RICHARD VERNOTZY, P.E., Contributing Editor

Since the beginning of the upstream industry’s migration from dry land into shallow- water arenas, and subsequently into deeper water depths of 600-plus ft, the development of reserves in ever-greater water depths to 10,000 ft has brought on significantly greater volumes of reserves, along with greater producing rates. This has required the development of a vast amount of new technology to bring these reserves to the marketplace.

|

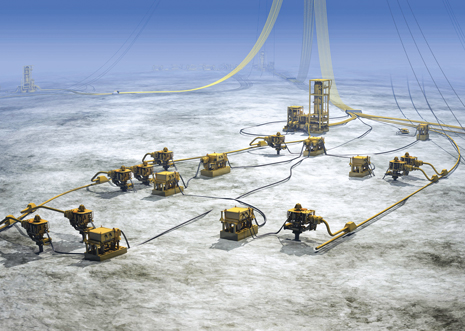

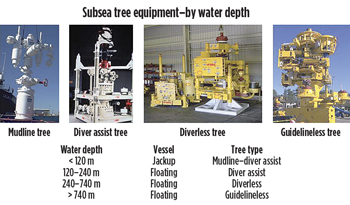

| Fig. 1. The evolution of subsea trees mirrors the industry’s progress, overall. |

Such innovation includes drilling capabilities; drilling equipment capabilities; ocean floor hardware and equipment; floating, rather than bottom-supported production structures; flowline and pipeline design; and installation technology and methods. Just look at the changes over the years in subsea tree equipment, Fig. 1. The industry has met all these challenges, which have resulted in field developments all over the world, in water depths up to and exceeding 10,000 ft of water, and, in some very harsh environmental conditions.

This article covers ongoing and expected deepwater developments in many parts of the world that are in significant geological trends, and various subsea hardware technologies that will enhance the capital and operating expenditures, and result in more cost-effective developments to improve development economics.

SUBSEA TECHNICAL INNOVATION

Technology enhancements in deepwater drilling systems have included floating rig designs, not only to accommodate the deepwater water depths, but station-keeping, from standard anchor and mooring systems to dynamic positioning systems. There has been the conversion of existing semisubmersible vessels to these standards, as well as large dynamically positioned drillships. The drillship fleets have increased with the construction of new vessels by many drilling contractors. This new construction will be a definite advantage to operating companies to get on a faster track to explore and develop their reserves.

In addition, well depths have increased to 25,000-plus ft from the seafloor, requiring these drilling units to have capabilities of 35,000-plus ft from the drill floor. Pressure containment equipment, including the blowout preventer system, now requires 10,000-psi capability. Studies are underway to increase this pressure capability to 15,000 psi, and greater, along with temperatures in excess of 300oF.

|

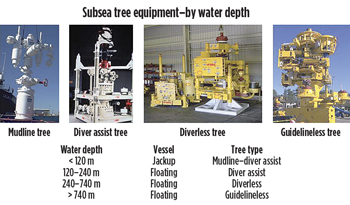

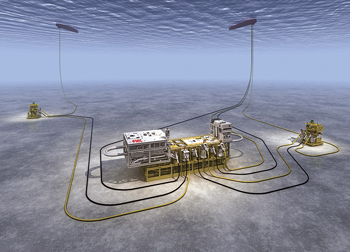

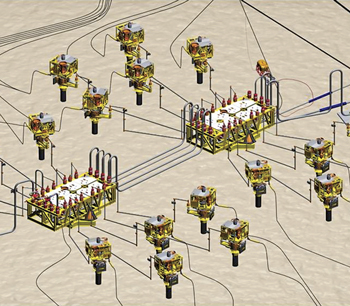

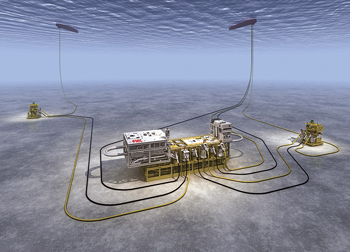

| Fig. 2. Early one-to-two-well installations (top) have expanded to large, multiple-well projects (bottom). |

