Lower Tertiary prospects.

Chevron. Focusing on the deepwater Lower Tertiary trend, Chevron has two operator projects scheduled for startup during 2014: Jack/St. Malo and Big Foot. The Jack/St. Malo hub and Big Foot have production capacities of 177,000 boed and 79 ,000 boed, respectively. Chevron is drilling producer wells for both of these projects, which are within 25 mi of each other. In late February, Chevron announced the results of a production test conducted during August-September 2012. According to Chevron, oil flowrates exceeded 13,000 bopd. Next in the line of capital projects for Chevron are Buckskin and Moccasin fields. The company is considering a hub concept for the two fields, where planning for appraisal drilling is underway. In late March, Chevron announced a discovery in the Coronado prospect, also within the Lower Tertiary. Drilled at 6,127-ft water depth to a depth of 31,866 ft, the Coronado No. 1 well encountered more than 400 ft of net pay.

Petrobras. The Brazilian operator is developing two of the deepest fields in the Gulf of Mexico. The Cascade and Chinook fields are, so far, from a pipeline network that Petrobras selected the FPSO option to start production in September 2012 at the rate of 80,000 boed. According to Petrobras America’s Walker Ridge asset manager, Caesar Palagi, the two projects have achieved several milestones: first FPSO, BW Pioneer, to operate in the Gulf of Mexico; world record for the deepest, free-standing hybrid riser system (8,200 ft); the deepest pipe-in-pipe design (8,895 ft); deepest export pipeline (8,200 ft); and the deepest mooring of a floating production facility (FPS) at 8,200 ft. Petrobras is in the process of drilling producer wells at both fields. The firm expects to have a total of 13 wells on line (six in Cascade, seven in Chinook), and is also considering replacing the BW Pioneer with a platform and tying back production to a hub, possibly Shell’s Perdido.

Pemex has traditionally drilled in the shallow waters of the southern Gulf, where it developed Cantarell field in the late 1970s. Cantarell’s output peaked at more than 2 MMboed in 2004 and is now at about 400 Mboed. In October 2012, Pemex announced its first major oil discovery in the deepwater Gulf of Mexico, near the Mexico-U.S. maritime boundary. Pemex estimates Trion I field to have 3P reserves of 250–400 MMboe. The Mexican discovery is adjacent to Perdido field. In late March 2013, Pemex expressed an interest in having international operators participate in the development of its deepwater fields. However, a law preventing Pemex from forming joint ventures remains a barrier for external investment and collaboration.

Carlos Morales, head of Pemex’s exploration of production division, said in a radio interview that Trion I could be among the top-10 crude-oil discoveries on either side of the Gulf.

NEAR-TERM AND FUTURE PROSPECTS

Based on the existing inventory of exploratory prospects for the deepwater operators and continuing successes on the shelf, there will be strong E&P activity in the Gulf of Mexico for decades to come. There still remain, however, the tantalizing prospects of treasures in the unexplored acreage in the Eastern Gulf along the West Florida shelf. With rising production from the onshore U.S. shale play, there is no incentive for either Federal officials or the state of Florida to consider lease sales in the foreseeable future.

|