JIM REDDEN, Contributing Editor

|

| An Encana location prior to suspension of Haynesville 2012 drilling activity. Courtesy of Encana Corp. |

|

Despite being home to some of the most prolific gas wells in the U.S., the once-celebrated Haynesville-Bossier shale has been relegated to little more than an afterthought, as cellar-dwelling commodity prices and comparatively excessive drilling and completion costs force even the most resolute operators to shut in and await better times.

For now, even the nation’s largest gas producer admits that profits are nearly impossible to come by for players in the non-liquid sectors, making new drilling an unjustified exercise. Rex Tillerson, the typically close-to-the-vest CEO of ExxonMobil, said the operator is making “no money” on domestic gas, going so far as to tell the Wall Street Journal in late June that “we are losing our shirts.”

Nowhere are shirts being shed faster than in the deep, technically challenging Haynesville-Bossier shale of Louisiana and Texas. There, enviable production rates and estimated ultimate recoveries (EUR) that rank near the top of all the North American shale sectors are overshadowed by abnormally high downhole temperatures and pressures that escalate well costs, further weakening the already dismal economics of the gas-dominant play. Many operators believe some relief could come from steadily developing plans to export liquefied natural gas (LNG) from the Louisiana coast. Unfortunately, the first facility will not begin putting a dent in the Haynesville gas glut until 2015 at the very earliest.

In the meantime, as reflected in the continually declining rig count, a number of leaseholders, primarily those with Louisiana acreage, have suspended 2012 drilling operations and shut in production while declining asset values are forcing others to consider write-downs. On the other hand, unlike the predominately gassy Louisiana Haynesville-Bossier, the Texas segment is yielding liquids, allowing it to fare somewhat better than its neighbor.

According to Baker Hughes, as of Sept. 17, the year-on-year active rig count in the Haynesville-Bossier area had dropped some 71%, with 38 rigs working compared to 131 in the same period last year. Of those, 17 were drilling in the core northern Louisiana parishes of Caddo, DeSoto, Sabine and Webster, while 21 rigs were making hole in the East Texas portion. In Louisiana especially, the active rigs are used mainly to maintain current production levels or retain expensive leases acquired during the height of the bull gas market that now seems like an eternity ago.

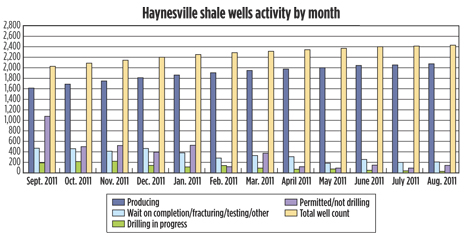

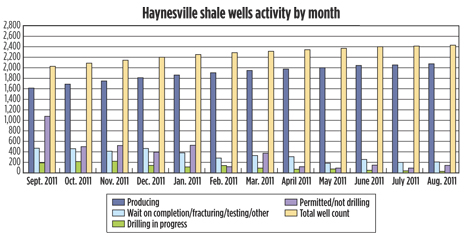

In addition, the most recent data from the Louisiana Department of Natural Resources (DNR), which regulates oil and gas within the state’s boundaries, shows 2,071 Haynesville producing wells as of Aug. 12, with 26 under construction and another 134 permitted but not in the drilling process, Fig. 1. By comparison, the DNR reported 1,615 Haynesville producing wells on September 2011, with 1,074 permitted but not being drilled.

|

| Fig. 1. Louisiana Haynesville well activity from September 2011 to August 2012. Source: Louisiana Department of Natural Resources. |

|

Furthermore, the latest production data available show the Haynesville’s position as the number-one gas-producing region is tenuous at best. The Haynesville surpassed the Barnett shale early last year, but the most current production figures have the Marcellus shale of the Northeast gaining ground. According to the U.S. Energy Information Administration (EIA), Haynesville-Bossier production stood at 6.92 Bcfd in May, down only slightly from the 6.93 Bcfd produced in April. By comparison, the Marcellus averaged production of

6.85 Bcfd in May.

In addition, the most up-to-date EIA resource assessment shows just under 75 Tcf of technically recoverable gas reserves in the Haynesville, second by a near five-fold margin to the four-state Marcellus that the EIA reported to hold more than 410 Tcf.