Ocean/subsea architecture has grown from one- or two-well developments with simple manifold systems or straight tiebacks to the surface facility, to multiple-well and manifold systems, Fig. 2. This has required complex hydraulic and electrical systems with many connections from the trees to the manifolds, and multiple connections (flying leads) from the hydraulic/electrical umbilical termination unit to the trees and manifolds. These systems can get even more complex, as is the case of the BP Thunderhorse development’s subsea/surface interfaces in the Gulf of Mexico.

As water depths began to exceed the capabilities of human divers, the remotely operated vehicle (ROV) surfaced as the “robot” to perform all necessary installation and maintenance functions on subsea architecture hardware/equipment modules. The ROV technology development and supply companies have done a tremendous job in keeping ahead of field development hardware and installation requirements.

|

|

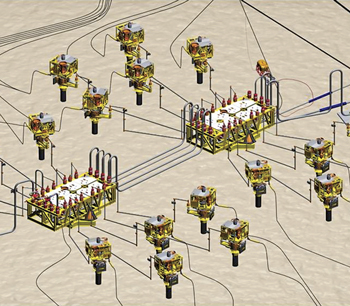

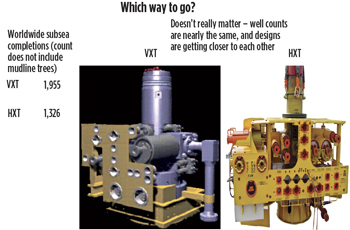

| Fig. 3. Alternative subsea completion types are one example of how engineering firms must keep up with technology, such as this 15,000-psi wet tree. |

Recent technology gains, that will soon be available, will aid ROVs in more easily finding components on subsea hardware, Fig. 3. In terms of sight, it sometimes becomes a little “tricky” for ROVs, since they see only in two dimensions. They also may have poor visibility, due to murky water conditions. In contrast, the new technology will use computer guidance to help the ROV find the required component on a manifold or tree panel. This will circumvent the two-dimensional/poor visibility issues.

The ROV market is a rapidly growing segment of the global offshore market, where technological advances in recent years have resulted in ever-increasing installation of subsea infrastructure. This growth has allowed companies to operate in ever-greater water depths. In turn, the complexity of subsea equipment, and the completely associated with operating in deepwater and ultra-deepwater areas have made ROVs indispensable to the development and safe operation of offshore projects around the world. Demand for ROV services will continue to grow, as operators offshore reserves. Due to this integral role that ROVs play, further, investment in developing their technology is expected to grow over the next decade.

SUBSEA TECHNOLOGY IN MOTION/THE GATHERING STORM

As the upstream industry moves farther and farther away from land and existing infrastructure, and into deeper and deeper water depths, the demand for timely development of technology to enable cost-effective development of the reserves underlying these waters becomes more and more important.

To satisfy this demand, several things need to happen. First, the industry needs to move to more standardized designs, to afford better repeatability processes for deepwater developments. Second, the focus of project teams, up to now, has followed the path of specific activity. They have followed their own process in regards for planning and gaining supplier/contractor input. Preferred equipment suppliers, contractors and other third-party suppliers, not just third-party engineering firms, are usually utilized for this purpose.

Third, however, these engineering houses may not always have the latest knowledge regarding field development alternatives, Fig. 3. Equipment suppliers and installation contractors often have new concepts or lessons learned that may not be known to the third-party engineering companies. Operators can benefit from this information, if they will work directly with those suppliers during the initial phases of development planning. These suppliers can bring to light alternative solutions that are more cost-effective and/or can lead to achieving first oil more quickly. The engineering consultants can help operators evaluate alternative concepts, but they should not be an operator’s sole source of information regarding supplier/contractor capabilities.

