|

Shortly after taking the oath as interim President of Venezuela on March 10, Nicolas Maduro announced that elections would be held on April 14. This announcement has created a climate of uncertainty in Latin America, due to two factors: the price of West Texas Crude rose 0.77% the day after Chavez’s death and closed at US $90.82/bbl, ending a long erosion in prices and export sales of crude to China dropped in volume. PDVSA exports approximately 640,000 bopd to China, half of which are linked to repayment of loans issued to Venezuela. However, March sales showed a significant decrease in volume over the previous year’s sales. February imports of Venezuelan crude oil were 9% lower than the previous year. During the January-February period, China’s total crude oil imports fell by 2.4%, compared to the previous year’s, to 5.68 million bopd. The General Customs Administration explained the drop as an adjustment for distortions during the Chinese New Year, which fell in January of the previous year. However, this does not explain the 8.4% drop in February, down from 5.92 million bopd in January.

PDVSA president, Rafael Ramirez, stated on March 10, during an interview with TV Telesur, that there is, indeed, a pre-election climate, saying, “I must state to the world that one of the fundamental commitments of our comrade, Nicolas Maduro, is that the fundamental policies of President Chavez will not change, including our agreements with Petrocaribe.”

Energy under Chavez. Venezuela currently supplies directly, and without intermediaries, to the signors of the Petrocaribe accord, approximately 95,000 bpd of crude and derivatives, a figure that experts say may even be as high as 150,000 bpd, under favorable payment conditions (PDVSA 2011 yearbook). Petrocaribe consists of Antigua and Barbuda, Bahamas, Belize, Cuba, Dominica, El Salvador, Guatemala, Granada, Guyana, Nicaragua, Dominican Republic, Haiti, Jamaica, St. Kitts and Neves, St. Vicente and the Grenadines, St. Lucia and Suriname. This also means that PDVSA will continue exporting 250,000 bbl of fuel to Bolivia at below-market prices and supplying Argentina with 30,000 bbl of refined products, marketed through its 119 service stations.

In recent years, PDVSA has created links with state-owned oil companies in Ecuador, Bolivia and Argentina (Petroecuador, YPFB and YPF) through investments in exploration and bilateral contracts. Caracas also has 122 energy agreements with Unasur: 41 with Brazil, 31 with Colombia, 15 with Argentina, 13 with Bolivia, eight with Ecuador, four with Uruguay, three with Paraguay, three with Guyana, two with Peru, one with Chile and one with Suriname. Among these joint E&P projects is the one with Ecuador to develop Maduro Sacha oilfield for an estimated production of 60,000 bopd at a cost of $1.366 million. PDVSA also participates in at-risk offshore gas exploration, offshore Ecuador, in the Gulf of Guayaquil, with an investment of $110 million. This is in addition to the investment in building the Pacific Ely Alfaro Refinery in Ecuador, with a 300,000-bopd capacity. In Brazil, it has invested in the Abreu e Lima Refinery, with a 230,000-bopd capacity. In Uruguay, it is participating in the expansion of the La Teja refinery, to a capacity of 60,000 bopd. PDVSA also owns 23 service stations in Ecuador, 43 in Brazil, 10 in Bolivia and 11 in Argentina. Total overseas investments, according to PDVSA (January 2013), were $40.026 million in 2012, a 14.7% increase over the previous year. According to the latest preliminary report by the Latin American Economic Commission (CEPAL), Venezuela’s PIB has grown 4.2% in 2010 and 5.3% in 2011, and will be over 2% in 2013.

|

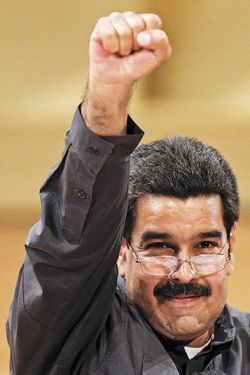

| Chavez’s likely successor, Nicolás Maduro |

|

Energy after Chavez. Hugo Chavez won the Oct. 7, 2012, elections with 54.5%, to opposition candidate Capriles Randoski’s 44.97%. If the opposition inverts the results in the upcoming April 14 election, it is expected that the opposition candidate would apply his own economic policies with the same intransigence as Chavez, and would reverse or cancel many of the investment and economic cooperation projects instituted throughout Latin America. This change in political and economic direction would affect, in the short term, regional energy policy and create economic uncertainty and social unrest. On the other hand, if Nicolas Maduro is elected in place of Chavez, for the legislative period ending in 2019, and continues his regional energy policies, it would be prudent for all the Latin American countries who currently receive between 1.1 and 1.2 million bopd, from PDVSA, to start changing their energy policies in the medium and long term. For example, Bolivia is betting on increasing its NGL production, to achieve self-sufficiency, by building two liquid gas separation plants, which will be operational by 2014, as well as applying incentives to convert automobiles to CNG use.  |