UN-SHALELIKE CHALLENGES

The Upper Jurassic Haynesville shale stretches some 9,000 sq mi across northern Louisiana and East Texas. Ranging in thickness from 150-300 ft, the Haynesville is unique to North American shales, in that penetration requires wells from 10,000 ft to as deep as 14,000 ft, TVD. Given today’s gas price structure, therein lies one of the primary reasons that the Haynesville shale finds itself locked more firmly behind the eight ball than its peers elsewhere. For typical Haynesville wells, bottomhole temperatures can reach as high as 350°F, and ultra-high pressure gradients of 0.85 to 0.93 psi/ft can send wellhead treating pressures during stimulation past 10,000 psi. Haynesville wells also require significantly higher water volumes than that required for fracing elsewhere.

Liquid loading is a key factor when it comes to keeping mature gas wells productive. Deliquification of Haynesville wells, to return them to full production, is not a simple proposition given their typically high pressures and flowrates, says pumping pioneer Lufkin Industries. Lufkin hopes to rectify that predicament with a long-stroke version of its hydraulic pumping unit (HPU) now under development. Lufkin says it has used its conventional HPU to successfully deliquify Travis Peak, Petit and Cotton Valley gas wells, primarily in East Texas, Fig. 2.

|

| Fig. 2. A long-stroke version of this hydraulic pumping unit is planned for use in deliquifying Haynesville wells. Courtesy of Lufkin Industries. |

|

PRESSURE ON COSTS

This HPHT environment has spawned well costs approaching $10 million, forcing operators to slash drilling and completion overhead. Operators say they have successfully negotiated price concessions from service providers and changed their well construction practices through increased use of managed pressure drilling (MPD), longer laterals, and, in the case of EXCO, employed a “factory” approach to drilling. The operator said its cost-cutting includes revising frac service contracts, which reduced individual well costs some $600,000, and negotiating 15%–20% reductions for multiple service costs.

Before suspending its 2012 drilling program, Calgary’s Encana, an early Haynesville player, said it had reduced drilling costs some 35% between 2008 and 2011. “The Haynesville is a great example of a play, where we were able to significantly drive down costs over a short period of time,” said Eric Marsh, executive vice president, EnCana, and senior vice president, USA Division. “By designing, developing and using fit-for-purpose, natural gas-driven rigs, drilling longer horizontal laterals, and vertically integrating fit-for-purpose completions equipment, Encana has significantly improved our supply costs in the play.”

Haynesville operators also face appreciably higher drillingwaste management costs, which are magnified by atypically larger concentrations of low-gravity solids. The inability to remove these ultra-fine solids from the oil-based mud commonly used in these HPHT wells not only increases the haul-off and disposal costs of cuttings, but it also hampers the performance of the drilling fluid, which can extend the days vs. depth curve. M-I SWACO says its integrated RHE-USE chemical and mechanical process effectively removes low-gravity solids from Haynesville wells.

MOST OPERATORS REINING IN

Unlike previous versions, the 2011 annual reports and investor presentations of many stakeholders show the Haynesville scarcely warranting a mention. A sampling of Haynesville-Bossier leaseholders shows most are in a major retrenching mode.

Chesapeake Energy Corp., which continues to hold a commanding 530,000-acre net leasehold position in the Haynesville-Bossier, said nearly all its acreage is now held by production (HBP) and plans to cut back its drilling plans considerably in 2012. Chesapeake reported to investors that it had reduced its drilling program in the second quarter of 2012 to six rigs in both the Haynesville and Barnett dry gas plays. The company said its gross operated production in the Haynesville surpassed 2 Bcfd in late 2011.

As part of its cash raising campaign, Chesapeake in September announced that it would sell gathering and processing systems in the Haynesville, as well as the Eagle Ford, Utica, Niobrara and Powder River basin plays.