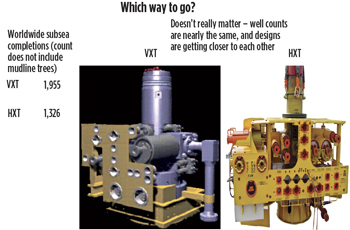

|

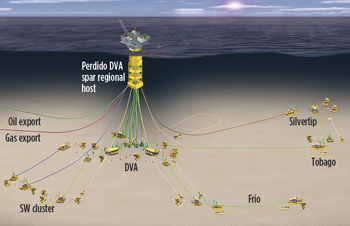

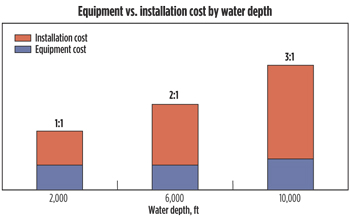

| Fig. 4. Installation costs skyrocket in greater water depths. |

What drives costs? The development of oil and gas fields in deeper water depths, approaching 10,000 ft, presents increasingly difficult circumstances, resulting in higher associated costs. For instance, operational costs, associated with completion/installation and working over of subsea wells, are increasing at a higher rate than the cost of the hardware. Indeed, the ratio of installation and hardware cost increases from roughly 1:1 for shallow water to approximately 3-to-4:1 in deeper water, Fig. 4. Therefore, those project members selecting selecting subsea hardware for a deeper development should have an understanding of the installed CAPEX and field life costs.

In addition, control system design must consider the length from the host platform (fixed or floating), and whether control equipment will be on or off the Christmas tree. Costs will also be affected by the type of well completion utilized, and the attendant downhole equipment requirements. Another cost variable is the type of flowline connection, i.e., template, manifold, Plet or Plem. Last, but not least, the overriding concern in selecting all of these items and controlling their costs is anticipation of what will be in the production stream—oil, gas, CO2, H2S, etc.

Project cycle times. Decisions made in a timely manner allow for proper definition of development solutions. However, delayed decisions in selecting alternatives can compress decisions made in the execution phase, and lead to mistakes. Time pressures created by delayed decisions can drive project managers to “same as before” solutions, which may not be the best options.

Distribution of risk. All too often, market conditions prompt contractors to take on project risks that they can’t define, just to win the work. This problem is compounded, when high insurance rates drive operators to push more risk onto contractors. Risk is also heightened by a lack of specific experience, on the part of either the contractor or the operator, regarding a given water depth, flowrate, reservoir characteristic, etc. Ultimately, risk money is added that is ill-defined, too high in price, and hidden from the operator. Lack of transparency erodes trust.

Fixed price bidding. Several things can be said about this item. The initial result of a fixed price bid is the lowest possible price, yet it is rarely the final price—it can only go up from there. Fixed price bidding instinctively drives the contractor into “protection” mode, rather than a “collaborative” mode. It goes without saying that unknowns and risk will add money to the bid price. In addition, overly competitive situations can cause contractors to “buy” projects, and then they rapidly get into trouble during the execution phase. Yet, often, the ultimate installed price is far higher than necessary

A MODEST PROPOSAL–HOW TO DRIVE DOWN COSTS

There are a few proactive steps that can be taken to control costs. This is particularly true, as regards project life cycles and reservoir and production enhancement.

Project life cycles. Subsea project managers should bring preferred equipment suppliers into the process early, rather than engineering houses—suppliers have the latest knowledge. Project teams should select a preferred field development strategy and then freeze the designs as early as possible—sometimes “better is worse than good enough.”

Reservoir and production enhancement. Deepwater development with wells on the ocean floor, along with the associated hardware infrastructure, can limit reservoir recovery and production rates, due to the backpressure imposed on the producing horizon as a result of the water depth and pressure drop through the subsea architecture.

|

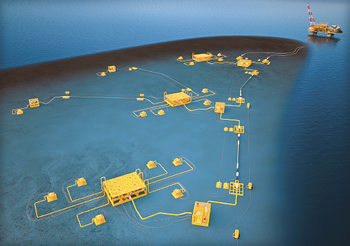

| Fig. 5. Petrobras’ layout at Marlim field, offshore Brazil. |

|

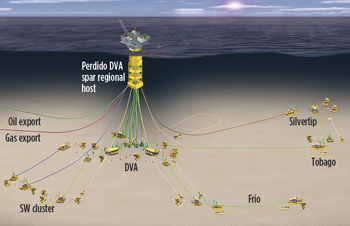

| Fig. 6. Field design for Shell’s Perdido project. |

Solutions that can be implemented, and have been used to date, are: 1) artificial lift downhole and/or at the seabed. This can be done via gas lift or ESP technology and 2 subsea processing. Examples include Marlim field, Fig. 5, operated by Petrobras, and Shell’s Perdido project, Fig. 6. Other options are multiphase pumping and metering. This, possibly, can allow an operator to produce its field back to shore.

A intervention method, that could enhance the use of ESPs in downhole deepwater/subsea completions near the producing formation, would allow the retrieval of the pump through the production tubing for repair and/or replacement. This would utilize “wet mateable” technology, which has been used successfully in subsea drilling control systems. Retrieval could be done with wireline (slickline), coil tubing with a workover riser system, or maybe riser-less. This technology/method is covered by a patent belonging to Shell.

Schlumberger/Cameron. The two firms recently announced a joint venture to manufacture and develop products, systems and services for the subsea market, called One Subsea. As this issue went to press, the companies were still working out the mechanics of the JV.

NOTABLE SUBSEA PROJECTS UNDERWAY

The back half of this article examines a large sampling of significant subsea projects underway worldwide, grouped by operator and region. Some of these projects’ more notable features and innovations are described.

ANADARKO

The Houston-based independent has several projects underway. Locations are in the U.S. Gulf of Mexico and overseas.

Gulf of Mexico. Lucius deepwater oil field is in the Keathley Canyon Block, where Anadarko (operator, 35%) has five co-owners. Lucius contains high-quality crude and associated gas. First oil is expected in 2014 after a $2-billion development cost.

The development was approved in December 2011 for six subsea producers tied back to a spar. Lucius will produce through a truss spar FPS. The spar will be installed in 7,100 ft of water, with a capacity of 80,000 bopd and 450 MMcfgd. Four development wells are scheduled for 2013.

The initial Heidelberg discovery well was drilled in 2009, in Green Canyon Block 203. finding more than 200 net ft of oil pay. In 2012, pre-FEED work to confirm the development concept, design, costs and schedule continued. In mid-2013, Anadarko anticipates sanctioning a potential stand-alone development, with estimated recoverable resources of more than 200 MMbbl of oil. With this in mind, Anadarko will begin the engineering, construction and transport of a 23,000-ton truss spar hull. To maximize cost efficiencies, Anadarko is implementing a “design one, build two” approach. Thus, the Heidelberg spar, similar to Lucius, will have a capacity of more than 80,000 bopd and 2.3 MMcmgd. Heidelberg should go onstream in 2016.

Mozambique. Anadarko continues to advance the natural gas resources found in Offshore Area 1 toward first LNG cargoes in 2018. Anadarko expects to achieve reserve certification in 2013, while securing oil-linked LNG sales agreements. Estimated recoverable resources in the range of 35-to-65-plus Tcf are ideally suited for large-scale LNG development. Anadarko is designing a four-train, onshore liquefaction facility, with plans to expand to 10 trains in future years.