BHP Billiton, which entered the play with its blockbuster acquisition of Petrohawk in mid-2011, holds 345,000 net Haynesville and Lower Bossier acres, with an average operated working interest of 75%, Chief Executive J. Michael Yeager said in an investor presentation. As of year-end 2011, Yeager said net production was 780 MMcfd, with a total risked resource potential of 22 Tcf at 90-acre well spacing. Yeager said the operator’s core acreage “delivers very strong well recoveries, with some in excess of 20 Bcf.” As of September, BHP was operating four rigs, primarily in Caddo Parish.

Encana holds 209,000 net acres in the Haynesville, but it presently has no rigs operating, and no immediate plans to resume drilling operations in the near term. The Canadian operator recorded second-quarter 2012 Haynesville production of 418 MMcfd, down from the 487 MMcfd it booked during the like period of last year.

Plains Exploration and Production Co. holds rights to 432,000 gross (84,000 net) Haynesville-Bossier acres after its 2008 joint venture with Chesapeake. In the fourth quarter, Plains recorded Haynesville-Bossier production of 199.8 MMcfed, a 23% increase of its first-quarter 2011 output. In its 2011 annual report, Plains said it has earmarked $140 million for 2012 to develop its Haynesville-Bossier acreage and improve recovery rates through in-fill drilling.

Anadarko Petroleum Corp. operates a new liquids-rich play in the Carthage area of East Texas and is one of the few operators to ramp up drilling this year. The operator says it has identified 450 drilling sites, including 350 in the Haynesville shale, with the remaining 100 in the Cotton Valley formation. Anadarko was operating eight rigs in East Texas in second-quarter 2012 and plans to drill 75 horizontal wells this year.

EXCO Resources Inc. holds 123,600 net Haynesville-Bossier acres in Louisiana and Texas, of which 90% are HBP. In second-quarter 2012, EXCO was operating 346 horizontal wells with production of around 1.2 Bcfd. As of June 30, EXCO was drilling six wells, with an additional 37 wells awaiting completion. The operator has been running four rigs.

ExxonMobil/XTO holds 240,000 net acres through its 2010 acquisition of XTO Energy, which operates the Haynesville holdings. At last count, ExxonMobil/XTO was operating two rigs in the play, but the firm made no specific reference to Haynesville activity in its 2012 earnings reports.

EP Energy LLC was formerly spun off as a publicly traded company in late May with Kinder Morgan’s acquisition of the El Paso Corp. The new company holds 41,000 net Haynesville and 24,500 net Bossier acres, but owing to low gas prices, it plans to suspend its planned drilling program this year.

LNG, NGL PROSPECTS

Meanwhile, operators are closely following the progress of no less than three LNG export facilities that are in various stages of development along the Louisiana coast. After clearing its final federal regulatory hurdle this year, Houston’s Cheniere Energy Partners has received the green light to begin work on its Sabine Pass LNG terminal in Louisiana’s western Cameron Parish. The nearly $5.6-billion project involves expanding the company’s existing LNG receiving terminal and will include construction of four liquefaction trains, each with a processing capacity of 4 million tons per annum (mtpa).

Cheniere has contracted to begin construction on the first two trains in what will be the first LNG exporting facility in the continental U.S. Cheniere says that during the past two years, it has negotiated long-term contracts with LNG buyers overseas for the purchase of more than 2 Bcfd over the next 20 years.

Like Cheniere, Sempra Energy is moving ahead with plans to install export capabilities at its Cameron LNG receiving terminal at Hackberry, La. The pre-filing process with the U.S. Federal Energy Regulatory Commission (FERC), which, once approved, clears the way for construction of the $6-billion LNG export facility.

Sempra plans to begin construction next year in three phases with the first liquefaction train slated to begin shipping in 2016 of gas-equivalent 1.7 Bcfd. Two additional trains will be online about five to 10 months later, providing capacity of 12 mtpa. The developer says it has three purchase contracts in place for deliveries of 4 mtpa, each.

According to the Louisiana DNR, operators of the proposed Trunkline LNG export terminal in Lake Charles also are in the process of securing federal authorization to proceed with construction.

|