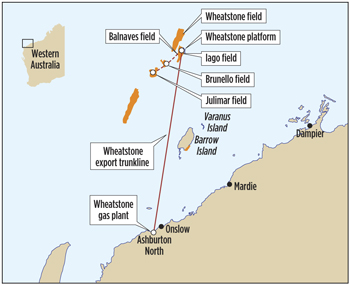

APACHE

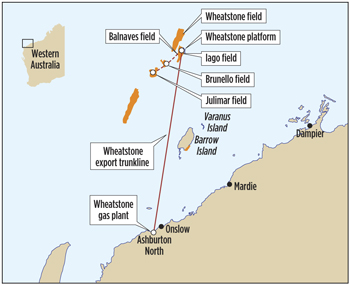

In the Carnarvon basin, offshore Western Australia, Apache and KUFPEC in 2009 joined with Chevron to develop the Wheatstone LNG hub. Apache and KUFPEC agreed to supply gas from their Julimar and Brunello fields, and to become foundation equity partners in the Chevron-operated Wheatstone LNG project.

The first phase of Wheatstone comprises an offshore central processing platform, a 140-mi pipeline to shore, and two-train onshore gas liquefaction, with a combined production capability of about 8.9 MMt of LNG per year.

|

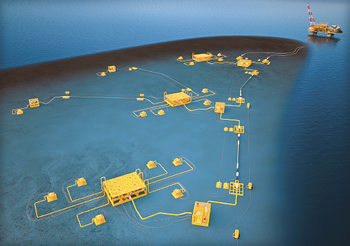

| Fig. 7. Artist’s impression of Apache’s proposed JDP subsea infrastructure. Illustration courtesy of Apache Corp. |

Apache will design and install subsea facilities to supply gas from Julimar and Brunello fields to the Wheatstone platform. The JDP will feature subsea gas producers drilled from three drill centers and two satellite locations, Fig. 7. Wells will be tied into a subsea manifold that is connected to intra-field flowlines, and linked to the Wheatstone platform by twin, raw gas production lines.

The JDP will unlock in excess of 2.1 Tcf of sales gas from Julimar and Brunello, generating net sales to Apache of about 140 MMcfd of LNG (1.07 MMtpa), 22 MMcfd of sales gas into the domestic market and 3,250 bcpd.

The Coniston development project is a subsea oil development in the Exmouth basin offshore North West Australia. This Apache-operated project is due for completion in April 2014, and involves development of Coniston and Novara oil fields via a tie-back to subsea infrastructure, already in place, for the Apache-operated Van Gogh field development. The project will also use Van Gogh’s NingaloVisio FPSO.

|

| Fig. 8. Balnaves oil field is an isolated reserve in the northern Carnarvon basin, about 180 km off the northwestern Australian coast. |

The Balnaves Development will extract oil from the Balnaves reservoir, an isolated reserve in the northern Carnarvon basin, about 180 km offshore North West Australia, Fig. 8. The subsea development will process liquids from the field for export via a dedicated FPSO.

CHEVRON

During 2012, Chevron continued construction at two major projects it operates in the deepwater Gulf of Mexico—Jack/St. Malo and Big Foot. The Jack and St. Malo fields are within 25 mi of each other, about 280 mi south of New Orleans, in 7,000 ft of water. Initial development of the $7.5-billion project will comprise three subsea well centers, with a total of 43 wells tied back to a hub production facility (semi-submersible FPS) that can handle 170,000 bopd and 42.5 MMcfgd. Startup is set for 2014. Crude will be exported from the platform via a 136-mi pipeline that will carry it to a Shell-operated platform in.

This was followed by the final investment decision on the $4.1-billion Big Foot project. Big Foot is Chevron’s sixth operated facility in the deepwater Gulf, about 225 mi south of New Orleans, in 5,200 ft of water. The development will utilize a dry tree, extended TLP, and have a production capacity of 75,000 bopd and 25 MMcfgd. First oil is also anticipated in 2014.

HESS

In 2011, Hess announced a development plan for Tubular Bells field in Mississippi Canyon Block 768 of the Gulf of Mexico, in 4,300 ft of water. Initially development calls for three subsea production wells and two water injectors. These will be produced from two drill centers tied back to a spar-based FPS owned by Williams Partners.

The first drill center will support two production wells and one water injector. The second drill center will host one production well and one water injector. The FPS is based on wet-tree technology and will process 60,000 bopd and 200 MMcfgd. It also will supply seawater injection.

SHELL

In the Gulf of Mexico, Shell’s Mars field was brought onto production in 1996 and is one of the largest GOM resource basins, so Shell is extending its life with the Olympus TLP. The site for the TLP, in the Mars B development, is in Mississippi Canyon Block 807, in 3,000 ft of water. The TLP will also provide process infrastructure for two of Shell’s deepwater discoveries, West Boreas and South Deimos, as part of Phase II work. Mars B was approved for development in September 2010 and should be operational in 2015. Mars B is the first project of its kind to expand an existing deepwater GOM oil field. A combination of factors produced this growth, including improved understanding of the reservoir and recovery potential.

Phase II is integrated with the ongoing development of the Mars B project, and involves constructing the Olympus TLP, to process up to 100,000 bopd, drawn from eight Mississippi Canyon blocks, including the Deimos deposit. The platform will have the largest tendons ever built to date, measuring 290 ft long and weighing 170,000 lb. Four tendons will be placed at each corner of the platform. The TLP’s export pipelines will be tied to the West Delta 143 hub

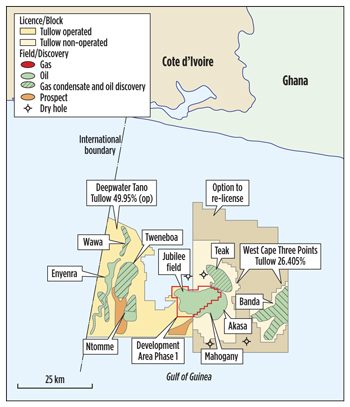

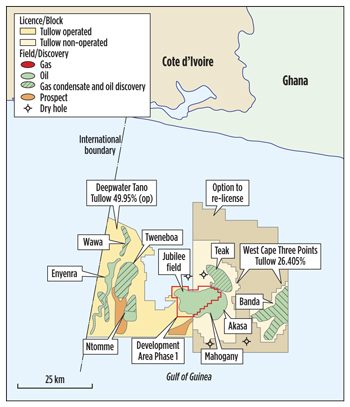

TULLOW OIL/KOSMOS

|

| Fig. 9. Tullow’s TEN project will jointly develop three fields offshore Ghana. |

In Ghana, operator Tullow’s TEN project includes the collective development of three hydrocarbon accumulations—Tweneboa, Enyenra (formerly, Owo) and Ntomme, Fig. 9. The three oil and gas fields are in the deepwater Tano license. They lie in water depths of 1,000 to 2,000 m, 25 km from Jubilee. Production is expected in first-quarter 2015. Peak output of 100,000 bopd is anticipated by 2018 and should recover around 216 MMbbl of oil, or more.

Tullow will jointly develop the fields using a single, 105,000-bopd FPSO, tied to 33 wells, including 15 oil producers, 15 water injectors, one gas producer and two gas injectors. Hydrocarbon fluids from the wells will be collected at a subsea manifold tied back to the FPSO, and processed onboard the vessel. Crude oil will be offloaded onto tankers. Gas will be injected into the reservoirs or used for powering the FPSO.

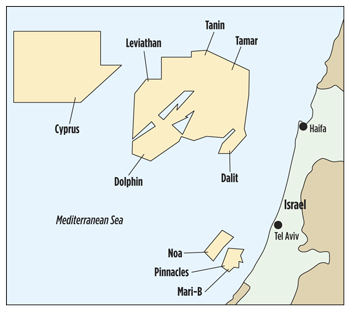

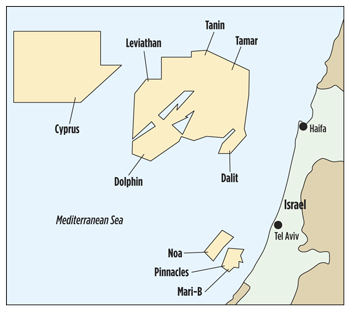

NOBLE ENERGY

This U.S. independent has several projects or potential developments concentrated offshore Equatorial Guinea and Israel. A recent large gas find off Cyprus offers another opportunity.

Equatorial Guinea. Noble holds a 47% interest and operatorship in Alen, a gas-condensate find, whose development was sanctioned in 2010. First production is set for late 2013.

Up to six subsea wells will be tied to a fixed platform, including three producers and three gas injectors. Development drilling began in late 2011. Associated condensate will be sent initially to the platform, where it will be separated into liquid and gas. The stripped gas will be re-injected into the wells. The condensate will be transported via a pipeline to the Aseng FPSO, about 24 km to the south.

Alen will include two platforms, one a wellhead platform, and the other a central processing platform (CPP). The condensate processing facility (the CPP) will sit in 238 ft of water, and process 440 MMcfgd and 40,000 bcpd. The facility has been designed to be a gathering hub, with an ultimate capacity of 750 MMcfgd.

|

| Fig. 10. The Tamar development is the center point of Noble’s operations offshore Israel. |

Israel. A string of successful Eastern Mediterranean wells at Tamar, Dalit, Leviathan, Dolphin and Tanin has resulted in several discoveries, providing Noble a very large gas resources inventory. Fig. 10. The Tamar field development continues to progress. The jacket and topside facilities were installed last December, and commissioning operations have begun. Production will flow from five wells connected by a 93-mi-long, subsea, double-pipe tie-back to the gas processing platform. Initial production is scheduled for April 2013. Noble has a 36% operated interest at Tamar, with gross mean resources of 9 Tcf of natural gas.

Noble has worked to provide additional gas deliverability until Tamar comes online. Noa gas field, near Mari B field, has been developed and went online in June 2012, in about 2,556 ft of water. Noble linked Noa to the Mari B platform. The subsea umbilical, riser and flowline (SURF) work was carried out by Helix Subsea Construction.

Found in 1,645 m of water, Leviathan has gross mean resources of 17 Tcf of natural gas. Noble is actively studying multiple export options, with an eye toward first production in 2017.

Cyprus. In late 2011, Noble announced a discovery offshore Cyprus, with estimated gross mean resources of 7 Tcf. The firm continues to appraise the field and is talking with Cypriot officials about an LNG terminal and potential development plan.

PETROBRAS

Offshore Brazil, Petrobras has a laundry list of deepwater, subsea development projects, almost in cookie cutter fashion. Each project has its own dedicated FPSO. These projects are in addition to the Baleia Azul (80,000 bopd and 2 MMcmgd), Baúna/Piracaba (80,000 bopd) and Sapinhoa (120,000 bopd and 5 MMcmgd) developments, which recently went onstream.

It is much easier to list the projects, as follows:

- Lula NE, 14 wells tied back to a chartered FPSO. First production, May 2013, with peak production in February 2015 of 120,000 bopd and 8 MMcmgd.

- Papa-Terra, 30 wells tied back to a TLWP and FPSO. First production, July 2013, with peak production of 140,000 bopd and 1 MMcmgd in October 2016.

- Parque das Baleias, 24 wells tied back to a chartered FPSO. First production, January 2014, with peak output of 180,000 bopd and 6 MMcmgd in January 2015.

- Roncador Module IV, 17 wells flowing to an FPSO. First production, March 2014, and peak production in June 2015 will be 180,000 bopd and 5 MMcmgd.

- Sapinhoa Norte, 15 wells tied to an FPSO. First production, September 2014, and peak output in March 2016 will be 150,000 bopd and 6 MMcmgd.

- Lula Iracema Sul, 15 wells tied to an FPSO. First production, November 2014, with peak output in February 2016 of 150,000 and 8 MMcmgd.

LLOG

LLOG, along with JV partners and co-owners, approved the $2-billion-plus Delta House development in the Gulf of Mexico. It will include an FPS, an oil and gas export line and subsea systems.

The Delta House FPS will be on Mississippi Canyon Block 254, in 4,500 ft of water, and accommodate production from several nearby fields in Mississippi Canyon 300 and Mississippi Canyon 431. It will use Exmar’s OPTI-11000 semi-submersible design and have a capacity of 80,000 bopd, 200 MMcfgd, and 40,000 bwpd, peaking capability up to 100,000 bopd and 240 MMcfgd, and space for 20 risers, to allow production from up to nine producing fields with dual flowlines. Production from six initial wells will go online in 2015.

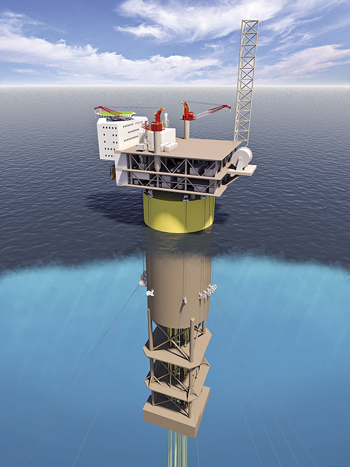

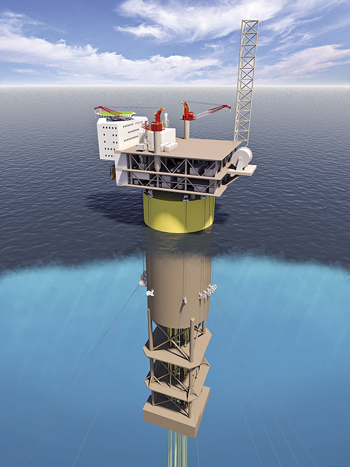

STATOIL

Aasta Hansteen is a three-structure (Luva, Haklang and Snefrid South) deepwater project offshore northern Norway, operated by Statoil. The expected, recoverable net volume is estimated at 40 MMboe to 60 MMboe of gas and 0.8 MMboe to 1.0 MMboe of condensate.

Producing Aasta Hansteen will be demanding, as the discovery is 300 km from land (northwest of Sandnessjøen) and outside the established infrastructure (the nearest installation, Norne, is 140 km away). The water depth is significant (1,300 m), and weather conditions are challenging. The gas is dry and has low CO2 content.

|

| Fig. 11. The world’s largest spar will be installed by Statoil at Aasta Hansteen field, offshore the far northern coast of Norway. |

Aasta Hansteen is the deepest subsea development in Norwegian waters, to date, and will provide a new standard for deepwater production systems, including new technology developments. Aker Solutions’ subsea production system includes three template-manifold structures and seven subsea trees, in addition to wellheads, controls, and workover and tie-in systems. Delivery should begin in first-half 2015. Technip was awarded a letter of intent to construct the hull for the world’s largest spar (Fig. 11) at Aasta Hansteen, in a consortium with Hyundai Heavy Industries.

|

The author

RICHARD VERNOTZY, president of Rockwell Enterprises, LLC, has more than 25 years of experience in the oil & gas industry, beginning with a major integrated company. He moved on to a major drilling contractor, then an independent. He had an engineering office in Houston, followed by a short stint in Denver as President/CEO of a technology development firm. Mr. Vernotzy came back to Houston to get involved in overseas work and joined an engineering company, managing deepwater development studies for the GOM, West Africa and Brazil. More recently, he has developed training modules for deepwater drilling, completion and production. Mr. Vernotzy has a bachelor’s degree in petroleum engineering and is a registered professional engineer. He is a Legion of Honor member of SPE, and a member and past president of National Oil-equipment, Manufacturers and Delegates Society (NOMADS), as well as a member of the Marine Technology Society and IADC. |

|